First – prices

The Russia/Saudi oil price war has nothing to do with natgas, but it gets lumped into the same pot as oil companies by unthinking herd investors and their computers plus there has been a glut from overproduction.

It is also impossible to start without some words on the virus as it has implications not only for the value of the companies I feature today but for all investors, many of whom have been badly damaged financially by it.

In my view, the panic injection of vast mountains of money into economies will do little to stop more people dying, including from suicides due to collapsed livelihoods, and cause long-term misery for many, but it will create a very strong recovery in demand for some things, and among those will be commodities such as natgas.

I have lost so much on shale gas producers who have produced so much natgas there was a glut even before the virus herd panic contagion and oil price wars, but there is money to be made with those that do something with it, including Tellurian (NASDAQ:TELL), Chart Industries (NASDAQ:GTLS), and Hoegh (NYSE:HMLP). I suspect we are near the bottom as far as panic selling is concerned. Maybe the excitement cycle tells us where we go next:

Source: Forbes.com

Recently, the natgas price was under $1.60, lower than at any time in the past 20+ years! A floor may have now been reached on prices due to the reduction in shale oil drilling in places like the Permian caused by the Russian/Saudi price war that is reducing the production of associated natgas. That could be good for natgas producers, but, conversely, if it is too good, it could adversely affect US LNG producers who are currently having difficulty getting new long-term contracts, causing them to delay investment in new LNG facilities. Some, however, like Energy Transfer (NYSE:ET) are forging ahead.

I have given up trying to predict natgas prices because they are as changeable as the weather, but this recent article Natural Gas Equities & Natural Gas Prices Lead The New Energy Reality by KCI Research is one of the best I have seen on the subject.

I am now in the HOPE stage of the cycle. I did not suffer the panic stage during the market crash and getting angry at those political “leaders” – who imprisoned us as a virus cure – would have been as effective as punching holes in fog, but I certainly became depressed as did the value of my investments, and none more so than that in TELL:

Hope Springs Eternal….

Tellurian

At risk of being sent to the gallows by anyone who bought TELL soon after my SA article that featured it, Tale of Two Gases, hopefully, we are now in the hope phase of the cycle as I have just risked a bit more of my health wealth by adding to my holding. The time of that article in mid February could hardly have been worse because, a few days later, management announced that Petronet of India had sought an extension to an MOU that would have seen it place a large order for LNG and make an anchor equity investment in TELL’s Driftwood project. That caused a collapse in the stock price followed by the onslaught from the virus panic selling made worse by TELL’s founder and chairman having to dump a load of his shares in early March at a cheap price apparently because of some breach of a covenant he had used them as security for a personal debt.

The Indian company will scour the world to get a lower cost deal, but TELL should be able to equal any, given the low cost of US shale gas. More on that later. Importantly also, the threat to TELL’s financial health in the short term has been fixed by an 18-month extension to its financing facilities aided by an internal restructuring that has cut costs.

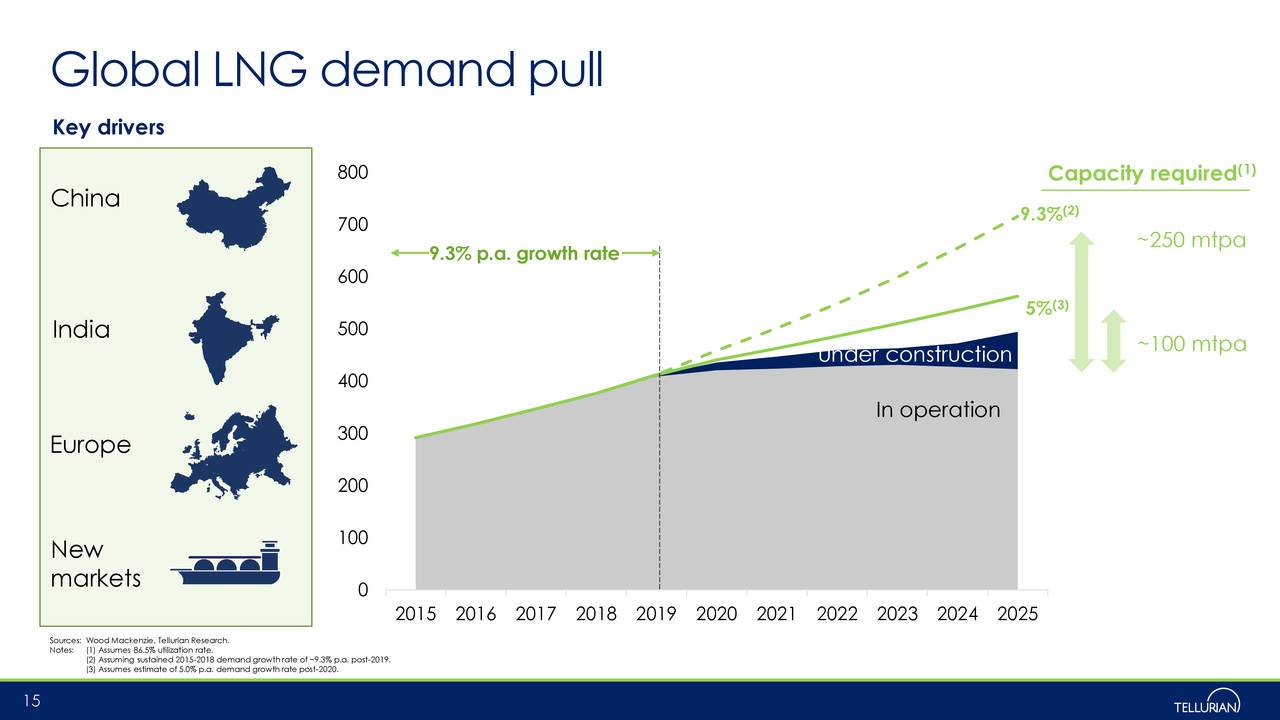

There is a glut of LNG as this Reuters report shows caused by a worldwide drop in demand, but longer term, the picture remains unchanged.

TELL’s founder and Chairman is Charif Souki. I discovered him in the early days of his plans to build Cheniere Energy (NYSEMKT:LNG) into the first US LNG exporter. That became my best investment ever.

I believe he and the team at TELL will do better as unlike Cheniere – a company that was financed with a mountain of debt – TELL is doing it with equity, including with stakes by large customers such as Total (NYSE:TOT). That has a downside in that existing stockholders are likely to get diluted when new funds are sought, but it should mean less risk and higher returns later. At the present time, Charif Souki, together with other members of the top team, owns the majority of shares.

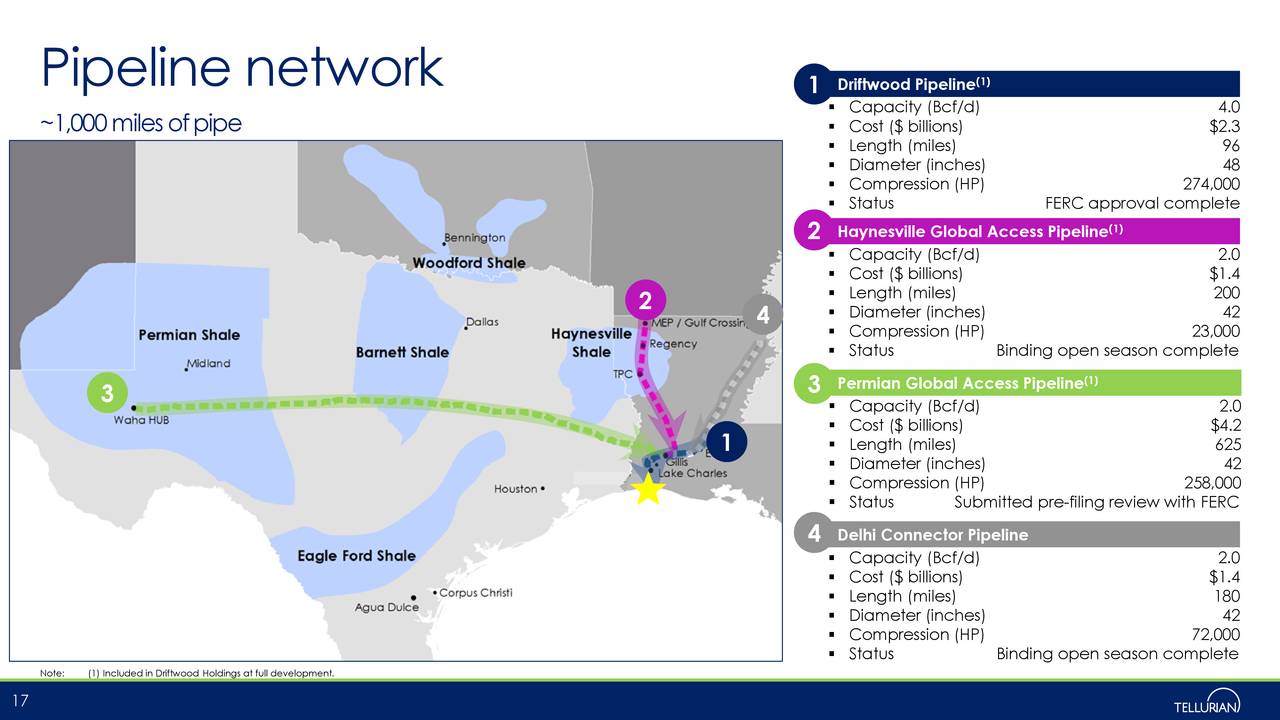

Also unlike Cheniere, TELL has its own natgas production source and will have its own extensive pipeline network to supply from there to its planned liquefaction plant at Lake Charles plus that network will connect with other natgas supply sources available also, as shown below…

Source: Tellurian presentation

The story TELL told in this presentation in February, before the panic, remains valid because, one day, the panic will be over and life will start to return to some semblance of normal, as it is in China. This recent news from TELL says more;

“Chinese LNG demand appears to be bouncing back as smaller Chinese buyers are taking advantage of available storage capacity amid low spot prices…

Chart’s technology will be a key component in TELL’s Driftwood LNG plant. And even in the ever-drifting lower EU, some things are operating normally as Europe’s Titan LNG import facility (major supplier/distributor of LNG) confirmed that all deliveries into NW Europe will continue as normal and without limitation.

TELL’s stock price dropped from around $6.40 on Feb 20 when my article Tale of Two Gases was published to below $1 around March 6 and sits at $1.67 as I write.

I bought more TELL recently at $0.85 based on those points because they mean the business foundations in that article remain intact and from that current price a return to $6.40 (Financial Times analyst’s mid range is $6) will be rather nice, but I doubt the ride upwards will be volatile until virus panic subsides. The excitement cycle tops out with optimism. I bought into to Charif Souki’s Cheniere Energy at $3.42 per share. I sold some at $40, some at $60, and some at $80!! Will he do the same at TELL??? Time will TELL.

Those business foundations mentioned above are also the reason for Chart Industries (GTLS) being one of my largest holdings.

Chart

Chart is a world leader in cryogenics and its technology is used in LNG plants around the world. That will go into TELL’s as mentioned above and into the next one to be built by Eagle LNG, an unlisted LNG world leader.

While LNG is the biggest part of its business, Chart is also a leader in critical gas equipment and that will play an important in helping people recover who get inflicted with the virus as this from Chart’s website shows. Crucial help that will add to profits and Chart’s reputation as responsible member of the world community unlike so many whose short termist knee jerk management is slaughtering the lives of their employees, suppliers and society generally pouring more turbulence on troubled waters.

I especially like their involvement in the whole gas processing cycle. This from their website:

“Chart Industries is at the heart of the energy revolution. Abundant, clean burning and less costly than distillates on an energy equivalent basis, natural gas has become the global fuel of choice as a bridge to a non-carbon future that is still decades away.

The key cryogenic stages used in mid-stream natural gas processing include nitrogen rejection, the process of removing nitrogen to meet pipeline standards, NGL recovery, which separates the high value natural gas liquids, and helium recovery; all of which are reliant on Chart products and associated process technology.

Liquefied Natural Gas (LNG) is natural gas that has been refrigerated to approx. -260°F (-162°C) and condensed. In its liquid state natural gas occupies around 1/600th the volume of its gaseous state making LNG the cost efficient solution for storage and transportation over long distances and/or where no pipeline exists. For more than 40 years Chart has pioneered the development and use of LNG and we supply equipment and solutions across the complete LNG value chain – Liquefaction, Storage, Distribution, End-use”.

LNG has long been shipped over water in special vessels, but we will also see a huge growth it transports by land on trucks and trains as gas becomes an important source of energy for inland and smaller communities worldwide. Evidence that could be a rapid development maybe in a collaboration between Chart and Exxon Mobil (NYSE:XOM) recently agreed in India for a virtual LNG pipeline. This video shows some of Chart’s “tankers” going to work for such purposes:

The CEO had this to say in her last report:

Full year record orders of $1.413 billion, a 23.7% increase (10.8% organic) over full year 2018, driven by record orders in trailers, LNG fueling stations, cryogenic equipment in India, lasers, hydrogen, cannabis and water treatment.

Record backlog ($762.3 million), up 34.2% from the fourth quarter of 2018 (32.2% organic increase) driven by strong fourth quarter 2019 orders including the highest order quarter in history for Distribution & Storage Western Hemisphere (“D&S West”).

Received engineering release in December 2019 for a Big LNG project for which orders are expected to be received in 2020.

Full year record sales of $1,299.1 million, a 19.8% increase over 2018 supported by record organic sales.

Full year reported earnings per diluted share $1.32 included substantial transaction, integration and restructuring costs, resulting in full year record adjusted diluted EPS of $2.52. The one-time costs in 2019 were related to restructuring and integration work that is expected to return $38.3 million annually beginning in 2020.

Increased 2020 base revenue guidance to $1.645 billion to $1.710 billion and base adjusted diluted EPS guidance to $4.90 to $5.50, reflecting timing and strength of fourth quarter 2019 order activity.

Looking deeper into Chart’s financials and one does not see the exciting picture that report portrays unless the past is not going to be repeated. Sales revenue growth over the past five years ending on Dec. 31, 2019, was a mediocre 25% that mainly seems to have been derived from many smallish acquisitions presumably financed by long-term debt that has increased by 255% from $214 million to $761 million. Profitability is poor with a gross margin of only 26.86% in 2019 leaving a net of 3.6% and a woeful ROE of 4.4% and ROI of 2.6%. Cash flow is mediocre too. The debt to equity level of 0.63 might be seen as safe, but all metrics could and should be much better.

To me – as an outsider but long term CEO of world leading advanced technology manufacturing companies (now retired and consulting startups on business development) – one thing, above all others, stands out. That is the gross margin.

Chart is essentially a niche company and is a world leader in that niche. It has competition, but as far as I can see, they are large companies such as Air Products and Chemicals (NYSE:APD) and TechnipFMC (NYSE:FTI) which have many other activities competing within for resources, and FTI management has been more focused in recent months on splitting into two companies – now delayed – than on normal business matters.

Such a niche also means a very wide moat that few, including Chinese copiers, will attempt to bridge because the technology – although not new – is special and the market size not large enough to justify the huge cost of entry. Those points should mean nice niche margins!

Chart uses a lot of steel, and there has been a glut of that for at least 5 years, so low material costs should have meant much better margins. Likewise, for aluminium, if they use much of that. Some margin improvement can almost certainly come from manufacturing efficiencies such as converting the multiple productions centres of the many acquired companies into centralised single source ones. Some items look to me as being ideal for a 3D manufacturing process. Chart is a manufacturing company and do I see any much hands-on modern manufacturing experience among those on the top team. Outside consultants could do the job anyway because they see change as it happens in many sectors which could bring a cross fertilisation of the best methods to Chart. Now is the perfect time to do it when so many other companies are freezing CapEx meaning new machinery and equipment can be had for bargain prices, and if any of Charts facilities are on short time working, they can be upgraded ready to maximise output and profit when normal times return. It is not easy to do such modernisations when plants are running flat out.

The simplest of all ways to improve margins for a niche company is by selectively increasing sales prices. Pricing is a science, and I see few signs that Chart knows much about that. They are not alone – such things kept me nicely rewarded in my full time working days!

Other new and highly profitable sources of income can come from added services such as remote monitoring of products using closed circuit feedback technology. Many of Charts products are ideally suited for that.

Those internally issues are relatively easy to fix (if I were the boss!) and I am invested in Chart because I like the CEO, believe the potential is enormous and – given the hammering the stock price has had mostly since the start of the virus panic – I see no reason why the price should not go back to my buy-in price in May last year of $78 from the horrible current price of around $24. That $78 price is also the median target for some analysts.

Back to that word HOPE, and maybe we will get some of that when Chart reports 1st quarter results on April 23 by which time hopefully there will also be some light showing the end of the virus panic tunnel. It could be that many of the issues I mention have or are being addressed with integration actions taken already. Some panic project delay announcements maybe in that report, but they will come back because, despite the possible internal weaknesses I mention, I believe Chart maintains an excellent reputation among customers and the story for LNG demand remains strong.

If margins are improved, then that added to those recent super sales results, and the potential will take Chart into a much higher league that would attract attention and many more investors.

Another major point in Chart’s favour for the future is its expertise with hydrogen, and that could add exponentially to Chart’s longer-term growth. Its expertise in other growing sectors also broaden the overall potential significantly.

My other main choice in LNG is Hoegh.

Hoegh

Hoegh (HMLP). First, and before the MLP part of the company name deters potential investors – as it nearly did me – I would mention that HMLP is structured as a normal C Corp and issues a 1099, so there are no tax complications. That is important for many investors including those like me who are not in the US tax system and do not want to be dragged into it in the way many partnerships do.

Hoegh is a leader in Floating Storage and Regasification Units – FSRUs.

FSRUs have established themselves as the preferred mode of access to the global LNG market, with multiple clear advantages over traditional onshore import terminals.

- Less capital intensive (c. 1/2 of the installation cost)

- Faster to install (down to 6 months vs. 4-5 years)

- Flexibility (to relocate the FSRU or use it as an LNG Carrier)

In addition to the standard FSRU setup with pipeline to shore with regasified LNG, it can serve as a hub for LNG such as:

- Small-scale distribution at sea – reloading LNG to smaller carriers serving other demand centres

- Small-scale distribution onshore – reloading LNG on to trucks for onwards distribution by road

- Bunkering – providing LNG as marine fuel, directly or by smaller shuttles

- Connectivity to shore – adaptable to local conditions by jetty or other mooring solutions

This is a recent statement regarding the virus situation:

Sveinung J.S. Støhle, Chairman of Höegh LNG Partners and President & CEO of Höegh LNG comments: “Höegh LNG is managing this unprecedented crisis in an efficient manner first and foremost thanks to the tremendous efforts by all the people working in our organisation, but also because the company has a robust crisis management system in place supported by modern IT solutions. All our assets are operating according to contracts, and we are in close dialogue with all our customers to make sure any issues are addressed in a coordinated manner. Despite the Covid-19 crisis, the LNG markets are functioning more or less as normal and commercial activities are making progress. Even with major populations being quarantined, countries around the world need energy and electricity to function, where low priced LNG and flexible LNG is an attractive solution.”

The latest earnings information can be found in this presentation.

An excellent article on Hoegh by Andres Rueda and its ability to sustain the high dividend was published on March 30. However, Hoegh did not read that and have just suspended the dividend punishing the stock price still further.

Hopefully, that truly means a floor to the price, and I look for future growth potential for FSRUs. That is growing constantly due to those advantages over onshore facilities mentioned above combined with the growing demand for natgas around the world.

There are some weird things going on in that world – more political “leader” things?! – and perhaps none more so in Australia one of the world’s largest producers and exporters of LNG yet it cannot deliver LNG around its own coast from where it is produced in West Australia to where much is needed in the heavily populated south eastern states of New South Wales, NSW, and Victoria whose capitals are Sydney and Melbourne. So some import terminals are being built including this one in NSW with LNG likely to come over the Pacific Ocean from the US!

AIE signs foundation customer for Port Kembla FSRU project

Hoegh will provide the FSRU as it already is contracted to do for a terminal in Victoria.

More such weird can be seen with Cyprus where Noble Energy (NASDAQ:NBL) has found enormous natgas reserves in the sea nearby but apparently cannot bring that ashore because of age old territorial claims by Turkey so according to this recent press release Höegh LNG Ltd. has applied for an LNG infrastructure ownership, operations and development license in Cyprus. That release tells us this: To diversify Cyprus’ energy mix to reach new emission targets for the country’s power production, Cyprus needs to replace the consumption of refined oil products with cleaner LNG as fuel. The plan consists of using one of Höegh LNG’s FSRUs as a fast track solution for the required fuel switching, thereby reducing air emissions, cutting EU emission taxes, enabling savings on fuel costs and reducing electricity price per KWh for local consumers.

The FSRU can stay on location as a bridging solution or for an extended period serving different customers on Cyprus as well as bulk breaking and delivering LNG to other customers in the Mediterranean.

For this planned project, Höegh LNG is working together with VTT Vasiliko Ltd. (“VTTV” – a VTTI Group Company) and H4E GasFuel Ltd. VTTV owns an existing jetty in the Vasilikos Port, at close proximity to the country’s power plants, that can be adapted for the FSRU terminal. Subject to the licence being granted, Höegh LNG expects to be able to start LNG import operations during H1 2021.

Sveinung J. S. Støhle, CEO & President of Höegh LNG states:

“This planned project is part of Höegh LNG’s strategy to secure new FSRU contracts for our assets. Even at this early stage I am very pleased with the progress we have made with our local partners VTTV and H4E Gas Fuel to offer a fast track LNG import solution for the Cypriot energy market.”

There are many other such opportunities around the Mediterranean coast and probably also around the coasts of Africa and South America. Maybe it will happen around the US coast too if President Trump goes ahead and waives the Jones Act for such needs. A couple of winters ago Boston imported LNG from Russia because it could not get the home made product!

Onshore facilities will also be a large market for Chart’s small scale LNG receiving terminals.

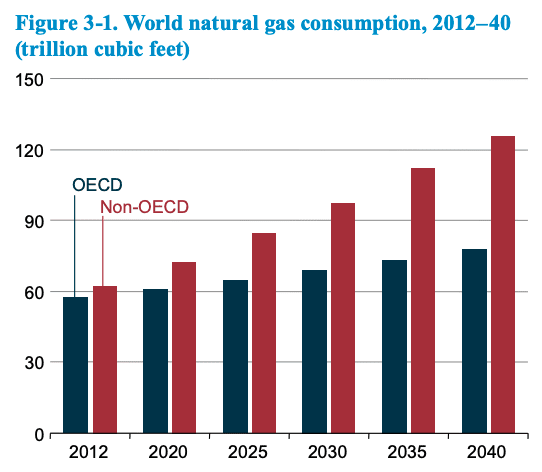

That all presupposes demand and all forecasts are for that to increase substantially:

Demand growth

We know there is a natgas glut at present that feeds into LNG pricing thus causing pressure on suppliers from buyers as has happened with that delay for TELL by its potential Indian investor and for other LNG companies.

Shell tells us where we are in this recent LNG Outlook statement.

Looking further ahead, the International Energy Agency, IEA, has produced this chart

TELL shows supply source capacity in this graphic. It is already showing initial signs of insufficiency coming soon

In my Tale of Two Gases, I mentioned some of the specific new uses for LNG including ships, trucks, trains etc. There is also the ongoing switch from coal to natgas for power generation worldwide. If there is “leader” concern about virus deaths then there surely needs to be more urgency from them also about deaths caused by coal that causes over 800,000 premature deaths globally each year.

Some countries are changing from coal fast and in the UK this past winter coal use by power generators has mostly been to get rid of stockpiles that are not being replaced. Polluted India and China – where many of those deaths occur – are changing to natgas fairly rapidly and have a long way to go still.

There will remain plenty of sources of natgas, and Reuters has reported a huge $110 billion investment Saudi Aramco is planning in unconventional gas.

Chart’s products maybe used in that project ct. That kind of thing will provide competition for TELL but opportunities for Hoegh too, once production starts. I doubt Aramco will have the same price advantage it has with its low cost onshore conventional oil, and it will find US shale gas producers – with their experience learning how to reduce costs – difficult to beat as have large Australian LNG producers like Woodside who, for whatever reason, cannot even deliver to potential customers in their own country.

The virus, natgas glut and other effects

So far, I have found no evidence that the virus panic and other adverse things have slowed down LNG demand in any significant way although, as mentioned earlier, something has happened and put downwards pressure on prices. As far as I know, most ocean-going LNG carriers have continued operating fairly normally, and all of Hoegh’s FSRUs have continued operating. China is getting back to normal. Few of us trust official figures from the Chinese authorities but knowing that BMW (OTCPK:BMWYY) car sales are now returning to normal and companies such as Toyota (NYSE:TM) and Volkswagen (OTCPK:VWAGY) are nearly back to normal production volumes in their factories there and that Apple (NASDAQ:AAPL) and Starbucks (NASDAQ:SBUX) have reopened most shops can give us some confidence that normal times are returning. The authoritarian state will do its utmost to aid that! The unprepared west is too. Badly hit Italy and Spain have announced the reopening of some businesses. Austria is restarting selectively too. Spain imports LNG from the US.

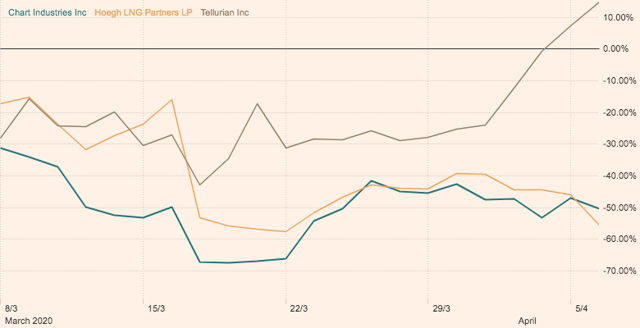

I conclude that the virus effect – apart from on those sadly killed by it – has mostly been the stock market panic. That has hammered the share prices of all three. Strangely Chart and HMLP have been hit the most. I would have thought that prize would have gone to TELL since it is at a much earlier stage in the business cycle. Perhaps that reflects investors view of the upside potential.

If markets bottomed around March 23 and if I am right that the virus panic has been overdone, then we should soon see less volatility and a sharp price revision upwards for all three. IF is one of the smallest words in the English language but has a very large meaning. However, one thing is sure based on the fact of little or no slowing of demand for LNG and the demand increases to come then the prices of TELL, GTLS and HMLP are way too low right now.

I shall end by wishing all good physical and wealth health and hope (that word again!) my article generates an interesting conversation because we can all learn and earn more from that.

Disclosure: I am/we are long HMLP, TELL, GTLS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment