RichVintage/E+ via Getty Images

Introduction

A lot has changed since I last wrote about Academy Sports and Outdoors, Inc. (NASDAQ:ASO) in December. The stock had a brief jump after reporting 3Q2021 earnings in early December but has ultimately experienced significant pressure to the downside for most of 1Q2022 due to the overall macro environment in equities.

ASO had a nice run up to its 4Q2021 earnings release and is now trading 33% off the 6 month low of $29.95. The annual results for 2021 only reiterated Academy’s ability to beat estimates, produce strong growth in all key metrics, and strengthen their position to return free cash flow to shareholders.

In December I speculated on the company being able to initiate a quarterly cash dividend in 2022 and ASO has already rewarded shareholders with its first dividend. ASO announced its inaugural dividend payment of $0.075/share on March 3rd, payable on April 14th to shareholders of record as of March 17, 2022. This represents an initial annual yield of ~0.75% based on the current share price, but I believe substantial growth to the dividend is coming. More on this later in the article.

With the stock having traded in the $30-40 range for most of 1Q2022, I have a Strong Buy rating on ASO. I believe that the stock remains significantly undervalued on the basis of its P/E multiple and the ability for ASO to return significant cash to its shareholders via buybacks and growing the dividend.

2021 Annual Results

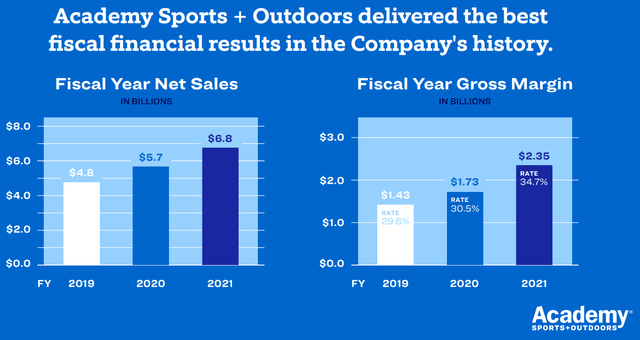

ASO continued to grow its Net Sales and Gross Margins in 2021. Both are impressive marks given it did not open any new stores in 2020 or 2021 and demonstrate the strength in its growing ecommerce and omnichannel platforms.

ASO 4Q2021 Earnings Presentation

Ecommerce sales grew 6.2% in 2021, and 50% of all ecommerce sales were “buy online and pickup in store.” Additionally, 75% of all online sales were fulfilled by their physical stores.

Gross margins continue to show strong growth, but it can be anticipated that the growth rate will slow as the business becomes more mature. ASO continues to reiterate that they believe in their supply chain, the focus on increasing inventory efficiencies, and improving their markdown strategy to expand gross margins.

Our gross margin rate of 34.7% highlights the outstanding planning allocation and supply chain work that was accomplished in an extremely dynamic retail environment. We believe the majority of these margin rate gains are sustainable and have reset our margin rate to a new level.

Source: Michael Mullican, CFO – ASO 4Q2021 Earnings Call

With GAAP Net Income of $671.4M and GAAP EPS of $7.12/share, 2021 was Academy’s most profitable year in the company’s history. Overall, ASO had a fantastic performance on every level for 2021, but the story from here really becomes about the timeline for growth and the potential for the earnings multiple to be reevaluated.

New Store Openings Return In 2022

ASO will open its first new store since 2019 in April of 2022 and has plans to open a total of 8 new stores in 2022. This will only be the first few small steps in the overall growth plan for the company that wants to grow by a total of 80-100 stores in the next 5 years.

Keeping in mind that they entered 2022 with 259 stores in 16 states, this will be a growth of 3% in 2022 and could mean a growth to their physical store footprint of 5.5-7% per year in 2023-2026.

I referenced this in my prior article, but as of the last time ASO touched on their capital plan for future stores, they indicated that it costs them ~$3M to open a new store and already have the distribution network in place to support up to 100 new stores without further investment. It is a big assumption that costs will remain the same over the next 5 years, but that would mean a capital outlay of $240-300M over the next 5 years to execute on their store growth strategy, or less than half of 2022 forward net earnings estimates of $590-640M.

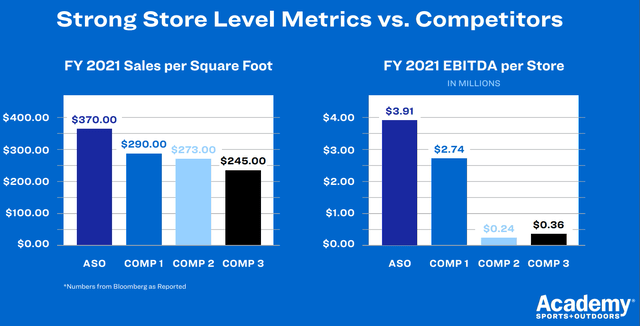

It is also important to highlight that ASO’s stores are profitable in their first year and produced an average of $3.91M in EBITDA per store in 2021. All else constant, the future growth in stores could produce $312.8-391M in EBITDA by FY2026. This would be more than 50% growth compared to 2021 in the next 5 years.

