Dejan Marjanovic/E+ via Getty Images

Background

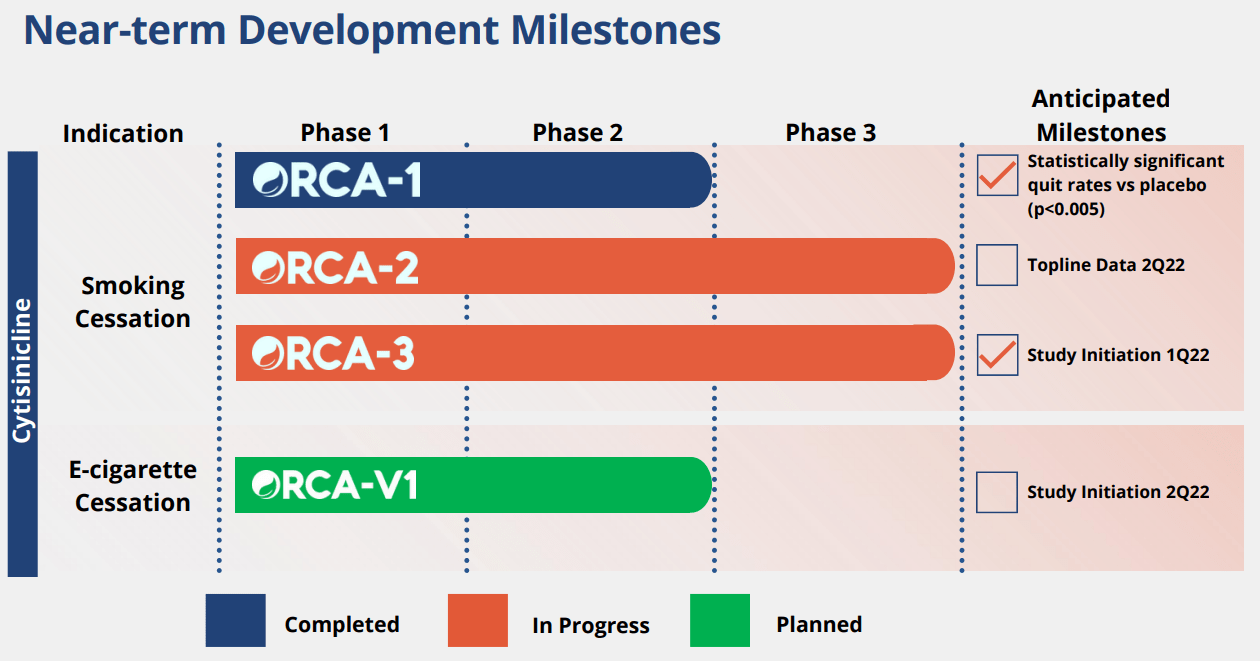

We are initiating coverage of Achieve Life Sciences with a speculative buy rating to play the upcoming top-line data readout of the Phase III ORCA-2 trial. Achieve Life Sciences (ACHV hereafter) is a US-based biotechnology company developing a treatment for smoking cessation, Cytisinicline. The company is a single asset company developing a drug called Cytisinicline that targets a multi-billion dollar smoking cessation market. Interestingly, the company plans to start a phase II trial to study the efficacy of the drug in E-cigarette addition, which is becoming a bigger and bigger social problem across the world, and data on negative health consequences are slowly emerging.

The history of the company is interesting; ACHV was licensed in Cytisinicline from Sopharma AD in 2009. The license included: manufacturing, efficacy, and safety data relating to cytisinicline, patent to sell oral dosages of cytisinicline in multiple European countries (i.e., France, Germany, and Italy), and other countries where Sopharma does not distribute Tabex. Sopharma is a Bulgarian pharmaceutical company located in Sofia.

According to the company, it seems like Sopharma and ACHV have signed a supply agreement where Sopharma will exclusively supply ACHV with the drug until 2037, which de-risks the CMC portion of the commercialization.

Company IR deck

Smoking cessation landscape: highly attractive, defensive market with the blockbuster opportunity

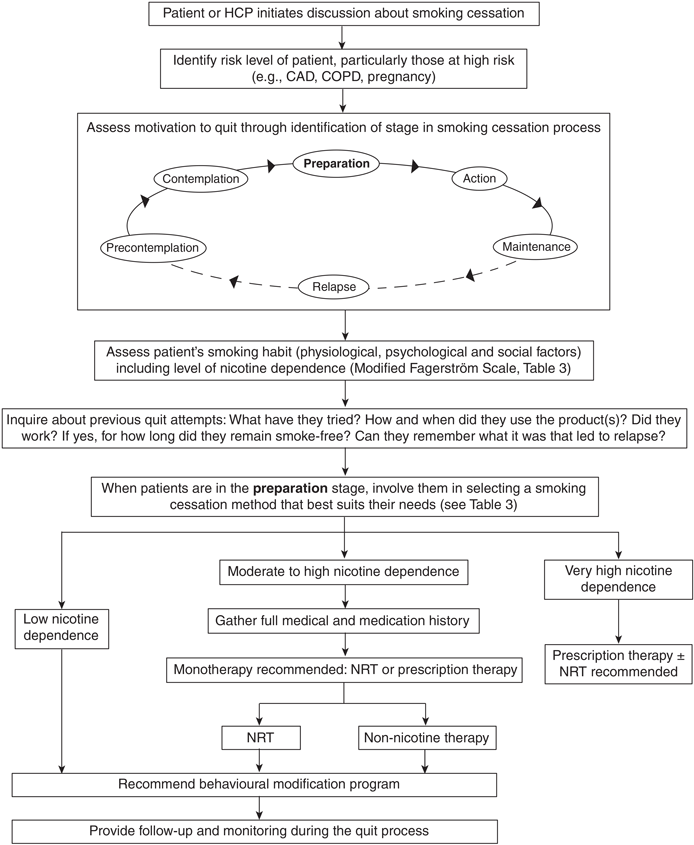

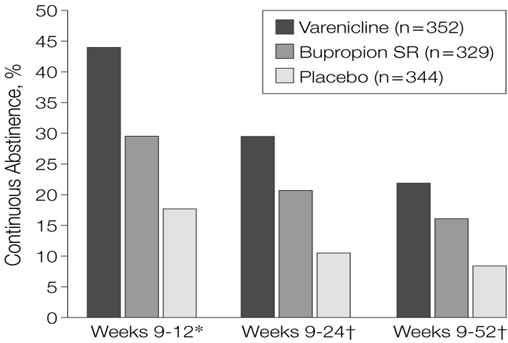

Currently, there are three buckets of smoking cessation treatment options. 1) Champix (Varenicline) and bupropion (atypical antidepressant), oral treatments that help patients dial down on smoking by reducing the craving for tobacco, 2) Nicotine Replacement therapies (NRT), through supplying nicotine slowly into our body, the drug helps patients reduce the amount of smoking, and 3) counseling from medical doctors or pharmacists to help patients plan their smoking cessation.

CPS guidelines – smoking cessation treatments

Champix and bupropion are effective oral treatments, but it comes with numerous side effects that are not pleasant (i.e., nightmares, insomnia, depression, suicide ideation), and Champix, is not recommended for patients who have bad kidney function as the drug is cleared renally. NRTs are not effective enough, and many patients relapse (going back to smoking habits). As such, prescribe multiple therapies together or do a mix-and-match type of strategy to help patients quit smoking.

Considering the high prevalence of tobacco consumption across the world and the lack of effective treatment approved since the FDA approval of Champix and Bupropion (approved more than a decade ago), we believe there is a high unmet need for a safer oral treatment that can be used in patients who can’t use Champix or Bupropion.

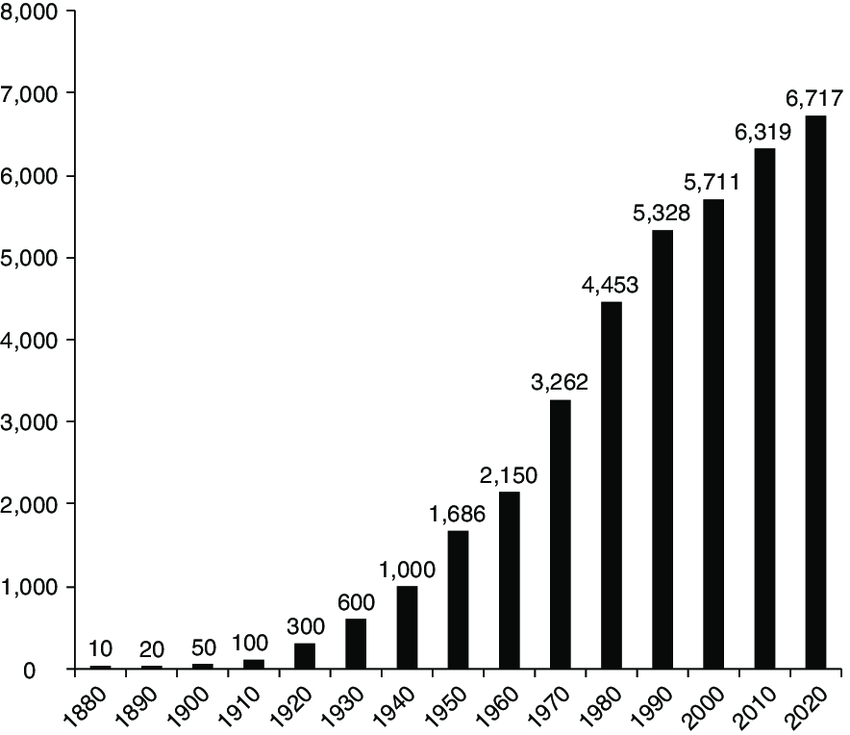

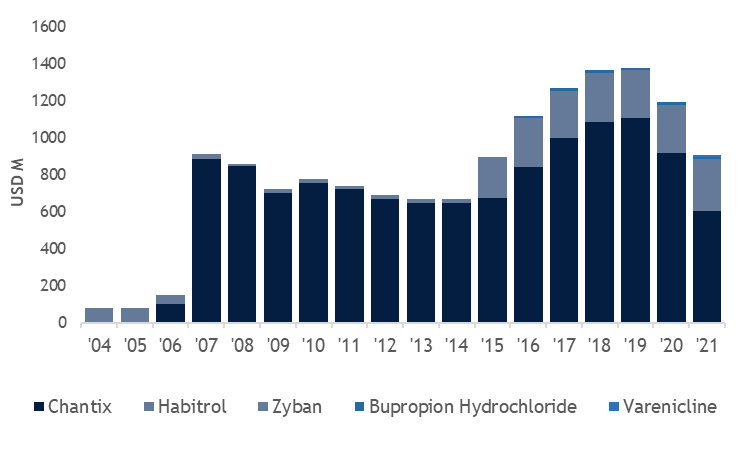

One may argue that the number of smokers is dropping due to the global trend of health campaigns and increasing awareness; however, as we can see on the graph below, the absolute smoking population is still increasing. We believe that as the awareness around smoking cessation grows, the market for smoking cessation treatment will continuously expand like what we saw with Pfizer’s (PFE) blockbuster smoking cessation drug Champix (valuation section).

Research Gate

Source: Research gate statistic

Lead product Cytisinicline

Tabex Expert – Image

The product was originally introduced in Bulgaria in the 60s under the trade name Tabex. Interestingly, cytisinicline is a plant extract from the seeds of the Cytisus Laburnum tree.

