Meranna/iStock via Getty Images

Today I will be completing a deep-dive on Adyen (OTCPK:ADYEY) (OTCPK:ADYYF). Herein, I will be delving into the main opportunities and tailwinds the company may be able to benefit from, and will proceed to outline where the company fits within the complex and vast payment ecosystem. In addition, I will break down how the company makes money, peek under the hood and look at its recent financials, and discuss how I’m thinking about the company’s next few years.

Introduction

I’ve always been a sucker for a good ol’ bank robbery movie. One of my favorites is Inside Man (spoilers incoming). The film starts off in a cell-like room, where a man tells us he has planned the perfect bank robbery and invites us to watch. Within the first half hour, one spectates an efficient gang enter a Manhattan bank, take hostages and proceed to engage in a series of high-stake negotiations with an army of police officers surrounding the institution outside. Sparing you the further nuances of the plot, for there are many, the protagonist of film, Dalton Russel, ends up getting away from this ordeal unscathed – not by making a flashy and spectacular getaway but by staking out inside a false wall that he and his cohorts had built within the bank supply room, filled with enough provisions to wait it out until the excitement surrounding the robbery had simmered down. There is something spectacular about the ability to hide in plain sight and this movie was a prime example of just that.

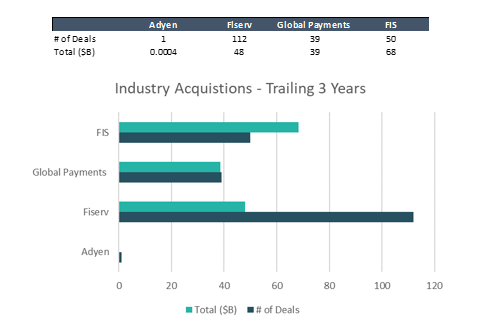

When I think about the world of tech, there is no shortage of products, developments, or innovations that deserve attention. Some pieces of technology, when broken down, are extraordinarily complex and exist out in the open. Others hide in plain sight, functioning in the shadows, but are still responsible for certain components of indispensable processes that allow our world to operate as we know it today. After delving into Adyen, I believe this company is a prime example of this phenomenon. Since it is largely business-facing rather than consumer-facing, not many are aware of the essential role it plays in the payments ecosystem. Its tendency to hide in plain sight makes it an overlooked component of the industry despite the fact that it is a truly impressive business. In the midst of competitors that are all too eager to engage in bolt-on acquisition strategies, the company is focused on beautiful simplicity – refusing to engage in any forms of M&A and insisting that its code-base expands organically internally to target an ever-growing array of opportunities. In addition, the company has a fortress of a balance sheet, a culture devoted to engineering excellence, a focused and aligned management team, and responsible talent compensation methods that are a far-cry away from the QE-induced SBC printing methods that have plagued the tech industry. I have spent a ton of time writing about tech over the course of the last two years, and there is no doubt that an uncomfortably large chunk of the industry exists as exit-liquidity for VCs and employees, leaving customers and shareholders to bear the brunt of poorly aligned incentive structures. Adyen is a breath of fresh air in comparison to that, and despite still being richly valued in a market environment that is growing more hostile by the day, I believe deserves more attention than what it currently has today.

Outline of Ecosystem

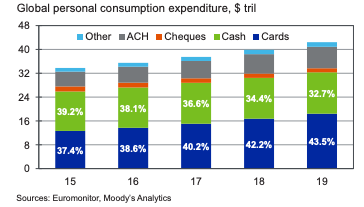

Before delving into where exactly Adyen fits within the payments ecosystem, I believe it is useful to start off with an attempt to quantify just how big the opportunity that the company has in front of it really is. First off, the continued growth of digital payments is a clear trend that is likely to only grow stronger in the coming decades. From the early 20th century onwards, consumers have clearly shifted away from predominantly leveraging cash for their purchases and moved towards payment cards. The emergence of the pandemic obviously accelerated this trend, however, an increased usage of payment cards in favor of cash was evidently was already observable beforehand:

Cards as % of Personal Expenditures

Despite there being a period of renormalization underway at the moment, as well as future headwinds to general economic activity that are likely to continue to run rampant, this trend still has legs, particularly as a result of imminent continued e-commerce penetration and increased rates of banking adoption in various emerging markets. Using the US as an illustrative example, total electronic payment card purchases were approximately $8T in 2020, a value that is enormous in magnitude. Evidently, as these purchases continue to rise, and as Adyen intertwines itself in a more substantial manner over the next few years with existing and new customers, this is an exciting value proposition. Additionally, payments as part of commerce experience are increasingly being shifted to the background in terms of the customer experience as a whole. With the likes of ride-sharing, grocery delivery, food delivery, etc., all becoming more relied upon services, digitally native payment solutions that occur with ease are becoming more paramount, highlighting some likely tailwinds that will continue to exist going forward.

Second, there is a general shift to unified commerce underway that is notable and should act to spur on growth going forward. Omni channel retail environments are typically composed of stand-alone systems, often resulting in a tangled web of uncoupled channels and integrations. As a result, the customer experience typically suffers. As an alternative, unified commerce is increasingly becoming paramount. Therein, sales channels are supported by single platforms that serve as end-to-end growth drivers, allowing for consumers to experience seamless interactions with brands across a multitude of touchpoints, ranging from in-person pickup, self-checkout and cashierless stores, etc. With Adyen existing in exclusivity within this space, there is no doubt that as these transformations continue to occur that the company will stand to benefit.

Third, arguably the additional big trend that the company aims to continue to reap rewards from is the overall prosperity of the “Platform Economy”. In the last ten years, the majority of most valuable companies in the world have become those reliant on the platform business model: i.e. the creation of a digital communities and marketplaces that customers can both interact and transact with. This trend is expected to continue, as projections indicate that upwards of $50T+ in economic activity is anticipated to be mediated by these digital platforms in a few years’ time. As Adyen continues to expand its product suite geared at platforms, it stands to capture some of the value sloshing around therein. As an example, outside of the payment processing, having the ability to extend credit to SMBs contained within a platform is something that has proved enormously accretive for the likes of Square (SQ), an interesting development to say the least.

