RiverNorthPhotography/iStock Unreleased via Getty Images

Thesis

I believe sustained growth for the aftermarket auto parts industry is at the beginning of a strong cycle driven by consumer and pricing trends. With the average age of cars on the road at all-time highs, automobile prices at record highs, and total vehicle miles traveled back at historic levels; wear and tear on cars and the potential need for parts & repairs may be elevated moving forward.

Alongside potential industry-wide demand, I believe Advance Auto Parts (NYSE:AAP) is at a profitability inflection point. Due to past operating inefficiencies, AAP lags competitors in terms of margins. With new acquisitions of strong brands like DieHard and Carquest, AAP is focused on increasing private-label penetration which in turn may support gross margins. With management focused on increasing distribution & store network capabilities as well as perks like same-day delivery for DIY customers, they may continue to drive growth in both professional and DIY segments.

With potential macro and idiosyncratic tailwinds on the horizon, I believe AAP has a solid long-term growth runway. Couple that with management’s ability to return cash to shareholders and what I believe is currently an attractive valuation, AAP may generate alpha long-term.

Background

Advanced Auto Parts is a leader in aftermarket automotive parts in North America.

Customers

- Professional Installers: Mechanics, auto shops, auto dealers (58% of sales)

- Individual Customers: Do-it-yourselfers “DIY”

- Independently Owned Operators

Products

Trade Names

- Advance Auto Parts

- Autopart International

- Carquest

- Worldpac

- www.AdvanceAutoParts.com

Locations (as of January 31, 2022)

- 4,706 total stores

- 266 branches

- 52 distribution centers

- e-commerce site

Vendors

- Purchased products from 1,200 vendors in 2021 including brands like Bosch, Castrol (BP), and Mobil 1 (XOM)

- Private brands include Autocraft, Autopart International, Driveworks, Tough One, Wearever, Carquest, and DieHard

Thesis Support

Industry Setup

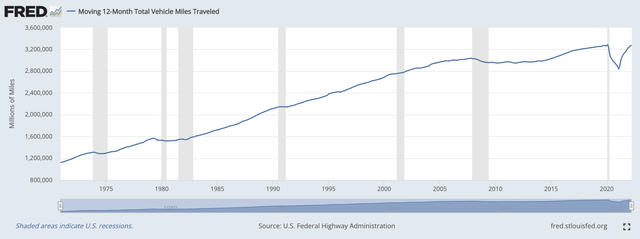

After declining by -13.4% year-over-year in February ’21, total vehicle miles traveled have recovered to all-time highs as of May of this year:

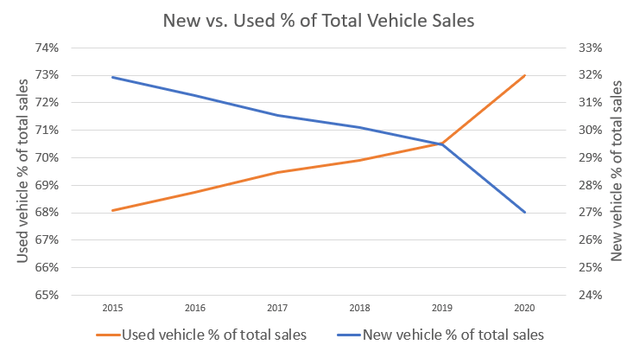

As more miles are driven, used cars also continue to grow as a percentage total of automobile sales:

More used car sales have led to the average age of vehicles on the road growing to 12.2 years, the highest level since the S&P (SPGI) began recording this metric.

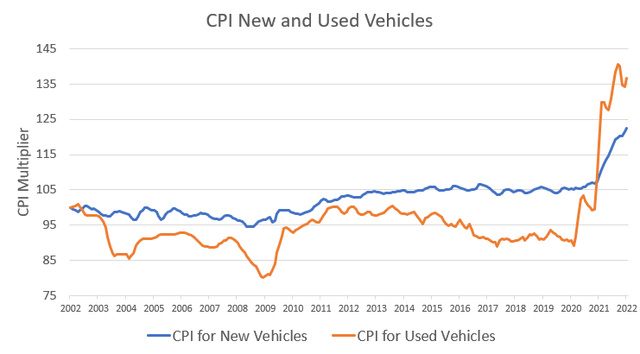

As vehicles have gotten older, they have also gotten more expensive, especially in the last two years:

Vehicle prices are also increasing as the 10-year Treasury yield recently eclipsed 340 basis points, a level not seen in the last decade. Simply put, rising financing costs coinciding with rising prices means affordability for vehicles may fall drastically.

Because overall vehicle affordability may decline, the average age of cars on the road is at record levels, and vehicle miles driven are still at all-time highs; I believe vehicle wear & tear and the need for parts & repair will increase.

Idiosyncratic Catalysts

Potential overall growth and margin expansion catalysts for AAP include the development of private label products, DIY industry expansion, and supply chain efficiency.

By increasing private label penetration (~40% of total sales currently), AAP may be able to increase gross margins because they don’t pay vendor incentives for their own proprietary products. By also selling their proprietary brands solely at AAP stores, product quality may drive more DIY customers to their stores (and website) and build strong relationships with professional customers.

I believe AAP is well-positioned to excel in the DIY segment by offering consumer incentives like price match guarantees, the Advance Same Day suite (free curbside pick-up or home delivery in <3 hours), and the Speed Perks loyalty program. Incentivizing DIY consumers may build loyalty and balance out the current disaggregated revenue mix. With a plan to open up an additional 125-150 new stores in 2022 and plans to continue growth through acquisitions; loyalty & brand recognition may help sustain positive returns on these new store/brand investments.

With significant investment in its supply chain following the urge to streamline supply chains after the COVID disruptions, I believe AAP is set up to experience a more efficient distribution network in the future. As these investments come to fruition, AAP may be able to keep stronger inventory control which may lead to better professional installer relations/loyalty. With better supply chain control and potential network effects with new acquisitions, there is ample room for margin expansion in my opinion.

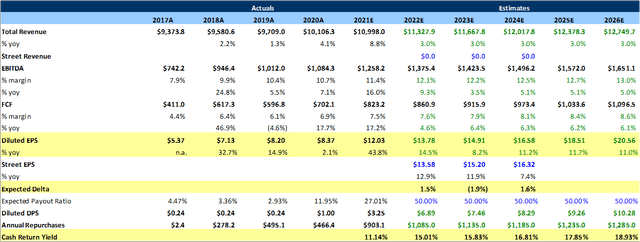

Cash Returns to Shareholders

Currently, AAP’s dividend is yielding 3.27% after increasing its quarterly dividend per share from $0.25 to $1.00 last year. In Q1 this year, management raised the dividend to $1.50 per quarter showing an LTM payout ratio of ~50%. The board also authorized an additional $1 billion share repurchase program in February of this year on top of the $1 billion announced in April 2021. In all of 2021, AAP repurchased $886.7 million of its common stock, retiring 4.6 million shares.

Between share repurchases and dividend payments, AAP returned $403 million to shareholders in Q1. If AAP keeps that cash return consistent for the next twelve months, that equates to 15% of its current market cap [in one year].

Financials

Earnings Forecasts

Discounted Cash Flow Analysis

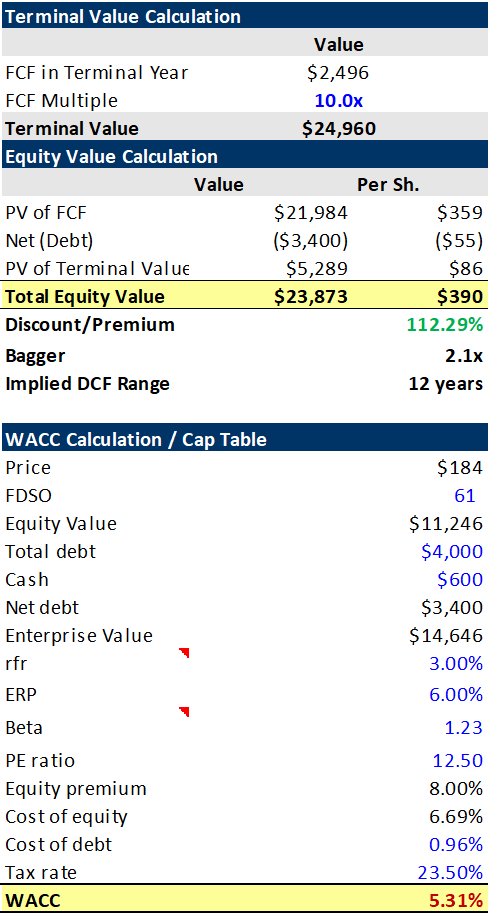

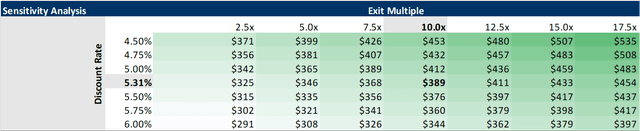

Based on my 30-year cash flow projections, 10-year terminal multiple, and my estimated weighted average cost of capital [WACC] of 5.31%; there is a 112% upside for AAP. Below are my discounted cash flow [DCF] analysis inputs and results:

Created By Author Created By Author Created By Author

Multiple Comparisons

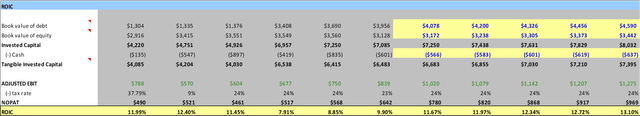

Currently, AAP trades at a 5x NTM P/E discount to the peer average between AutoZone (AZO), O’Reilly Automotive (ORLY), and Genuine Parts Company (GPC). With margins and returns on invested capital also well below the comp. average, I believe the discount is currently justified. With the discount to peers and potential roadmap for growth and margin expansion, I believe there are a lot of opportunities for AAP to become more in line with the industry in terms of valuation multiples:

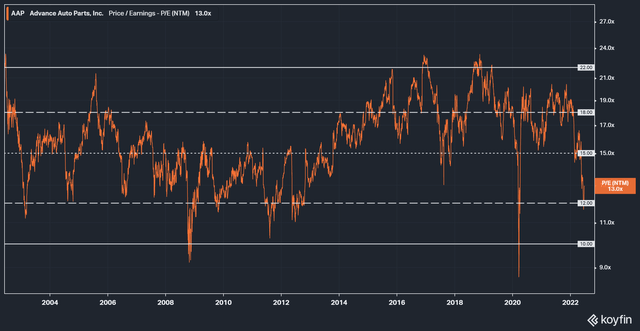

Given where AAP currently trades in terms of relative valuation, I also believe upside currently outweighs further downside purely based on its P/E:

Risks

Narrow Moat

Outside of competitive advantages like inventory efficiency and customer loyalty, I believe AAP has no special positioning in the aftermarket auto parts industry. Competitors like AutoZone and O’Reilly all operate very similar business models fighting for virtually the same customers. As the industry shifts further online, AAP and other aftermarket auto dealers also have to compete directly against Amazon (AMZN).

Because of all these competitive forces, I believe AAP has a narrow moat and limited pricing power which is a key risk that may keep its growth and multiple suppressed.

A mitigant to this risk is customer loyalty which can be derived from a quality proprietary product suite and efficient inventory control in my opinion.

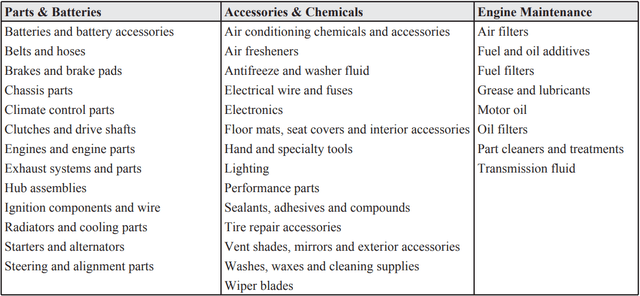

Electric Vehicles

Technological advances in auto manufacturing especially in the EV space could hurt AAP’s current business model long term. With engine maintenance accounting for 12% of revenue last year and parts and batteries accounting for 66%, wide adoption of EVs could hinder demand in both of these segments.

A potential mitigant to this risk is an adaptive business model and growth in other segments like ‘accessories and chemicals.’

Summary

I believe the aftermarket auto parts industry has strong long-term tailwinds that may support overall demand. I also believe AAP is positioned to expand margins given its supply chain investments and new programs incentivized to build customer loyalty. Combine potential margin expansion, industry tailwinds, and acquisition/new store growth; AAP could deliver strong returns for shareholders at current valuation levels.

With the board and management seemingly focused on returning cash to shareholders, that could also be a strong catalyst for price appreciation given its current market capitalization.

Be the first to comment