ismagilov/iStock via Getty Images

Intro And Update

You already know the inflation & recession news & how it’s affecting the market. Now that we are well into bear market territory, not even the $Trillion blue chips are safe from a selloff. This isn’t surprising.

What is surprising is the level of support that A10 Networks (NYSE:ATEN) has in these market conditions. When I first wrote about A10 after a conversation with Dhrupad Trivedi, the CEO inspired confidence with his consumer-centric business with strong tailwinds.

But I knew the risks. An un-established small cap cybersecurity stock that was a David to the other mega sized cybersecurity Goliaths. I “knew”, for sure, if the market declined, A10 was going down with it. But apparently, I am not alone thinking that A10 is a safe bet.

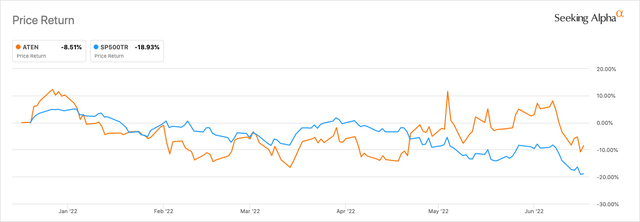

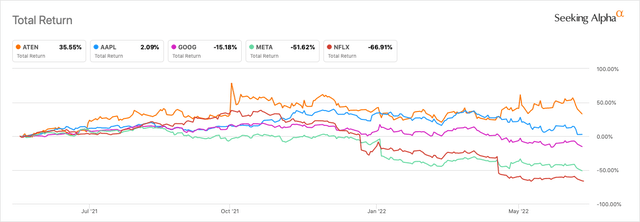

A10 6 month (SeekingAlpha)

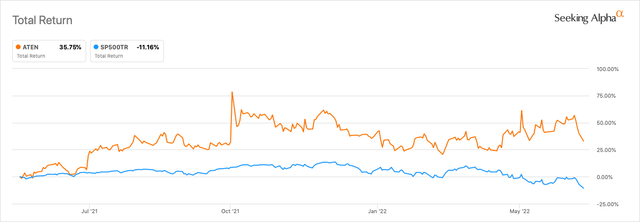

A10 one year (SeekingAlpha)

In fact, A10 has a higher ROI (or less of a loss, I should say) than the FANG stocks. Despite the fact that blue chips such as Apple (AAPL) have 50X more cash on hand than A10’s entire market cap, the company’s shareholders haven’t budged, & the stock price is almost flat. I will discuss the reason for this strong support below.

Continued Execution

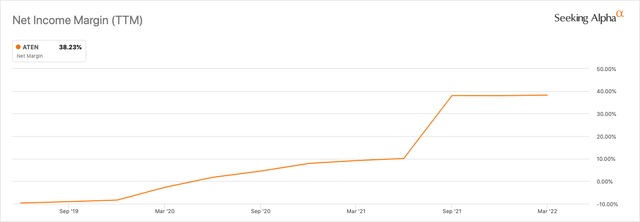

In the last quarter, A10 grew its sales by 14%. At the same time, operating income grew by 99% with operating margin reaching just shy of 13% vs. 7% from the year prior. Net margins doubled from 4.8% to over 10%.

A10 Net Income Margin ttm (SeekingAlpha)

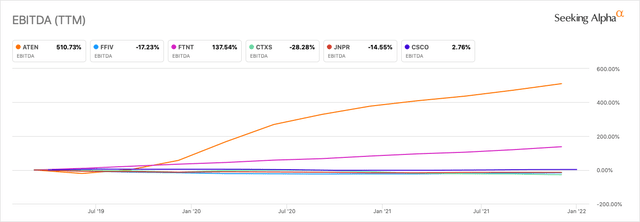

A10 EBITDA vs Competitors- Percentage (SeekingAlpha)

Although this is all great news, this is hardly the reason for the support. Plenty of other companies have also grown sales and profits by triple digits only to have their market cap cut in half. I believe the reason for the support is the growing appetite for the cybersecurity and 5G aspects of A10. The 5G market is projected to pass $1.6T by 2030.

With A10 positioning itself in this sector, the company can now pick up large customers such as SK Telecom. According to the case study, SK Telecom has a first mover advantage into the 5G sector in South Korea. Adding & retaining customers like these is contributing to A10’s 38% growth in EMEA revenue. Transcripts also say that A10 acquired another 10% customer in the last quarter.

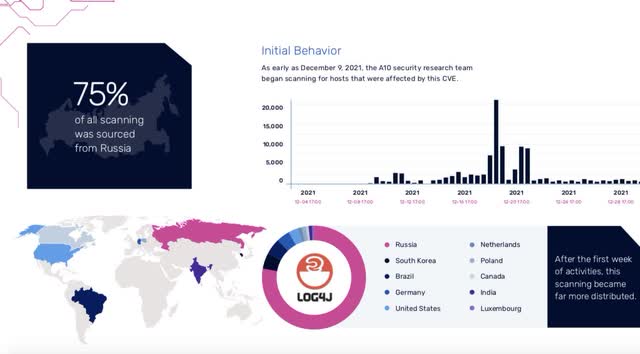

CyberSecurity

A10’s DDoS stopped over 15M attacks in 2021 total. No facet of life that uses an internet connection is safe from these attacks, whether it be education, healthcare, or the Department of Defense. DataCenter also reports “a 100% increase of more obscure potential amplification weapons year-over-year, such as Apple Remote Desktop, which A10 notes was used in the Russia-Ukraine conflict.” In fact, according to A10’s recent threat report, over 75% of the cyber weapons detected by the company were from Russia.

A10 & Russia Hack Attacks (A10 Threat Report)

A10 in Ukraine (A10 Threat Report)

A10 also joined MISA, the Microsoft Intelligent Security Association. In my opinion, the continued execution and growth of the cybersecurity part of A10’s business is the reason for the strong support in the market. Cyber threats aren’t going to disappear. For example, this White House press release is the President’s position about the ongoing threat to cybersecurity, particularly with Russia. While there may be over 460 different product offerings on the MISA web page, this invitation only demonstrates A10’s execution.

So Is A10 A Good Investment Right Now?

In the short term, all investments are unpredictable. But the stability of A10’s stock price in these unstable times is quite a statement about the market’s opinion of the company. The predictability of the cybersecurity threat is greater than the unpredictability of the market.

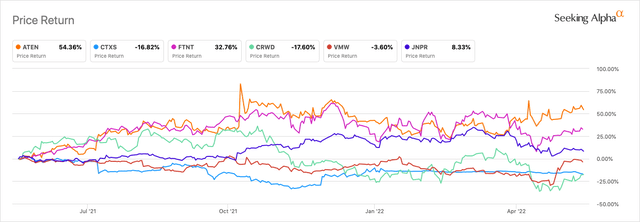

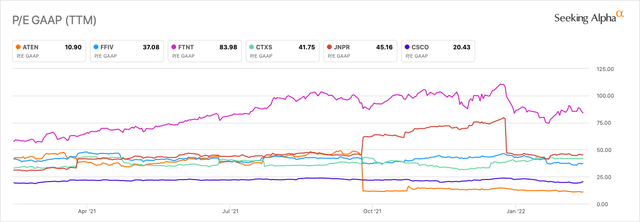

For example, the market has sold off enough to officially declare a bear market. I find it very interesting that the rock solid FANGs have sold off more than a small cap, largely undiscovered technology company. Even more interesting is the recent price return compared to its competitors, all of which are larger companies. Despite all this, A10 still has the best valuation.

A10 vs FANG (SeekingAlpha)

A10 vs Competitors – Price Return (SeekingAlpha)

A10 vs Competitors- P/E (SeekingAlpha)

Since my conversation with Trivedi, I became very bullish on the stock and believed it would outperform the market over the long term. While I never thought that a stock price remaining flat would outperform the market, I do believe that A10 will outperform the market significantly over a 3-5 year period as well as its competitors. I have not sold my position in A10 and do not plan to.

Be the first to comment