David Tran

Adobe (NASDAQ:ADBE) just reported its third-quarter earnings and the company is tanking, down over 10% at the moment. I believe the earnings are not what’s driving the stock price down here, but rather the announcement of its acquisition of Figma, which I will discuss below. However, despite the company now being down substantially from its all-time high, I still think do not think investors should pull the trigger here. While fundamentals remain strong, the current valuation offers little upside and the company continues to face strong currency headwinds. I believe investors should hold and wait for a better entry point before dipping in.

Q3 Earnings

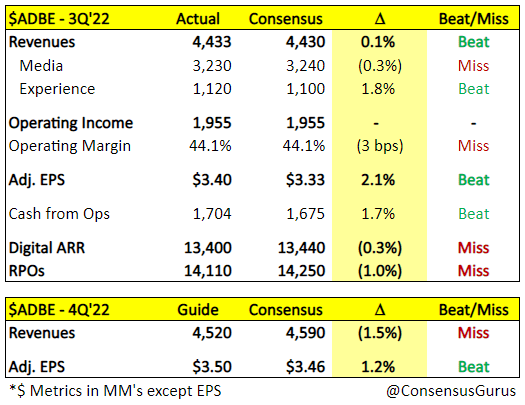

Adobe’s Q3 financial results appear to be decent when considering how volatile the economy has been. The company reported total revenue of $4.4 billion, up 13% YoY (year over year) from $3.9 billion. Digital media segment revenue was $3.2 billion, up 13%. Creative revenue accounted for $2.6 billion, up 11%, while document cloud revenue accounted for $607 million, up 23%. The growth is largely driven by strong demand for photoshop and lightroom offerings, as well as video-related products. Adobe Sign continues to see strong traction, with new customer wins including Amazon (AMZN), Boeing (BA), ServiceNow (NOW), etc. On the experience cloud side, revenue for the quarter was $1.1 billion, up 15%. This is attributed to the strong momentum for Adobe Experience Platform and Adobe Commerce.

The bottom line was a bit disappointing. Operating income was $1.48 billion compared to $1.44 billion, up only 2.8%. This is due to a significant increase in operating expenses, which shot up by 18.5%, outpacing revenue growth for the quarter. As a result, diluted EPS also dipped 4% from $2.52 to $2.42. Operating cash flow was $1.7 billion, up 21.4% from $1.4 billion. I am not too worried about the drop as profit should rebound once operating expenses stabilize. The RPO at the end of the quarter was $14.1 billion, up 12% YoY. The company’s balance sheet remains very healthy with $3.9 billion in cash and only $3.6 billion in debt (prior to the acquisition).

ConsensusGurus

Figma Acquisition

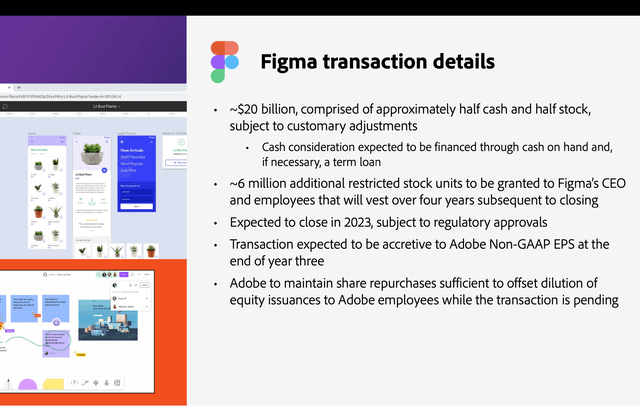

The vocal point for the quarter was definitely the company’s acquisition of Figma, a leading web-first design platform. The deal will be valued at around $20 billion, comprised of approximately half cash and half stock.

Figma is a company that offers collaborative design tools for teams to enable better workflow. It is currently used by multiple large enterprises such as Block (SQ), Spotify (SPOT), Twitter (TWTR), and more. Like Adobe, Figma has strong gross margins of around 90% and is already generating positive cash flow.

While the acquisition is surely able to eliminate some competition and further enhance Adobe’s product suite, the deal seems quite desperate in my opinion. Yes, they successfully got rid of a major competitor, but is this really a viable long-term solution for tackling competition? They are still facing competition from Canva and other emerging companies. The acquisition may actually signal that Adobe’s competitive advantage is now deteriorating.

From the press release, Adobe stated that Figma is expected to add $200 million in ARR (annual recurring revenue) in 2022, and to surpass $400 million ARR exiting fiscal year 2022. This indicates a valuation of 50x fwd P/S, which is absurd. For instance, even Snowflake (SNOW), one of the most expensive SaaS stocks in the market, is trading at an fwd P/S ratio of around 29. This is a huge overpay in my opinion, especially when considering how bad the equity market has been lately.

While the top line will contribute immediately, the bottom line is not expected to be accretive until 3 years later. I also don’t like the terms of the deal. Adobe is funding the acquisition through half cash and half stocks, which means it will need to issue around $5 billion worth of shares. Using the current market cap, this stock offering will result in a dilution of around 5.8%. Overall, I don’t think this is a good deal coming from Adobe.

Is Adobe A Buy, Sell, Or Hold?

While I don’t like the Figma acquisition as it appears to be very expensive and dilutive, Adobe’s fundamentals remain intact. The company continues to report double-digit revenue growth despite facing a tough macro environment. Demand for products like Adobe Sign and Magneto continues to be strong. The bottom line saw a slight dip but should recover soon as operating expenses stabilize. On-going buybacks will also provide some support for the EPS figure as well. After the huge drop in share price since late last year, the company is now trading at a P/E ratio of around 31.5. The valuation is fair in my opinion when considering its leading market position and durable double-digit growth rate. However, this leaves the company with little upside as multiples expansion is unlikely. Investors should also be aware of currency headwinds. The strong dollar has been posting immense headwinds on Adobe. In the recent quarter, the company already had a 2% currency hit on revenue due to FX. If the dollar continues to spike, its financials will likely continue to be impacted. Therefore, I rate Adobe as a hold at the current price.

Be the first to comment