metamorworks/iStock via Getty Images

A Quick Take On Actelis Networks

Actelis Networks, Inc. (ASNS) has filed to raise $19 million in an IPO of its common stock, according to an S-1 registration statement.

The firm designs and sells Internet of Things ((IoT)) networking products.

Despite a large and growing industry, the company produced no revenue growth in 2021.

I’ll provide a final opinion when we learn more about the IPO.

Company & Technologies

Fremont, Colorado-based Actelis was founded to develop IoT networking technologies for deployment in cities, campuses, military bases, airports and rail and roads.

Management is headed by founder, Chairman and CEO Mr. Tuvia Barlev, who has been with the firm since inception in 1998 and was previously head of the R&D organization at Teledata and a senior research officer with the government of Israel.

The company’s primary offerings include:

-

Switches

-

Extenders

-

Security

-

Management

-

Industrial Ethernet

-

Amplifiers

-

Repeaters

-

Software

Actelis has booked fair market value investment of $8.4 million as of December 31, 2021 from investors.

Actelis – Customer Acquisition

The firm pursues clients via a “vertical based” approach both via direct sales and through various partner channels.

ASNS focuses on the verticals of intelligent transportation systems, rail, federal and military, energy and water, airports, smart city, industrial campuses, education campuses and airports.

Sales and Marketing expenses as a percentage of total revenue have risen as revenues have remained stable, as the figures below indicate:

|

Sales & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

2021 |

25.8% |

|

2020 |

21.7% |

(Source)

The Sales and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, was 0.0x in the most recent reporting period. (Source)

Actelis’ Market & Competition

According to a 2020 market research report by Mordor Intelligence, the global market for IoT was valued at an estimated $761 billion in 2020 and is expected to reach $1.39 trillion in value by 2026.

This represents a forecast CAGR of 10.53% from 2021 to 2026.

The main drivers for this expected growth are an increasing adoption of IoT technologies across a wide range of industry verticals, including automotive, manufacturing and healthcare.

Also, a shift to manufacturing ‘Industry 4.0’ is placing an emphasis on complementing and augmenting human labor with robotics to reduce accidents and increase efficiencies.

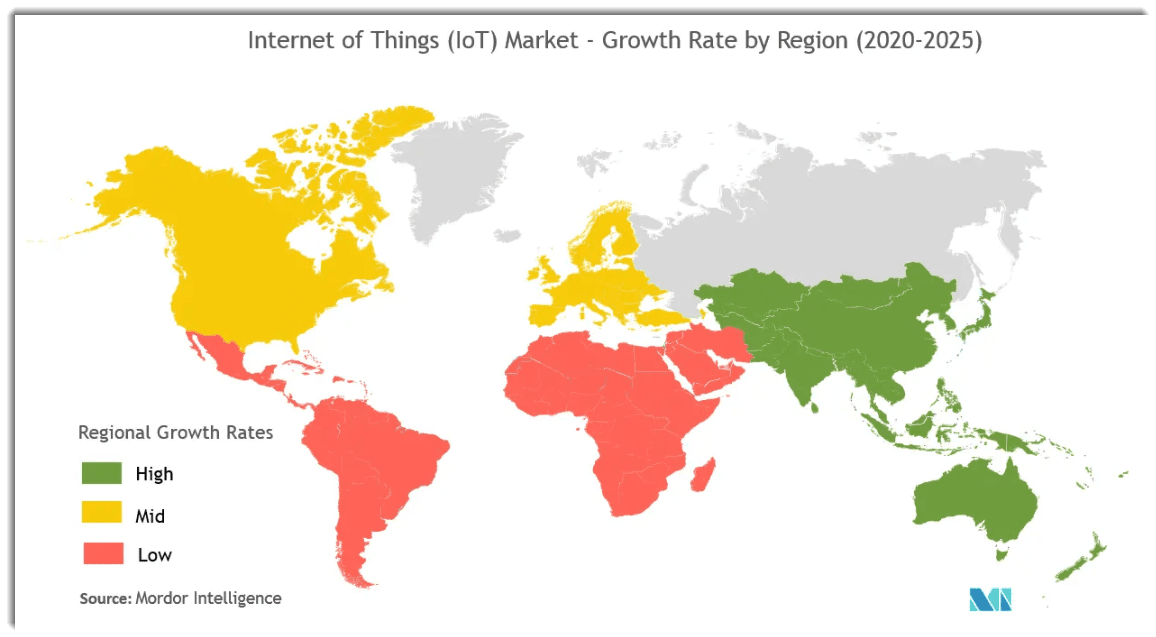

Regional growth rates are estimated in the chart below:

Global Market For Internet of Things (Mordor Intelligence)

Major competitive or other industry participants include:

-

Moxa Technologies

-

ADTRAN

-

FlexDSL Telecommunications AG

-

EtherWAN Systems

-

Belden

Actelis Networks Financial Performance

The company’s recent financial results can be summarized as follows:

-

Flat topline revenue

-

Reduced gross profit and gross margin

-

Growing operating and net losses

-

Increasing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2021 |

$ 8,545,000 |

0.2% |

|

2020 |

$ 8,532,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

2021 |

$ 3,970,000 |

-20.3% |

|

2020 |

$ 4,982,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

2021 |

46.46% |

|

|

2020 |

58.39% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

2021 |

$ (1,860,000) |

-21.8% |

|

2020 |

$ (131,000) |

-1.5% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

2021 |

$ (5,251,000) |

-61.5% |

|

2020 |

$ (1,505,000) |

-17.6% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2021 |

$ (2,726,000) |

|

|

2020 |

$ (343,000) |

|

(Source)

As of December 31, 2021, Actelis had $693,000 in cash and $18.7 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021, was negative ($2.8 million).

Actelis Networks IPO Details

Actelis intends to raise $19 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

for our research and development efforts;

for sales and marketing activities;

for general and administrative corporate purposes, including working capital and capital expenditures.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently involved in litigation that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is Boustead Securities.

Commentary About Actelis’s IPO

ASNS is seeking U.S. public capital market investment to fund its growth plans.

The company’s financials have shown no growth in topline revenue, lowered gross profit and gross margin, increasing operating and net losses and higher cash used in operations.

Free cash flow for the twelve months ended December 31, 2021, was negative ($2.8 million).

Sales and Marketing expenses as a percentage of total revenue have risen despite flat revenue growth; its Sales and Marketing efficiency multiple was 0 in 2021.

The firm currently plans to pay no dividends on its shares and anticipates that it will use any future earnings to reinvest back into the company’s growth initiatives.

The market opportunity for Internet of Things software and equipment is quite large and expected to show strong growth over the coming years, so the firm enjoys favorable industry dynamics.

Boustead Securities is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 23.0% since their IPO. This is a top-tier performance for all major underwriters during the period.

The firm’s auditors have indicated ‘substantial doubt’ about the company’s ability to continue as a going concern owing to its significant recurring losses from operations and this opinion could limit the firm’s ability to raise additional funding.

Despite a large and growing industry, the company produced no revenue growth in 2021.

I’ll provide an update when we learn more about the IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment