Nikada/E+ via Getty Images

Thesis

Virtus AllianzGI Diversified Income & Convertible Fund (NYSE:ACV) is a closed end fund with a convertibles focus. The vehicle holds a large outright equities sleeve of over 20%, and has a mandate to write covered calls on the stock positions:

The Fund normally invests at least 50% of total managed assets in convertibles, and has the latitude to write covered call options on the stocks held in the equity portion

The fund has a technology focus, with IT composing over 27% of the fund’s portfolio. The top 4 sectors account for over 70% of the fund’s holdings, and IT is balanced with a defensive sector, namely Health Care, which is the second largest concentration. This composition has given the fund outsized gains in 2020/2021 when rates were close to zero and the Fed was engaging in QE. The story has been different in 2022, with the fund down over -35%. The main drivers of the CEF’s performance have been the equities and converts positions, compounded by the fund’s 33% leverage.

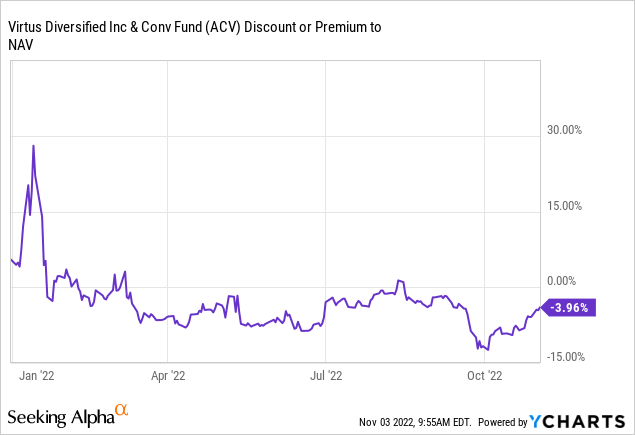

The fund is now trading with a -4% discount to NAV, which fluctuates with risk-on/risk-off environments. We saw the fund’s discount widen out to -12% during the last risk-off bout in September, and we would expect a similar oscillation during the next bear market leg.

We feel the rest of the year will be difficult to navigate for ACV, with more pain ahead as the bear market continues. The fund has significant leverage on top of its structures, thus magnifying the down moves. 2023 will be a much more constructive year for the fund, with an expected positive performance, but buy-and-hold investors should expect a normalization of investment returns, with the zero rates tech boom environment behind us.

Holdings

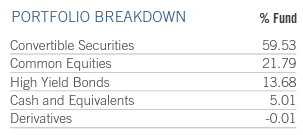

The fund holds convertible securities, outright equities and bonds:

Portfolio Slicing (Fund)

The largest exposure is to convertible securities, but the fund does not lie about its main risk factor, namely equities, therefore holding them outright as well. The high yield bonds bucket is there to juice up returns and actually provide for a stream of net investment income.

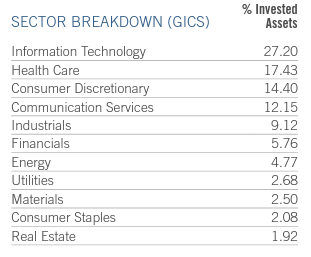

The largest sector in the portfolio is information technology:

Sector Breakdown (Fund)

The top four sectors account for over 70% of the fund’s portfolio. Tech is the usual suspect when it comes to convertibles, given the propensity of the companies in that industry to be cash-flow poor, hence they tend to raise capital via structures that give investors participation in the equity upside rather than true cash yields out the door.

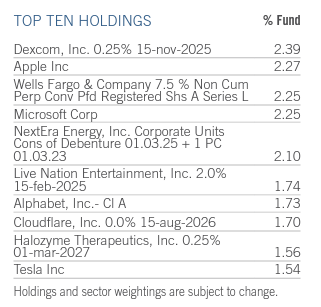

The top holdings in the vehicle are a mix of convertibles and outright equities:

Top Holdings (Fund)

We can see the fund holding Apple, Google and Tesla shares outright here.

Performance

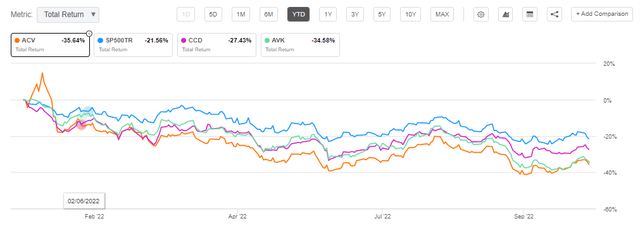

The fund is down significantly in 2022:

YTD Total Return (Seeking Alpha)

We can see ACV is at the bottom of the cohort in terms of its performance for 2022. The reason behind the fall this year is the leverage the fund runs and the fact that it has an outright equities sleeve. With convertibles, there is an equity option component which has gained in value with volatility higher. Outright equity positions are only driven by delta (i.e. the market moves in the underlying stocks).

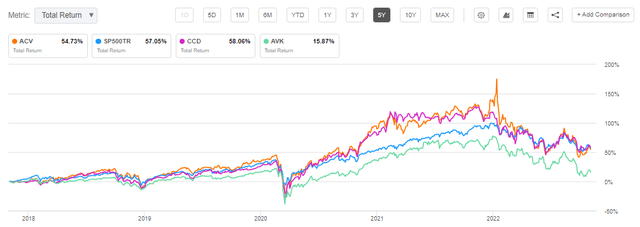

On a 5-year basis the fund has a competitive total return profile, outpacing the S&P 500 index during certain time-frames:

5Y Total Return (Seeking Alpha)

We can see that both ACV and CCD had stellar performances in 2020/2021 due to their technology overweight positioning.

Premium / Discount to NAV

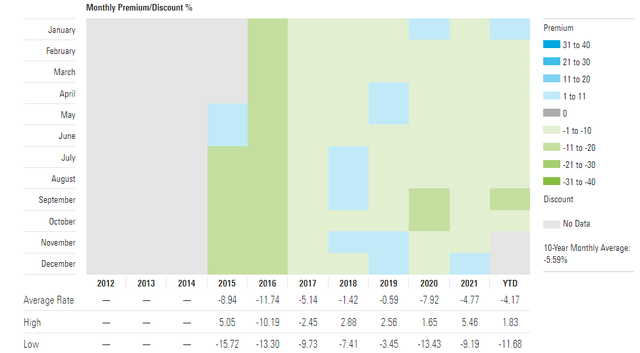

The fund usually trades at a discount to net asset value:

Premium / Discount to NAV (Morningstar)

We can see from the above table, courtesy of Morningstar, that the fund has traded at average discounts of -5% since inception in 2015. The year-to-date performance for the discount to NAV is interesting:

We can see that as the year started the fund moved to a level below its net asset value, indicating that investors thought the holdings are going to be constrained in their performance, and that the one-time distribution from the past (discussed more below) was not the most optimal idea. The fund has kept trading at a discount to NAV with a certain beta to the risk-on/risk-off market moves (i.e. as the market rallied in July/August, the fund moved closer to a 0% discount).

Distributions

The fund now has a managed distribution plan:

In December 2021, the Fund announced that it will institute a managed distribution plan and raise its monthly distribution rate by 8% to $0.18 per share, effective February 1, 2022. By implementing a managed distribution plan and providing a more attractive distribution rate, the Fund is seeking to enhance shareholder value and reduce the current discount to NAV at which its shares currently trade.

Source: Annual Report

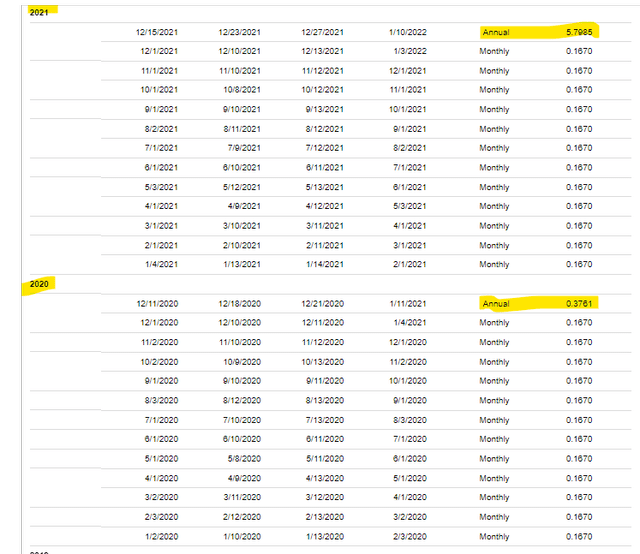

The CEF used to have substantial one-off distributions at the end of each year during the boom years of 2020/2021:

Distribution History (Seeking Alpha)

The fund basically sent investors crystalized capital gains via one-off distributions. While this is good for the holders during those time-frames, for buy-and-hold investors a managed distribution is more favorable. The reasoning here is that a managed distribution ensures an accretive or flat NAV even during “lean” years.

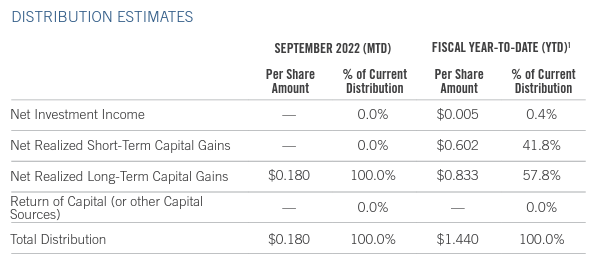

To note that currently the fund is not using ROC, despite the poor collateral performance in 2022:

Distribution Composition (Fund)

We expect this to change if the market does not produce positive performances in the underlying collateral.

Conclusion

Virtus AllianzGI Diversified Income & Convertible Fund is a closed end fund with a convertibles focus. The vehicle however has a large outright equity sleeve which accounts for over 20% of the portfolio. The CEF has a technology focus, which represents more than 27% of the portfolio. This positioning has been responsible for outsized gains in 2020 and 2021 as tech stocks rallied on the back of a zero rates environment. The fund had special one-off distributions during those years, when it returned to holders the crystallization of outsized portfolio gains. ACV has now switched to a managed distribution plan, aiming for a $0.18 monthly payment. Down over -35% this year due to the market downturn and its 33% leverage, the fund will have a difficult rest of the year to navigate. We expect a much more constructive and positive performance next year; however, with the tech sector set to revert to more modest positive annual performances, ACV will deliver more normalized returns going forward.

Be the first to comment