AnuchaCheechang/iStock via Getty Images

Today, I will be providing an update on NASDAQ:AMD -1.33%↓ after their recent Q3 earnings report. Therein, I will discuss the chip sector broadly for a moment, delve into what’s changed for the company since I last wrote about them, and more.

Not too long ago a pandemic ravaged our world, and resulted in many aspects of Global Economies coming to a standstill. However, through crisis, adaptation and transformation emerged, and a series of trends that were already underway were accelerated. Arguably, the most noticeable was the increased digitization of everyday life. With the outside environment deemed borderline apocalyptic, individuals were confined to the safety of their homes. Work was conducted through zoom and slack rather than in the seclusion of an office, relationships were maintained through digital mediums, spending shifted towards goods and away from services, and entertainment was relayed almost entirely through screens. With these transformations came an unprecedented requirement for semiconductors. Whether that be a result of the increased need for client computing or with tech companies, hyperscalers and data centers needing to bolster their infrastructure to keep up with an unforecastable level of traffic, semiconductor companies, though struggling with a myriad of shortages and supply chain issues, blossomed from a worldwide situation that was otherwise dreary.

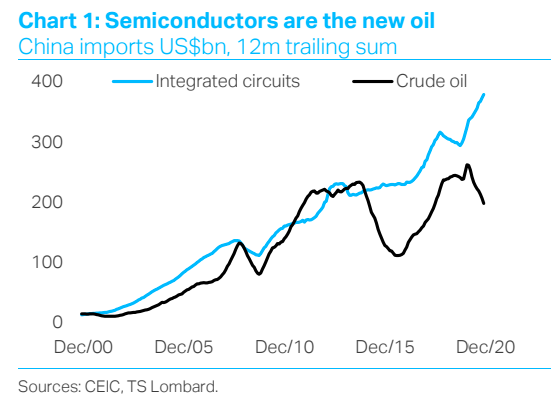

Many have stated that semiconductors are the new oil and for good reason – these complex pieces of technology are in almost every single one of the devices, appliances or other gadgets we have come to rely on so heavily. As such, there is an unfathomable global demand for chips. Without them, economies would come to a standstill. Take China as an example. This economy was one of the fastest growers over the course of the last few decades, and the rapid expansion of their industrious capabilities required an abundance of almost every commodity known to man. Despite that, the value of their semiconductor imports actually far exceeded that of Crude Oil even before the pandemic accelerated rates of digital transformation:

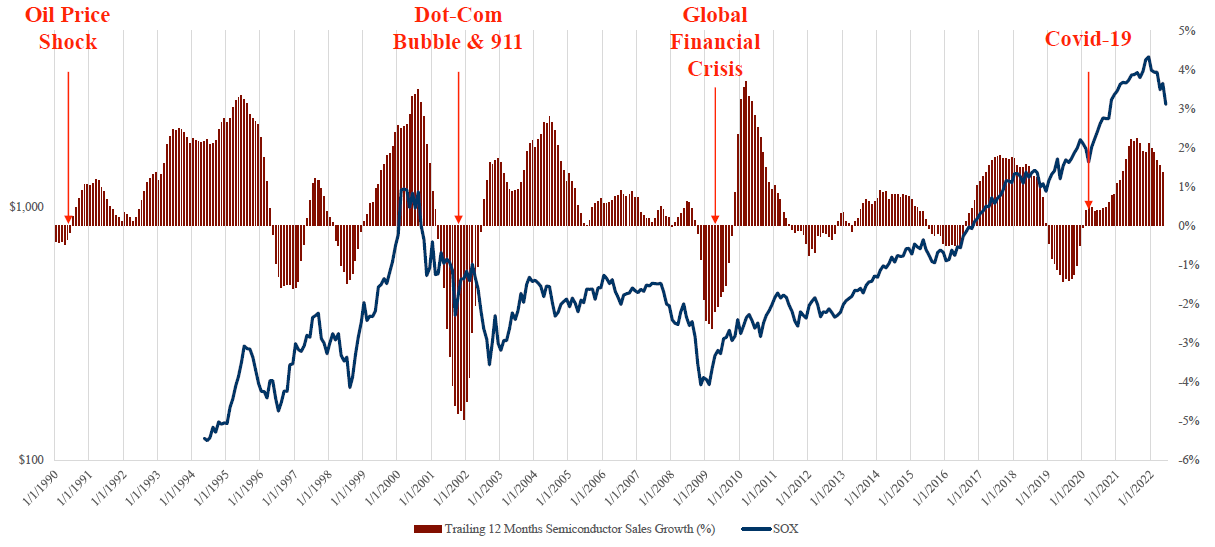

Although the secular demand for these pieces of tech is only growing stronger, like any highly sought after commodity, semiconductors have experienced a plethora of boom and bust cycles over the course of their short history:

