10’000 Hours/DigitalVision via Getty Images

Adobe stock (NASDAQ: NASDAQ:ADBE) has been under selling pressure recently. The stock has dropped 33% from its all-time high of $699. A weak growth outlook by management is the major concern of investors. This weak outlook may be attributed to growing competition for its creative tools.

This article takes a look at Adobe’s strong competitive advantage because of its Creative Cloud subscription bundle of 20+ Apps. I discuss why Adobe’s next leg of growth may be fueled by two key areas:

- Creative Cloud Express product helping non-professionals be graphic designers.

- Substance 3D, Aero products helping businesses be metaverse-ready.

However, The next leg of growth may be challenging for Adobe. Due to strong competition, consumers have many equal choices and Adobe’s moat seems to be narrowing. Adobe seems fairly priced at $460 at the time this was written. For a surprise upside from these levels, investors will be looking for revenue growth in excess of 13% per year, higher than what is guided by Adobe’s management for FY2022 ($17.9B).

Adobe Creative Cloud Family of Apps (adobe.com)

Adobe’s competitive positioning, the good and bad

Adobe has three business segments: 1) Digital Media (Creative Cloud and Document Cloud), 2) Digital Experience (Adobe Experience Cloud), and 3) Publishing and Advertising (Legacy products). Adobe’s growth strategy focuses only on 1) Digital Media, and 2) Digital Experience business segments.

Adobe’s growth strategy (adobe.com)

Within each of these business segments, Adobe faces aggressive competition in three key functions: 1) Comparable Product features, 2) Cheaper price, and 3) Popularity. There is no one direct competitor for Adobe, but many fragmented competitors.

In order to assess Adobe’s competition thoroughly, we need to break down the analysis into five categories: 1) Graphic Design, 2) Video Editing and Animations, 3) UI/UX design, 4) PDF, E-signatures, and document workflows, and 5) Marketing and Commerce automation.

Graphic Design:

Graphic designing has two types of customers: 1) Professionals who design for a living, and 2) Non-professionals who have creative needs for posters, youtube thumbnails, Instagram posts, icons, etc.

For professionals, Adobe Photoshop, Illustrator, InDesign, InCopy, Lightroom, etc. are exceptionally suitable because of their advanced features and interoperability. No other software comes close, with Adobe products owning more than 80% market share of companies using graphics software.

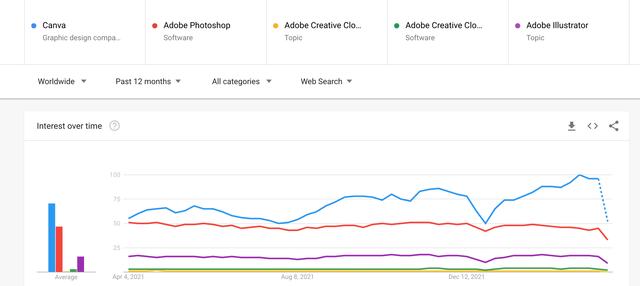

However, these products are not easy to master. This is why non-professionals, seek easier tools like Canva for their graphic designing needs. Adobe has recently launched its equivalent Creative Cloud Express product for non-professionals (formerly known as Adobe Spark). Google trends (NASDAQ: GOOG) analysis shows Canva’s popularity is higher than even Adobe’s flagship products Photoshop and Illustrator. Adobe’s Creative Cloud Express, the direct competitor of Canva, has seen very less searches.

Google Trend Analysis: Canva vs Photoshop vs Illustrator vs Creative Cloud vs Creative Cloud Express (Google Trends)

From a feature and pricing perspective, Adobe Creative Cloud Express has done a good job to catch up and stay relevant to non-professionals. It remains to be seen who advertises the best at non-professionals to convert them to paying customers. Canva is currently the clear winner.

Video Editing and Animations:

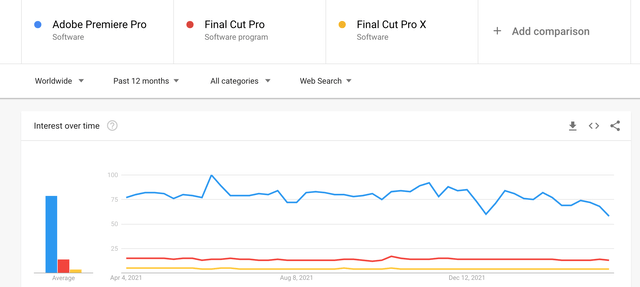

Video editing and animation tools are getting more and more popular. In a creator economy, everyone has a story to tell and they express them through beautiful videos. Adobe’s Premiere Pro is a popular video editing tool. Adobe After Effects is used for adding visual effects to videos. Adobe Premiere Pro’s close competitor (23% market share) is Apple’s (NASDAQ: AAPL) Final Cut Pro (25% market share). The popularity of Adobe Premier Pro is higher than Final Cut Pro.

Google Trend Analysis: Adobe Premier Pro vs Apple Final Cut Pro (Google Trends)

From a feature point of view, both have their pros and cons. Both products may attract different types of customers depending on their needs.

UI/UX design:

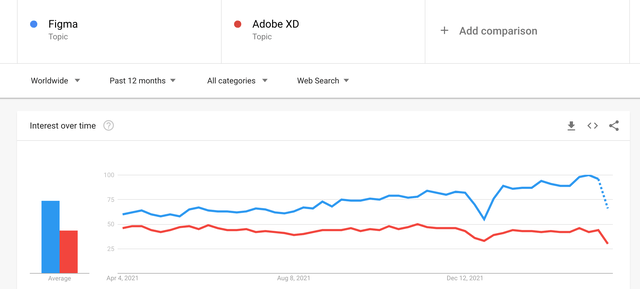

UI/UX design tools are mainly used in App and website development prototyping. This gives creators a chance to test out their visual ideas before they are built. The most popular tools in the UI/UX design space are Figma and Adobe XD. Figma is more feature-rich and popular than Adobe XD at this moment. Figma is well known for its collaboration features.

Google Trend Analysis: Adobe XD vs Figma (Google Trends)

PDF, E-signatures, and document workflows:

Adobe Sign is an E-signature tool to collaborate on signing documents. Adobe competes with DocuSign (NASDAQ: DOCU) and lags behind DocuSign in market share and customer reviews.

Marketing and Commerce:

Adobe Experience Cloud is a tool to automate customer insights and create personalized marketing journeys. Adobe mainly competes with Hubspot (NYSE: HUBS) and ActiveCampaign and lags behind both in market share and customer reviews.

In this article, I will focus more on Adobe’s Creative Cloud solutions, as it contributes nearly 60% of Adobe’s revenue pie.

Adobe’s masterstroke: The Creative Cloud Bundle

Adobe has been wise to bundle all its products together under one subscription plan. The Creative Cloud bundle offers the best of 1) Graphic Design, 2) Video Editing and Animations, 3) UI/UX design and 4) PDF, E-signatures and workflows tools, all under one price. This acts as a great value for money, where Adobe is truly able to bring the best of all its products under one roof. If one is serious about creating content and has not yet formed loyalty to any product, Adobe’s Creative Cloud bundle seems like a wise choice. As mentioned before, Adobe does not have one competitor, but many fragmented competitors. Creating a bundle is the best way to make customers harness the multiple high-quality products which Adobe offers.

Delighting customers with innovation is key in a competitive environment

Adobe has two key initiatives to delight its existing customers:

- Incorporating AI with Adobe Sensei into all their tools, to create delightful experiences such as creating graphics from raw sketches, changing smiles in photos, AI-based search (eg: finding Eiffel Tower in my photos), changing sky from day to night, skin smoothening, PDF liquid reading mode, and many more. These little features improve the experience of the customer and help them achieve their creative goals smarter and faster.

- Adobe has built a community with Behance, which allows creators to showcase their work, engage, and get hired. Behance has also added NFT support, to help creators showcase the authenticity of their artwork.

Catalyst: The Next Leg of Growth for Adobe

My thesis states that if Adobe stock needs a favorable upside from here, Creative Cloud Express, Substance 3D, and Aero will have to excel. Adobe Substance 3D and Aero are tools to help businesses be metaverse-ready. They specialize in creating 3D scenes, textures, 3D objects for videos or games, and Augmented reality experiences.

Adobe’s Substance and Aero products help businesses be metaverse-ready (adobe.com)

During the Q1 FY2022 earnings call in March 2022, Adobe’s management mentioned that Creative Cloud Express and Substance will be key growth drivers in near future.

Q1 FY2022 Adobe Earnings Call transcript extract (adobe.com)

In my Bull case valuation later, I explain the possibilities for the stock, if Adobe is able to achieve this. However, I believe Adobe’s moat is narrowing due to the tight competitive landscape. The next leg of growth may be challenging.

Adobe is a Hold at these levels, due to a weak revenue growth outlook

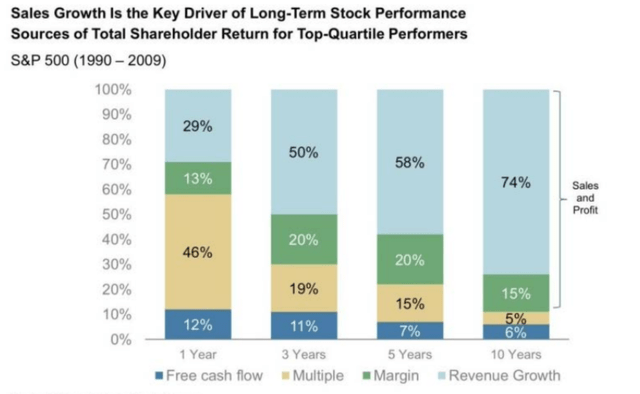

Before we go into Adobe’s valuation, it is important to remind ourselves that sales growth is the key driver of long-term stock performance. Cash Flows, Multiples of course matter, but over a ten-year period, sales growth influences the stock performance the most.

Sales Growth is the key driver for Long-term stock performance (BCG Analysis, Morgan Stanley Research)

This is why it is crucial for Adobe to reclaim its sales growth momentum. I will analyze three cases for Adobe: Base Case (Management Guidance), Bull Case (Next Leg of Growth), and Bear Case.

For Adobe, I prefer to use a 5-year discounted cash flow model with a perpetuity growth rate, instead of relative valuation. This is because Adobe has consistent and growing cash flows. I am willing to make some educated assumptions about future growth rates based on where I believe the world is heading.

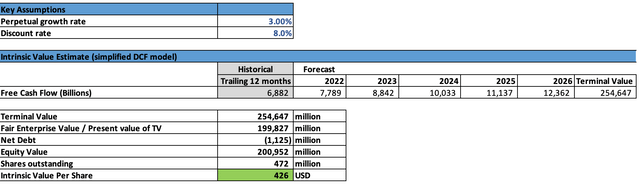

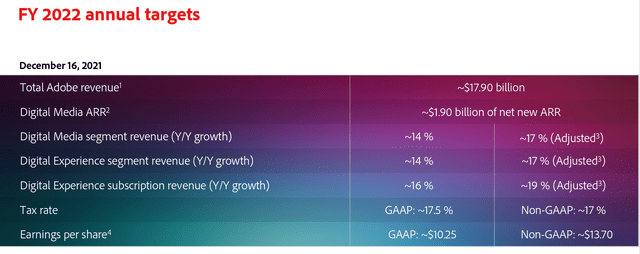

Base Case: Management Guidance

Assumptions:

- Revenue growth 11% CAGR from 2022-26

- Free cash flow margin in 2026: 46%

- Perpetuity growth: 3%

- Discount rate: 8%

Intrinsic value: $426

Adobe Base case Intrinsic Value (Varun Vithalani)

Base case assumption thesis:

Adobe’s Creative Cloud business segment (Photoshop, Illustrator, Premiere Pro, Creative Cloud Express, etc.) faces an uphill task to convince new creators to choose Adobe products over competitors. Competitors like Figma, Canva, and other free tools are making it difficult for Adobe to attract newer customers. I believe Adobe will continue to thrive with existing creators who have built loyalty to Adobe’s products over years and have become experts in them. But if I am a new creator, I have a lot of choices and some are free. There is no compelling reason why I must choose Adobe. As a shareholder, I feel a little nervous about that. While Adobe does have a strong moat with its brand name and products, I certainly feel its moat is shrinking due to a tight competitive landscape. Adobe’s Document Cloud and Experience Cloud business segments have similar challenges. For example, Adobe, the creators of PDF, should have seen the E-signature market way before DocuSign. But they did not capitalize on their obvious optionality and are now lagging behind DocuSign and playing catchup.

With such challenges in mind, I believe the 11% CAGR is a fair assumption, considering management has guided for ~$17.9B revenue in FY2022 from $15.78B in FY2021 resulting in a 13% YoY growth. Adobe could prove my base case wrong, with new growth avenues like Adobe Substance, Aero, Creative Cloud Express, or a new acquisition. But unless proven otherwise, giving a growth rate of higher than 11% CAGR would mean assuming something which the management also does not expect. I believe Adobe’s Base case is the most probable and Adobe is near fairly valued with shares trading at $460 at the time this was written.

Adobe FY2022 Guidance (adobe.com)

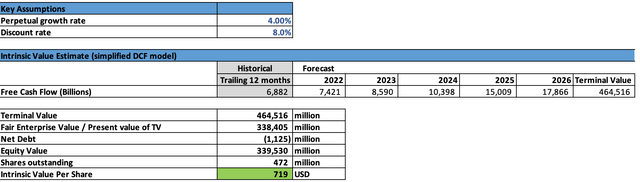

Bull Case: Next Leg Of Growth

Assumptions:

- Revenue growth 20% CAGR from 2022-26

- Free cash flow margin in 2026: 49%

- Perpetuity growth: 4%

- Discount rate: 8%

Intrinsic value: $719

Adobe Bull case Intrinsic Value (Varun Vithalani) Bull case assumption thesis: For the bull case to be achievable, Adobe will have to show the next leg of growth with Adobe Substance, Aero, and Creative Cloud Express. I feel this will be challenging due to a few reasons. Firstly for 3D software, Adobe Substance Painter and Substance Designer are late entrants, and there are many incumbents and competitors such as Autodesk (NASDAQ: ADSK) Maya, Mari, Houdini, Blender, Cinema 4D, etc. The popularity of Blender is higher than most others. While Adobe Substance 3D has advanced texture painting abilities compared to others, it is not a holistic 3D product. It needs to be used in tandem with other 3D software for movie production or similar content creation. My educated guess tells me that the 3D market, with a niche in texture painting, is not big enough for Adobe’s next leg of growth. Secondly, Adobe Aero, the augmented reality (AR) tool is available only on iOs at the moment, with a public beta for desktops on Mac and Windows. From its reviews, Aero seems like it’s an entry-level AR tool, good for prototyping and fun rather than real use cases. Aero has only 9,000 worldwide downloads in Feb 2022. Augmented Reality does have clear use cases. It can help brands sell their products better, but Aero is too limited in its features yet to help brands do so. Once again, Adobe is a late entrant in the market. With so many AR development products available, there is no compelling reason to choose Adobe over the competition. And lastly, Creative Cloud Express is an easy-to-use graphic design tool for non-professionals. Canva saw this market early and has captured it very well with its simplicity, efficient pricing, and good branding. In my opinion, Adobe has made a fundamental mistake here by renaming its product from ‘Adobe Spark’ to ‘Adobe Creative Cloud Express’. To make everyone use a product, it has to sound simple and catchy. Canva’s growth has been rapid and has started to become a household name for new non-professional creators. Adobe should have seen this trend sooner than anybody else. The bull case for Adobe will be challenging for all the reasons mentioned above. Here I assume a 20% Revenue CAGR from 2022-26, whereas Adobe expects 13% revenue growth in FY2022. Personally, I prefer to perform valuations either in line or under the company’s guidance. Thus, my base case scenario is a safer view.

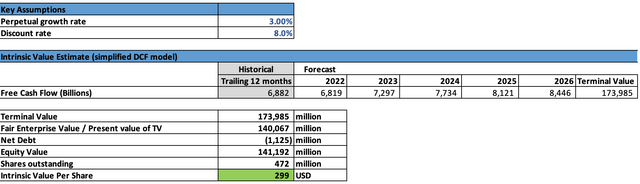

Bear Case: Lower than Management expectations

Assumptions:

- Revenue growth 5% CAGR from 2022-26

- Free cash flow margin in 2026: 40%

- Perpetuity growth: 3%

- Discount rate: 8%

Intrinsic value: $299

Adobe Bear case Intrinsic Value (Varun Vithalani)

Bear case assumption thesis:

For the bear case to happen, it would mean Adobe starts losing its existing loyal customer base to competitors such as Figma and Canva. I feel Adobe has a very strong brand and they will continue to innovate to keep up with the competition. Thus, it’s unlikely that Adobe starts to lose customers who are already subscribed and loyal.

Valuation Summary:

I give Adobe a ‘Hold’ rating, as I believe the Base case scenario of $426 is the most probable.

What to look for next:

Adobe must prove it can grow higher than its FY2022 guidance of 13% revenue growth. Things to observe in the next few quarters:

- Overall Revenue Growth and if it is on track for above 13% for FY2022.

- Any clues by management for future growth outlook beyond FY2022.

- Creative Cloud Express commentary by management about its adoption and revenue.

- Substance 3D, Aero commentary by management about its adoption and revenue.

- Any new acquisitions Adobe makes to expand their TAM.

Final Thoughts:

In this article, I have focused on Adobe’s Creative Cloud business as it makes up nearly 60% of Adobe’s revenue pie. Other Adobe businesses of Document Cloud and Experience Cloud continue to do well, but face challenging competition. Adobe’s moat is shrinking with a tight competitive landscape. The brand stays strong and will continue to thrive, once they reclaim the growth momentum.

My major concern with Adobe is that its innovations are driven by competitors or by acquisitions. They seem to play catchup most of the time.

As for valuations, I personally do not use these intrinsic value numbers to make entry and exit decisions. I use them as references only to validate my thesis.

Be the first to comment