nespix/iStock via Getty Images

Agile Therapeutics (NASDAQ:AGRX) just completed its first full year as a commercial company, which was highlighted by an attractive growth curve for its flagship product, Twirla. Agile has been working hard to establish Twirla in the contraceptive market despite crushing COVID-19 headwinds. For 2021, Agile pulled in $4.1M in revenue, but the company’s full-year OpEx came in at $64.4M. Obviously, the company has a huge gap to cover before we see them reporting positive earnings. Consequently, I have to adjust my investment strategy to avoid locking up my capital during a time when the company is burning through cash and the growth trajectory is unclear.

I intend to review the company’s Q4 and full-year 2021 earnings. In addition, I will highlight the company’s game plan for ensuring Twirla’s growth and the company’s success. Finally, I discuss my new AGRX strategy.

Earnings Review

For Q4, Agile pulled in $1.5M in net revenue and $4.1M for full-year 2021, but the company’s OpEx came in at $18.2M for Q4 and full-year OpEx came in at $64.4M. Agile closed out Q4 2021 with a net loss of $23.4M and a full-year net loss was $74.9M. At the end of 2021, Agile had $19.1M in cash, cash equivalents.

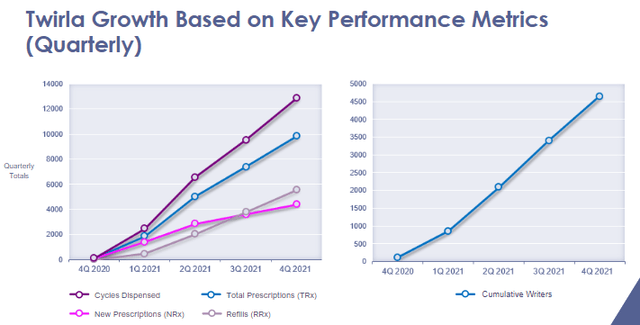

In Q4, Agile sold 12,849 total cycles dispensed, which grew 35% over Q3, while total prescriptions grew 33% to 9,837. New prescriptions grew 22% to 4,381, with refills surging 47% to 5,456. What is more, the company reported a surge in total prescribers, which was up 40% from the prior quarter.

Twirla Quarterly Growth Metrics (Agile Therapeutics)

It looks as if there are many signs of a healthy growing brand. I would highlight the number of refills… which is up 47% over the prior quarter.

Game Plan

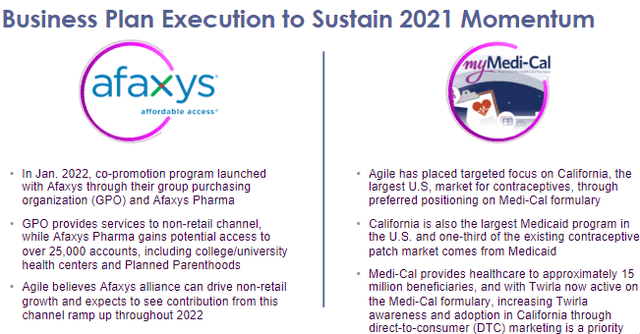

Now, the company is looking to continue these trends into 2022 by executing the company’s business plan. Agile is going to tap their co-promotion partnership with Afaxys to leverage their group purchasing organization to get Twirla out in the non-retail channel, where Afaxys can contact in excess of 25K accounts, including Planned Parenthoods and college student health centers. Afaxys should improve Twirla’s non-retail growth throughout 2022 and beyond.

Plans For Twirla (Agile Therapeutics)

Another lever to pull is California’s Medicaid program, Medi-Cal, which is the largest Medicaid program in the United States. Medi-Cal has put Twirla on their preferred drug list, which is significant considering Medi-Cal provides healthcare to around 15M people and Medicaid accounts for 1/3 of the patch market. Obviously, getting on the preferred drug list will open the door to millions of potential Twirla users.

Agile is now running a Twirla direct-to-consumer commercial on Connected TV, which is essentially TV streamed through Smart TVs, desktops, or mobile devices. Agile is targeting the big five states of California, Texas, Florida, Illinois, and New York, which will reach roughly 5.7M women ages 18 to 24.

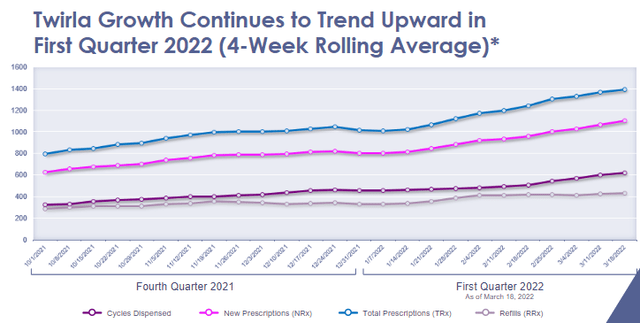

It would appear Agile is making the right moves to get Twirla in the right places and in front of the eyes of the right people. So far, the company is starting to see their recent efforts start to yield results in the first quarter of this year.