ASO 4Q2021 Earnings Presentation

Most of this growth should come in markets and states that are currently underserved or not served at all by the company. This will only expand the company’s brand awareness and offer further opportunities to grow the profitability of the omnichannel platform.

Returning Cash to Shareholders

2021 was just the beginning for ASO and the cash that is going to flow back to shareholders in the coming years. The company repurchased and retired 10.6M shares for $411.4M ($38.81/share) in 2021 under their share repurchase program. The company has another $189M available as of Q1 that it intends to fully utilize in 2022.

They most likely used most of that allocation, if not all of it, in Q1 as the stock traded lower. However, at current prices, that could mean a further retirement of ~4.8M shares. Leadership continues to reiterate that they not only plan to complete the current repurchase plan but that further buybacks are in play assuming they continue to produce cash at the current levels:

We have $189 million remaining. We certainly plan to utilize it. We’ve used more cash to repurchase hands of stock in the past 18 months than we raised in the IPO. And as long as we’re continuing to put big results on the board to generate cash, we will deploy the buybacks accordingly.

Source: Michael Mullican, CFO – 4Q2021 Earnings Call

After the current buyback program is completed, ASO would have approximately 85M shares outstanding. The current dividend payment would only be a payout ratio of ~4% at the mid-point of 2022 guidance. As a point of comparison, DICK’S Sporting Goods (DKS) has a payout ratio of over 10% and a retail giant like Target (TGT) is over 23%.

I believe it is safe to assume that ASO is only getting its feet wet with the initial dividend payment. Significant growth to the dividend can be anticipated to move it closer to the sector median yield of 1.85%, which would take a nearly 25% CAGR over the next 5 years to achieve.

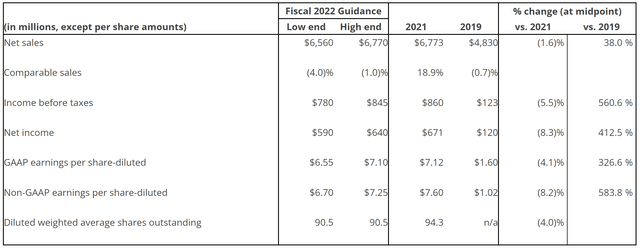

Valuation In 2022 & Forward Guidance

ASO leadership isn’t shying away from the fact that 2022 will most likely be a flat year in terms of sales growth and net earnings. Inflation, supply chain challenges, and the cost of labor will be a challenge in 2022. However, the company believes that it provides the right value to the right segment of consumers to keep the business stabilized in 2022:

[W]e’ve got businesses that can offset them during the time that they’re down and can help us weather through some of the challenging times. That’s one of the reasons quite frankly this year is a little bit of that stabilization year. But with the new stores with the dot-com and the things we’re doing in our stores we see them continuing to provide growth opportunities now and in the future.

Source: Ken Hicks, CEO – 4Q2021 Earnings Call

ASO 4Q2021 Earnings Presentation

While growth in earnings per share will be limited in 2022, the valuation of the stock continues to lag the sector. ASO’s stock is only trading at 6x forward earnings while the sector median is closer to 13x and their closest peer, DKS, is at nearly 9x. There is clearly a lack of confidence or misunderstanding in ASO’s ability to maintain sales and margins at current levels.

If ASO continues to strengthen the balance sheet by paying down debt, repurchasing shares, and growing the dividend, it can only be expected that the P/E ratio will rise in 2022 closer to that of its peers and the sector median.

Investment Strategy

When I wrote my first article in December, I disclosed that I had no beneficial ownership at the time and received some comments as to why I did not own the stock given my bullish sentiment.

You can call it luck since I didn’t have the capital available at the time, but I have now been able to initiate a position in ASO given the drop in price from the beginning of the year and plan to continue to average into ASO throughout 2022. I believe ASO could easily trade in the $55-60 range by the end of 2022 and am looking for a dividend CAGR of >15% in the next 5 years. That is why I now have ASO in my dividend growth portfolio.

I am very bullish on ASO stock at a price point that is currently near $40/share. I believe it remains a deep value relative to its cash flow, growth prospects in the coming year, and just being in the infancy of returning cash to shareholders.

Be the first to comment