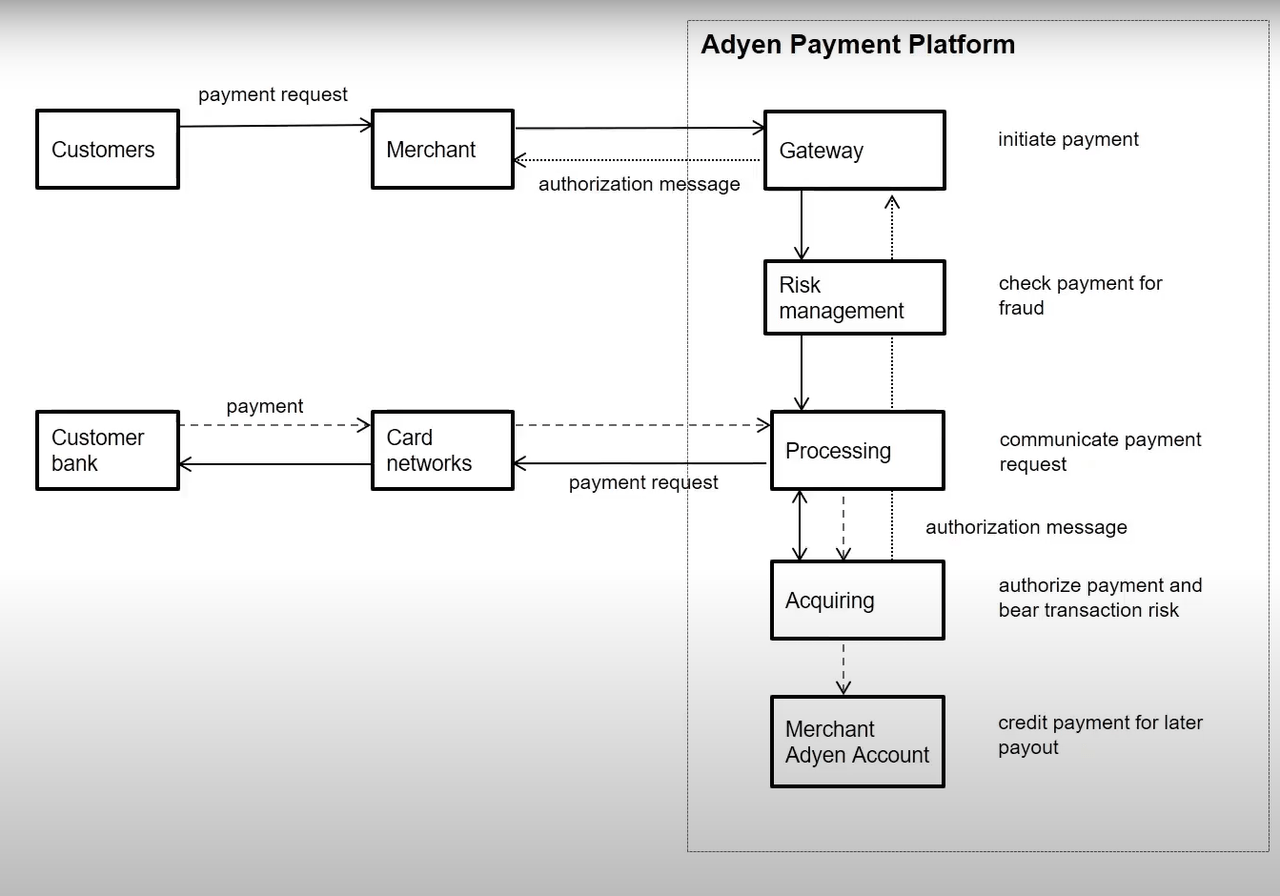

Although these ramblings do not capture the full array of every major market development that Adyen stands to benefit from, it gives a sense of a few things to monitor going forward. Before moving on, let’s find out exactly where Adyen fits within a typical transaction. If a customer wants to buy a good or service, a payment request will be made commonly through a POS system. Thereafter, the associated data will be sent to the merchant acquirer, which in this case is the component of the system encompassed by the Adyen Platform, as outlined below:

How Adyen Fits Within a Transaction

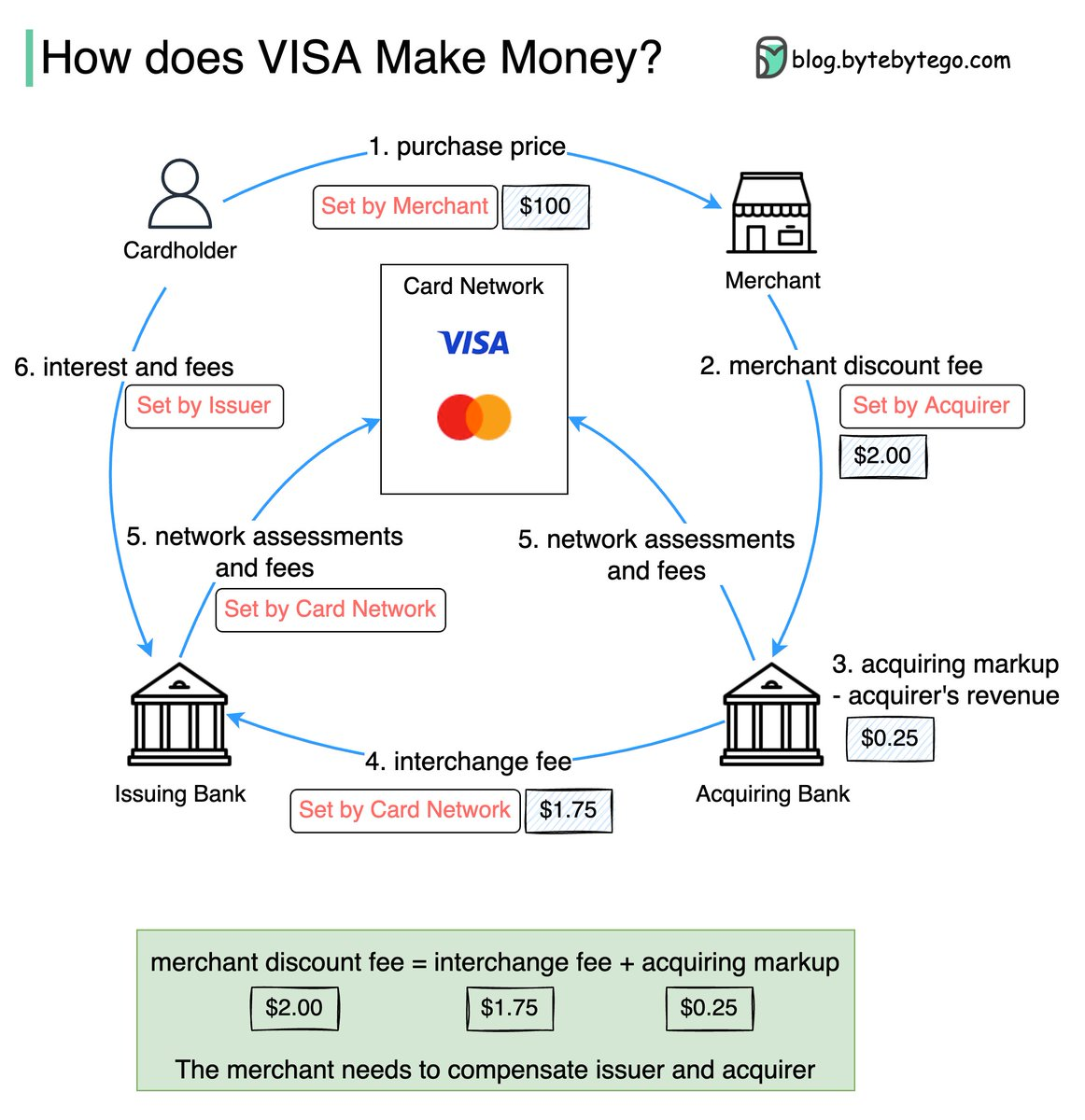

Once the merchant acquirer receives the transaction data, they will start to perform the necessary risk management procedures. This commonly consists of ensuring the request is a legitimate one through a series of fraud checks. Once the payment is given the okay, the merchant acquirer will interact with the card networks (i.e. the rails provided by Visa (V) or Mastercard (MA)), and said networks will then communicate with the customer bank (issuing bank responsible for issuing the card and associated account of the customer). Once their identity has been confirmed with their bank, the card network will then relay the payment authorization back to the merchant acquirer, which will then confirm the sale to the merchant themselves, allowing for a transaction to be conducted in entirety and receipt to be issued. Occurring alongside this process is the actual transfer of funds themselves. The card network will calculate the net settlement amount, resulting in the issuing bank extending credit on behalf of the customer, the merchant acquiring bank receiving said extension, and the merchant’s account then receiving the amount they are owed, less fees. The fees of this process vary, however, an over-simplified illustration with reasonable accuracy can be seen outlined below:

Fee Distribution Within a Transaction

Now that we have a basic understanding of the main things Adyen stands to benefit from, as well as how it fits within a typical transaction, let’s delve into what exactly the company offers customers and how it makes money from it.

Business Breakdown

Adyen’s business can be segmented into four main areas of offerings: Payments, Risk Management, Authentication, and Issuing.

Payments

The payments area of Adyen’s business is relatively self-explanatory, when viewed in conjunction with their aforementioned role in the ecosystem as a whole outlined above. As a financial technology company, Adyen lets businesses accept, process and settle payments. The company supports over 100+ payment methods and accepts said payments through all channels (take online, in-app, within a storefront, etc. as examples). As alluded to, these capabilities are directed at three main use-cases, online, in-person and with unified commerce. Online payment functionality is directed at providing customers with solutions that can be easily integrated with their business, increasing conversion rates (an important selling point), while offering global coverage, helpful dashboards, industry standard adherence and fraud protection. This area supports B2C solutions, allowing for businesses to build unique and branded payment experiences with customized payment flows, and add-on features such as tipping, one-click payments etc. Subscription capabilities allow for Adyen to help promote these business models, supporting a variety of different pricing models, invoicing frequencies, alerts and database protection, leveraged by some industry-giants reliant on this business model such as Spotify. Lastly, B2B methods are supported, allowing for pay-by-link, bank transfer, corporate cards, quick settlements and payouts in all major currencies to occur, while providing functionality that reduces bookkeeping and reconciliation issues, commonly leveraged by the likes of Uber. In-person payments consist primarily of POS solutions (including terminals and the newly minted in-person payment acceptance via iPhone) offered by Adyen, of which adhere to PCI compliance standards, can be connected to, integrated and initiated with a simple API, and all managed from one central dashboard, if desired. Lastly, Adyen offers customers the capabilities to support unified commerce, allowing for a host of new channels to be opened, supported and consolidated into one system rather than incorporating the siloed alternative solutions offered by competitors. As a result, capabilities including the likes of self-scan and pay, buy online and return in store, buy in store and ship home, pay with QR code, pay via a self-service kiosk, etc. are all supported.

A few illustrative examples I came across within my research cement the company’s prowess nicely. First, at Spotify (SPOT), the company wanted a flawless checkout flow. Using Adyen, they were able to transition from a two-page checkout to a one-page checkout, increase the rates of authorization, then leveraging the data provided by Adyen’s platform to drive conversion. Second, Adyen’s capabilities helped Joe & the Juice, a large healthy food chain, shift to omni-channel functionality in the midst of a global pandemic that demanded this functionality. Third, the company’s offerings geared at marketplaces and platforms have been leveraged by the likes of Lightspeed (LSPD). Lightspeed has transformed from being a POS provider, to a business supporting the reseller model, to a company with full end-to-end control, meaning that merchants can now use the platform for all of their payments needs. This allowed for the company to address all the needs of their SMB customers, differentiate themselves from competitors and start to focus on new business avenues once their full payment capabilities were made possible with Adyen’s services.

Risk Management

Adyen’s risk management capabilities, encompassed by their RevenueProtect product, allow for users to block fraud, prevent disputes and stay ahead of the ever-increasing complexity of associated trends using their technology. Customers can delve deep into a unified view of their payment data in order to detect, prevent and respond to fraud, leverage a series of risk templates that help a risk-setup be tailor-fit to the business needs, leverage customizable risk rules to analyze each and every transaction, if desired, create custom notifications to review and deal with charge-backs, identify abnormal purchasing behaviour across various channels, and play around with experimentation tools that help determine what the best route for traffic optimization may be. Comprehensive risk management tools are also geared at a variety of different industries. For subscriptions and gaming, these pieces of technology can be used to detect/block synthetic subscribers, stop card testing attacks, and only allow for eligible cards to be accepted for recurring transactions. For on-demand businesses, tools therein can help identify genuine customers, detect possible account takeovers, identify shoppers and uncover fraudulent domains, reduce fraud attempts related to the likes of CVV & BIN attacks, prevent potential card-testing attacks, and identify customer journeys throughout one’s business. For events-based businesses, these risk tools can be used to protect ticketing and event processes, reducing the prevalence of voucher fraud, allowing for custom risk-checks, capture delay and review, and flow authentication. Lastly, for travel businesses, the risk management suite can be used to setup comparison lists and reviews cues, detect and block synthetic subscribers/bots, avoid account takeover attacks, all in the aim of identifying genuine customers and traffic.

Authentication

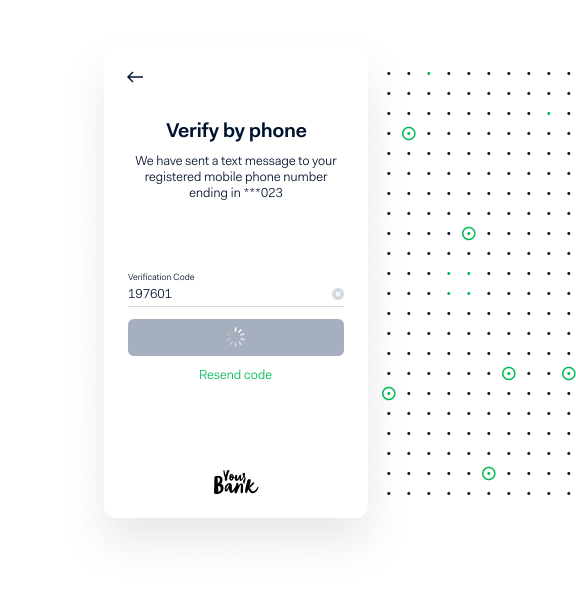

The payment authentication landscape is challenging to navigate and often differs on a country-to-country basis. With Adyen’s 3DS2 authentication technology, businesses are able to leverage this functionality behind the scenes of their processes, with each transaction then able to be routed based upon the regulation type, risk assessment criteria and pre-specified policies of the business, of which can be incorporated in a manner that doesn’t hinder or interrupt customer experiences. As a result of certified SDKs and iframes integrated within the checkouts, as well as associate APIs, a data conduit is able to form between businesses and banks, increasing authorization rates as a result.

Authentication Example

Issuing

Lastly, Adyen offers customers the ability to create a virtual or physical payment card programs through their unified payments platform. This all-encompassing card issuance solution consists of APIs that can be leveraged for custom-branded physical or virtual card issuance, and provides the ability to exert controls and real-time authorization on cards in order to manage their associated spending, makes a plethora of data available for businesses to gain insight into associated transactions and operations, all while adhering to global regulatory and compliance standards with reliable interchange pricing. Services are geared at platforms and marketplaces where card issuance can be used to increase the UX with faster payouts, on-demand services where new services providers can be added to the platform expediently, online travel to provide customer funds to be used with car, hotel or airline partners, corporate expense management use-cases where budgets can be controlled and monitored with respect to employee uses, and business financing, where funds can be made instantly available through payouts made to physical/virtual cards.

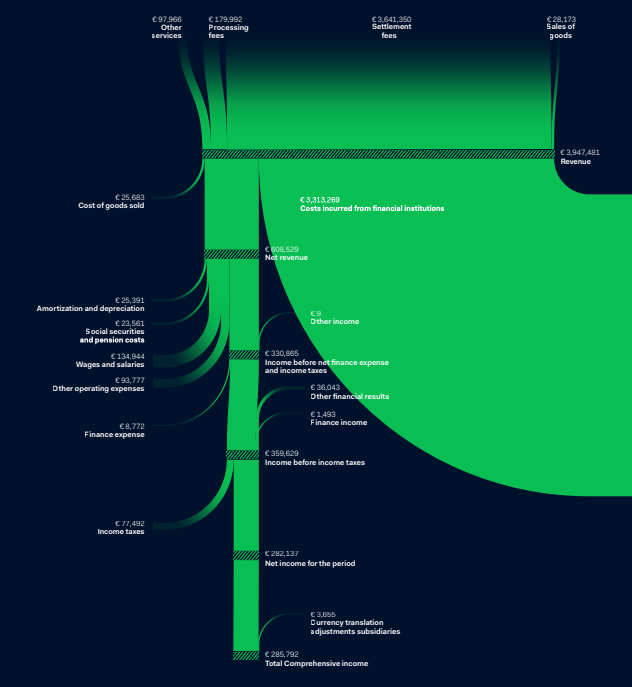

With all of this in mind, what exactly does the journey from Adyen’s top to bottom line look when all of these products and offerings taken into consideration? Adyen generates revenue in four key areas: settlement fees, processing fees, sales of goods sold, and through other services. Settlement fees are fees paid by merchants, often a percentage of the total transaction value, the process of which is outlined in the two diagrams contained within the previous section; in short these include interchange fees, payment network fees, costs incurred from financial institutions and the fees Adyen charges to merchants based upon incurred costs + an associated markup. Processing fees are self-explanatory, and rather than occurring as a % of the transaction value, are a flat fee charged to merchants for initiation of a transaction and subsequent use of Adyen’s platform. Sales of goods sold are primarily derived from the sale of Adyen’s POS terminals. Lastly, other services essentially includes revenue generated through FX service fees, third party commission and issuing services. All of these combine into the Gross Revenue metric. Management will then subtract and distribute the fees owed to financial institutions (i.e. to the issuing banks, networks etc.) and the COGS to arrive at their Net Revenue metric. Taking Net Revenue and subtracting Operating Expenses including Wages & Salaries, Social Securities & Pension Costs, Amortization and Depreciation and Other OPEX, and including Other income gets you Income before net finance expense and income taxes. Taking this value, less the finance expense (finance income, expense and other financial results) and taxes results in the company’s net income. The entirety of this process can be seen encompassed by the following schematic:

Adyen’s Income Statement Visualized

With this understanding of the company’s business in mind, let’s take a glimpse at the company’s past before making any assumptions about the potential trajectories of their future.

