vzphotos

AbbVie (NYSE:ABBV) has become a money machine and the stock has gained over the last couple of years while the market has faltered. The drug company still faces a loss of exclusivity on several key drugs, but the stock isn’t correctly priced for the ongoing earnings stream. My investment thesis remains Bullish on the drug stock trading at a discount to their earnings potential.

Humira Hurdle

AbbVie is a money machine, but the big question with any of the biopharma giants is the level of growth of those earnings. Each company faces drugs with LOE dragging on growth rates and profits.

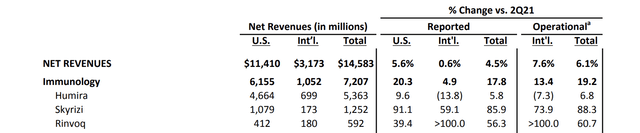

Humira is the big issue facing AbbVie with biosimilars already dragging down international revenues. The drug is still a large 37% of total revenues for the biopharma at $5.4 billion in Q2’22.

Source: AbbVie Q2’22 earnings release

As the table shows, Skyrizi and Rinvoq are generating some sizable growth in the immunology segment to offset the eventual declines of Humira. The promising drugs contributed to $1.9 billion in quarterly sales and are forecast to reach annual sales of $7.5 billion, though a small portion of revenues compared to the still growing Humira.

At the recent Morgan Stanley conference, President Rob Michael confirmed the well-established scenario of moving past LOE on Humira as follows:

We’ve got five key therapeutic areas that can drive very strong industry-leading growth. Once you get on the other side of the Humira, we will have the lowest LOE exposure in the industry through the end of the decade.

Part of the limited impact to the overall business is Alvotech failing to gain FDA approval for their Humira biosimilar. The company had reached a settlement with AbbVie for an entry date of July 1, 2023, but the manufacturing setback could place the launch at risk. Alvotech still expects to meet the expected launch date, but any biosimilar delays in the U.S. could lead to substantial profit boosts for AbbVie in the short term.

Limited Financial Impact

At the conference, the President highlighted the overall financial impact of the LOE loss of Humira as far below a lot of the fears over the last several years.

I think in 2023, 2024, you’ll see lower growth, but we’ll still grow the dividend. Payout ratio is about 41% today. It will be in the low 50s in 2023 and 2024 and then think of it getting back to the mid-40s by – in the second half of the decade. Buybacks, we said, we are really just limiting it to offsetting the dilutive impact of equity compensation.

Even with annual dividend hikes over the next couple of years, the payout ratio will only rise about 10 percentage points due to the profit dip from Humira. Of course, the stock market isn’t always forgiving of any growth hits.

AbbVie is paying out a $5.64 dividend to shareholders now on a $13.88 earnings stream. The guidance for a 50% payout suggests EPS could dip to as low as $11.28 with a 2% annual dividend hike pushing the earnings target towards $11.74 based on an annual dividend of $5.87 by 2024.

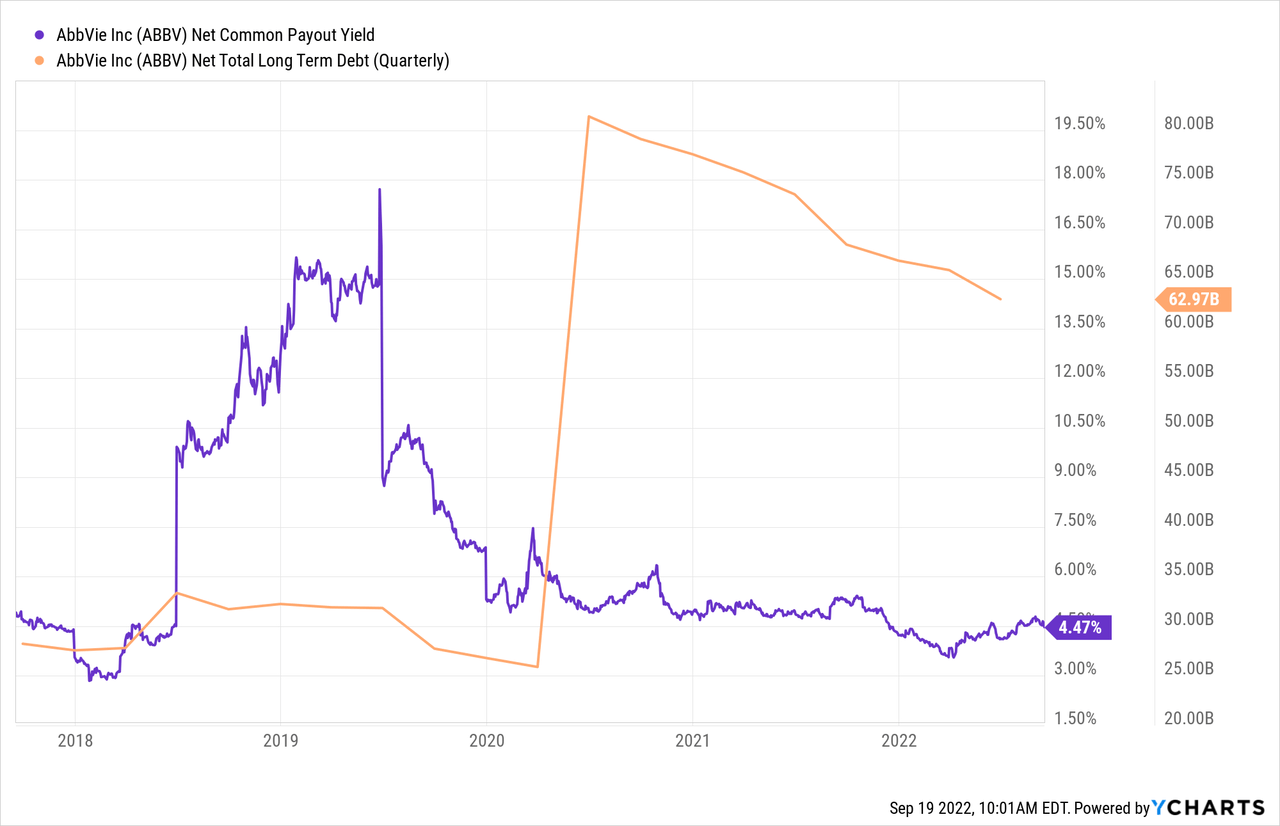

The biopharma has reduced debt issues after taking on major debt with the Allergan merger. A period of lower earnings is a small hurdle when Humira only has a $2 EPS hit to the business considering the ongoing interest expense hit on $63 billion in net debt is over $1 with annual interest expenses topping $2 billion now.

The net payout yield (combination of dividend yield and net buyback yield) is down to primarily the dividend yield at 4.0%. AbbVie has spent the last couple of years paying down debt from the merger, but the biopharma is in a much better position to repurchase shares on weakness in the future.

With 1.7 billion shares outstanding, even the Humira LOE dip still leaves over $5 in profits after paying the annual dividend. The biopharma will have close to $7 billion in annual profits available for capital returns or debt repayment.

The stock is up significantly from a few years ago, but AbbVie is still cheap at 12x low point EPS targets. The biopharma offers a solid 4% dividend yield without a high payout rate.

Takeaway

The key investor takeaway is that AbbVie isn’t the massive bargain of a few years ago, but the stock is still cheap. Investors should buy the stock on weakness and ride AbbVie back up to the yearly high above $175.

Be the first to comment