Dragoljub Bankovic/iStock via Getty Images

It has been a tough year for a great many equities, including Abbott Laboratories (NYSE:ABT). It performed poorly from the start of 2022, and has substantially underperformed a great many of its large cap pharmaceutical peers. I believe Abbott’s decline is likely near its end, and that the beyond mere valuation, there is also strong and reasonable psychological support at $100 per share.

Abbott’s full-year guidance for adjusted diluted EPS from continuing operations is at least $4.70 per share was not well received back in January. Abbott maintained that target and verbiage when it reported Q1 earnings this spring.

ABT 2022 guidance (Abbott Laboratories Q2 Infographic)

Abbott actually projects full-year 2022 diluted EPS under GAAP of at least $3.35. Abbott forecasts $1.35 per share primarily related to intangible amortization, costs related to a voluntary recall, expenses associated with acquisitions, restructurings and cost reduction initiatives, and other net expenses. Excluding those items, Abbott reaches an adjusted diluted EPS of at least $4.70.

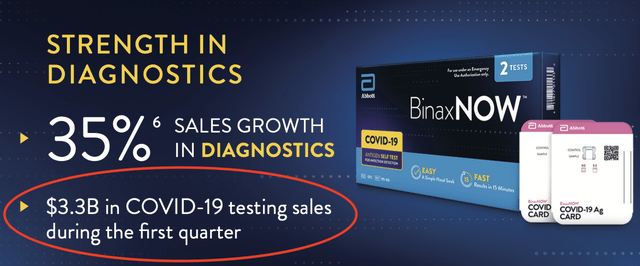

These costs and expenses are also partially responsible for some of the company’s poor performance. The market was likely anticipating higher guidance and lower expenses. Also, Abbott provided low guidance for Covid-19 testing, with an initial forecast of $2.5 billion, while subsequently reporting $3.3 billion in Covid-19 test sales in Q1 of 2022.

ABT Covid-19 Q1 sales (Abbott Laboratories (red ring added by Zvi Bar))

Even though it is probable that testing revenue will slow in subsequent quarters, it is still likely to bring in billions more this year alone.

With the addition of those BinaxNOW tests, Abbott’s diagnostics business unit is its largest revenue producer, with sales of $5.3 billion last quarter. Without those, Abbott’s medical device business unit is usually its largest. Medical devices brought in $3.6 billion in Q1 of 2022. This included $1 billion in sales from FreeStyle Libre, which is the company’s continuous glucose monitoring system.

Abbott has multiple glucose monitors that are sold under the FreeStyle brand. The Libre is its more modern CGM. This device is core to Abbott’s success, and it has been locked in competition with DexCom (DXCM), which is focused on that business. It is lucky for both of them that diabetes is epidemic, and demand for glucose monitoring is substantial.

At the end of May, Abbott announced FDA approval of its FreeStyle Libre 3 system for use by individuals age four and older living with diabetes. This should help support system growth in the near term, and help with the company’s continued rollout of their newer CGM device.

Abbott also has a strong global nutrition business unit that continues to grow. Abbott’s market-leading brands, including Ensure, Glucerna, and Pedialyte/PediaSure. Abbott was struck by a baby formula recall and the need to shut down production at a Michigan factory. This tragic error also likely substantially contributed to Abbott’s terrible performance in the first half of 2022.

Since peaking at the end of 2022, Abbott has continued to decline within a fairly tight trading range. It appears as though its last bounce off the bottom of that range, which coincidentally touched around $100 per share, was bought with subsequent high volume follow through. I think this range will end up being strong support going forward.

ABT daily candlestick chart (Finviz)

Abbott is also a dividend aristocrat that is likely to increase its dividend this winter. Abbott has now increased its dividend for 50 consecutive years. Abbott’s current quarterly dividend is $0.47 per share. The company has maintained a dividend payout ratio of about 40 percent, which is reasonably well covered.

Abbott’s ability to maintain and easily raise its dividend is likely to be a more meaningful differentiator going forward. Companies with well covered dividends are generally defensive, due to their existing profitability, and should outperform in a bear market scenario.

Like most large pharmaceutical and medical device companies, Abbott is highly sensitive to political risks. Increased attention upon the company should weigh on share demand and price. In particular, Abbott derives a significant amount of revenue from diabetics, and U.S. politicians like to talk about protecting diabetics, but they usually go after the insulin makers.

The issues with Abbott’s specialty baby formula certainly created a heightened level of scrutiny, and the potential for further political risk during this mid-term election cycle. Such election related weakness is almost always a strong buying opportunity.

Conclusion

Abbott’s is a high-quality asset that has performed well for decades, but which has stumbled over the last two quarters. This decline coincides with a broad market sell-off and an election cycle that is typically harsh to health care equity valuations.

I believe Abbott provided lowball guidance, and there is a strong likelihood of their beating full year guidance, even with the subsequent baby formula issues. Large cap pharmaceuticals all appear to offer excellent value at risk as compared to the broader market, and it is also likely that their valuations will increase after the mid-term elections. As a result, Abbott looks like a reasonable long-term holding to accumulate at current levels.

Be the first to comment