Similar to other commodities, semiconductors go through a five-phase cycle. A surge in demand outpaces supply, and can be attributed to economic expansion, a new technological breakthrough, or heightened buying activity as a result of low prices. With a rise in prices, producers will experience margin expansion, which in turn will result in higher degrees of capital expenditures allocated towards meeting the increased demand. With heightened spend comes an increase in capacity, which, when coupled with the existing high prices, creates an equilibrium of sorts between this factor and supply. Eventually, new production will overwhelm demand, causing prices to drop, capital expenditures to be reeled in to avoid unprofitable production, and eventual arrival at a cyclical bottom. As we’ve seen so far in 2022, shortages have abated and the onslaught of global economic slowdowns has resulted in a decrease in activity of the sector as a whole, a phenomenon that will likely continue for the foreseeable future. Viewed in conjunction with the general factor-based drawdown in tech as a whole, and the entrance into a sustained environment where the cost of money increases, the performance of these equities, AMD included, has been poor.

What has been happening with AMD?

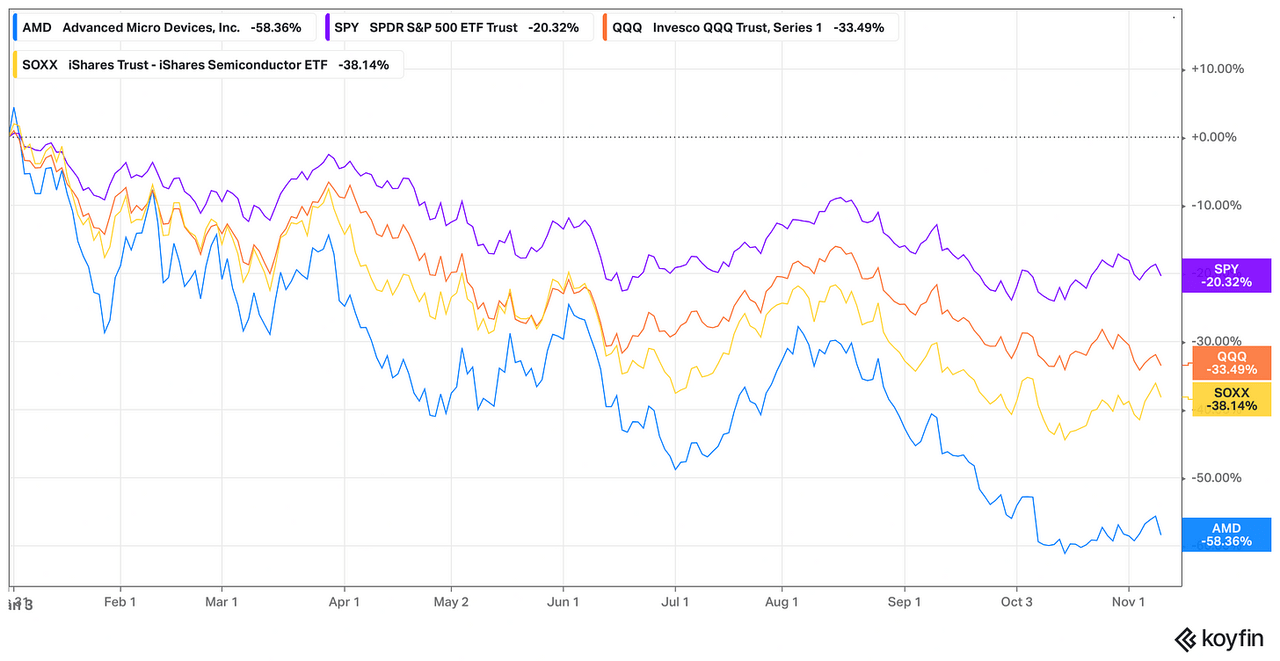

On a YTD basis, AMD has felt the impacts of gravity in a noticeable manner, outpacing the losses of broader market and tech-based indices as well as the semiconductor space as a whole (as measured by the SOXX semiconductor ETF).

