The Good Brigade/DigitalVision via Getty Images

I feel that the above picture is representative of how the last year or so has aged me as a holder of AbCellera (NASDAQ:ABCL) stock. For reference, I am a 40 year old man.

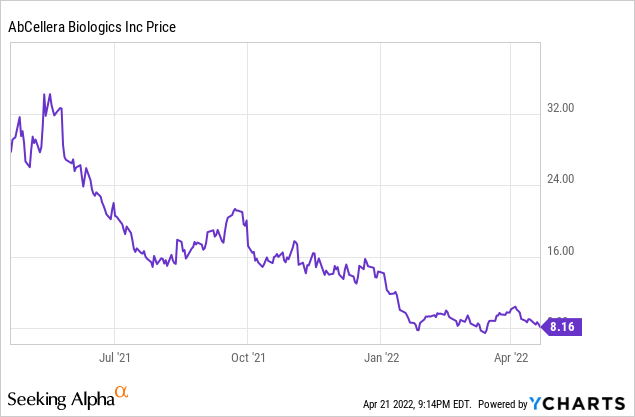

It has been a brutal market of late for shareholders of nearly anything biotech or growth related; however, AbCellera has somehow fared even worse than most, down a whopping 71% over the last year.

The most frustrating thing as a shareholder, at least in my opinion, is when the company does basically everything you want them to do, yet prevailing market sentiment acts as a black hole, pulling your shares down no matter the actual business results.

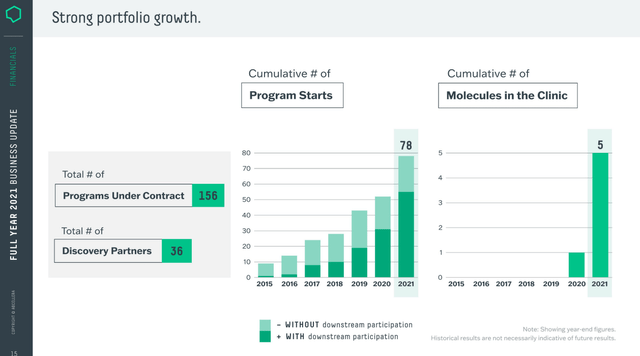

By all reasonable metrics, the company’s actual business is performing wonderfully. The company during 2021 grew its programs under contract by over 50% to 156, the number of partners by 25% to 36 and program starts by 33% to 78.

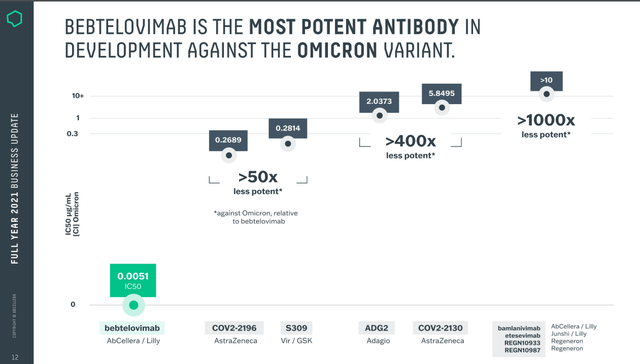

In addition to the significant progress on programs and partners, the company is literally swimming in cash with over $720 million sitting on the balance sheet with no debt and still more cash on the way thanks to Bebtelovimab, the company’s pan variant, best in class COVID-19 antibody treatment marketed by Lilly (LLY).

In my opinion, it is clear that the market does not like or appreciate the company’s royalty based business model, nor its reliance on COVID therapies to generate revenue in the short to medium term. I believe that this view is short sighted and dramatically undervalues the potential earnings power of the company in the medium to longer term.

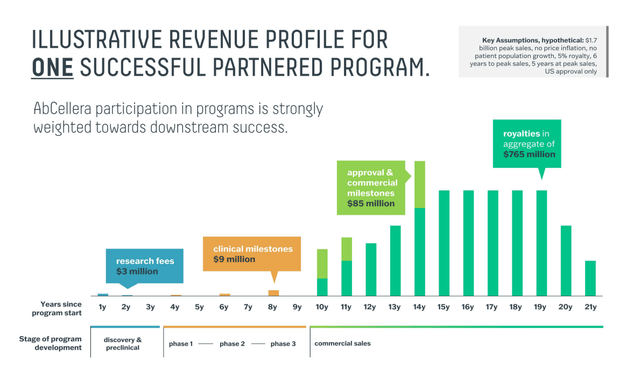

In the latest earnings presentation, the company released a hypothetical model showing the earnings power of just one (non-COVID related) potential successful drug in its royalty portfolio of over 130.

In the above model, you can get a sense of the potential of the company. In this scenario, an AbCellera partner successfully markets a drug with $1.7 billion in peak sales with AbCellera receiving a 5% royalty rate.

In this scenario, AbCellera is set to receive over $862 million in royalties and milestones over the potential life of the drug and $85 million per year in royalties once peak sales are reached. Remember that royalties are in essence 100% profit with zero cost of goods sold, so a very large percentage of these royalties will likely go directly to the bottom line.

The main hang-up with AbCellera among investors is almost certainly the 10-year gap from a program start to royalty generation, leaving what appears to be a rather large gap in potential revenues.

Where I get excited with this company is that most people forget that AbCellera started this business model back in 2015, well before they were a public company and all the way back in 2018 had started around 10 programs with royalty potential. As of year end 2021, the company has disclosed 3 non-COVID related, royalty eligible drugs that are already in the clinic with partners.

This type of business model is basically a snowball that starts very slowly but gathers speed and size quickly. The company, as of the end of 2021 has started 55 programs with royalty participation and is contracted to work on 156 programs in total with over 130 eligible for royalties. If just one program can potentially generate $85 million in annual royalties, five could generate $425 million, ten can generate $850 million and so on.

This is a company that gets stronger and stronger with every program start as every program generates more data, which improves the next program and so on and so on. This, from what I can see, is potentially a perfect compounding machine that is much further along in its journey than many give them credit for. We all simply need the patience to see it through.

T Cell Engager Program

In what appears to be a new avenue for potential growth at AbCellera, and one that the market completely ignored, is that the company announced in early April an internally developed T cell engager program.

“T cell engagers are widely recognized for their tremendous potential as precision oncology therapeutics. However, a limited pool of available CD3-binding antibodies and technological challenges in engineering bispecifics have hindered development, leading to many first-generation molecules with poor efficacy or safety,” said Bo Barnhart, Ph.D., VP, Translational Research at AbCellera. “Our discovery engine has allowed us to build a panel of hundreds of diverse and fully human CD3-binding antibodies. Combined with our OrthoMab™ bispecific platform, this enables rapid screening of many combinations of CD3- and tumor antigen-binding antibodies to find pairs with optimal biological function and good developability.”

CD3 T cell engagers, which bind to T cells and cancer cells simultaneously, are able to redirect T cells to tumor cells, regardless of T cell specificity. Two different parental antibodies, a CD3-targeting antibody that fine-tunes T cell activation and a tumor-targeting antibody with high specificity for cancer cells, are needed to create an optimal bispecific T cell engager. Highly diverse panels of developable and functionally validated parental antibodies increase the probability of finding effective and manufacturable CD3 T cell engagers and reduce the need for downstream engineering to eliminate liabilities.

The company apparently used its internal tech stack to develop this program in a matter of only a few months, starting work on this program in late 2021 and it would appear that AbCellera is looking to partner with a drug company going forward at what are assumed to be highly attractive terms.

Where I believe this is significant is that the company now is presenting yet another way to monetize its technology through the creation and focus on internal programs that leverage the massive quantities of data the company holds.

This program appears to be similar to the way the company monetized its COVID treatment as AbCellera basically invented the Bamlanivimab antibody and partnered it to Lilly for 20% royalty terms. I would imagine that the T-cell engager program would take a similar path allowing for much higher royalty rates upon commercialization.

Bottom Line

AbCellera’s stock, and long suffering holders such as myself, have been bruised and beaten for basically the entirety of its existence as a public company. Lately however, shares appear to have found a relatively stable bottom around the $8 level which gives the company a $2.32 billion market cap and a $1.6 billion enterprise value.

I believe that if AbCellera successfully pivots the business more towards internally developed programs partnered at much greater royalties to complement the traditional 5% royalty programs, the company stands to greatly increase its already very bright prospects.

In my opinion, given the potential earnings power of the company over the long term, the current price of shares appears to be an absolute steal for new investors with both ample patience and a high risk tolerance.

The caveat being that sentiment could always take shares lower still. I clearly began accumulating way too early in this name with my opening purchase in the high $20 range roughly 1 year ago; however, I firmly believe that my current all-in cost basis of $12.97 will be viewed favorably in a few years’ time.

Thank you for reading and I look forward to your comments below. Good luck to all!

Be the first to comment