We highlight that cytisinicline has been used for smoking cessation by +20 million users in Russia and Vietnam. We like the fact that the drug was used by more than 20 million users highlighting that long-term safety risk is unlikely, which highers our conviction in terms of safety.

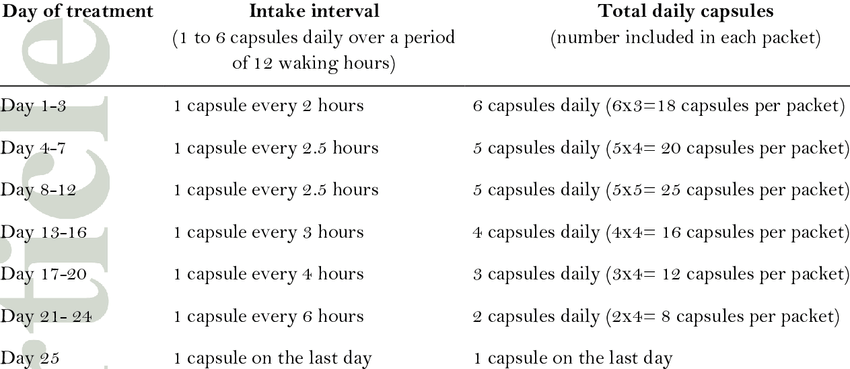

We highlight it is oral dosing with a high-frequency dosing schedule, .5 mg declining dosing regimen for 25 days. We are not the biggest fan of the highly frequent dosing schedule of the product as SOC Champix has once a day dosing schedule. The lesser the frequency, the better for substance abuse disorders. There is a probability that, in practice, patients might skip a dose or refuse to start on Cytisinicline because of this inconvenience.

Research Gate – Cystine dosing schedule.

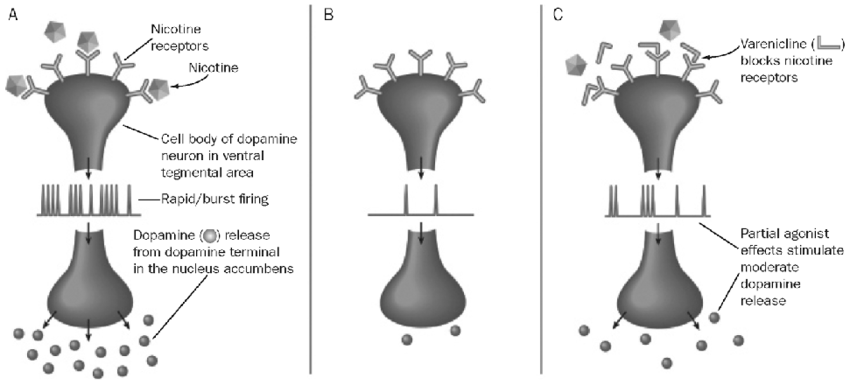

On the mechanism of action front, Cytisinicline has a dual mechanism of action targeting the α4β2 nicotinic receptors located in the brain. We note that α4β2 nicotinic receptors are where nicotine binds the most and causes dopamine to be released. Dopamine is the key neurotransmitter that drives the addictive properties of nicotine and smoking.

Research Gate – MOA of smoking cessation treatments

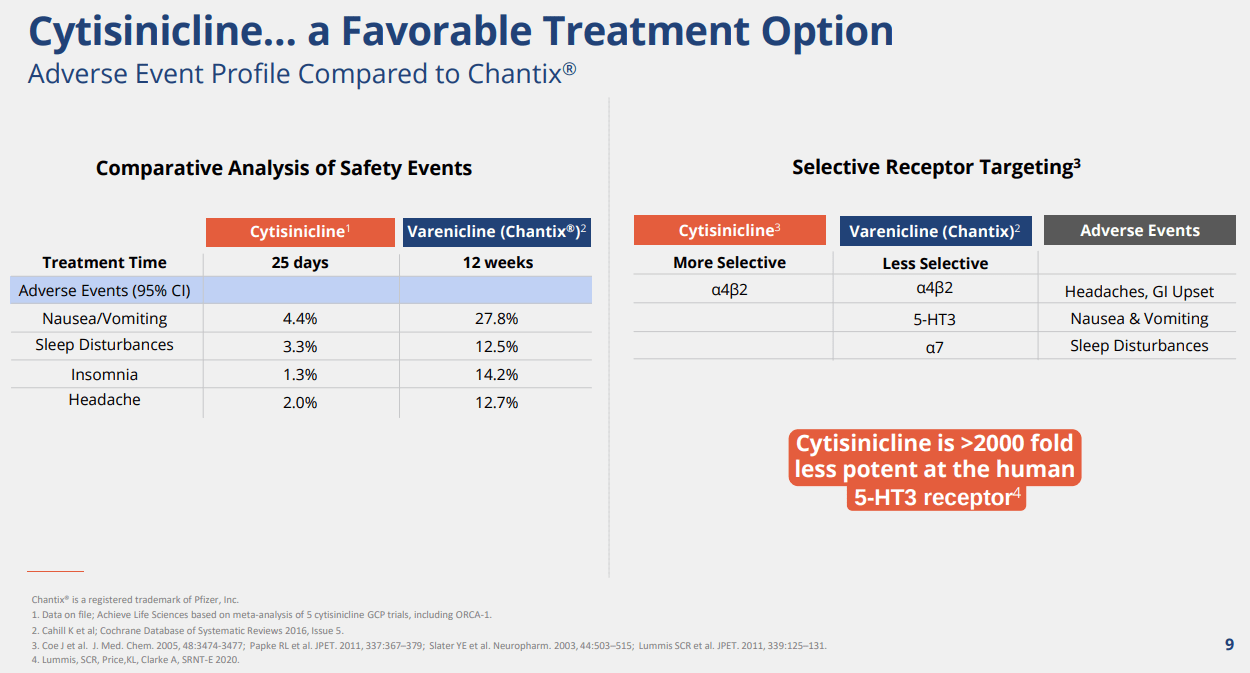

We highlight that this mechanism of action is similar to SOC blockbuster drug Champix, but it seems like that Cytisinicline is significantly more selective at binding and affinity for the α4β2 nicotinic receptors is greater. Furthermore, we believe mechanistically, the reason why Cytisinicline has cleaner safety compared to Champix is that, unlike Cytisinicline, Champix also binds to the α7 and 5-HT3 receptors, which may cause various psychiatric side-effects such as abnormal dreams, change in taste, diarrhea, trouble sleeping, and rare but reporting of agitation, irritability, loss of appetite, mood changes were shown. We believe it is because the α7 receptor impacts the memory, learning, and attention span of patients and 5-HT3 receptors are related to nausea and vomiting centers of the brain stem.

ACHV IR Deck

Clinical data

We like Cytisinicline because of three reasons 1) moderately effective in absolute abstinence (at least non-inferior), 2) clean safety without insomnia, abnormal dreams, nausea compared to Champix, and 3) robust real-world evidence: the fact that it was already used by 20M+ people (in Russia and Vietnam) and no concerning side effects were shown, de-risks the asset.

We opine that If the company can continuously show clean safety and non-inferior or slightly inferior efficacy compared to standard of care Champix during the large phase III study, we believe the drug has a high probability to be approved and has the potential to capture a large market share in the multi-billion dollar smoking cessation market. The market position that we expect Cytisinicline will have would be a safer version of Champix or a 2nd line agent that patients can try if bupropion or Champix is not effective (if the patient relapses).

Company IR Deck

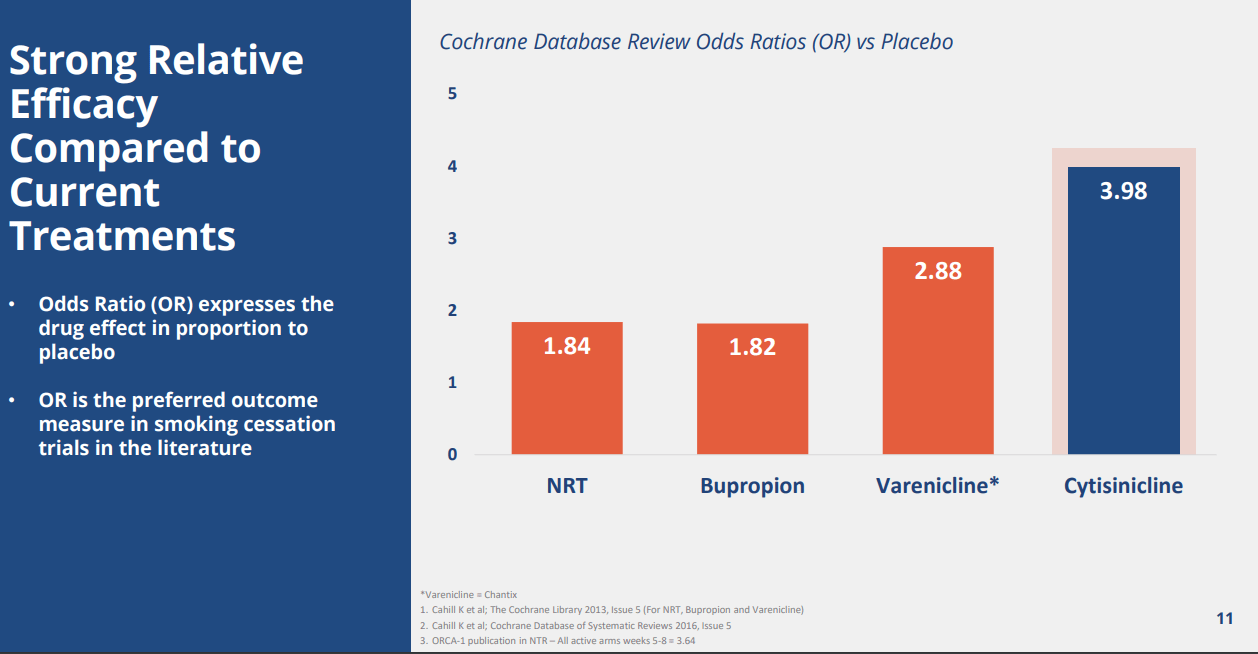

Meta-analysis showed superior odds ratio vs. placebo for Cytisinicline. We believe it is hard to compare the efficacy unless we conduct a head-to-head trial, but we believe the meta-analysis from the Cochrane database shows a positive tidbit of potential superiority or at least non-inferiority. We highlight that FDA tends to not require a categorical variable for approval of a drug in the substance-abuse space. As such, showing a trend of abstinence would be the key focus for the company in order to be approved.

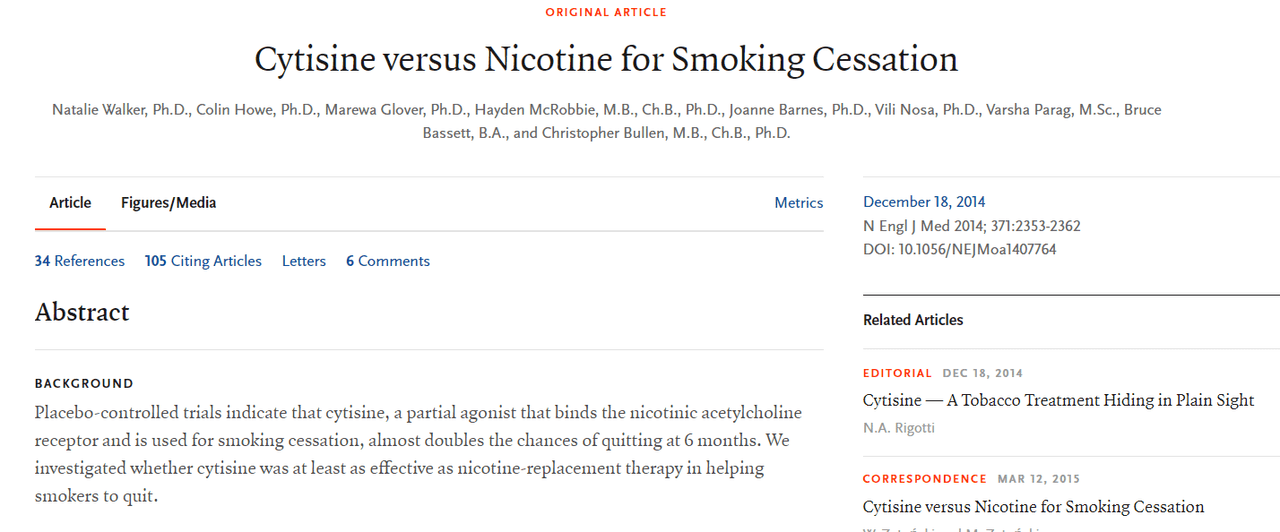

Besides the meta-analysis noted above, we highlight several investigator-led trials that showed the efficacy and safety of Cytisinicline. For example, the TASC trial (Cytisinicline vs. NRT) and the CASCAID trial (Non-inferiority trial – Cytisinicline vs. NRT) showed promising data.

NEJM Article

RAUORA trial was funded by the Health Research Council of New Zealand. This trial showed superiority in smoking abstinence rates at all-time compared to Champix; however, the results were not statistically significant.

The trials conducted by the company

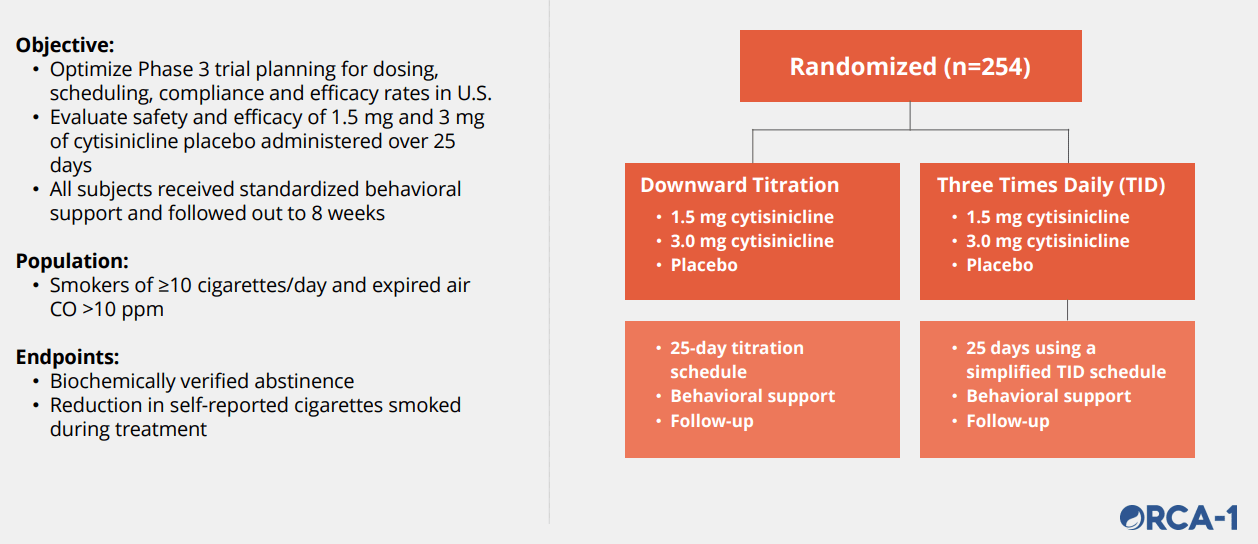

ORCA-1: Phase 2b Study (Source)

ACHV IR Deck

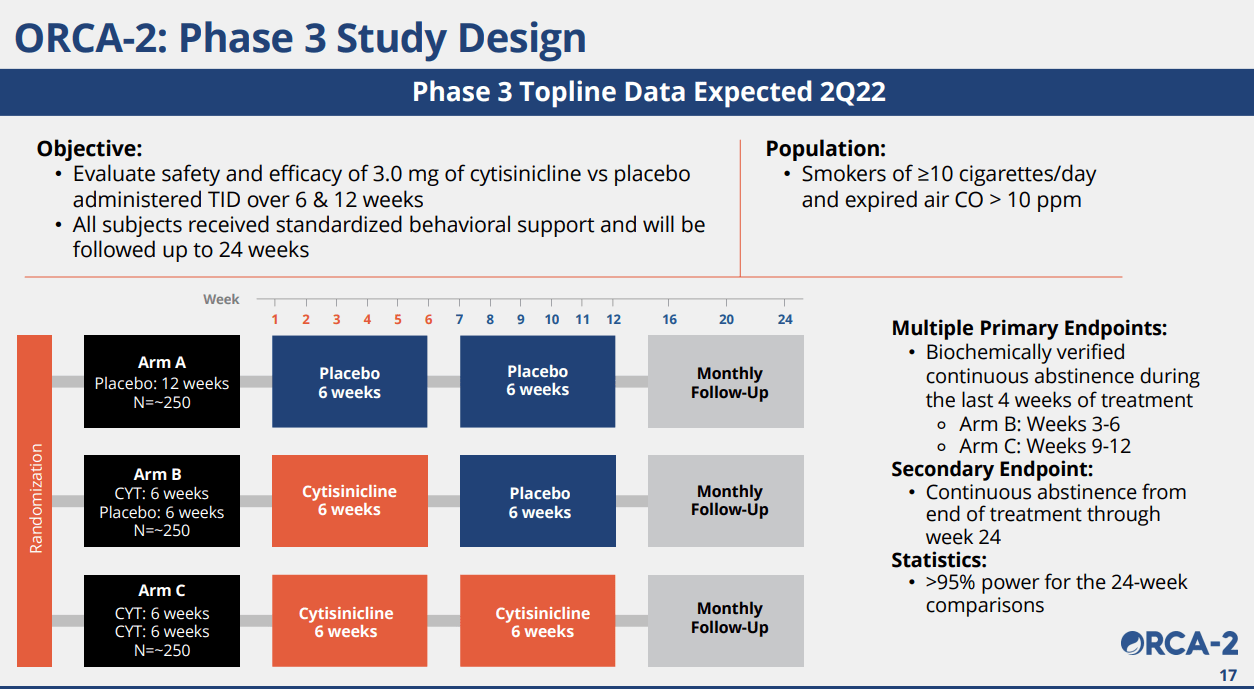

We believe the trial is powered sufficiently. A few interesting facts that we have noticed is that the population studied are heavy smokers, and patients received behavioral support and followed out for 8 weeks. We think the behavioral support may be hard to standardize due to the in-person nature of counseling; we are not too sure how much bias it will introduce.

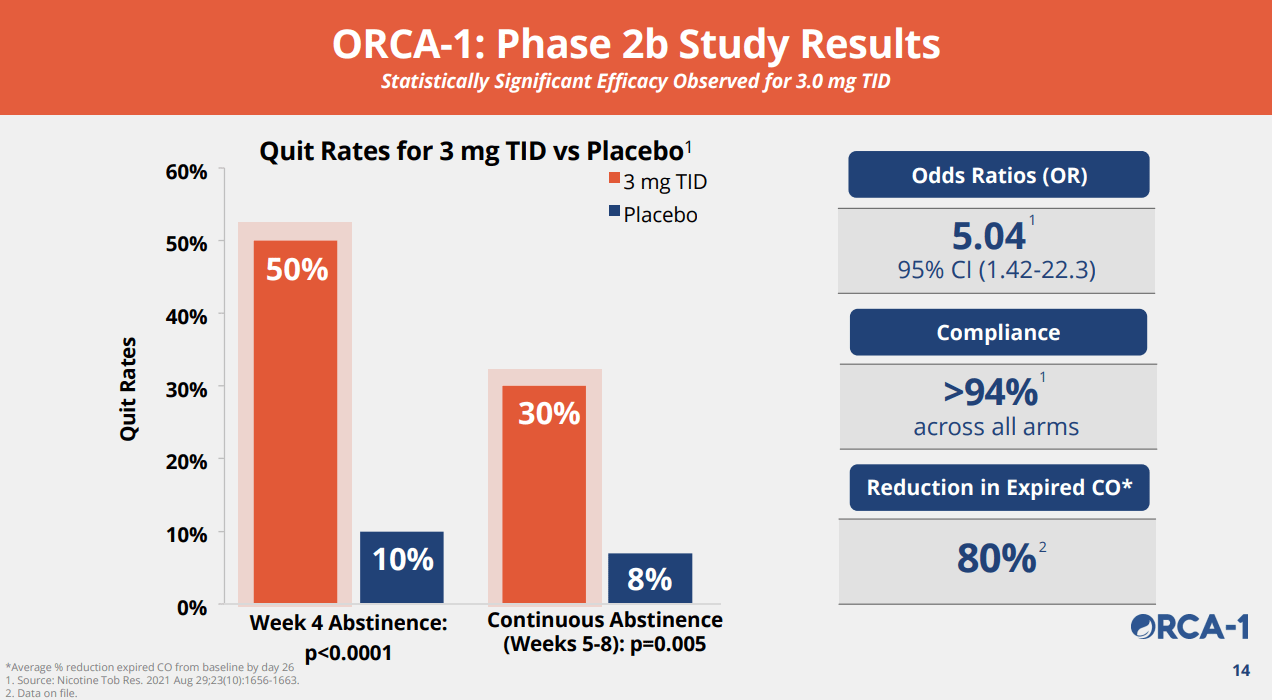

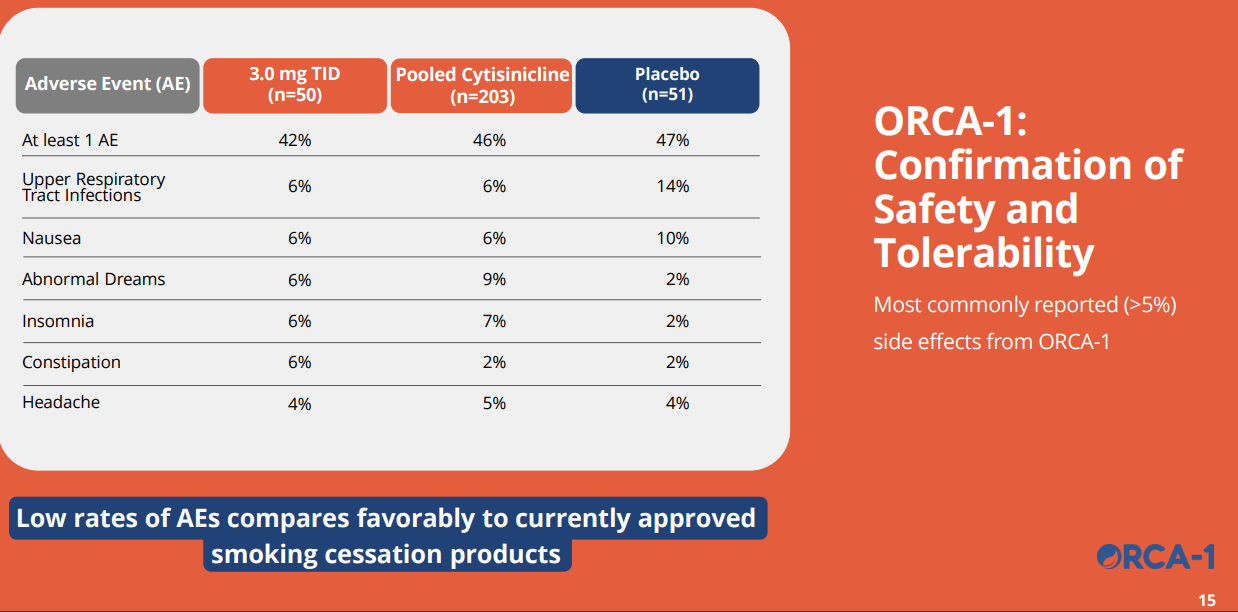

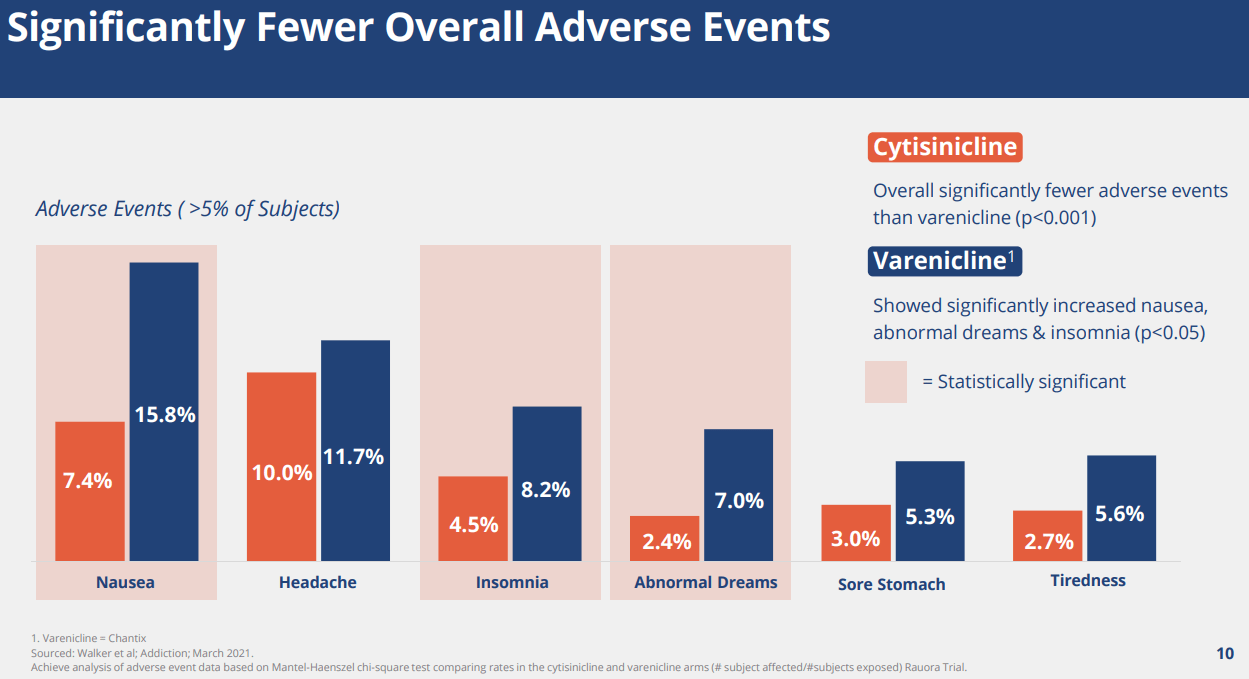

Three key takeaway from the trial are 1) statistically significant improvement in efficacy, 2) robust safety where the drug only showed a slightly higher adverse event profile than placebo for insomnia and abnormal dreams, and 3) Compared with Varenicline (Champix), it showed significantly cleaner side-effect profile on nausea, insomnia, abnormal dreams, and headaches, which are the critical drawbacks of Varenicline. We believe the data was highly promising.

ACHV IR Deck

ACHV IR Deck

ACHV IR Deck

Phase 3: ORCA-2 trial design looks highly robust

Considering that the company announced that the final patients were enrolled on June 29, 2021, we expect top-line data of the ORCA-2 phase 3 trial during Q2 2022. We believe the data will likely be positive and act as a material catalyst that can boost the stock price significantly from the depressed level that we are seeing today.

ACHV IR Deck

A clear path to approval: ORCA-3: second and final phase 3 registration trial

The company has announced that the trial is currently enrolling, and the design will mirror the phase 3 ORCA-3 trial. The trial is going to enroll around 750 patients in the US, and we believe it is a reasonable size and will be powered enough to see the efficacy of the drug in smoking cessation.

ACHV IR Deck

Considering that Champix was approved based on a head-to-head comparison with Bupropion and SOC NRTs, we believe there is a chance that FDA may ask the company to provide another head-to-head trial.

ORCA-V1: e-cigarette cessation trial

Around 2Q 2022, the company is planning to initiate a phase II trial to study the efficacy of Cytisinicline in a population who consume E-cigarette. Considering that we are seeing explosive growth in the usage of e-cigarettes, we believe the benefit of e-cigarette usage may be a key differentiator (With the SOC) if the company can produce robust efficacy data on it. Mechanistically speaking, we are positive about its benefit in e-cigarettes as e-cigarettes work very similarly to actual cigarettes. It works by stimulating the nicotinic receptors, and nicotine is absorbed through blood-streams in the lungs. However, considering that e-cigarettes tend to act faster (nicotine is delivered through the brain more quickly than conventional cigarettes that are combusted) and the fact that patients can increase the potency by using higher potency vape juice, this may be a harder patient population to target. We look forward to reading more data on this trial moving forward.

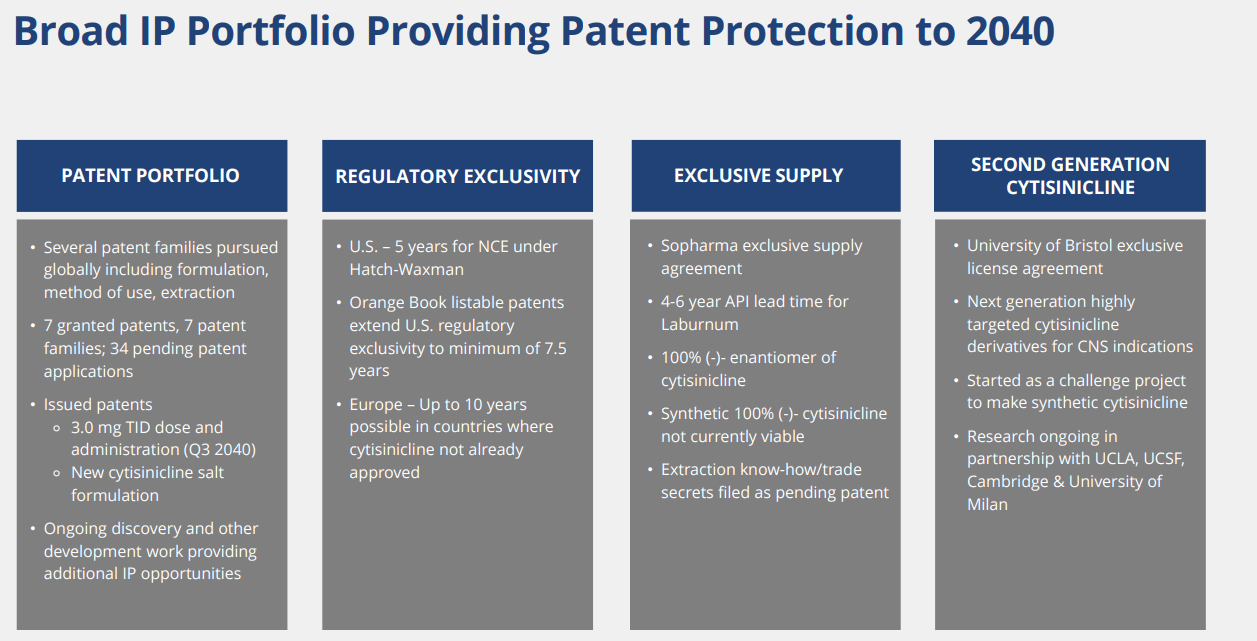

IP Moat: some patent protection, but the company does not have a composition of matter patent.

ACHV IR Deck

Considering that the company is using cytisinicline, which is a known substance and approved in a few other non-US countries, we believe robust patent protection to be highly important. We believe the company has some patent protection, but we do not think the IP estate is highly robust. As such, generic entrants may be a possibility even if the drug gets approved.

Risks

-

Dilution Risk. Considering that the company is planning to run multiple late-stage trials, we believe a public offering may be on the horizon to replenish its cash reserve.

-

Clinical failure can plague the stock as the majority of the company’s value is driven by Cytisinicline.

-

The macroeconomic backdrop of war in Ukraine and interest rate hikes from the FED can plague the company and the biotech sector (we are in a bear market: (XBI), (IBB), and (SPY) continuously drifting downwards).

-

Generic entrants may be a possibility, considering that the company does not have a composition-of-matter patent.

Valuation

Evaluate Pharma

We highlight that market for smoking cessation treatments has been highly attractive and defensive. For example, standard-of-care treatment Chantix has generated USD 1bn+ revenue during the last decade since its launch. Using a conservative USD 300-500M peak sales (30-50% of Champix’s peak sales number), a 56.4% probability of success (phase 3 to BLA), and a peak sales multiple of 3, we get a risk-adjusted EV valuation of USD500M, which is 10X from the current valuation (current EV is around 43M as of April 3rd, 2022). As such, our target price is 70 USD. If the drug fails, we expect the company’s enterprise value (EV) will trade down to near cash or under its cash value (USD 3/share).

Key catalysts

The company has announced that the last study follow-up visit for the last patient enrolled in the ORCA-2 Ph III trial took place in late December 2021. As such, we expect the topline data results around 2Q of 2022.

Conclusion: a speculative buy

We like the smoking cessation and substance abuse market as the market is large (multi-billion dollar opportunity) and defensive; for example, Champix has defended its blockbuster status for almost ten years since its approval. Furthermore, considering how SOC smoking cessation is covered by various payers across the world, we believe payers are willing to reimburse effective treatments as tobacco comes with both short-term and long-term health economic concerns (i.e., cancer, diabetes, etc.). On the clinical data front, we believe the phase 2 data was highly compelling, and we speculate that the phase III data will likely be positive (safer than Champix and non-inferior than champix). Considering that the drug has been widely used in Russia and Vietnam and estimated 20+M patients have used it so far, we are not worried about troubling adverse events emerging during phase III trials. We like the ACHV’s current set-up for two reasons: 1) the valuation is ridiculously cheap (EV of 43M), and 2) phase III data readout is coming up in the short term. We believe, If the phase III data is positive (like the phase II study), the stock could go up 50%-200%, and if the trial is not impressive (significantly inferior abstinence level compared with Champix or severe adverse event showing up), then we expect a max 50% downside (near the cash value). We are planning to buy an option-sized position.

Be the first to comment