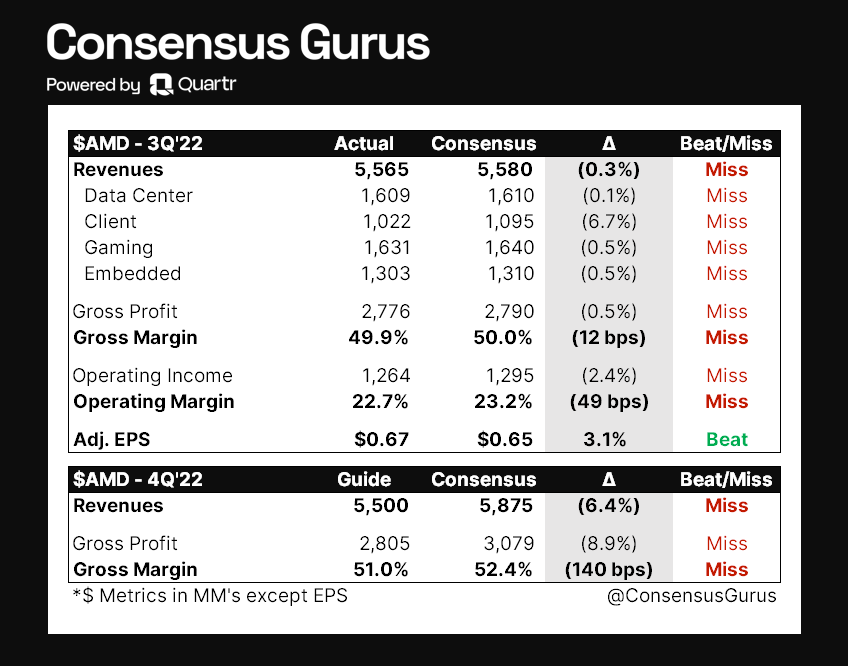

The reason for the significant underperformance, arguably, has been the company’s relatively disastrous recent Q3 earnings, which, despite the company pre-announcing their Q3 revenue, gross margin and operating expense values, still resulted in slight misses on the quarter. The main focus point, however, in my opinion, should be the Q4 guide. The associated miss was almost entirely the result of Client and Gaming segments, and not reflective of any weakness in Data Center or Embedded. Given the higher sensitivity of these segments to the macro environment, I believe the anticipated slowdown highlights the fact that the company is expecting to face the brunt of an economic slowdown in the upcoming period (per Consensus Gurus):

Looking under the hood, we can start to gauge how the various aspects of AMD’s business are performing. The company’s four operating segments, i.e. Data Center, Client, Gaming and Embedded showed mixed results.

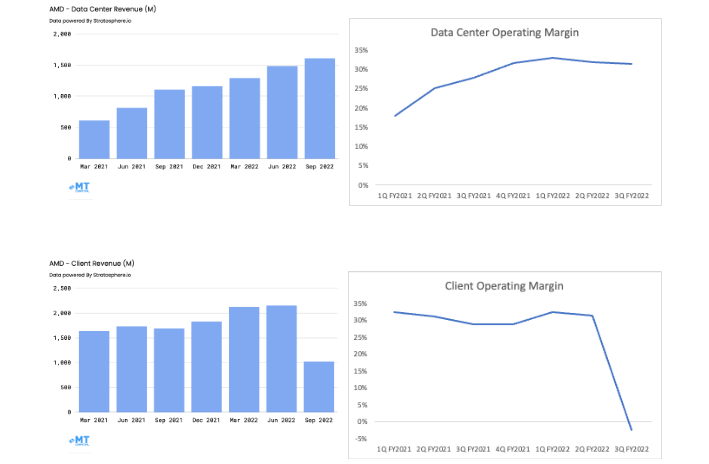

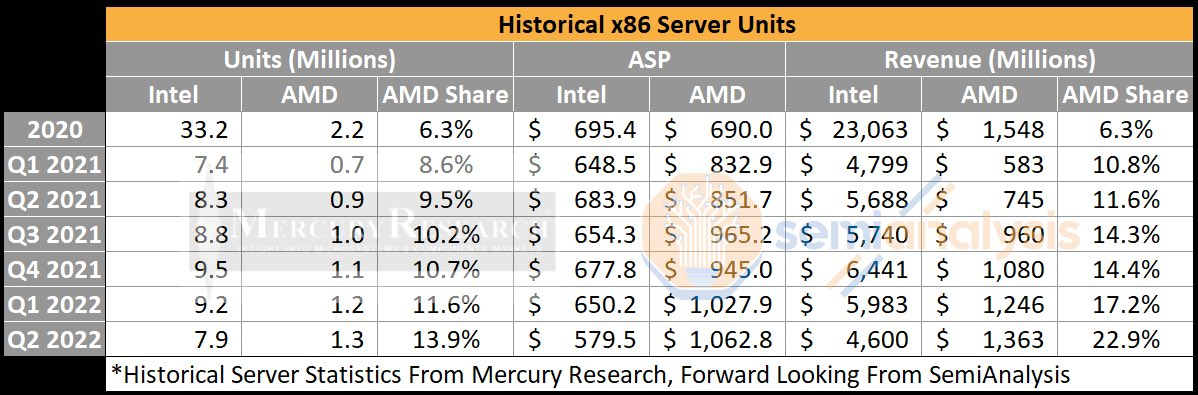

Starting off with the Data Center, this segment increased revenue 8% sequentially and 45% YoY in a horrid tape, with operating margins remaining in-line with what has been seen over the last few quarters at 31%. Cloud demand remains strong as deployments of EPYC processors increase, enterprise was relatively weak given how OEMs were working through matchset issues, and pensando DPUs continued to show strength amidst cloud demand. Going forward, if macro conditions can be worked through, it may not be unreasonable to expect that 20-30% top-line growth to continue in this segment. Thus far, North America Cloud has remained the company’s most important segment, whereas China and Enterprise have been weak, and forecasts are not anticipating any real recovery in the latter areas going forward. It will be important to monitor this segment going forward to ensure that there is no noticeable slowdown. Using cloud hyperscalers as a proxy, GCP (GOOG) (GOOGL), AWS (AMZN) and Azure (MSFT) saw their growth decelerate on YoY bases, however, their backlogs still continue to grow noticeably. Although this is not reflective of just the North American market, I believe it gives a sense that cloud overall, as judged by the biggest players, hasn’t really shown any material weakness despite the environment. Looking at things from a different lens, the rapid rise of AMD’s market in server CPUs has been stunning, to say the least, a happening that is very exciting if the trend is to continue (which many analysts anticipate) given the unbounded growth prospects of the space as a whole going forward.

SemiAnalysis

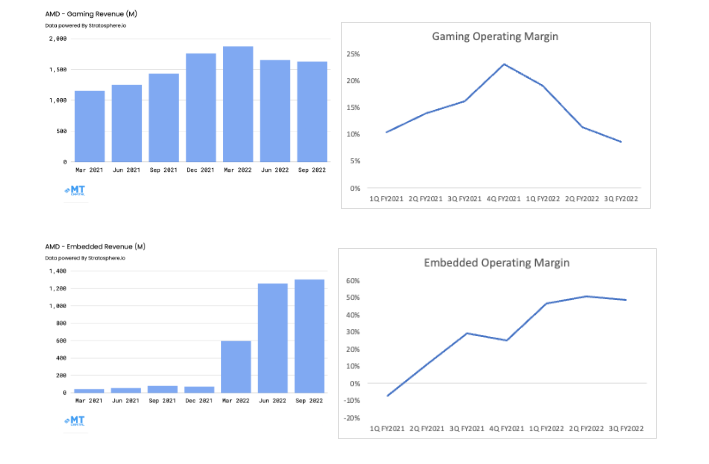

Client was evidently disastrous, a phenomenon that should not be too much of a shock given the nature of the pull-forward that occurred during the pandemic. Decreasing 40% YoY and 53% sequentially, operating margins came in negative as a result of both much lower volume, and lower ASPs that emerged in response to market conditions. Going forward, and even anticipating the fact that the segment is likely to decline 20% YoY for FY, a further 10% deterioration next year is not unlikely, as outlined by Dr. Su on the quarterly call. As SemiAnalysis outlined in his Q3 earnings roundup piece, market share in this segment also declined, with an estimated 86% being attributable to Intel (INTC) and 14% to that of AMD, a step backwards for sure but not a dealbreaker with respect to progress as of right now. Gaming told a similar, albeit less painful tale. Soft consumer demand and the fact that GPU inventories were reduced downstream resulted in deceleration, a 14% increase YoY and 1% decline sequentially despite this time of the year being typically strong for the segment. Due to the lower top-line values, operating margins decreased slightly sequentially, coming in at 9%. Lastly, alongside its Data Center peer, the Embedded operating segment continued to show strength, driven by strong demand exhibited by aerospace, defense, industrial and communications customers, with the segment showing 4% top-line increases sequentially and operating margins coming in relatively-in line with what has been shown over the last few quarters at a whopping 49%.

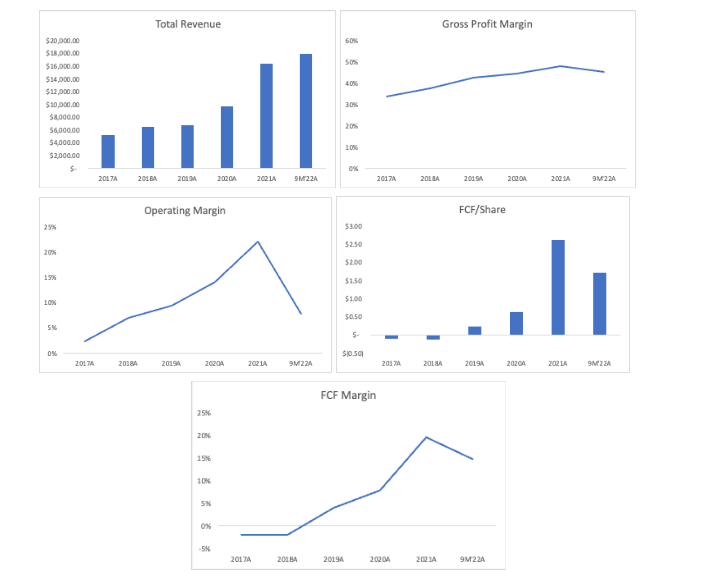

When everything is viewed together, there is evidence of short-term hardship. Despite revenue increasing 45% on a YoY basis, gross margins saw a 600bps decline on a YoY basis for the quarter, attributable to both the amortization of intangibles related to Xilinx, charges related to revenue, and ASPs, particularly in client, taking a hit on a quarterly basis (though still increasing YoY), a phenomenon that may continue to be exacerbated heading into a weakened environment. As a result, the company is likely to break its multi-year consecutive streak of improving GAAP gross margins going forward. With the short-term challenges of client and gaming segments taken into consideration, the fact that S&M and G&A expenses have remained consistent relative to top-line, and R&D expenses ramped up for the quarter, operating margins saw a nasty print for the quarter coming in at (1)%; exacerbating 9M’22A’s move downwards to 7.85%, stark contrast to years prior. These factors, despite being coupled with a consistent CAPEX profile given the fabless nature of AMD’s business, have resulted in a decline in FCF margins and FCF/share in comparison to FY’21 (exacerbated by the increased share count in comparison to FY’21 that occurred as a result of the Xilinx acquisition):

Lastly, it is worth touching on the semiconductor tension between US and China, which has been all the rage of late. Although AMD does have pretty substantial exposure to China (~25% of total revenues attributable to the region), the company’s main activities in the area are related to the company’s consumer-facing and PC businesses, rather than with the data center. In other words, AMD is not feeling the brunt of these new policies in a similar manner to how NVDA has. Being that as it may, things may very well escalate further, and as such, any further policy decisions warrant close scrutiny to ensure AMD doesn’t face further impact from the region that is any worse than the impact from Chinese economic slowdown that they have already seen.

In short, I would summarize AMD’s situation at the moment as follows:

-

Arguably, the company’s most promising segments, i.e. the ones that present the largest opportunity for high-magnitude impact given their relatively unforeseeable trajectories in Embedded and Data Center are still strong. These require monitoring to ensure that an economic deterioration doesn’t impact associated spend. Taking Data Center as an example, we have seen Hyperscalers report slight deceleration, a phenomenon that may be indicative of pullback, but not a clear sign as of right now.

-

Client and Gaming saw a massive pull-forward of demand and over-earned during the pandemic, and are likely to continue to feel pain for the foreseeable future as spending patterns normalize, and they work their way through their heightened exposure to the economic cycle in comparison to that of their counterparts.

-

Headwinds are noticeable in the company’s margins and the positive expansionary movements these metrics saw pre-2022 are unlikely to return to trend until markets regain a sense of stability.

-

The company’s competitive positioning relative to Intel, particularly in server CPUs continues to be enticing. AMD’s leaner operations and lack of focus attempting to build out a competitive a competitive fab presence sets AMD up well competitively in the coming years, in my opinion.

-

AMD’s growth story, particularly with Data Center, doesn’t appear to be broken just yet.

Thanks for reading my ramblings on AMD after their most recent earnings. My original deep-dive on the company can be found here.

Disclaimer: The information and research contained herein is all my own opinion and should not be used as a substitute for proper due diligence. Please consult your financial advisor and evaluate your financial circumstances before making any investment decisions.

Disclosure (as of November 14, 2022): MT Capital Research holds no position in the securities discussed herein and does not anticipate to initiate a position in the forthcoming five days.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment