David Tran/iStock Editorial via Getty Images

Investment Thesis

Adobe Inc. (NASDAQ:ADBE) has been a market favorite for many years, outperforming the S&P for an astounding period of time. Many times we have taken a cursory glance at this stock and thought, “It’s probably overvalued,” and we have continued to eat our words. With the stock correcting since its post-COVID highs, it is a great time for an Adobe skeptic such as myself to take a deep dive into this stock to assess if it is truly the real deal.

Adobe is positioned well as a business. On the one hand, it has its Digital Media business, which is monopolistic in nature and has a huge moat. On the other hand, Digital Experience looks to grow aggressively, seeking to carve out the marketing aspect of the digital economy. Both areas of the business are highly profitable, and management has a great track record of allocating profits to further improve shareholder returns.

Although economic factors may impact growth here, we think demand will remain robust. As prudent investors, we like to see immediate upside against a company’s valuation. For the first time in a long time, we think Adobe is trading at an attractive discount to its fair value.

Company Description

Adobe is one of the largest global software businesses, specializing in creative software solutions for individuals and professionals.

Adobe operates 3 key segments:

- Digital Media – This is the largest business area, allowing individuals and companies to create and publish a host of different digital creations. This includes Adobe’s Creative Cloud and Document Cloud services.

- Digital Experience – Provides services for the creation, execution, monitoring and optimization of digital marketing material. This includes Adobe’s Experience Cloud service.

- Publishing – Provides services for authoring and publishing needs.

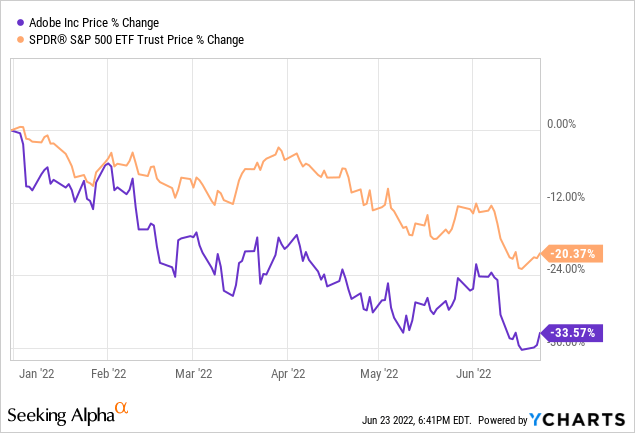

Software companies have taken a beating in recent months due to economic conditions worsening and interest rates rising. Investors are expecting growth to slow and future earnings to be discounted by a greater amount. Software businesses trade at a premium because of this growth and so are the first on the chopping block when things begin to slow.

Adobe’s shares are down 33.5% YTD and has had 2 successive quarters of “shaky” earnings. I call them shaky, as Adobe performed moderately well and markets seemed unsure how to react. We believe there is a degree of fear driving the share price movement, with markets expecting things to worsen, even when things look okay currently.

Adobe’s Market

As part of its annual review, Adobe announced that it had upgraded its total addressable market estimate for 2024 to $205BN, suggesting the amount of growth remaining for the business is great. Much of this growth is expected to come from their Experience Cloud offering, which Adobe believes will grow subscription 20% this year. With economic development across the globe and developments in technology, more and more of the world’s operations find themselves online. Adobe has developed its Experience Cloud offering as a means of monetizing the back-end data.

Moving to Adobe’s creative cloud platform, it faces little-to-no competition in the market. Over the course of a decade, Adobe has managed to optimize its offering to the extent that no other business has managed to gain a foothold in the market. According to Gartner, Adobe is a leader in Digital Experience Platforms, underpinning the quality of their products. With a monopolistic position in the market, Adobe is able to absorb most of the new customers in the market. Said market should grow as it has in recent years due to the amount of productive work that continues to move onto the internet. For this reason, we are not concerned about growth slowing in Adobe’s core operations and explain why Adobe is expecting Digital media to grow 17% in the coming year.

Can the Economy Impact Adobe?

I am sure it is not news to people that economic growth is slowing and many are now fearing stagflation. The impact of this will likely be falling demand, as discretionary income dips. The added complexity of inflation will make this worse, as even those who do not lose their job/struggle substantially will still see their cost of living rise and sentiment remain low.

In theory, we see Adobe as fairly recession-resistant. The reason for this is that many use Adobe’s services to conduct their trade, be it professional photographers using Photoshop, services firms using Acrobat Reader or influencers using Lightroom. Growth will certainly slow as less demand means less business, but recurring revenue should remain robust, with demand being sticky. This is purely in theory however, if we look back at actual results, we find the following.

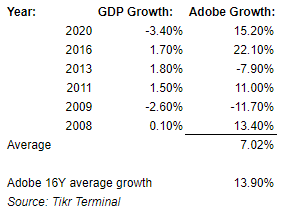

Adobe growth v. US GDP growth (TIKR Terminal & Trading Economics)

In the last 16 years, U.S. GDP growth has fallen below 2% 6 times. Adobe’s average growth fell to 7%, half of its average 14% growth during the same period. Given that growth remains, this is good news, although 2009 is definitely slightly concerning.

Adobe, the Financial Powerhouse

Adobe’s financial performance is nothing short of incredible. In Q2 of 2022, Adobe achieved the following.

| Source: | Adobe | ||

| $’000s | Revenue | Y-O-Y Growth |

New ARR (DM)/Sub Rev (DE): |

| Digital Media | 3,200 | 15% | 464 |

| Digital Experience | 1,100 | 17% | 961 |

As we note, Adobe is growing at strong double digits and is importantly generating new business. ARR/Subscription revenue is a better indicator for SaaS revenue, as it better reflects true revenue compared to the accounting recognition of revenue, and shows that Adobe will achieve another year of 15-20% growth.

Digital experience growth is the important metric here, this is likely the future of Adobe and so seeing consistent strong growth in subscriptions will ensure the future of the business is fruitful.

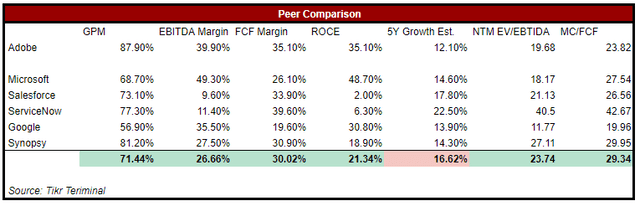

When assessing KPIs of a business, we like to look at them in the context of similar businesses. In the case of Adobe, we have compared them to other Software businesses.

Peer comparison to Tech businesses (TIKR Terminal)

We note that Adobe is noticeably more profitable than the peer group we have chosen, with only ServiceNow (NOW) generating more FCF. This is a direct return to shareholders and suggests Adobe is the most profitable software business, when adjusted for size. Partnering this with a market-leading ROCE suggests management is incredibly successful with capital allocation.

The only concern would be that analysts are expecting Adobe to grow the slowest of the pack. Given that the Digital Experience segment is still in its growth phase, analysts are likely hesitant as to how growth will shape up. The likely reason for the peer group difference is the natural differences between the services offered. Salesforce is almost a requirement for businesses of a certain size and ServiceNow is at the forefront of the cloud computing revolution we have seen in recent years, thus at a different point in its life cycle.

Adobe is a mature business, still putting up strong double-digit growth, the epitome of GARP. For us, the key metric for the business is the FCF generation, as this is a direct increase in shareholder wealth. Adobe is a market leader here.

Valuation

We now move onto the area that has always concerned me. As with most Software businesses, Adobe has traded at a premium during “the good times” to reflect the aggressive growth we have seen over the last decade. However, with the recent correction, things may have changed.

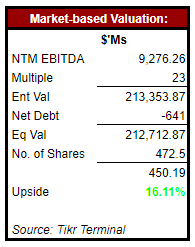

Market-based valuation

As we noted in the table above, Adobe certainly holds its own against the peer group. Yes, growth is expected to be lower, but the FCF margin compensates for this. Over a 10-year period, 12.1% growth and 35.1% FCF margin is a superior combination by 28%. Given this, a 23x multiple seems fair.

Based on this valuation, we derive a valuation of $450.

NTM EV/EBITDA valuation (TIKR Terminal)

This suggests an upside of 16.1%. Given the 1.08 beta and lack of volatility, this is a strong return.

DCF

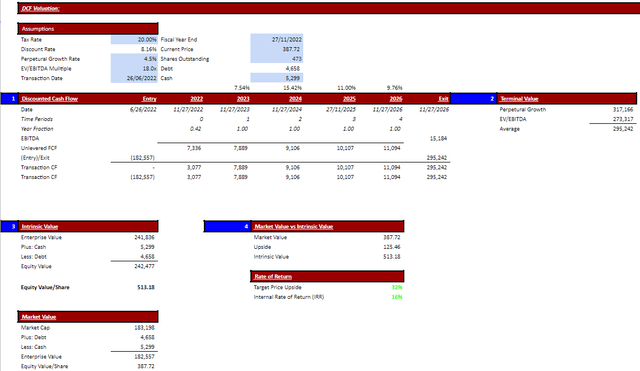

Normally, we like to conduct at least two valuations. We have been very prudent in our assumptions, expecting FCF growth to be lower than the preceding 5 years and the exit multiple to be 18x.

This gives us a valuation of $513 a share, with an IRR of 16%.

Adobe DCF valuation (Author’s own calculation)

Therefore, the upside for Adobe looks strong based on the company continuing as it is. In the past, the business looked overvalued based on the metrics at the time, but innovation allowed the business to go beyond the forward-looking assumptions. This could certainly happen again, with growth driven by Digital Experience. Regardless, in its current position alone it looks very attractive.

Investment Risks

UBS analyst Karl Keirstead downgraded Adobe earlier this year on the belief that marketing spending was brought forward in 2020 and 2021. This is a logical hypothesis, as businesses looked to take advantage of the most-COVID spending binge. This could mean lackluster growth in the coming 24 months, importantly an earning miss could result in negative price action. This said, at the time the shares traded at $532.55 after the news, and so the risk is likely priced in.

Final Thoughts

We have been an Adobe skeptic for as long as I can remember. The reality, however, is that you need to pay a premium for a best-in-class Software business. Adobe is certainly this, with its leading free cash flow generation and sticky demand, Adobe should have no issues navigating the coming period of time. At its current price, we may never be able to purchase Adobe at such a discount again. Adobe is a premium business without a premium attached, and so if you have ever wanted to invest in this business at a cheap price, we believe now is that time. We thus rate this stock a buy.

Be the first to comment