Galeanu Mihai/iStock via Getty Images

The following segment was excerpted from this fund letter.

In many cases, ClearBridge engagements have specific objectives, such as encouraging the retirement of fossil fuels and increasing use of renewables. Such has been the case with electric power company AES (NYSE:AES), with whose executives and board members we have been engaging for several years on the company’s path to reduce its carbon footprint.

We believe our voice, as a top shareholder, has been a valuable addition to AES’s decision making along this path, and our engagements have helped us identify where climate-related risks in a company’s operations could be climate-related opportunities.

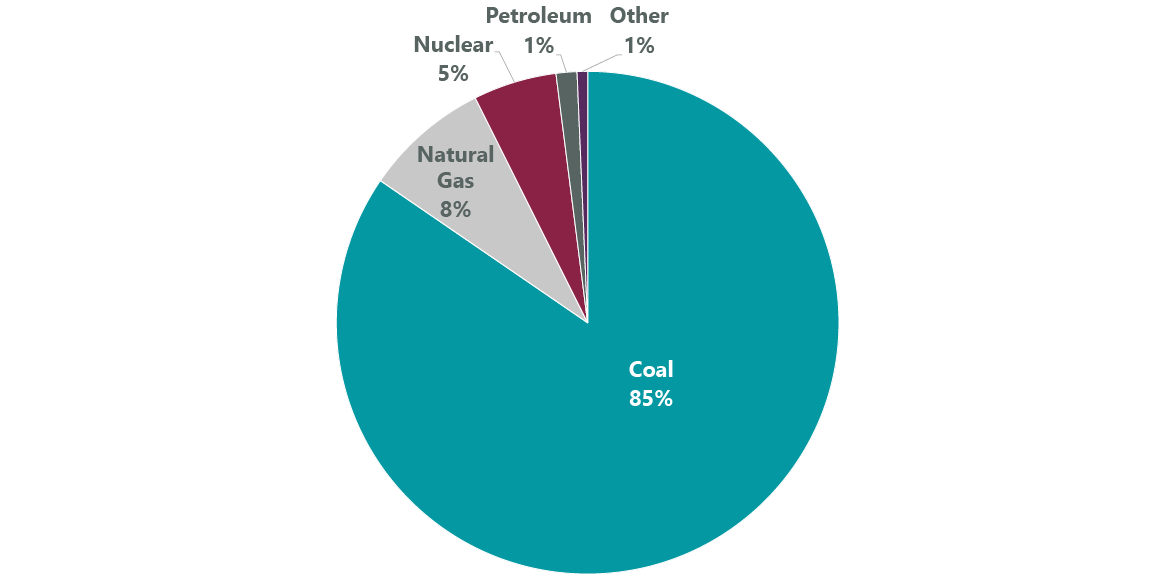

Several years ago, we began discussing with AES the lack of terminal value from coal (Exhibit 2), and we expressed how coal-related ESG concerns were weighing on AES’s valuation multiple, as the ESG risk premium was rising. We helped convince AES to stop investing in coal plants and start shutting down existing coal capacity.

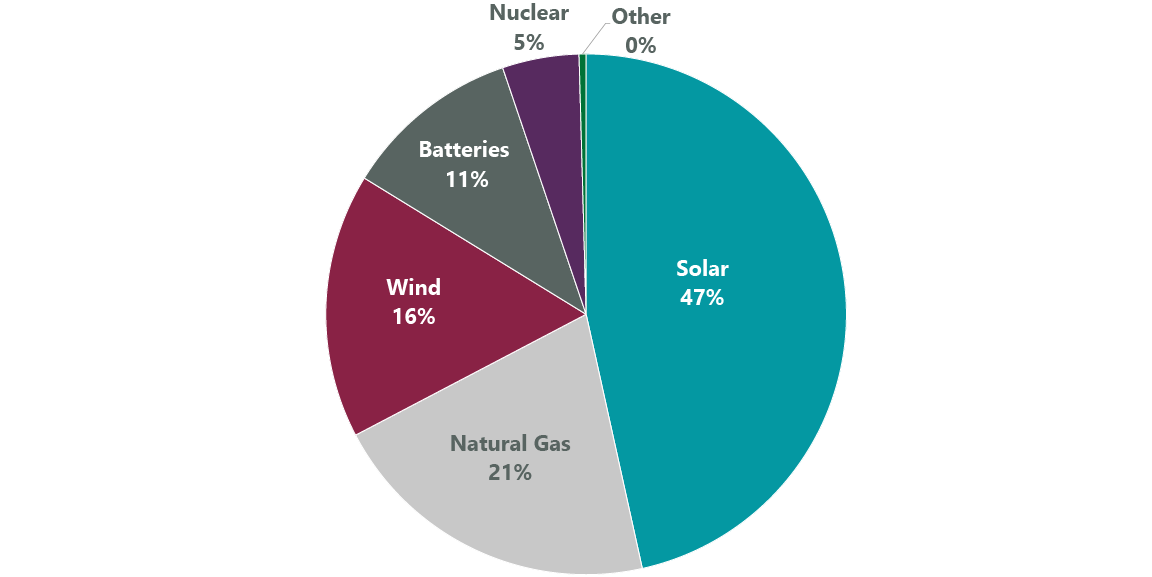

The next step was to add renewable energy exposure in the form of wind, solar and industrial scale battery storage (Exhibit 3), in line with U.N. Sustainable Development Goal (SDG) 7: Affordable and Clean Energy (we discuss how an investment framework may further the SDGs in our 2022 Stewardship Report). We shared our belief that any lost near-term operating earnings would be made up with a higher valuation multiple.

Exhibit 1: Planned U.S. Utility-Scale Electric Generating Capacity Retirements 2022 (14.9 GW Total)

Exhibit 2: Planned U.S. Utility-Scale Electric Generating Capacity Additions 2022 (46.1 GW Total)

As our discussions have progressed, AES has been increasingly aggressive in reducing its carbon intensity by lowering coal capacity and investing in renewable energy, as evidenced by its declining GHG emissions. As we had anticipated, AES’s valuation multiple recovered as its product mix shifted from coal to renewables.

ClearBridge encourages companies to align their net-zero goals with the Science Based Targets Initiative’s (SBTi) standards, which clearly define pathways for companies to reduce carbon emissions in line with the Paris Agreement goals. In April 2022 we met with AES Investor Relations and its General Counsel to discuss setting science-based targets as the latest step in this path, and in line with SDG 13: Climate Action. At the meeting, AES confirmed it is exiting coal in 2025.

The company continues to develop as a leader in renewable energy, in June 2022 announcing the formation with other leading U.S. solar companies of the U.S. Solar Buyer Consortium, which will invest more than $6 billion in solar panels to scale up domestic solar manufacturing.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment