andresr/E+ via Getty Images

Investment Thesis

I wrote an article on Adriatic Metals (OTCPK:ADMLF) a little over a year ago and I have since added it to the portfolio. Adriatic Metals is a low-cost polymetallic development company in Bosnia & Herzegovina, in the construction phase, with the aim to start production in less than year from today. The company is listed in Australia, the UK, and has an OTC listing in the U.S.

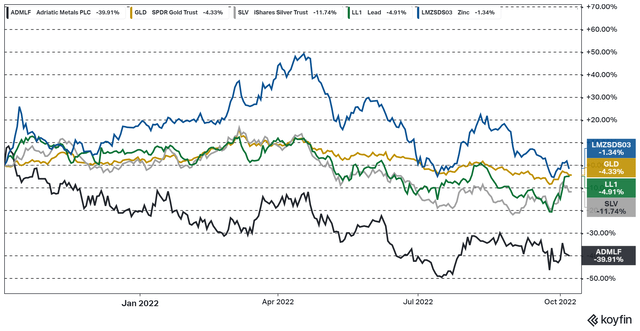

The stock price has declined substantially over the last year due to the poor sentiment for miners and development companies especially, much more than what can be expected due to the decline in the underlying metals of the key Vares project. The valuation is therefore very attractive.

Adriatic Metals is primarily focused on the Vares project in Bosnia & Herzegovina, presently under construction, which I will focus on in this article. The company also has the Raska exploration project in Serbia, with some long-term potential.

Vares Project Update

Adriatic Metals did in late last year announce the $244.5M project financing, which included $120M in senior secured debt, a $22.5M copper stream, and $102M in equity at a stock price of £1.52, which is well above where the stock is currently trading.

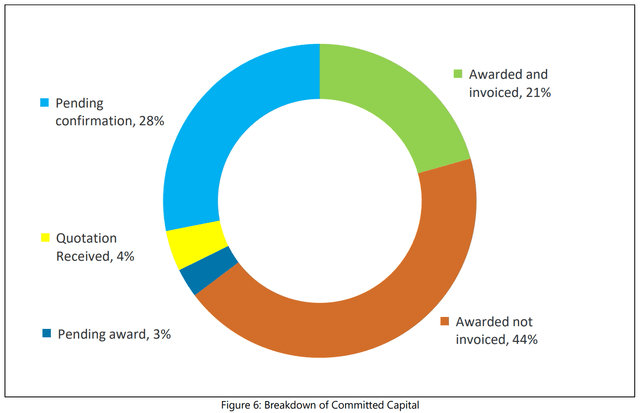

The project is consequently fully funded, and the construction phase is progressing well. The company provided its Q3 update on the 7th of October, where the initial capital cost is now estimated to $173M. That is $5M or 3% above the feasibility study from last year, which is quite good in my view given the inflation we have seen lately. Also note that 72% of capital expenditure excluding contingency is awarded, pending award, or recently quoted, as shown in the chart below. So, any substantial cost overruns are very unlikely at this stage.

Figure 2 – Source: Q3 Vares Project Update

The project was up until recently expected to have its first concentrate production in late Q2-23, but that has now been pushed out to Q3-22. Even if the majority of long lead items and equipment orders are expected on schedule, global supply chain disruptions have caused some minor delays.

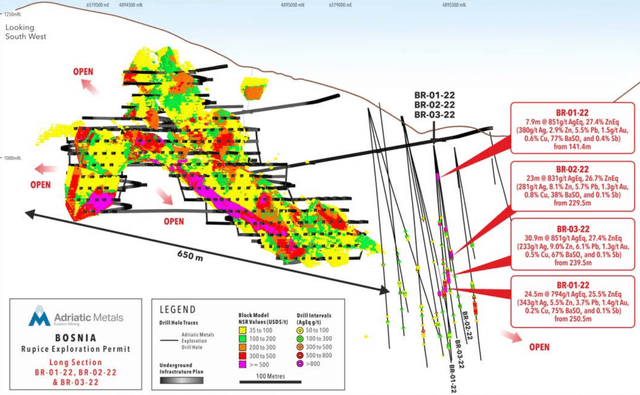

While the economics for the Vares project are already today extremely good, it should be noted that the company is doing both exploration and infill drilling at the moment, and a resource update is expected in Q1-23 for the Vares project. Where the drill highlights have shown 20-30 meters with a 800-900 g/t silver equivalent grade, which is of course excellent. This has the potential to both extend the mine life and boost he net present value of the project.

Figure 3 – Source: July 2022 Adriatic Metals Presentation

Valuation

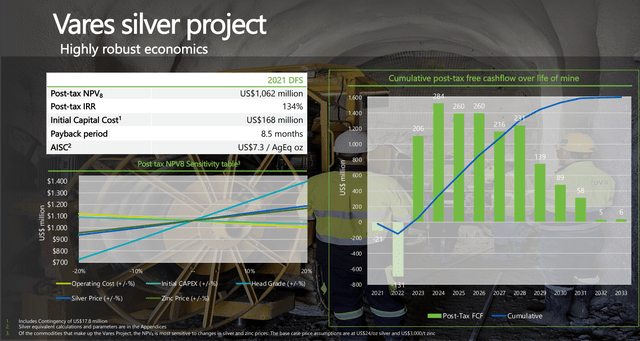

Vares is a low-cost polymetallic project with superb economics, where the post-tax IRR is above 100% even if metal prices have declined some from the feasibility study and the initial capital cost is up 3%. AISC was estimated to $7.3/AgEq ounces.

Figure 4 – Source: July 2022 Adriatic Metals Presentation

To estimate the value of the project, I will rely on the following commodity price assumptions: gold $1,700/oz, silver $20/oz, zinc $3,050/t, and lead $2,050/t. Based on the sensitivity table of the feasibility study and revenue contribution per commodity, we are now looking at an NPV of about $900M.

The company did as of H1 2022 have 266M shares outstanding, which together with the latest fx rate and a stock price £1.24 gives us a market cap of $366M. Now, the company has some debt as well, but the total value of the copper stream, senior secured debt, and $20M convertibles roughly offsets the initial capital cost of the project. We can also expect the cash position to be relatively low in Q3 of next year, even if there is a contingency to handle more minor cost overruns or delays. So, the market cap to NPV is an appropriate metric for the valuation of the stock, which currently stands at 0.41.

Conclusion

A market cap to NPV of 0.41 is in my view very attractive for a low-cost project where I am using relatively conservative commodity price assumptions. We are less than a year away from initial production, the project is fully financed, it is tracking just slightly behind schedule and above budget.

As mentioned earlier, Adriatic Metals will also deliver a resource update in early 2023 that is likely to increase the NPV, and there is nothing to suggest it would be the last time the project grows, as it is open in a couple directions.

There have been some concerns about the political stability of Bosnia & Herzegovina, which does not contain much substance according to the CEO. Given the current global geopolitical situation, there is probably a decent amount of political uncertainty in most countries at the moment. I don’t think Bosnia & Herzegovina and the region of the country where Adriatic Metals operate is much worse in that regard.

There is little operating history for international mining companies in the country, but the government has been very supportive. In South and Central America as a comparison, we have a lot of operating history, but we are presently seeing much less supportive governments in my view.

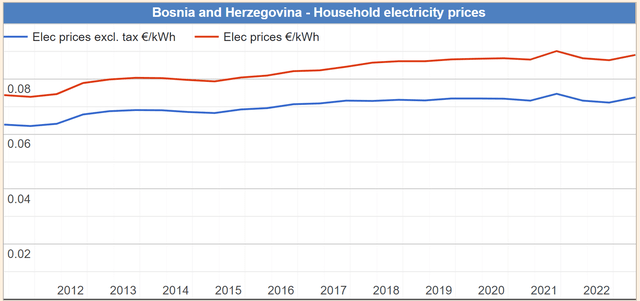

One positive aspect is that the country is not feeling the pain of the energy crisis to the same degree as much of Europe, where energy prices have so far remained low and relatively stable. That is because the country primarily relies on coal and hydro for its electricity generation. Lower electricity prices will be beneficial for Adriatic Metals and that will at least not be a source of political tension for households in the country.

Be the first to comment