Twirla’s First Quarter Performance (Agile Therapeutics)

Looking at the graph above, we can see a nice inflection in cycles dispensed, new prescriptions, total prescriptions, and refills.

Downside Risk

I do expect Agile to report strong sales growth in the coming years and Twirla will gather momentum to become the leading patch on the market. However, our optics on revenue and cash burn is currently murky at best. We still need another year or so of commercialization before the financials become clearer and allow us to map out a timeline for positive cash flow. But at this time, it is obvious that Agile will require additional capital to reach cash flow positive. As a result, investors need to accept that there is a strong possibility that the company is going to have to run a secondary offering at some point in the future.

Another major concern is the stock regaining NASDAQ compliance. The share price is trading below the NASDAQ’s minimum of $1 per share. The company was notified by NASDAQ that they were out of compliance and they had until May 9th of this year to regain compliance. The company could get an additional six months to regain compliance, but they called a special meeting of stockholders on April 21st to approve a reverse stock split. I believe the company will get the go-ahead, however, it is possible shareholders vote against it and the company runs the risk of being delisted.

Considering these points, I still have AGRX in the Compounding Healthcare Bio Boom speculative portfolio.

My New Strategy

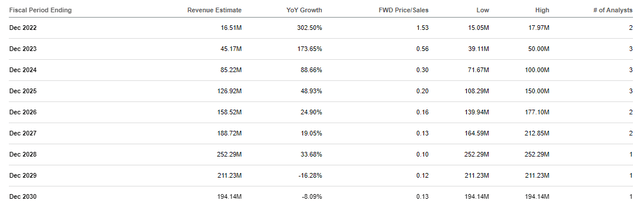

In my preceding AGRX article, I mentioned that I was looking to remain conservative after the Street’s cut Agile’s annual revenue estimate for 2022 from $83M to that $63.53M, and then dropped it down to $26M at that time. Now, the Street expects the company to pull in around $16.51M for 2022.

AGRX Revenue Estimates (Seeking Alpha)

For that reason, I am going to remain conservative for 2022 and will wait until the company beats the Street’s estimates forcing analysts to improve their outlook for the stock. Agile might be making some progress and reporting growth, but they will have to impress Wall Street’s gatekeepers before I am not willing to take my AGRX position out of the “house money” state.

I was looking to execute some scalp trades to generate some cash while accumulating a larger position for a long-term investment, but I have yet to find a good setup for a trade.

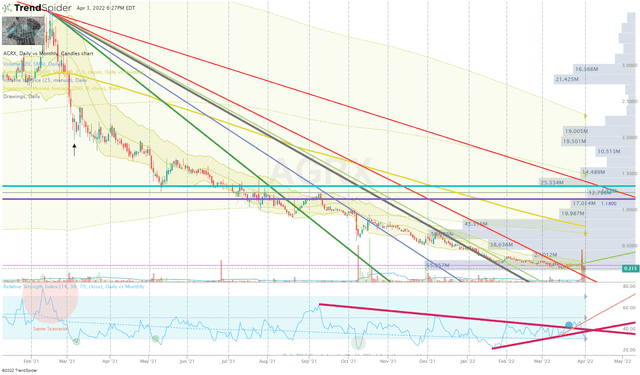

AGRX Daily Chart (Trendspider)

AGRX Daily Chart Enhanced View (Trendspider)

Luckily, I still haven’t used all my “dry powder” that I have allocated for complete capitulation. Looking at the Daily Chart, it is possible we just witnessed a near-term capitulation event that will provide an opportunity to buy. However, I am not looking for a quick scalp trade anymore. Instead, I am looking to use a “hybrid DCA strategy” that involves making periodic investments in combination with discretionary buys under a “buy threshold”. The periodic investments will be will minuscule in size and will be executed every couple of months or so. The discretionary buys will be performed after finding a technical setup for a buy, but the share price needs to be below my “buy threshold”. Unfortunately, I can’t determine what that price is at the moment because we are waiting for the outcome of the special shareholders meeting this month that will determine if the company will perform a reverse split. Once the decision on the reverse split is made, I will use a combination of revenue estimates, cash position, and fundamental valuations to determine a discounted value that I will be willing to pay for AGRX.

I might believe in Agile’s long-term prospects as a speculative investment but it looks as if the company’s prowess won’t be evident for a few more years. The hybrid DCA strategy will force me to take a slow and methodical approach to building a position and will prevent me from locking up my capital for an extended period of time.

Long-term, I expect to build a respectable position over the next three years in anticipation Twirla will become the leading contraceptive patch on the market and/or Agile is acquired at a premium price.

Be the first to comment