piranka/E+ via Getty Images

Introduction

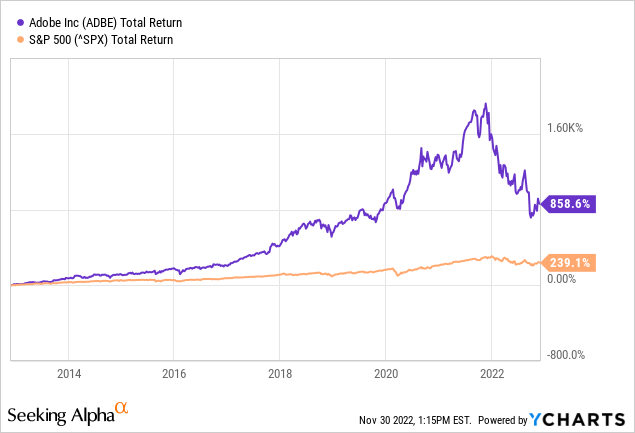

Looking at the outperformers of the S&P 500 (SP500) over the past 10 years, the well-known Adobe (NASDAQ:ADBE) is in the list. Adobe generated a return of as much as 25.4% per year, while the S&P 500 averaged 9.1% per year.

The recent fall in the share price offers an attractive opportunity to enter cheaply, the stock’s valuation numbers look rosy and its high free cash flow yield of 43% will generate enough cash even in uncertain times.

The planned acquisition of Figma will provide Adobe with additional sales and further growth. The acquisition of Figma is a strategic choice to maintain its competitive advantage but will have a negative impact on earnings in the coming years. The acquisition price of $20B is on the high side, which is why I prefer to see Adobe move on without Figma.

Figma Takeover Deal Is Way Too Expensive

Sept. 15, 2022 Adobe announced it is acquiring Figma for $20B in cash and stock. Figma’s CEO and employees will receive an additional 6 million Adobe restricted stock units that will vest in four years after the completion of the deal. Adobe shareholders were not amused with the announcement causing the stock to fall 16%.

Figma is a collaboration-based design tool focusing on user interface and user experience design with an emphasis on real-time collaboration. It allows employees to collaborate real-time on creative projects. The creative aspect of the company fits well with Adobe’s Creative Cloud, and some apps compete with Adobe apps. Figma is on track to double its annual recurring revenue this year to more than $400 million. Net dollar retention, a measure that tracks existing consumer spending over time, is over 150%. Following the acquisition, Adobe will integrate Figma into Adobe’s Creative Cloud.

Evercore analyst Kirk Materne said the deal makes strategic sense, he thinks Adobe has lost momentum to Figma and would be better off buying them out and combine forces.

I think Figma is a strategic move for Adobe, it fits perfectly into their cloud solutions offering. Figma generates $200M in revenue in 2021 with 50k customers in 2022, which means the acquisition price relative to 2021 revenues for Figma is extremely high at 100.

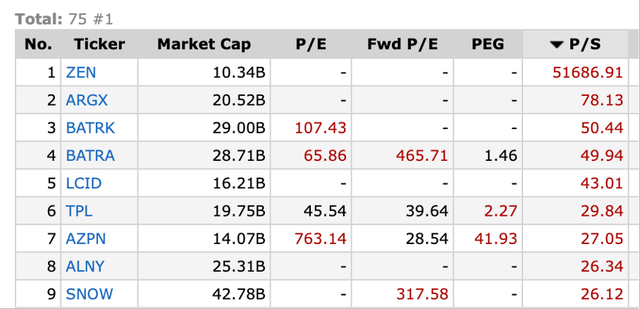

Figma’s revenue has doubled from 2020, but a PS ratio of 100 is extremely high in current market conditions. How does this compare to the current market? I consulted Finviz and sorted stocks with a market cap higher than $10B and a PS ratio higher than 10. If we exclude Zendesk (ZEN), there is no company that has such a high stock valuation.

Adobe is highly profitable with a gross margin of 88%, and its price to sales ratio is currently 9. Figma’s gross margin is about 90%, almost equal to Adobe’s. In the following table, I have optimistically estimated Figma’s revenue growth for the next 5 years.

After 5 years, the acquisition price seems in line with Adobe’s current price to sales ratio of 9. This requires Figma to grow strongly in sales to $2.2B over the next few years to justify the acquisition price. This table alone tells me that the acquisition price is extremely high. However, there is a real chance that a recession is coming because the yield spread is inverted. This makes it unlikely that Figma’s sales will rise 80+% in the next few years.

|

Acquisition Price |

$ 20,000 |

M |

|

|

Year |

Sales in M |

Sales growth |

PS ratio |

|

2022 |

$ 200 |

100% |

100 |

|

2023 |

$ 400 |

100% |

50 |

|

2024 |

$ 720 |

80% |

28 |

|

2025 |

$ 1,152 |

60% |

17 |

|

2026 |

$ 1,728 |

50% |

12 |

|

2027 |

$ 2,246 |

30% |

9 |

Despite Figma being a good strategic fit for Adobe, Adobe is paying too much for Figma. Meanwhile, Figma’s acquisition has passed a thorough antitrust review by the Department of Justice.

On the other hand, if Adobe does not acquire Figma, another software giant will. Still, Adobe owns an extensive portfolio of software in its Creative Cloud, and Adobe’s strength enables it to create a similar product as Figma, a Web-based design tool with an emphasis on real-time collaboration.

Strong Revenue Growth In 3Q22

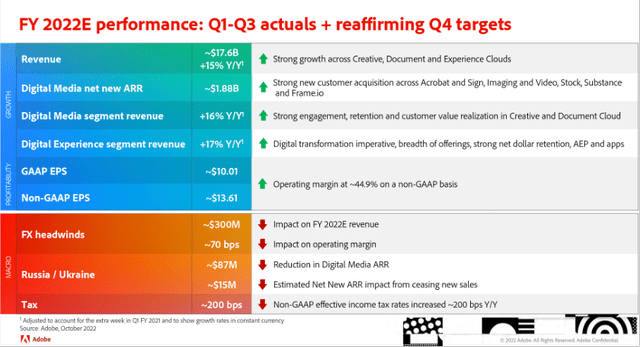

Adobe continued to perform strongly, with revenue up 15% year over year, adjusted earnings per share of 9% year over year and adjusted operating margin of 44.9%. The strong dollar had a negative impact of $300 million on revenue and operating margin, and the war between Russia and Ukraine also caused a decline in Digital Media’s annual recurring revenue.

FY 2022E performance (Adobe 3Q22 Investor Presentation)

Revenue is expected to increase 16% in FY2022, with strong growth of 26% expected for Document Cloud. Creative Cloud revenues are expected to increase 14% year-on-year.

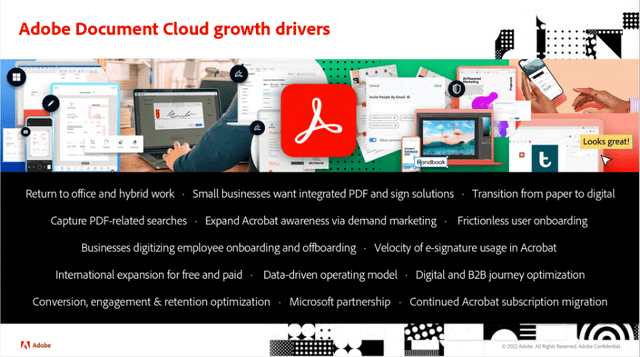

Adobe Document Cloud Growth Drivers (Adobe 3Q22 Investor Presentation)

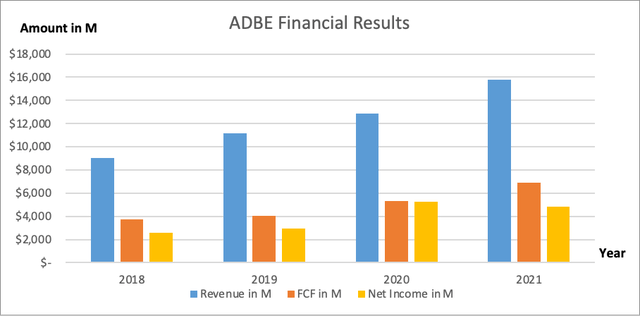

Looking at recent growth over the past 3 years, Adobe experienced strong increases in revenues, profits and free cash flow. Revenues increased by an average of 20.6% year over year, profits by an average of 23% over the same period and free cash flow by an average of 22%. These are strong growth rates.

Adobe Financial Results (Adobe 3Q22 Investor Presentation)

Share Repurchases Should Drive The Stock Price Up

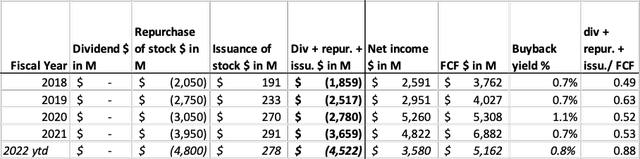

Adobe chooses to return cash to shareholders in a tax-friendly manner by repurchasing shares. Share repurchases reduce the supply of shares and repurchases in the open market increase demand and should increase the share price. The share repurchase program involves about half of free cash flow. The buyback yield is measured at 0.8%, quite low, but the recent drop in the share price offers a higher repurchase yield in the near future.

Adobe’s Cash Flow Highlights (SEC and author’s own calculations)

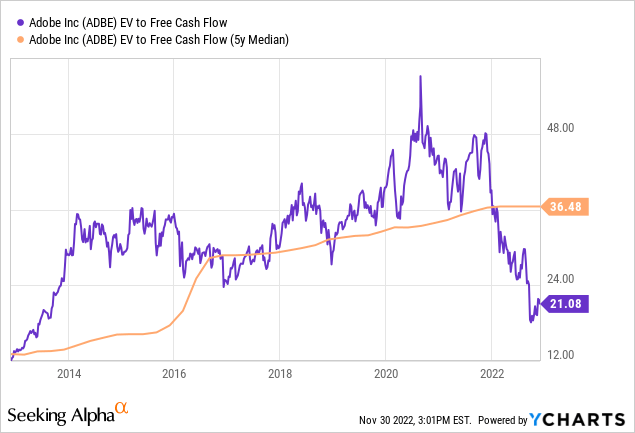

Valuation Metrics Look Favorable

With the EV to FCF ratio, I chart the stock valuation. This ratio compares market capitalization, cash and debt on the balance sheet to free cash flow. The chart shows that the ratio has fallen sharply, below the 5-year average of 36. The shares are favorably valued compared to the historical levels.

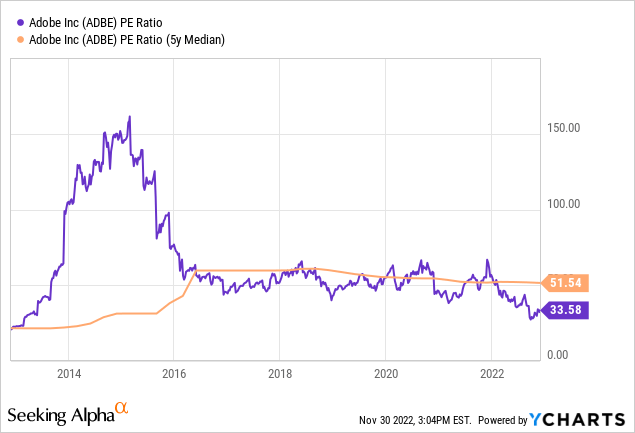

I made the same chart for the well-known PE ratio. This ratio also shows that Adobe shares are favorably valued compared to historical levels. The average PE ratio of 51 is high compared to that of the S&P500 of 21. Adobe is quoted at a premium of about 50% to the market. However, it is important to look to the valuation in the near future.

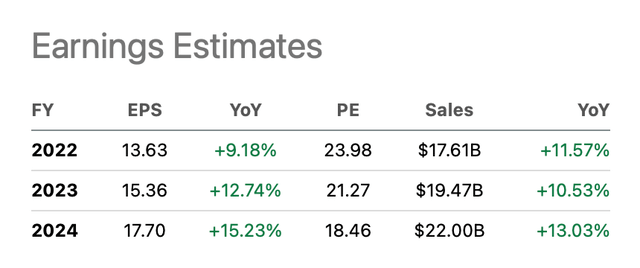

28 analysts are positive about Adobe’s near-term future, with only 3 analysts giving downward revisions. Earnings per share are expected to increase an average of 14% per year through fiscal 2024. Revenue is expected to increase an average of 12% per year over the same period.

Adobe’s Earnings Estimates (Seeking Alpha)

The projected PE ratio of 18 in fiscal 2024 looks favorable compared to the market PE ratio. Adobe appears undervalued for the foreseeable future, and its strong free cash flows provide ample opportunity for further growth. I like Adobe’s strong growth, high free cash flow margin and rich product portfolio. But I don’t like the high price for the acquisition of Figma. Figma is a strategic move to include in Adobe’s Creative Cloud, but not for the high price of $20B. Therefore, I hope the deal doesn’t go through and Adobe will continue to grow and develop their apps to compete with Figma.

Key Takeaway

- Adobe generated a return of as much as 25.4% per year, while the S&P500 averaged 9.1% per year.

- Sept. 15, 2022 Adobe announced it is acquiring Figma for $20B in cash and stock. Figma’s CEO and employees will receive an additional 6 million Adobe restricted stock units that will vest in four years after the completion of the deal.

- A price to sales ratio of 100 to acquire Figma is extremely high in current market conditions. There is no company that has such a high stock valuation right now.

- Adobe owns an extensive portfolio of software in its Creative Cloud, and Adobe’s strength enables it to create a similar product as Figma, a Web-based design tool with an emphasis on real-time collaboration.

- There is a real chance that a recession is coming because the yield spread is inverted. This makes it unlikely that Figma’s sales will rise 80+% in the next few years.

- Adobe continued to perform strongly, with revenue up 15% year over year, adjusted earnings per share of 9% year over year and adjusted operating margin of 44.9%.

- The projected PE ratio of 18 in fiscal 2024 looks favorable compared to the market PE ratio. Adobe appears undervalued for the foreseeable future, and its strong free cash flows provide ample opportunity for further growth.

- I like Adobe’s strong growth, high free cash flow margin and rich product portfolio. But I don’t like the high price for the acquisition of Figma.

Be the first to comment