JHVEPhoto/iStock Editorial via Getty Images

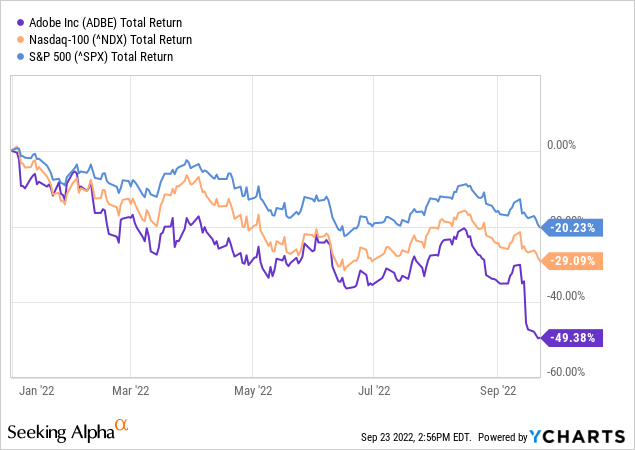

After Adobe (NASDAQ:ADBE) shareholders enjoyed many years of massive share price gains, the last few months have not been easy for Adobe to bear. The change in sentiment initially began with the high inflation rates, which caused the Fed to adopt a very restrictive monetary policy. This development, in turn, led to a sharp rise in two-year and ten-year government bond yields, making growth stocks, in particular, look less attractive.

The announcement of the acquisition of Figma for 20 billion further accelerated the downward trend. Since the high in November 2021, the stock has lost 60% of its value, which is almost as high as during the financial crisis. Of course, this means that the share has also fallen significantly more than the benchmark indices S&P 500 (SPX) and Nasdaq 100 (NDX).

The fall in the share price is mainly explained by criticism of the price of the takeover and the resulting danger that Adobe’s market position will lose its dominance. The criticism certainly deserves attention, but I am convinced that the market has massively overreacted here. It is not justified that the stock is trading at valuation levels last seen during the switch to the subscription model in 2014. In the medium and long term, getting into Adobe should pay off handsomely at current prices.

Q3 Numbers and Figma Acquisition

To be fair, I have to admit that I gave the stock a bullish recommendation back in March at prices around $450, which I still stand by today, but of course, it doesn’t perform well over the period under consideration. I have to admit that at that time I had assessed inflation as much more harmless and, accordingly, the pace of the Fed’s interest rate hikes.

The market felt the same way, as yields on two-year government bonds were still at 2%, whereas today they are above 4%. In addition, Adobe has become less optimistic about the future due to a deteriorating macroeconomic environment as well as a strong dollar.

This is reflected in massive revisions to estimates, especially for the years, as analysts expect stronger headwinds here, also given growing competition. With assumed growth rates of even less than 10% in some cases, a lot already seems to be priced in here.

The last quarterly figures were not bad at all. Sales were up 13% YoY (15% constant currency), EPS on a GAAP basis was down 4% while EPS on a non-GAAP basis was up 9%. I was a bit disappointed with RPO, which grew only 12% to 14.1 billion. Ideally, growth there should be higher than sales growth. As it is, it tends to indicate a slowdown in growth. However, the outlook for the coming quarter was still in line with expectations, even if the strength of the dollar again cost a few percentage points of growth here. On a positive note, free cash flow YoY grew by almost 20%.

But major relevant news on the day was of course the announcement that Adobe plans to acquire competitor Figma. While the majority of investors agreed that Figma is a very good addition to Adobe’s product portfolio, the purchase price of 20 billion came under a lot of criticism. This is also quite understandable given the fact that Figma’s ARR is expected to be just 400 million in 2022, up from 200 million last year.

That may be impressive growth, but does it justify such a valuation multiple? The market seems to agree that it does not, and the stock has fallen 25% since the announcement. This topic has been covered extensively in analyses over the past few weeks, so I’ll be brief here and have outlined the key pros and cons below.

Pros:

- 100% YoY ARR growth rate in challenging macro environment.-> Indicates sustainable growth and robust business model

- Net Retention Rate of 150-> Impressive number, only comparable to Snowflake in the industry

- Gross Margin at 90%

- Positive operating cash flow ->Important milestone, break-even should be within reach

- Estimated total addressable market of $16.5 trillion in 2025-> Still plenty of room to grow, currently just 2.4% of the market reached—> Adobe is acquiring a fast-growing competitor that could have been a threat in the future.

Summary: Management acquires a high-quality company, with strong growth and high customer satisfaction, which will strengthen Adobe’s market position and growth in the coming years.

Cons:

- Purchase price of $20 billion seems very high given an ARR of 400 million in 2022 ->Valuation is reminiscent of the 2021 peak for high-growth companies

- Half of the purchase price will be financed through shares-> Number of shares, steadily reduced in recent years through share buybacks, will be highly diluted. Negative impact on EPS.

- High purchase price induces Adobe to be increasingly concerned about its competitive position and to maintain growth at all costs.

According to the data point of view, everyone can form their own opinion about the deal. I must say here that I do not presume to judge the deal in detail, because as an outsider I do not have access to all the data and facts that must have been decisive for Adobe’s management.

The offer will have been preceded by a months-long process where the price was carefully weighed. Perhaps it is too high, but I would much rather see management buy a high-quality business at an inflated price than three low-quality businesses at a low price.

I once created a small discounted cash flow model to check how much Figma would have to grow in the next few years to at least recoup the purchase price. Of course, I have only very limited data here. But this model gives a rough idea of how Figma would have to develop in the future. Everyone can judge for themselves whether they think this is realistic. In the following scenario, Figma would be worth 20.5 billion. I have taken 9% as the WACC and 3% as the terminal growth rate.

Most investors probably consider this scenario to be very unrealistic and the share is trading 22% lower since the announcement. In part, the share price drop would be understandable, as the purchase of shares and the issuance of employee shares dilute the outstanding shares. However, this dilution is “only” 7.5%, which is significantly lower than the share price discount. In absolute terms, the stock has lost over 35 billion in market capitalization after previously losing 47% or 160 billion US dollars. Is this still rational? I doubt it and believe that the market has overreacted here, which is also due to the market environment.

Valuation is as low as it was in 2013

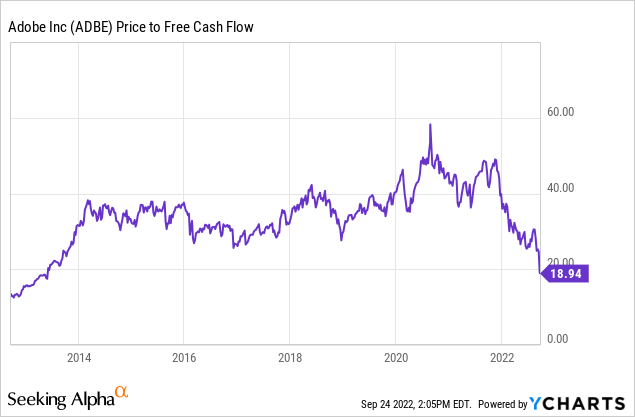

Adobe stock has typically traded at a premium valuation in recent years. The reasons for this were the stable growth, the high-margin subscription business and the dominant market position. In November 2021, investors were even paying nearly 20 times revenue for the company. This value has now fallen to 7.6, which may not seem so attractive at first glance.

This impression is put into perspective when the high margins are considered. Gross margins of 88%, operating margins of 35% and comfortable free cash flow margins of almost 45%. Not many companies can offer this, especially with the low fluctuations of Adobe thanks to the low cyclicality of the business model.

The picture becomes even clearer when you look at the price/free cash flow ratio, which currently stands at 18. The last time this ratio was below 20 was in 2013 when margins were much lower and the future was quite uncertain after the switch to a subscription model, which justified the value more then than now.

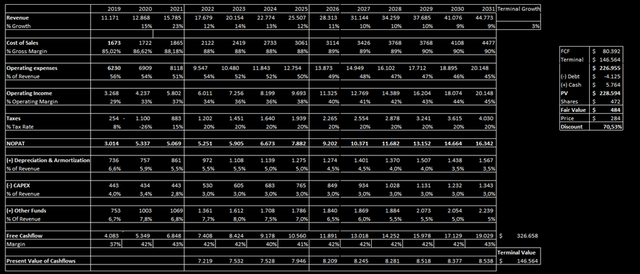

Understandably, Adobe traded at values around 30 for years, so even if you only give the company a value of 25 due to slowing growth, that would still be a potential 38% from current levels. But of course, this is still a very superficial valuation, so in the following, I use my discounted cash flow model. For this purpose, I have made some assumptions:

- Average sales growth until 2031 of 10.8% p.a.

- Gross margin can improve to 90% in the long run

- Operating expenses slowly decrease to a value of 45% of sales

- Tax rate at 20%

- Depreciation & Amortization decrease to 3.5% of sales in the long run

- CAPEX remains at 3% of sales

- Free cash flow margin remains above 40% of sales

- WACC of 9%

- Terminal growth rate 3%

With these assumptions, the fair value is $484, which would represent a potential 70% from current levels. Note that I have not included any additional revenue from the Figma acquisition in this model. If Figma’s growth is similar to the level I’ve shown above, the fair value would be much higher again. Adobe is undervalued to me.

The Bottom Line

Adobe remains one of the best quality companies in the world, regardless of Figma. In my view, the market is putting far too much focus on the takeover price, forgetting the robust core business as well as management’s strong track record in recent years. A healthy dose of doubt is of course warranted, as the purchase price looks very expensive and this raises justifiable skepticism about Adobe’s market dominance.

However, I consider the current discount to be grossly exaggerated and see it primarily due to the uncertain market environment. Adobe is a clear buy for me at the current level thanks to its lower valuation and exceptionally high margins.

Be the first to comment