cmannphoto/E+ via Getty Images

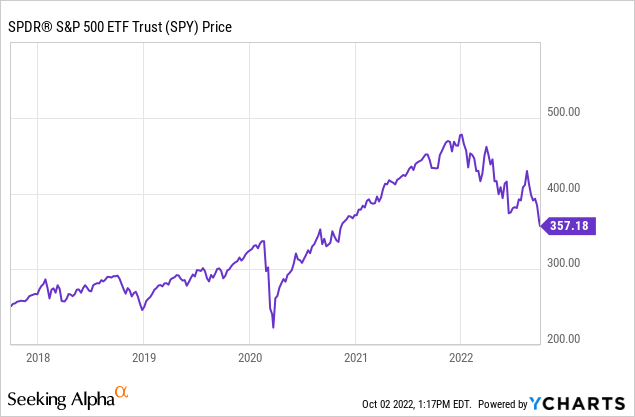

The wild ride for stocks continues, with the S&P 500 (SPY) closing the quarter down over 25% YTD and the Dow (DIA) down a bit less than 22%. Markets are at a crossroads. Not only do stocks have to contend with earnings season and inflation numbers in Q4, but also with midterm elections in November.

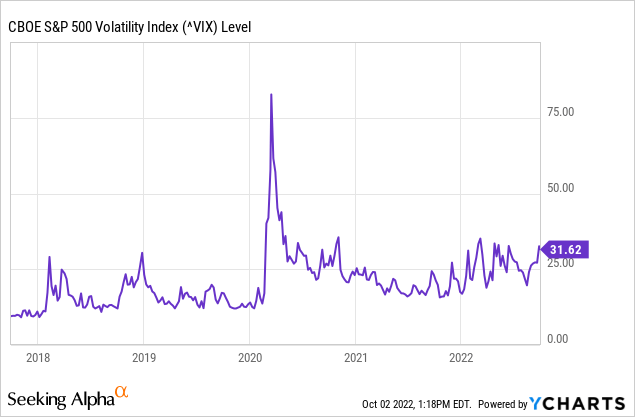

Volatility is sharply on the rise, and with the VIX (VIX) over 30, investors should expect large swings on a daily and weekly basis. At current levels of VIX, this implies daily moves of 2% in either direction, weekly moves of 4.4%, and monthly moves of 9.1%.

Without further ado, let’s look at some key fundamental themes for Q4 and break down how they may affect the value of your investments.

1. Earnings

Lest we forget, stocks are pieces of underlying businesses. As such, over the long run, there’s no greater correlation with how your investments do than how much the companies you invest in make in per-share profit over time.

We’ve got a few early earnings reports already, and they’re flashing a clear warning signal for markets. Restoration Hardware (RH) reported decent numbers but soft guidance. Former high flyer Adobe (ADBE) got hammered as the market gave a thumbs down on its latest earnings report and its massive acquisition of SAAS provider Figma. FedEx (FDX) got crushed too, blaming macro headwinds. And NIKE (NKE) and Micron (MU) both sold off as well after weak earnings.

This is too many companies to ignore in a short period of time, and I’m going to go out on a limb and say that earnings expectations and corporate guidance are both too high. The early cycle reports are a clear warning shot for high P/E companies like Apple (AAPL) and Amazon (AMZN) that report later in the cycle.

Q2 2022 was the best quarter for earnings – ever. However, I doubt it repeats. The wheels may be about to fall off the bus here for earnings though without the benefit of stimulus and pent-up pandemic savings. As we continue to slide into recession I expect earnings to subside to levels closer to where they were pre-pandemic. I’ve previously published some complicated analysis on nominal GDP, profit margins, etc., that’s outside the scope of this article, but I expect earnings to come in about 10% below analyst expectations for 2022 and about 20% below expectations for 2023. That’s a bit below $200 on the S&P 500 for both years.

2. Inflation/The Fed

So far this year, since earnings have actually been quite good, the dominant narrative has been inflation and the Fed. The market started the year expecting the Fed to raise rates a few times, but brutal inflation numbers showed this was a dangerous fantasy.

My feeling is that the market is now accurately pricing what the Fed needs to do. In a couple of previous articles, we compared expected Fed policy with well-known rules of thumb among economists. Fed policy is finally there now. The main thing they have left to fight is the YOLO mentality among consumers, who aren’t really responding to traditional signals to slow down (higher rates, lower stock prices). With mortgages in the US nearing 7%, it’s hard to see how consumers don’t start to get the message that the party is over.

The Fed gets another report card on inflation at 8:30 a.m. Eastern, Oct. 13. My guess is this report actually will be OK, and that stocks will rally off of it. However, some econometric models are predicting another hot number though, and if core CPI comes in hot again, the markets are going to blow a fuse. Investors should also keep an eye on the Fed’s QT program, which is expected to drain away about $285 billion more in liquidity between now and year-end.

3. Midterm Elections

Voters take to the polls on Tuesday, Nov. 8 to have their biannual say in how the U.S. government is run. Republicans are expected to retake the House of Representatives while Democrats are expected to retain the Senate. I could base this on polling, but what I actually prefer is to use betting websites to get an idea of what the market thinks.

PredictIt (my preferred political betting website) has Republicans at 80% favorites to win the House, while Democrats are 58% favorites to keep the Senate. For 2024, Ron DeSantis is slightly favored over Trump and Biden as the most likely winner, but that’s for another article. The US government is shutting down PredictIt in February, which is unfortunate because it’s nice to be able to read a Bloomberg article about some possible political change and then see what percentage chance the market is actually putting on it.

How do midterms affect stocks? America’s founding fathers designed the political system to force gridlock and encourage compromise. As such, the financial markets generally tend to favor split governments. The main event here that would affect stocks is if the Democrats expand their House majority and take the Senate. This would give the Democrats full control of the government, and would likely lead to some corporate tax increases. If this happens, I think you can take about 7% off of S&P 500 earnings.

But over the longer term, no matter what party is in power, previous governments have made some potentially unsustainable promises with retirement and healthcare. Some sort of solution is a necessary evil. Whether it’s tax increases, spending cuts, or both will remain to be seen. The options are all bad – the most likely solutions that would balance the budget and fund entitlement spending are big raises in payroll taxes, a VAT (replacing state sales taxes with a national sales tax of 20% or so), raising the retirement age, or means-testing Social Security (i.e. taking it away for those who saved on their own for retirement).

4. War and Plague

The coronavirus is now mostly in the rearview mirror, not totally from a public health perspective, but from the perspective that it affects the economy and government policy.

Ironically the main remaining policy from COVID is the suspension of student loan payments. Roughly 43 million Americans owe about $1.75 trillion in student loans. If we ballpark the principal and interest on this at about $200 billion per year, then that’s about 1.1% of the after-tax income of America that would go to student loans, vs. about 0 now. After multiple extensions, these payments restart on Jan. 1, while the court battle over whether the Biden Administration’s $10,000 per borrower in student loan forgiveness is constitutional. Of course, all bets are off if another variant or another virus takes us back to square one.

Also, the war in Ukraine continues to grind on. It’s a grim situation from a humanitarian perspective, and it’s likely to set the economies of Ukraine, Russia, and Belarus back for quite some time. However, the war has little effect on corporate profits in the US or globally, and while it initially caused inflation to spike, workarounds were found to alleviate some of the worst shortages. The most pressing issue going forward for global stocks is whether Russia fully cuts off gas supplies to Europe – and whether Europe can store enough gas and/or get enough alternatives to keep factories running throughout the winter. Some analysis by Goldman Sachs has indicated that the key economies in Europe will now be successful at this. The market prices are showing hope here as well, with prices well below the panic peak in August.

Bottom Line

Autumn is nice because it brings pleasant days and cool nights. However, for stocks, autumn is likely to bring some more trouble as data on earnings and inflation comes in and investors fret over midterm elections. However, when it comes to the dangers of the war and the pandemic, things may settle down a bit. Investors should prepare for stocks to fall further in Q4 and cover likely contingencies. But with the Fed stepping out of the way, the free market is working to deny capital to profitless zombie companies and redirect it into areas of growth. As the current bear market presses on, the seeds are slowly being sown for the next bull run. I still have a fair value of around 3300 or so for the S&P 500, but small caps (IJR) and international stocks (VEA) are fairly valued and may end up being nicely undervalued if stocks continue to fall. Prices are likely to keep falling, likely giving farsighted investors some nice entry points. Markets don’t generally stop falling when hitting fair value, so investors should look to space out their buys and earn 3%-4% annualized on their cash in the meantime.

Be the first to comment