Financials

Within this section, I converted EUR values disclosed within Adyen financial reports into USD. As a result of FX volatility, there will be a margin of error here. All dollar values are in millions of dollars.

Income Statement

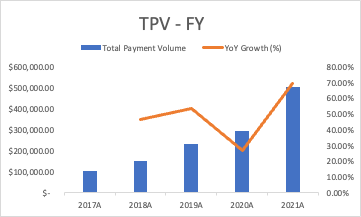

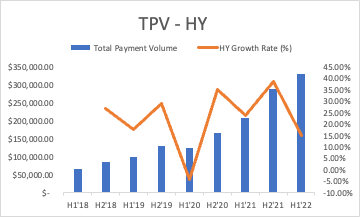

Before delving into specific Income Statement constituents, it is pertinent to take a look at some high-level KPIs that give an illustration of how the company’s business is performing. Starting off with Total Payment Volume, we can gauge just how rapidly the amount of volume flowing through the Adyen platform has grown. On both a FY and HY basis, we can clearly see that even post pandemic-induced tailwinds, macro-related headwinds have not reared their ugly head just yet. From FY’17 to FY’21, TPV has compounded at a ~48% CAGR, and continues to show commendable strength on a HY basis when gauged by HY growth.

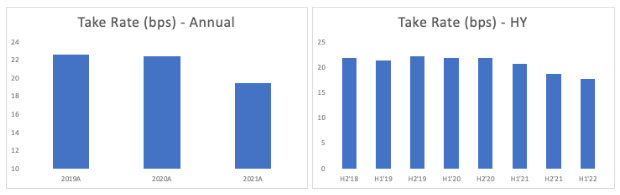

The volume growth has coincided with a lower take-rate overall. This phenomenon is to be expected and occurs as a result of the company’s tiered pricing model, by where large customers will receive a break on fees if they bring more volume to the platform. On an annual basis, TR fell from 22.5bps for 2018A to approximately 19.4 bps seen in FY’21, behavior we’ve seen continue on a H1’22 basis, where TR came in at 17.6 bps for the most recent reporting period.

These metrics when viewed in conjunction with the company’s extremely low volume churn rates (less than 1% for the last few years now), as well as the overall growth in the number of transactions, which increased from approximately 3.7 billion in 2017A to 15.8 billion in 2021A, quite clearly show the stickiness and activity going through its platform overall. With the company’s land and expand business model, the declining take rate is more illustrative of the fact that the company is continually extracting more value from its customers. As such, investors should focus more heavily on absolute margins rather outright take rate.

Lastly, two additional factors should be monitored to gauge the overall stability of Adyen’s business. First, the company still has relatively high concentration of revenue attributable to their top ten customers, a value that has decreased from 2017A to 2021 from 33% to 20%, but still puts Adyen in a relatively vulnerable position given it is reliant on the success of these partners. Second, the company’s full-stack volume (i.e. volume that leverages the platform from gateway to acquiring) should continue to be tracked. This value decreased YoY in H1’22 from 83% to 78% as a result of heightened airline activity (they cannot leverage acquiring services). In an ideal scenario, full-stack volume should remain steady as it bolsters the company’s take rate overall.

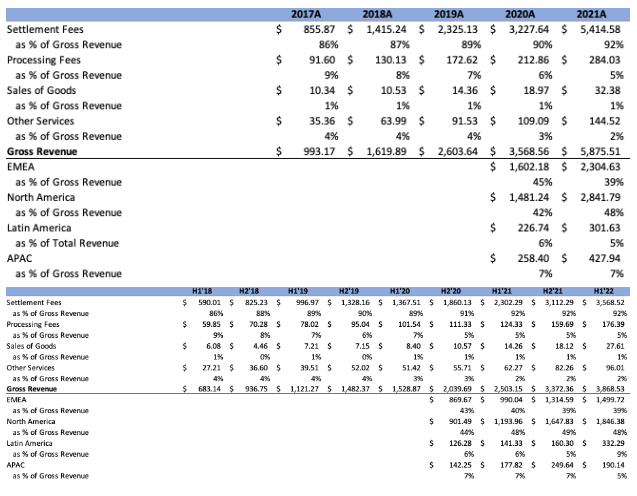

Revenue

Starting off with Gross Revenue, on an annual basis this value has increased at an approximately 56% CAGR from 2017A to 2021A, coming in at $5.9B for 2021A and approximately $3.87B for H1’22, largely attributable to Settlement Fees on a segment basis, and increasingly attributable to North America and EMEA on a geographic basis, as outlined below:

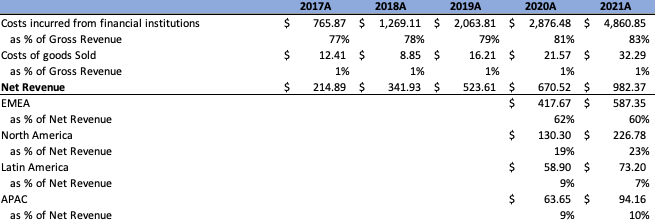

On a Net Revenue basis (the more important top-line value after costs incurred from financial institutions and COGS have been removed), a clearer picture is painted. Increasing at a CAGR of 56% between 2017A and 2021A, Net Revenue came in at $982M for FY’21, and is clearly more attributable to Europe, although this share has decreased slightly YoY.

On a HY basis, YoY growth remained strong, with Net Revenue increasing 37%+ and coming in at approximately $596M. Although the EMEA area is still the predominant region which Adyen derives value from, the US is continuing to take an increased amount of share:

Financial institutions costs have increased on a relative basis over the last few periods, a result of increased interchange and scheme fees, a phenomenon that should not be viewed as problematic seeing as they are passed on to Adyen’s customers. Looking forward into the coming reporting periods, a high 20% to low 30% net revenue growth in top-line is what is guided for, values that will need to be monitored alongside consumer and general macroeconomic stability to determine if in fact this will be achievable or not, and if Adyen’s premium multiple will be maintained accordingly.

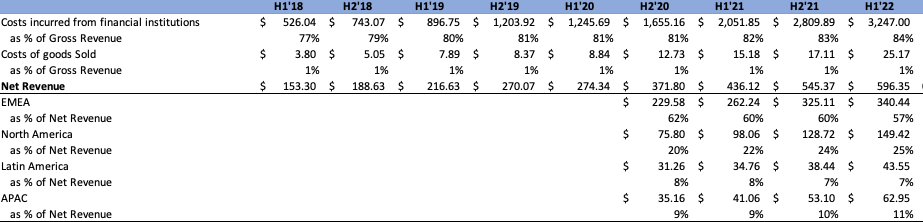

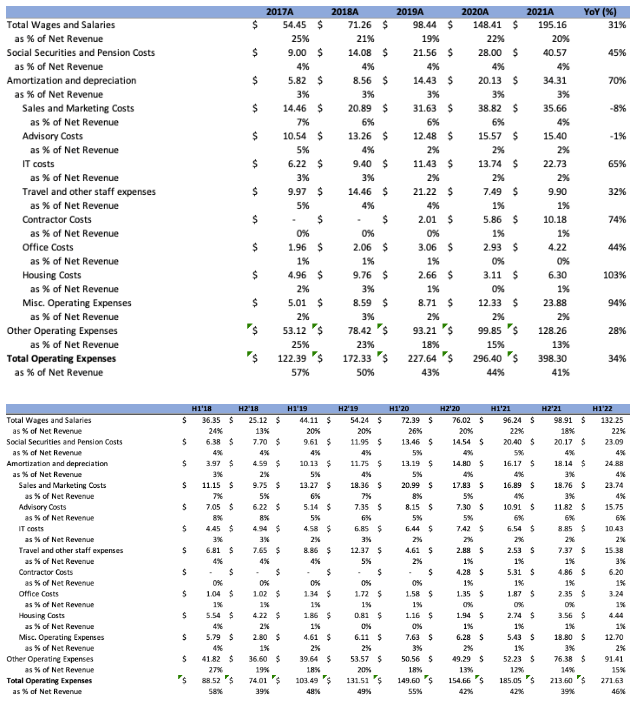

Expenses and Margins

A breakdown of Adyen’s various expenses by category, i.e. Total Wages and Salaries, Social Securities and Pension Costs, Amortization and Depreciation and Other Operating Expenses (and all of the various expenses therein) on both an FY and HY basis can be seen broken down below:

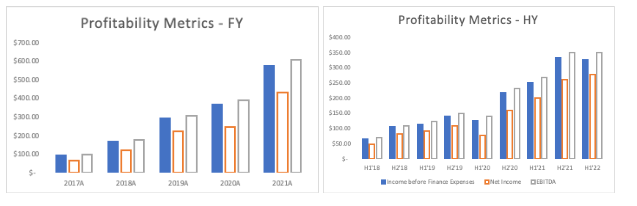

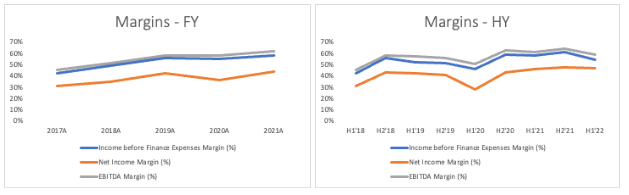

When comparing H1’22 expense profiles with that of FY’21, a big analyst discussion surrounded the slight ramp-up in Total OPEX, with H1’22 Total OPEX coming in at 46% of Total Net Revenue in comparison to 41% in FY’21, occurring as a result of Adyen directing increased activity at investing in its business, expanding key team areas etc., increased travelling costs as a result of re-opening, etc. Adyen has evident financial responsibility and despite this ramp-up, still remains ridiculously profitable. In comparison to a large majority of the tech sector, the company has been able to maintain a high degree of top-line growth (30%+) with these astounding Income Before Finance Expenses, Net Income and EBITDA values and associated margins on both an FY and HY basis:

Balance Sheet

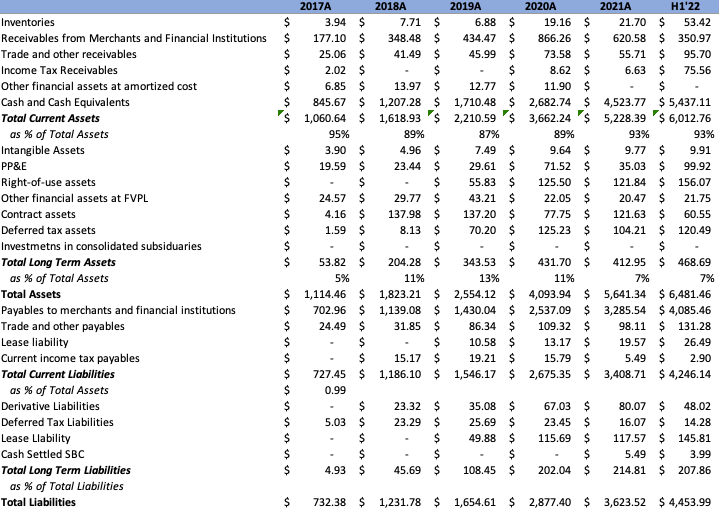

The structure of Adyen’s balance sheet as of H1’22 relative to other FY periods can be seen outlined below:

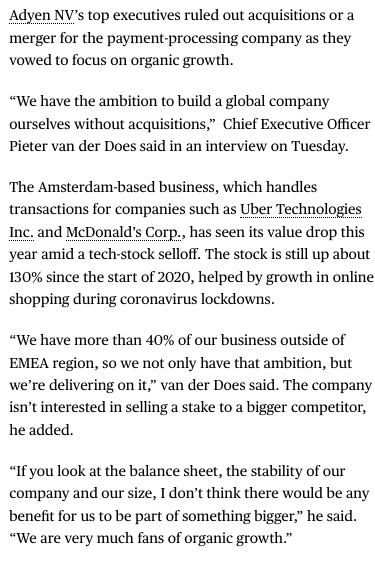

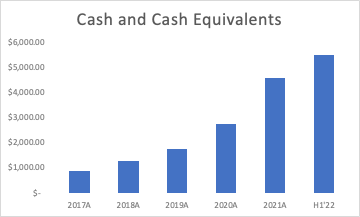

The company’s balance sheet is very straightforward. Other than the constituents of the company’s working capital, the biggest takeaways are the increasing size of the company’s war chest and the negligible debt on its balance sheet. Adyen is hellbent on achieving success by way of organic growth. As such, management has been adamant that they will not engage in any growth-by-acquisition and will continue to bolster a humongous net cash position in order to appease regulators with the strength of their balance sheet, statements that can be corroborated by management from an interview earlier this year:

Is this use of capital the most accretive way forward for shareholders? Only time will tell, however, even if the company wants to continue to engage in no M&A, I feel using some of the war-chest for opportunistic buybacks heading into potential continued weakness for tech may make some sense going forward.

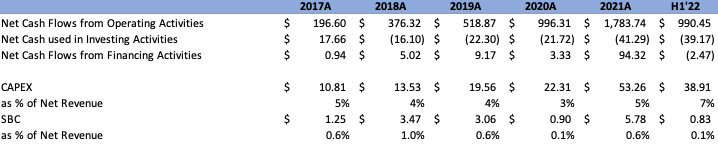

Cash Flow Statement

The change in the company’s various cash flows over the last few FYs and for the most recent HY’22 period, as well as associated metrics contained therein, can be seen outlined below:

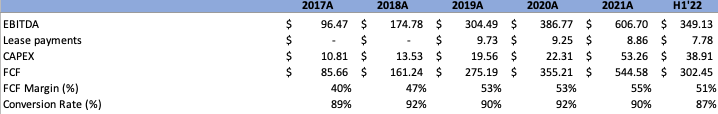

Honing in on HY’22, CFO came in at approximately $990B, a 63.47% increase from HY’21. Net cash used in investing activities was approximately $(39)B, attributable almost solely to the purchase of PP&E, followed by the capitalization of intangible assets. On a relative basis, CAPEX increased with respect to Net Revenue in comparison to previous FY periods. Long-term guidance is for this value to stabilize in the 5% of Net Revenue range; however, this quarter saw slight elevation as a result of supply chain challenges related to the company ordering new server capacity for their data centers, what the company has denoted as “ahead of the curve” investments that should normalize going forward. Lastly, the company’s CFF was an outflow of approximately $(2.5)B. The change in the company’s FCF (EBITDA less capex less lease expense) and conversion rate (FCF/EBITDA) can be seen outlined below:

Quite clearly, even despite slight upticks in investment seen in H1’22, the company still maintains extremely strong FCF generation and a ridiculous conversion rate, a phenomenon that is unlikely to change going forward.

Discussion

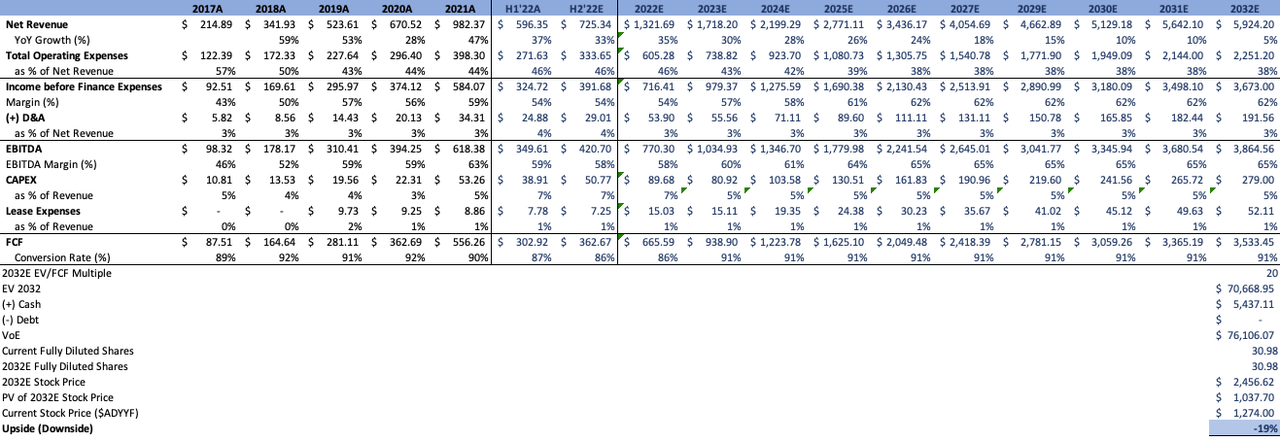

Before delving into a general discussion of the competitive forces that exist within this space, let’s take a look at a modeling scenario that gives a general idea of what may be baked into the share price and the possible share-price related outcomes investors may be able to expect going forward. This analysis is very simplistic and is contingent on the following assumptions:

-

Net Revenue continues short-term medium growth in the high 20-30% range as per management guidance, declining thereafter into the end of the forecast period

-

OPEX remains elevated for H2’22E but normalizes downwards before stabilizing at the latter end of the period

-

D&A stabilizes at historical averages

-

EBITDA margins reaches management’s long-term targets of 65%

-

CAPEX remains elevated for the remainder of the year as a result of heightened investment but stabilizes at historical averages thereafter

-

Lease Expenses remain at historical averages

-

Share Count does not change going forward

-

2032E EV/FCF Multiple of 20

-

Discount Rate of 9%

With those assumptions, we arrive at the following scenario:

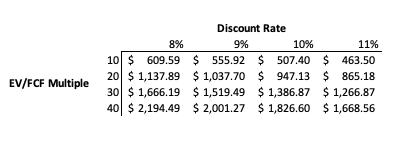

In my eyes, this conveys the fact that Adyen, despite the recent sell-off, is still expensive, and even if a lot of things go right going forward, investors may not be exposed very much upside. Additionally, completing a sensitivity analysis with both the 2032E EV/FCF multiple and discount rate conveys a similar phenomenon:

These points hopefully convey potential outcomes for a rosy future trajectory, but how will Adyen fare going forward within an industry that contains abundant competitive forces? The first upstart that Adyen can be compared to is Checkout.com. This company, founded by the Swiss billionaire Guillaume Pousaz, embraced the “move fast and break things” mentality in the low-interest rate environment seen prior to this year. As of January 2022, the company had raised a stunning $1.8B in funding from Series A-D in little under 3 years, amassing a $40B valuation in its latest round. Given the haircut that both Adyen and the other upstart worth mentioning, Stripe (STRIP), have taken this year, it is not unreasonable to say that this has likely decreased by 30-40%. However, given that the company’s investors do not make their holding evaluations public, there is no way to know for certain. Both Adyen and Checkout.com operate semi-similar business, existing as entities that assist with the processing of payments between consumers and merchants, and offering services ranging from providing security surrounding the transactions to the provision of technology that underpins customer’s checkout experiences. Checkout.com is likely bolstering a larger growth rate, with May 2020 translation volume growing 250%+ YoY and total dollar volume growing 200% in 2018. The last disclosed numbers indicate that nearly 50% of transactions occur in Europe, with Europe revenues in 2020 being approximately $253M. In 2020, the company likely had $500M+ in Revenue, a value that would mean their $40B raise may have had a 80X 2020 revenue multiple. Strategy-wise, Checkout.com serves more mid-market clients in comparison to Adyen’s heavy enterprise focus. The company doesn’t have a full omnichannel offering like Adyen, with its software and hardware prowess, and is instead focused on primarily being an internet and e-commerce focused vendor thus far. A large majority of the company’s growth efforts were contingent on the continued success of web-3 clients, with Checkout.com serving the likes of Coinbase (COIN) and FTX (FTX-USD). In short, I believe Adyen exists as a leaner and lower-risk operation. The company, operates more efficiently, and is focused on building out its platform solely internally rather than a growth at all costs mentality, and is less exposed to industries that were highly influenced by a series of fads. Although Adyen may suffer from the fact that it is not compensating engineering talent in the same realm as Checkout.com, most SBC plans are likely underwater this year, so this may be net neutral overall, at least in this current environment.

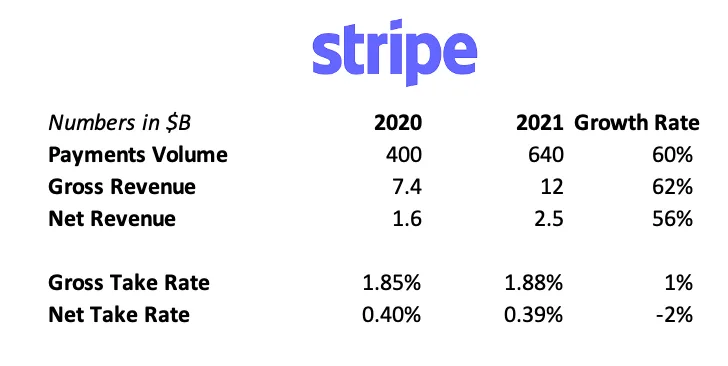

Moving along to Stripe, this company is arguably one of the most popular privately held payment companies bar-none. Per this great analysis by Tanay Jaipuria, we can delve into how Stripe’s financials compare with Adyen.

Stripe Financials

As of 2021, Stripe was bigger than Adyen in terms of total payment volume processed, had higher gross revenue than Adyen due to higher aggregate take rates, almost double the net revenue and likely substantially lower EBITDA margins in comparison to Adyen’s best-in-class values. Stripe evidently started its journey as tailoring its products to SMBs, whereas Adyen was the opposite. As a result of this focus, its customer base can be exposed to higher take rates in comparison to the higher payment volumes and lower take rates associated with Adyen’s predominantly enterprise-focused clients. Stripe also has a much broader product suite in the pre-built components, financial services, multiparty payments, direct payments and business operations segments, presence that again lets them command a higher take rate overall. Stripe’s compensation per employee is likely substantially higher than Adyen’s. However, I believe Adyen’s operations and exorbitant cash position put it in a better position to weather the continued storm facing tech companies going forward. Thus far, we have not seen Adyen’s metrics convey any competition-induced pressures, with the company still commanding strong Net Revenue growth and very low volume churn. Going forward, this will continue to require monitoring to ensure this doesn’t change.

Looking forward, it will be interesting to see how the next few years unfold for Adyen. With competitive forces not going anywhere, and what appears to be a decade+ of easy monetary policy coming to an end, will the next decade be as stupendous as the last? Adyen’s customers, particularly some of their large tech-based enterprises, have experienced tremendous growth, that there is no doubt, but how much of this growth can be underwritten into the future? Abundant and arguably ludicrous funding practices were able to fuel businesses with unsustainable unit economics, creating an index full of zombie companies that would not have been unable to survive otherwise. This is me being pessimistic, and Adyen has shown no sign of steep deceleration thus far in the year. However, the rate of digital transformation was undoubtedly increased over the course of the pandemic, and I have contemplated whether there are still lingering effects of an overshoot present within this industry, of which may fall victim to mean reversion, or prove to make the company’s forward guidance appear unrealistic. With a technical recession in the US already underway, it may be unwise to assume that continued growth occurs to the magnitude that Adyen anticipates. However, the payments industry is so intertwined with modernity that we are unlikely to see a high magnitude change. Take 2008 for example; in this financial crisis the demand for Visa services barely staggered, and 2020 saw the company’s constant total volume growth actually increase for the 12 months ended June 30th, 2020. The sector as a whole will need to be continually monitored and payment industry peers may be able to give us insight into this phenomenon before Adyen reports their H2’22 results, an event I will be waiting for eagerly.

Conclusion

In a Tech Sector full of grifters, Adyen stands out from the pack and it was a pleasure to learn more about them. With a steep valuation, I will be avoiding this one for now. However, I will continue to monitor the story to see if that premium does dwindle in the coming years. Thank you for reading my research.

Disclaimer: The information and research contained herein is all my own opinion and not be used as a substitute for proper due diligence. Please consult your financial advisor and evaluate your financial circumstances before making any investment.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment