Design Cells/iStock via Getty Images

Founded in Seattle, Washington, United States, Adaptive Biotechnologies (NASDAQ:ADPT) is a company specializing in developing “immune medicine” and related technologies to “harness the inherent biology of the adaptive immune system”. Adaptive Biotechnologies intends to advance the practice of modern medicine through the use of ingenious, immune system-based technologies to analyze and deal with diseases. The company’s clinical diagnostic product called clonoSEQ has been tested and authorized by the Food and Drug Administration (FDA) to detect and monitor minimal residual disease in patients with select blood cancer.

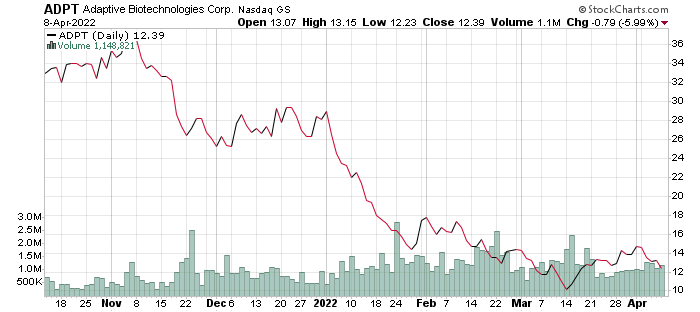

StockCharts

Adaptive Biotechnologies has attained new heights in its quest to meet the world’s need for immune sequencing technology. With a revenue increase of 57% year-over-year in 2021, Adaptive Biotechnologies is an ideal company for any investor willing to invest in the biotechnology industry, making it a buy for investors’ biotech portfolios.

Financial Analysis

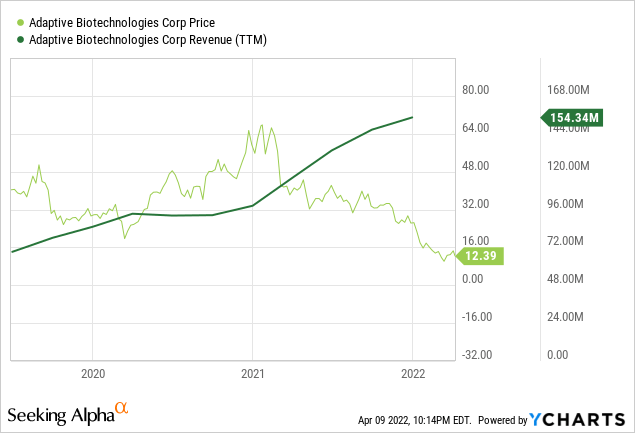

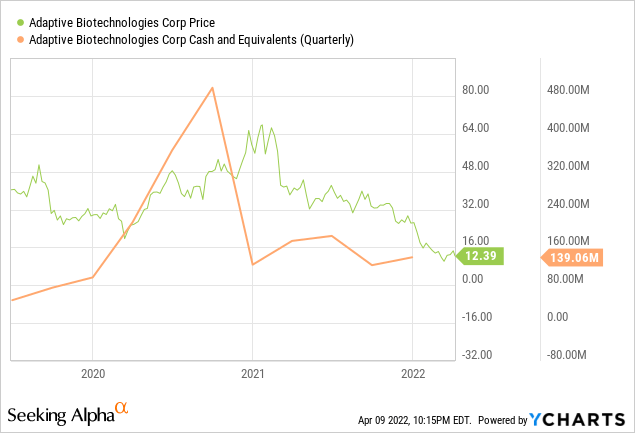

YCharts

When it comes to biotechnology companies one of the most important factors to look at is a strong balance sheet to support the research and development of pre-clinical products, this is especially important when supported by revenue growth in existing products on the market. With that being said, Adaptive Biotechnologies had an impressive balance sheet in the last financial year. The company recorded $154.3 million as revenue in FY 2021, a whopping 57% increase year-over-year. In the previous year, Adaptive Biotech had recorded $98.4 million as total revenue, while $154.3 million recorded in FY 2021 represent a capital increase of $55.9 million. An increase in the company’s sequential revenue could be credited to a few milestones, including the emergency use of the company’s T- Cell-based COVID-19 test, which saw more than 30,000 ordered tests. In Q1 2021, Adaptive Biotechnologies recorded a revenue of $38.4 million which represents an 84% increase year-over-year. The use of the company’s T-cell-based COVID-19 test was a significant factor in the increase in revenue in Q1 2021. The company’s product clonoSEQ also had a robust clinical adoption in this quarter, while Adaptive Biotechnologies also pocketed $7 million from two pharmaceutical companies which had partnered with it on minimal residual disease (MRD) data sharing. In Q2 2021, the biotech company recorded $38.5 million as revenue representing an 83% increase compared to the second quarter of the previous year. Q2 result was primarily driven by the strong clinical volume of clonoSEQ.

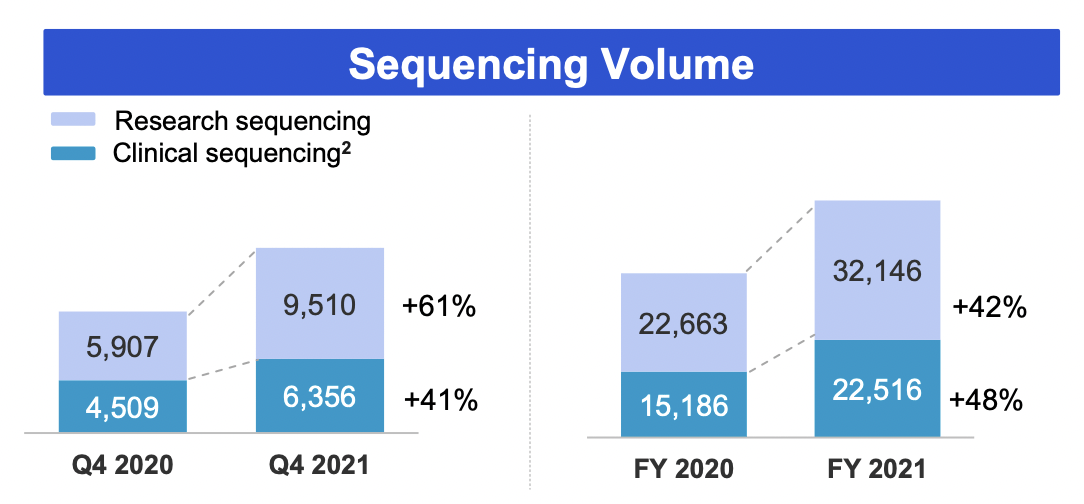

investors.adaptivebiotech

In Q3 2021, Adaptive Biotechnologies revenue in this quarter was almost the same as the previous year. The company recorded a revenue of $26.3 million compared to $26 million recorded in Q3 2020. By the end of FY 2021, Adaptive Biotechnologies has recorded total annual revenue of $154.3 million and Q4 revenue of $37.9 million. While Adaptive Biotech had no debt at the end of FY 2021, the company maintained $139 million as cash and cash equivalents. Having such excess capital is especially important for biotech companies, as pre-clinical development and clinical trial expenses can be in the hundreds of millions.

Adaptive’s strong revenue inflow can significantly be credited to the strong clinical performance of clonoSEQ, which recorded 22,516 testing in FY 2021. The company also pocketed a cumulative revenue of $10 million from pharmaceutical partners who employed data from its MRD assay to boost their drug approvals.

YCharts

Valuation for companies in the biotech industry can be especially difficult for companies with a pipeline that does not yet have any products to market. Luckily for Adaptive Biotechnologies, that is not the case. While there will be a requirement for future significant expenditures in their R&D pipeline, with revenue already over $150 million their current marketable products are the primary factors in their current valuation. Currently, their price to sales ratio of 9.84 is significantly higher than the sector median of 5.41, however, from a historical perspective, the P/S ratio has been in a constant decline over the past year. This is a factor of growing revenue and likewise demonstrates that its revenue should keep the valuation under control even as we expect the price to appreciate over the coming years.

Product Overview

clonoSEQ

One of the most exciting products in their portfolio is clonoSEQ, by being the “first and only FDA-cleared” diagnostic test that measures minimal residual disease (MRD) in bone marrow samples.

It utilizes the force of next-generation sequencing (NGS) to help clinicians predict patient outcomes and support treatment in multiple myeloma, chronic lymphocytic leukemia (CLL), and B-cell acute lymphoblastic leukemia (B-ALL) care. It could also be used in vitro diagnostic (IVD) test service. clonoSEQ is reported to have the ability to detect one cancer cell among a million healthy cells. clonoSEQ is used at 31 National Comprehensive Cancer Center (NCCN), academic institutions, and community clinics. It is utilized in 48 out of 50 states of the United States.

T-Detect

Other clinical diagnostic products of the biotech company include T-Detect, a new-generation sequencing-based assessment to assist in recognizing persons with compatible T-cell immune system response to SARS-CoV. In March 2021, T-Detect COVID was awarded Emergency Use Authorization (EUA) by the Food and Drug Administration, becoming the first to ascertain recent or prior COVID-19 infection. In addition, the company’s drugs discovery pipeline includes cell therapy and antibodies.

immunoSEQ

Adaptive Biotechnologies also have a life science research on immunoSEQ, which provides an immune sequencing solution that helps discover the scope of the adaptive immune system. This solution gives the power to decipher the intricacy of the adaptive immune system, giving essential insights into the body’s reaction to disease and therapy.

Growth And Market Valuation

Adaptive Biotechnologies was founded in 2009 with the mission to be able to read how the adaptive immune system detects and treats disease. The company took up the mandate to formulate how natural abilities could be harnessed to make a difference in the lives of people living with many different diseases. Over time, Adaptive Biotechnologies has engaged in various partnerships, including one with Genentech and another with Microsoft (MSFT), to figure out the human immune system and identify cancer and other diseases using Microsoft’s large-scale machine learning and cloud computing capabilities. In 2021, to enhance operation through effective leadership, Adaptive Biotechnologies announced the appointments of Leslie Trigg and Katey Owen to its Board of Directors. The company has always been known for its strategic leadership. For instance, Chad Robins oversaw the company’s initial public offering, and it went smoothly. This earns Adaptive Biotech the rank of one of the year’s best biotechnology initial public offerings.

Meanwhile, the biotech industry has grown over the years, with its prominent growth happening during the COVID-19 pandemic. The industry is valued at more than $500 billion in 2020, with the prospect of reaching $2.4 trillion in the next six years. It is, therefore, valid to say that the massive size of the biotech industry and the pace at which it will grow in the next few years illustrate a huge market opportunity for Adaptive Biotechnologies Corporation.

With regards to the individual companies’ growth potential, the two products to focus on are the T-cell-based COVID-19 test and clonoSEQ. I expect that the main driver of growth in the next several quarters will be the diagnostic tests portfolio. While there is definitely warranted concern that the T-Detect COVID tests that have been driving growth over the last year will start to decline with the virus transmission rates falling, it is important to remember that T-Detect is a technology with a broad applicable market that extends beyond COVID. In fact, I would argue that the performance of T-Detect COVID is a testament to the technologies’ effectiveness and ability to drive revenue growth. As the technology in T-Detect has the ability to also be applied to diseases such as Lyme disease and offers significant advantages when compared to traditional antibody tests, the potential market remains substantial. The company’s product clonoSEQ also had an excellent volume of clinical adoption in the last quarter, with research and clinical sequencing volumes of 61% and 41% respectively compared to 2020. All of these factors point to the importance that the diagnostic testing products in Adaptive Biotechnologies’ portfolio will play in driving company-specific growth over the next quarter.

Risk And Competitors

Adaptive Biotechnologies’ business and operations are characterized by several risks which could negatively affect the company’s revenue. The need to fund research is one of the greatest risks associated with the biotech industry. As a biotech firm with many pipeline products, Adaptive Biotechnologies needs sufficient funds to run its clinical trials. This risk is further compounded as there is no certainty that the company’s pipeline products will be successful. Until pipeline products are certified and approved, they are still speculative.

Furthermore, Adaptive Biotech is exposed to internal risk with the company’s agreement with Genentech. Among other potential risks associated with the agreement, it can also reduce the amount of royalty the company receives from its marketable products. Adaptive Biotech is also exposed to a damaged reputation if an error or significant defect is detected in any of its marketable products. The company also has some strong competitors, including Navidea Biopharmaceutical (NAVB), a larger and more funded company. Adaptive Biotechnologies requires sufficient funding and strong management to be able to compete fairly.

Future Outlook

The future growth and development of Adaptive Biotechnologies is interconnected with the biotech industry. However, the robust metrics that characterized Adaptive Biotech make it a company that could become the next big thing in the industry. The company’s leading product clonoSEQ has enough potential to drive substantial revenue and lead it to another double-digit growth by the end of the current financial year. Already, Adaptive Biotech has working relationships with more than 175 biopharmaceutical partners, including Moderna. All of these factors point to a company that I believe investors should consider adding to their portfolio, especially when considering the potential for significant return in the medium to long-term.

Be the first to comment