gorodenkoff/iStock via Getty Images

The recent dip in Adobe (NASDAQ:ADBE) shares over the last year has been painful for investors. A combination of rising rates, easing covid restrictions, and general economic sentiment has hurt earnings and battered the otherwise buoyant stock, sending shares down by more than half, and cutting earnings multiples to 9-year lows.

Despite the malaise, the company has continued to execute its long-term business plan. Management has navigated the demand pull forward from Covid, launching new products and even purchasing a major competitor – Figma – for $20 Billion. While some argue that Adobe overpaid, we see it as continued evidence that Adobe management sees the bigger picture. Adobe is a company that needs to defend its competitive moat, and being price insensitive to get the deal done actually serves their long-term stakeholders.

Taken together, management’s continued commitment to the long term and the decline in share prices over the last year seems to have presented regular, everyday investors with an excellent opportunity. Adobe has all the hallmarks of being an excellent long-term wealth compounder, and purchasing shares right now seems like an extremely attractive entry point to begin building a position.

What is a “Compounder”?

Before diving into the specifics about what makes Adobe such an attractive long-term investment, it’s important to define exactly what we mean when we’re talking about “compounders”. Compounders are companies that offer the unique prospect of compounding an investment’s value at a higher-than-average rate, and different analysts have different ways of defining these types of opportunities. Some look at return on invested capital, some look at qualitative things like product satisfaction, and some measure IRR. We take a different view.

Compounding doesn’t happen automatically – it requires buyers and sellers in the market to agree that an asset’s value has increased vs. the year before. Thus, when it comes to finding an asset that will compound its value over time, there are only two factors that matter: supply and demand.

Let’s take a look at a quick example, using two stocks with drastically different supply and demand profiles.

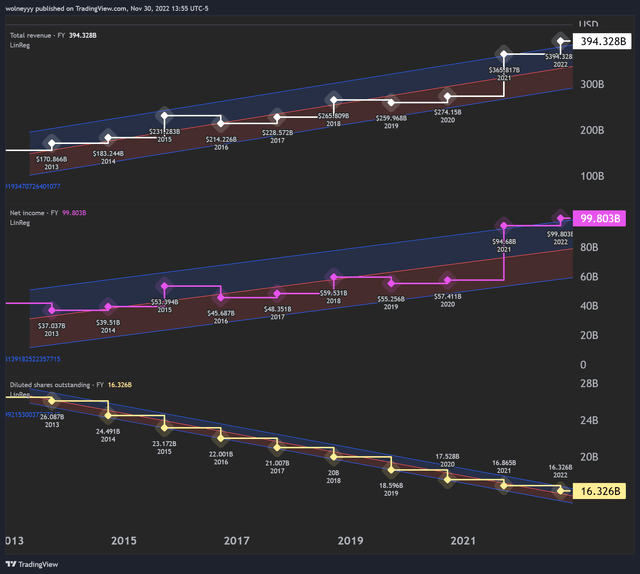

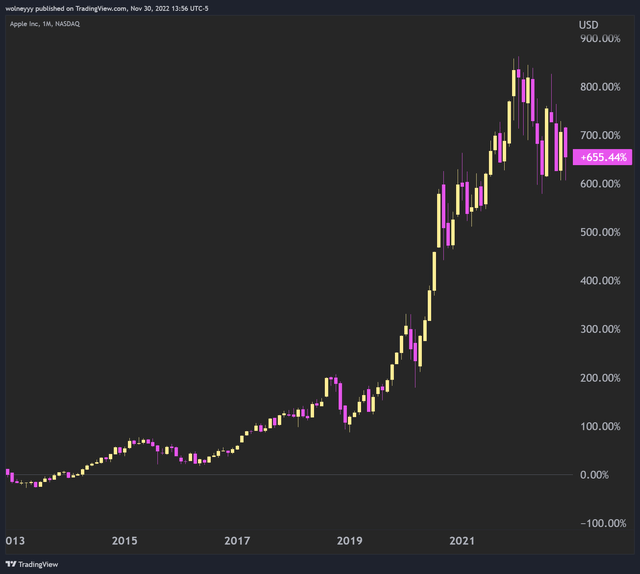

This first company is Apple (AAPL). As you can see, Apple has been growing revenue and earnings like clockwork over the last decade. This increased utility has led to an increase in demand for shares in the growing enterprise. In this way, we can use increasing revenue (scale of the business) and increasing earnings (competitive advantage, profit for investors) as proxies for demand.

But what about supply? Well, as it turns out, Apple has also been retiring shares from the outstanding investor base, buying them up in the open market. Long-term investors have seen their percentage ownership of the business increase over the last 10 years, without doing anything. As a result, even if the business hadn’t grown at all over the last decade, earnings per share would still be increasing.

When you put these two dynamics together, it can be an incredibly powerful compounding force. Check out how the company’s stock has performed over the last 10 years: it’s up over 650%.

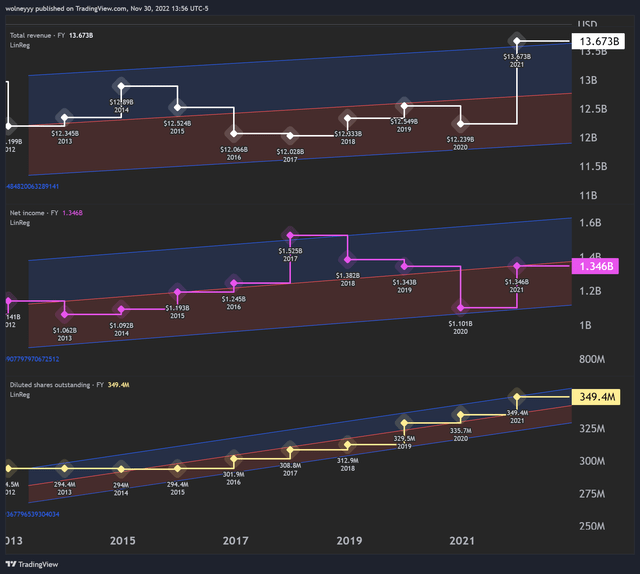

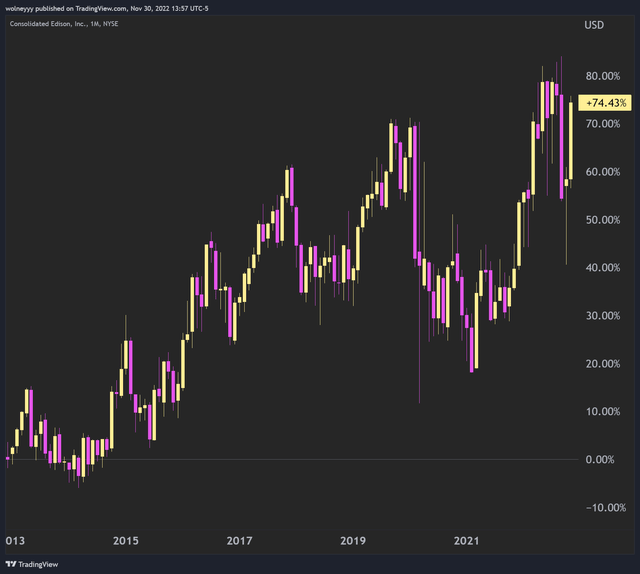

On the flip side, let’s take a look at a company that has much different supply and demand dynamics. Let’s look at Consolidated Edison (ED).

First: the good. The company isn’t shrinking. Revenue increased 12% over the last decade, from $12.2B to $13.7B. Earnings growth has been similar, as net income has only picked up 17%, moving from $1.14B to $1.34B. The company also pays a ~3% Dividend. This is a tepid demand profile for the stock, to say the least.

What about supply? Well, supply in shares of ConEd has grown by almost 20% since 2012, moving from 294m to 349m, a gain of over 18%. The company has used its equity as a weapon, and diluted shareholders to raise capital / make acquisitions. This can make sense if the move is accretive, but clearly it hasn’t been, as the results haven’t shown up in more than a decade of earnings.

Thus, with a mixed demand profile and an increasing supply of shares, it should be almost no surprise that Consolidated Edison shares have languished, up only 74% over the last 10 years:

Even if you include dividends, this is massive underperformance when compared with the broader indices.

Remember: actions speak louder than words. No matter what investors, analysts, or executives say, it’s difficult to argue with the proven performance of a company built over a meaningful period of time.

What makes Adobe a compounder?

In short, Adobe is a compounder because it has the same favorable supply and demand dynamics that all great compounders share.

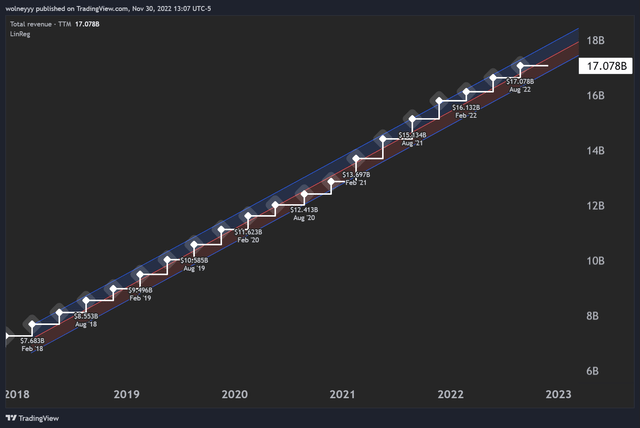

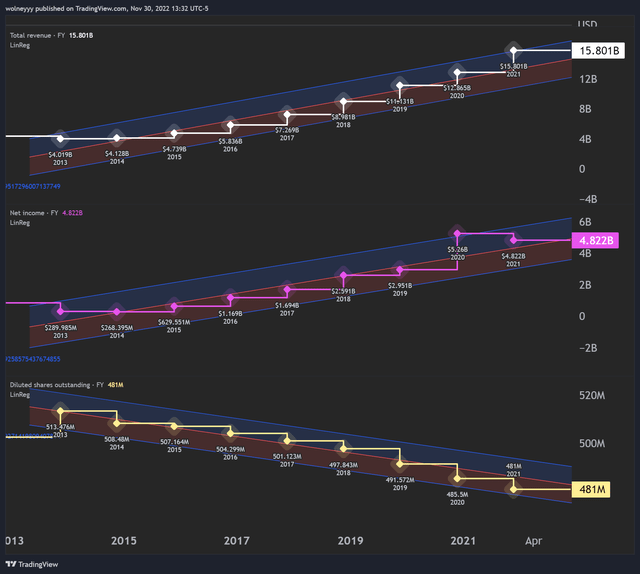

First, let’s take a look at Adobe’s revenue.

Adobe’s revenue has exploded over the last 5 years, growing from $7.2 Billion TTM to $17 Billion TTM. This is incredibly impressive and represents over an 18% CAGR. Clearly, the size of the business is increasing as executives have executed their business plans competently.

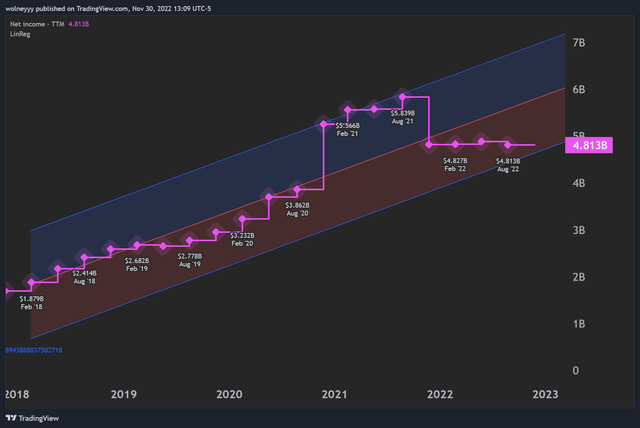

The same trends exist when it comes to net income:

While the standard deviation in the trend of net income is higher than the rhythmic pace of increasing revenue, the growth has been quicker. In the last 5 years, net income has grown from $1.7 Billion TTM to $4.8 Billion TTM, representing an astonishing 23% CAGR – even higher than the revenue growth rate.

In short, the increasing utility of holding Adobe stock creates highly favorable long term demand trends.

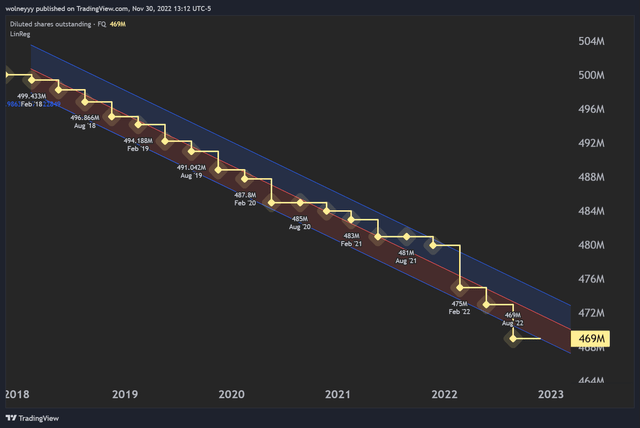

What about the supply of Adobe shares?

Shockingly, supply of shares has actually decreased over the last 5 years, as management has retired shares from the open market. While the decrease in share count has not been drastic – decreasing from (diluted) 500m shares to 469m shares – Adobe management has shown that they aren’t willing diluters of the company’s stock.

So, to recap, supply and demand trends in Adobe stock make it a highly attractive potential long-term investment.

Why is now a good time to buy?

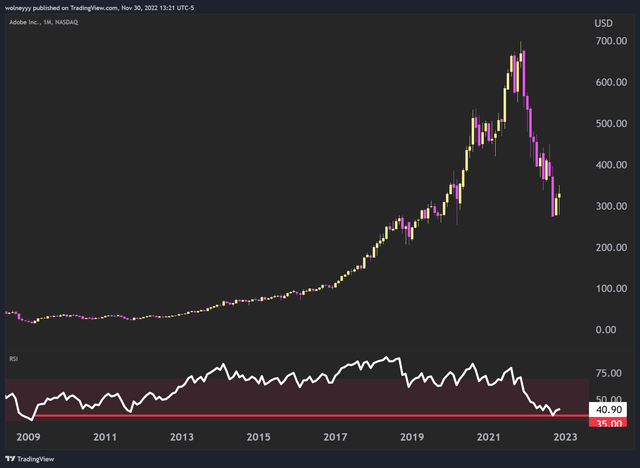

Right now is a good time to buy because the stock is oversold, heavily discounted, and potentially ready to mean-revert higher.

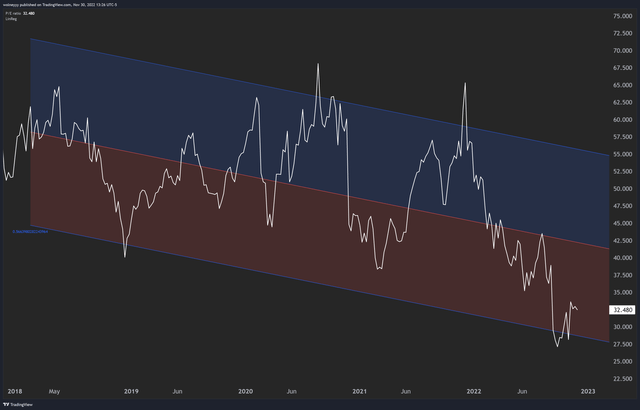

From a technical perspective, the stock is the most oversold it’s been since 2009 on the monthly chart, with a recent RSI reading of ~35.

When stocks get this “extreme” on one side of the market or the other, it usually means there’s an opportunity for a sharp trader or investor out there. For us, this oversold condition isn’t likely to hold forever, and thus it presents an opportunity, especially given the positive, longer-term supply and demand dynamics already discussed.

Additionally, from a valuation standpoint, the stock is extremely historically cheap, both in terms of net income multiple, and sales multiple. Right now, you can purchase shares in Adobe at only ~32 times earnings, a significant historical discount considering Adobe was trading at greater than 60x less than 12 months ago. You can see below that shares have dipped into extreme value territory, even briefly trading out of the standard deviation valuation range:

While it’s possible that these extreme technical and valuation metrics are a result of “the market trying to tell us something” about Adobe, it’s far more likely that this is a “buy when there is blood in the streets” opportunity. Fading fear in proven winners has proven to be a historically profitable strategy.

So, what are people worried about, anyway?

There are a number of factors having to do with this recent decline, chief among them the cyclical low we experienced in the rate cycle earlier this year. As rates go up, the net present value of future cash flows goes down. Stocks also become less and less attractive vs. “Risk free” rates.

As future earnings get more and more discounted, companies which derive a significant portion of their value from future growth become less valuable. This is especially true for companies with no earnings to speak of. As a result, nearly all of the high growth companies on the market today have been sold indiscriminately.

However, Adobe is a profitable, growing company, now. It’s different than the hundreds of other companies down more than 50% this year. It has a profitable business plan it’s executing. It’s produced billions in earnings for its investors, and meaningful revenue growth as well.

It is also plausible to believe that the re-rating the stock has experienced is a result of a pull-forward in demand for its services. As the pandemic raged, many were forced inside, and used all types of digital services at higher-than-usual rates. This trend positively impacted Adobe, as you could see from the financial data earlier. However, as the pandemic has begun to die down and people go back to their old habits, usership and earnings have dipped as well.

While this is a valid fear, if you zoom out at Adobe’s financials, then it’s clear to see that there’s a lot of “room” for earnings to shrink before they fall outside of the trends the company has previously produced.

In other words, we think the recent earnings performance is baked into the stock, and current fears are overblown.

Risks & Summary

While it seems as though the risks are priced in at this point, there is further risk that management stops executing, and the demand for Adobe shares is dampened dramatically over time. There is also the risk that the selling momentum is not over yet.

Finally, there is the risk that Adobe just lit $20B on fire with their acquisition of Figma. While it’s likely that they did overpay, all quality assets require this of buyers, whether or not they are public securities. This, to us, is a strong indicator of Adobe’s competence and continued commitment to long-term shareholders, not a financial misstep.

Thus, on balance, this selloff may prove to be an excellent opportunity to snag yourself a piece of this terrific long-term asset.

Be the first to comment