gorodenkoff/iStock via Getty Images

Adobe (NASDAQ:ADBE) is set to report second quarter earnings on June 16th. Like many peers in the tech sector, its stock price remains a far cry from just several months ago. Unlike many tech peers, ADBE is highly profitable with an active share repurchase program. This is a name whose fundamentals only improve with a lower stock price, with a business model that has stood the test of time. I discuss what metrics I am looking at ahead of the upcoming earnings report, and why the stock is a buy for the long term.

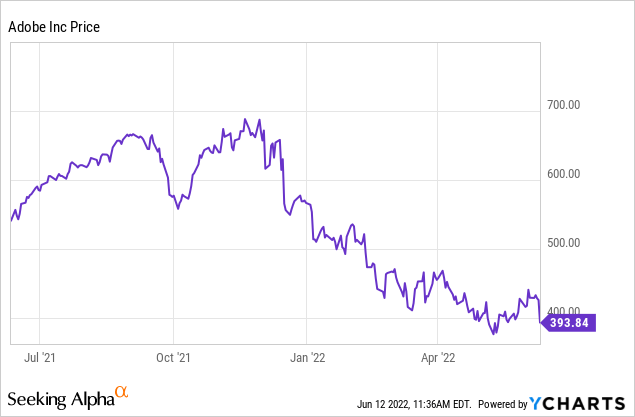

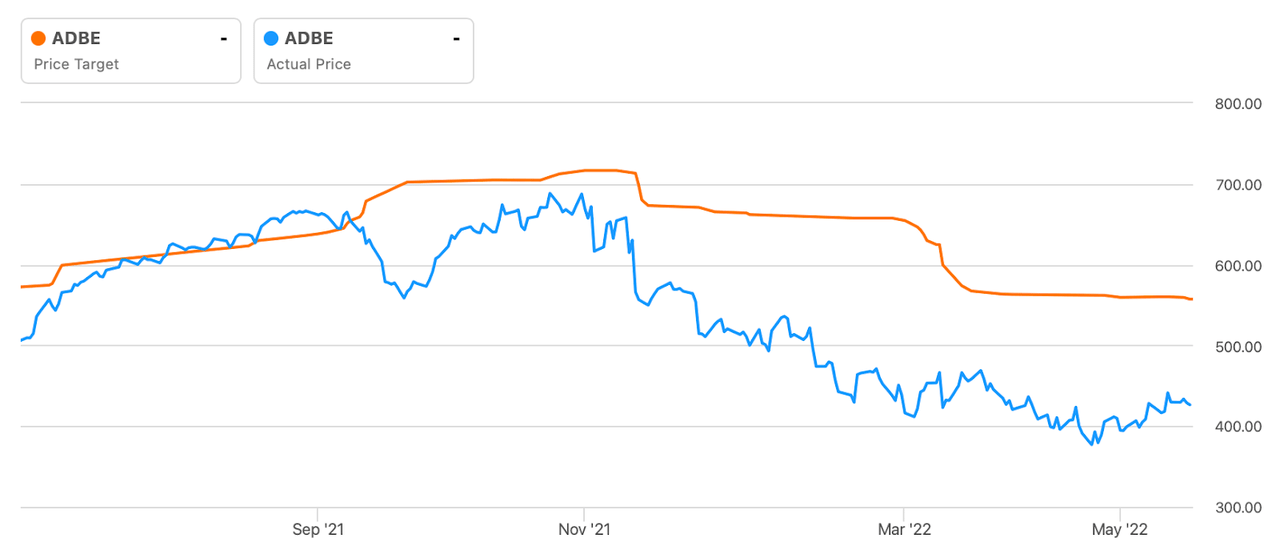

ADBE Stock Price

Even after the fall, ADBE stock does not look as cheap as many peers. It is easy to overlook that the stock is actually down 43% from all time highs.

The stock is now essentially at pre-pandemic levels. It is unbelievable to say it, but ADBE is “only” down 43% – that is just the type of market we are in right now.

ADBE Stock Key Metrics

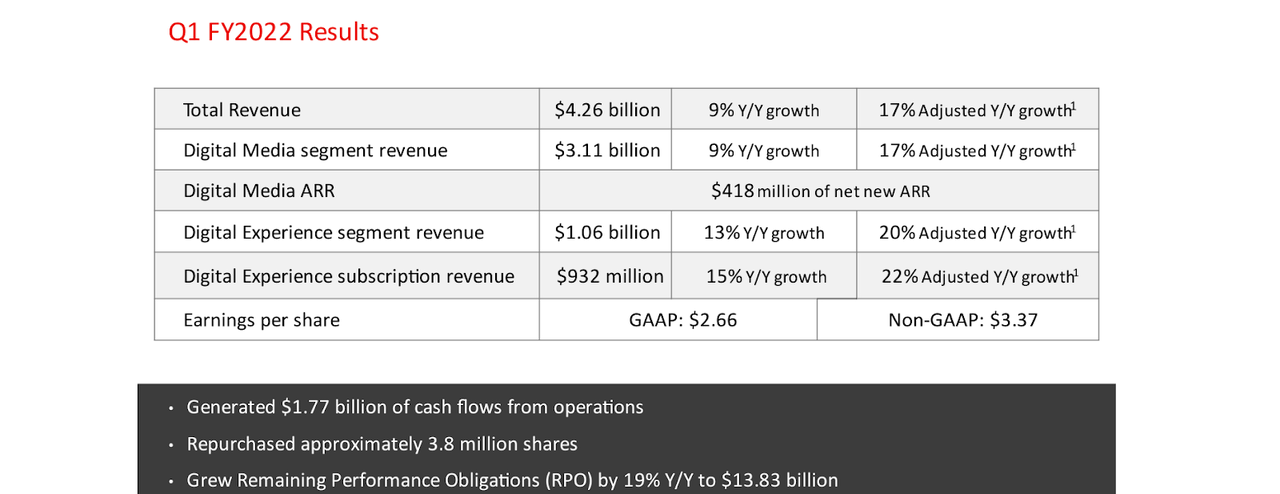

In the latest quarter, ADBE reported solid topline growth with resilient margins.

2022 Q1 Slides

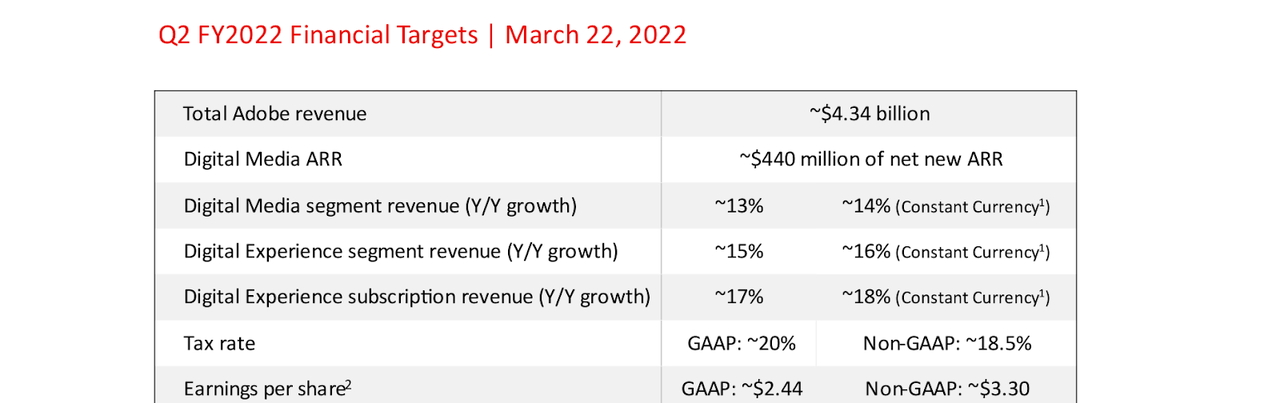

The company continued to repurchase shares out of free cash flow, something I expect the company to continue doing as the stock price languishes. ADBE has guided for the second quarter to see $4.34 billion in revenues, representing 13% year over year growth. Non-GAAP earnings per share is expected to grow by 9% YOY.

2022 Q1 Slides

On the conference call, management iterated their expectation for growth to accelerate in the second half of the year.

“As we look towards the back half of the year, we expect quarterly sequential revenue and EPS growth in Q3 and Q4. In Digital Media, we expect strong second half ARR performance across Document Cloud and Creative Cloud, including continued strength of emerging businesses like Acrobat Web, Frame.io, Substance and Creative Cloud Express. In addition, we expect ARR contributions to increase sequentially in Q3 and Q4 from a new offering and pricing structure which starts late in Q2.”

Some readers might find it concerning that earnings per share is growing slower than the top-line. Software companies should have operating leverage, not to mention that shares outstanding has been going down due to the ongoing share repurchase program. The key point to understand is that present-day earnings can be negatively impacted when the company invests in future growth because those associated expenses show up in the income statement before future revenues. It is for this reason that I prefer to value these stocks on the basis of sales multiples while applying a long term margin assumption.

I expect the main focus in the second quarter to be on ADBE’s ability to meet its issued guidance (on a constant currency basis) as well as reiterate its outlook for accelerated growth in the second half. In the current environment, meeting guidance is the new “beat and raise.” I have just discussed why I am not concerned about immediate profit margins, but I wouldn’t be surprised if Wall Street dings ADBE stock in the event of margin contraction, as there has been a greater focus on profits. Shareholders should be prepared for volatility even in the event of decent results.

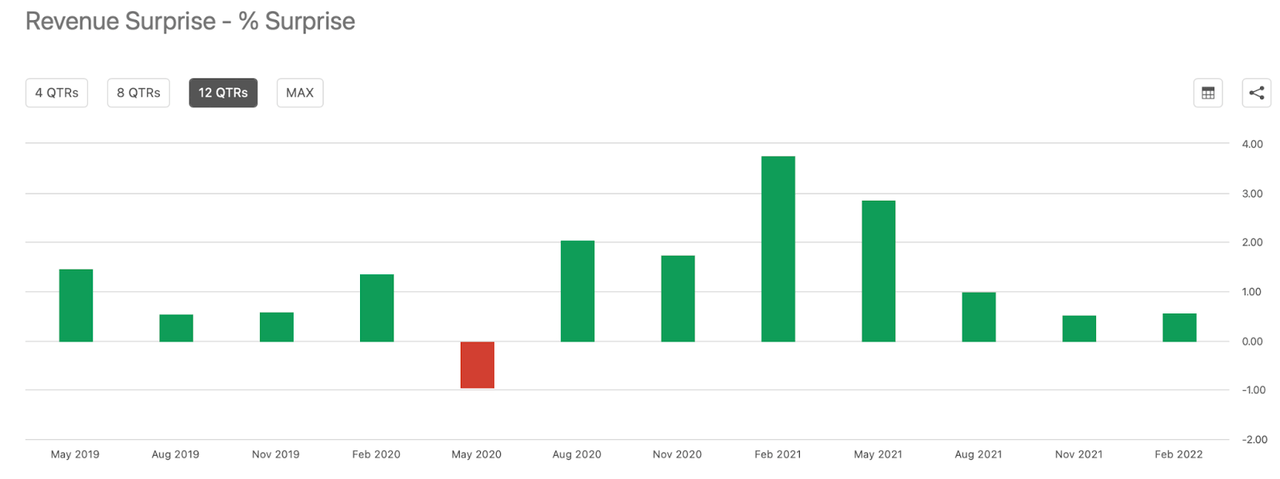

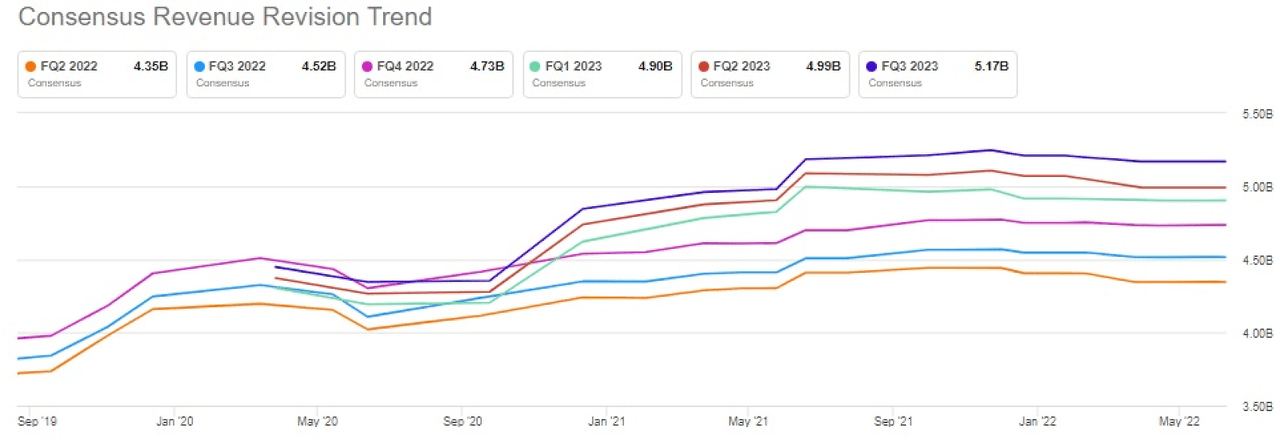

ADBE does have a history of surprising against revenue estimates, though I note that the current consensus expectation for $4.35 billion is slightly higher than management’s own outlook.

Seeking Alpha

Enterprise tech companies like Okta (OKTA) have continued to deliver strong results. I expect ADBE to do the same this week, although it is possible that Wall Street will not react in the same way that it used to prior to this crash.

ADBE Earnings Estimates Revisions

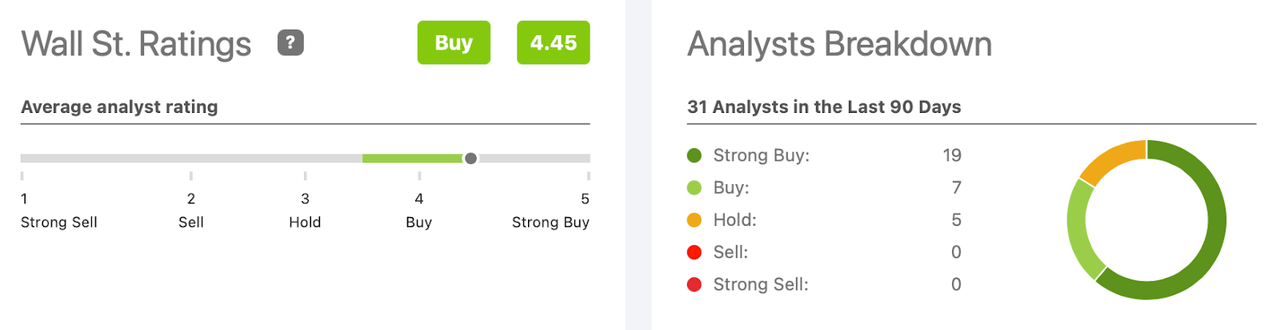

ADBE is a name which analysts in general have stuck with, even as the tech sector crashes. The average rating is 4.45 out of 5, a solid “buy” rating.

Seeking Alpha

We can see below that the average price target has dropped alongside the tech crash, but not nearly as much as the target declines in tech peers.

Seeking Alpha

Consensus revenue estimates have remained fairly stable.

Seeking Alpha

These reflect the trust that ADBE has earned over the years, as it has proven itself to be a company with conviction to execute. ADBE’s track record has helped insulate the stock price from the current crash, even though the stock still trades at a premium multiple. This relative strength is impressive, but may work against shareholders if ADBE fails to live up to these high expectations.

Is ADBE Stock A Buy, Sell, or Hold?

ADBE is trading at 10.4x forward sales and 29x forward earnings. Those aren’t obviously cheap multiples considering that the company is expected to grow at a low double-digit clip over the next several years. Don’t get me wrong – ADBE is highly buyable here – but this is a market where growth premiums have all but vanished. ADBE generated a 38% net margin in the latest quarter (also 38% all of last year). I expect the long term net margin to trend toward 45% once the company allows operating leverage to take place. That places the stock at 23x earnings power. This is a name which is buying back more stock than free cash flow while maintaining a net cash position. The stock arguably warrants a 2x price to earnings growth ratio (‘PEG ratio’), which would represent a stock price of around $479 per share, 21% higher than current prices. I stress that ADBE offers less upside than higher-growth peers, as any scenario where ADBE goes up 21% likely leads to greater upside elsewhere. Yet ADBE offers a sturdy business model, strong balance sheet, strong margins, and an ongoing share repurchase program. These factors help reduce the risk profile of the stock. Key risks to consider center around competition and the potential for margin contraction. ADBE’s multiple is highly dependent on its ability to further increase its profit margins over the long term. Another risk to consider is that of volatility. ADBE has proven less volatile than unprofitable tech peers, but there could be more downside if Wall Street switches gears and begins to view the stock to be of higher risk. I could see the stock trading down at least 50% to fall in-line with other tech peers exhibiting a similar top-line growth rate. It is arguable that ADBE’s high profit margins and ongoing share repurchase program should help prevent such a scenario, but those factors have not prevented stocks like PayPal (PYPL) from trading down to low single-digit multiples of sales. I rate ADBE a buy, though note I have been adding cheaper names in the tech sector to the Best of Breed portfolio.

Be the first to comment