LilliDay/E+ via Getty Images

There are things to do when investing in a recession, but it’s probably more important to know the things not to do. This article will attempt to lay out the argument for both. First, however, I will present a familiar chart which presents a model of what happens over a full market cycle. It doesn’t tell you what to do or not to do. What it can provide is a framework of how to think.

How Sectors Perform Over A Market Cycle

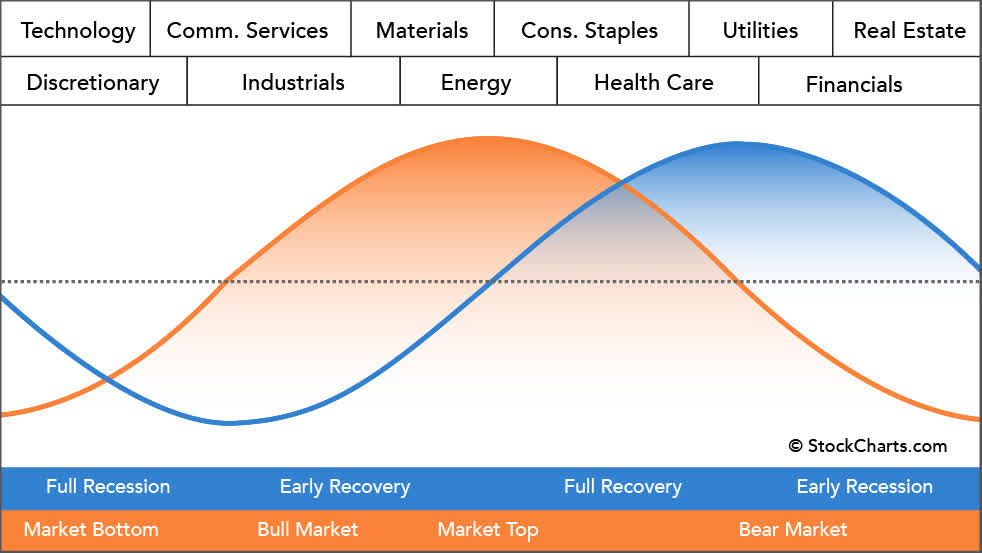

The chart below is based on Sam Stovall’s S&P’s Guide To Sector Rotation. Stovall is a distinguished fundamental and technical analyst and market historian following in the footsteps of his father Bob Stovall whose career began in 1953. Old timers may remember Bob Stovall as one of the “elves” on Louis Rukeyser’s Wall Street Week. The Stovall model, in other words, has behind it quite a pedigree and a large chunk of market history:

The Sector Rotation Model

S&P 500 Guide to Sector Rotation

The above chart tells you the sequence in which various sectors should be leaders over the market cycle. What it doesn’t tell you is when to buy or overweight those sectors. It just states that different sectors are stronger at different points in the economic cycle. You will notice that the blue line which represents the Market Cycle precedes the Economic Cycle. That’s because investors move to anticipate economic effects. It also suggests that if you wait for the recession to be obvious you are probably too late to make portfolio adjustments even if you want to.

What the chart doesn’t show is the length of the different stages, which is historically much longer for the recovery and bull market stages. In both the 1990s and the 2010s the economic growth and bull market stages lasted for much of the decade. Even if it were possible to anticipate the next phase, buying specific sectors is more a trading strategy than a long term investing strategy. I can’t do it consistently, and I believe very few people can. There’s also the problem of short term capital gains taxes. So how is the chart able to help?

The table below a the more generalized version of the Stovall model.

| Stage | Full Recession | Early Recovery | Full Recovery | Early Recession |

|---|---|---|---|---|

| Consumer Expectations | Reviving | Rising | Declining | Falling Sharply |

| Industrial Production | Bottoming Out | Rising | Flat | Falling |

| Interest Rates | Falling | Bottoming Out | Rising Rapidly | Peaking |

| Yield Curve | Normal | Normal (Steep) | Flattening Out | Flat/Inverted |

The generalized version presented in the table above is probably more helpful than the chart of partially overlapping sine curves. Both tell the same story, but the table doesn’t have the illusion of regularity presented in the chart. Market Cycles generally follow a pattern but they are not exactly regular. They usually involve a sequence of the Federal Reserve tightening and loosening interest rates and liquidity as in the last two lines of the table.

At times, however, Market Cycles and Economic Cycles both feature events which are both extreme and unforeseeable such as the abrupt market decline beginning in February 2020 which coincided with the COVID pandemic lock down. In less than a month the 35% bear market was followed by the equally sudden bull market and economic boom. Another example of an unforeseeable event is the oil price shock of 1973 which caused a huge jump in the already inflationary cycle of the 1970s. In both these instances events led and the Federal Reserve was reactive. Playing events like these is pretty tough.

There is a difference between investing “during” a recession and investing “in anticipation” of a recession. The options when a recession is already underway are limited. The best options are things you can do in anticipation of a recession. The very best options are those you can undertake in order to prepare your portfolio to ride out challenging economic environments of all kinds, recognizing that a recession is an event which can occur at any time. Here are some strategic suggestions including both dos and don’ts:

Suggestion #1: Don’t Panic And Sell

Panic selling almost always turns out to be wrong. If you own well-chosen stocks, a recession and bear market aren’t the end of the world. Your portfolio will eventually come back and, who knows, if it does turn out to be the actual end of the world, there’s not much you can do about it. Eat all the ice cream with chocolate sauce you always wanted to, I suppose. Panicking can be bad for your health. Do a weight work out or walk five miles every day, ideally in the woods. Plants and trees give off chemicals that are good for your health. Read a book about animals. Embrace stoicism. It’s not so much what happens to you as how you deal with it. Detaching yourself from what is going on around you is the first principle of successful investing.

Suggestion #2: Do Nothing At All

Don’t just do something. Sit there. Don’t look at your portfolio for a while. This is the John Bogle approach, suggesting that you establish a proper mix of an index stock fund or ETF combined with an index bond fund or ETF. As the founder of Vanguard and first to popularized index funds, he would naturally prefer the Vanguard Total Stock Market ETF (VTI) and the Vanguard Total Bond Market ETF (BND). I like them too. Both have minuscule expense ratios (.02% and .03%) and include everything in proportional weights. That provides natural diversification. You don’t attempt to outsmart the market by focusing on a particular sector at a particular time.

The John Bogle approach is hard to beat for individuals who don’t spend a lot of time studying the market. Those who have followed Bogle have done well. While I very much subscribe to the approach of doing little or nothing, index investing hasn’t been my personal approach. The S&P 500 (VOO) or VTI has the virtue of automatically increasing your exposure to the best growth stocks as they grow to be an ever larger portions of the index (adjusted daily). There is also the downside of periods like the last two years when high flyers come back to earth and drag down the index. My own portfolio consists of individual stocks put together in a way that seeks to avoid that extra volatility. I wrote about my portfolio choices here in response to questions in reader comments asking what I owned overall.

It’s not necessary to beat the index to do very well and achieve your personal goals. One goal of a stock portfolio is to avoid catastrophes by staying away from stocks with high risk. The indexes are required to own them. You don’t have to. A sensible goal is to beat the index in risk-adjusted terms. Most of the stocks I own are low beta and are selected to perform well enough in a variety of environments including inflation, deflation, and recession. I have also bought I Bonds regularly since 2000. Most purchases came when inflation wasn’t a major issue, but they have recently served very well as an insurance policy against inflation.

Remember that the most important actions dealing with a recession are taken before the recession begins. Being prepared is always the way to go. Don’t let yourself go into a recession with an un-diversified portfolio full of risk. When I was a financial advisor the saddest thing I ever thought (but never actually said to a client) was “The solution to your problem is not to have gotten yourself into that position in the first place.”

Suggestion #3: Don’t Chase Individual Sectors Unless You Are A Skilled Trader

It doesn’t make much sense to me to make long term buys on the basis of your expectations for short term outperformance. Even if you manage to get it right, what do you do when the cycle moves on to the next stage? My preference is to own a mixture of quality stocks which as a group will provide good returns over the long run. I realize that many analysts emphasize particular sectors for various market stages, both on Wall Street and here on Seeking Alpha. The focus is often on sectors with high dividends. Owning some stocks which pay good dividends is fine. Among other things it reduces the duration of your equity portfolio because high dividends accelerate return of your capital. They may also go down less than the market in the early stage of recessions.

Two examples of such holdings in my portfolio are Johnson & Johnson (JNJ) and McKesson Corp. (MCK). Both are good companies in the health care area which are largely uncorrelated to the rest of my portfolio. It’s important for you to know that I bought them when no recession was on the horizon. Two other areas which protect in recessions are insurance, where I own Travelers (TRV) and Markel (MKL), and aerospace/defense, where I own Raytheon (RTX) and might add Lockheed Martin (LMT) if it becomes cheaper in the course of a further market decline. Both insurance and aerospace/defense have customers who will not reduce their spending because of a recession. I knew that when I bought them, but it was not the only reason I bought them. I had no expectation of nailing the timing of a recession. They are simply part of a diversified portfolio.

While I believe that it’s a good idea to own a few diversifiers like JNJ, MCK, RTX, and LMT which are likely to decline less than the market in a recession, it doesn’t make much sense to rush out and buy consumer staples, health care, and utilities when the Market Cycle appears to be turning down. For one thing, you may turn out to be wrong about the Market Cycle. For another, three very different phases will follow, the first usually within a year. When the economy begins to recover other sectors will likely outperform. My approach when a recession seems more likely than usual is to hold more cash than I otherwise would.

Suggestion #4: Buy Good Stocks That Have Suddenly Gotten Cheap

In a bear market accompanied by a recession most stocks go down. The thing to do is to recognize this as an opportunity. It’s always a good idea, as Warren Buffett says, to buy companies which have good fundamentals whenever they are selling at a favorable price. It’s a particularly good idea to look for such companies in recessions and bear markets. Here’s what Buffett said in a Forbes interview in 1974 which was published two months after what proved to be a market bottom never revisited:

Draw a circle around the businesses you understand and then eliminate those that fail to qualify on the basis of value, good management and limited exposure to hard times… Buy into a company because you want to own it, not because you want the stock to go up…

What good, though, is a bargain if the market never recognizes it as a bargain? “I asked Ben Graham, who then was my boss, about that. He just shrugged and replied that the market always does eventually…Today on Wall Street they say, ‘Yes, it’s cheap, but it’s not going to go up.’ That’s silly. People have been successful investors because they’ve stuck with successful companies. Sooner or later the market mirrors the business…

Buffett concludes the interview with this line: “Now is the time to invest and get rich.”

As it turned out the 1974 stagflationary recession turned out to be one of the two best times in US history to have invested. The other was July 8, 1932, when the Dow Jones Industrial Average reached a closing low of 41.22 in the darkest days of the Great Deflationary Depression.

Suggestion #5: Take Advantage Of Opportunities In Fixed Income

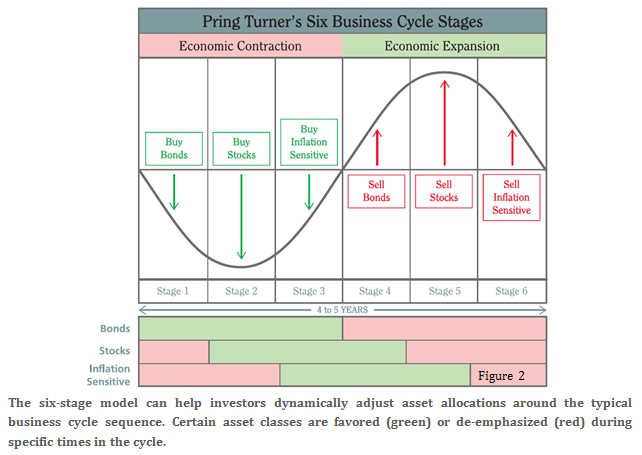

The chart below is a model of the economy using just three asset classes – bonds, stocks, and commodities. It fits well with the Stovall table in the introductory section. Understanding the sequence in which these three asset classes usually rise and fall suggests the one real-time action which may increase investment returns as a recession unfolds:

Pring Turner Capital Goup

The chart implies two simple principles: In an economic contraction, bonds rally first, then stocks, then commodities. In an economic expansion, bonds decline first, then stocks, then commodities. As I said in Strategy #3, trying to time Stock Sector Buying occasionally works for skilled traders but is not a sound policy for long term investors. The same holds for commodity stocks, the closest most investors come to actual commodities. Most are too cyclical to serve well as long term investments. For the most part, this chart is a guide to what usually happens in the markets, not necessarily what you should rush out to do. The one part of it that may be actionable in real time is fixed income investments.

Think of fixed income – described in the chart’s shorthand as “bonds”- is an asset class that extends all the way out from cash in money market funds to maturities of 30 years. The thing you can sometimes do in a timely fashion is shorten or lengthen maturities. In my most recent article recommending a ladder of short Treasuries USER 12554601 reminded me of the mantra “Short duration as interest rates rise and longer duration as they fall.”

The current situation is ambiguous. The Fed is committed to increasing rates sharply, but meanwhile the behavior of many rates and other indicators point toward a recession which might move the Fed to reverse its position and cause rates to fall. My solution as I wrote in the linked article was to move half of my cash reserve to a short term Treasury ladder starting at 6 months with steps of every six months out to two years. This plus the 50% still in cash produces a Treasury average rate over 3%. Longer Treasuries offer little if anything more. It also maintains the flexibility for adding to the ladder if the Fed keeps raising rates. On the other hand, you can buy and lock in longer Treasuries if it becomes clear that the Fed is about to lower rates in order to fight the recession. You can also use cash at that time to buy stocks which have the longest duration of any financial asset. This nuanced strategy using Treasuries is the only thing I see which can take advantage of Market Cycles and Economic Cycles as they unfold.

Suggestion #6: Take Advantage Of Tax Losses

Over the years I have taken every opportunity to sell stock positions which are in the red. This is one of the advantages of having a stock portfolio instead of owning stocks through an index. If I have a stock or a tranche of a stock position which is in the red, I generally sell it toward the end of the year. Most of the time I have been able to buy it back after 31 days without paying more. I do try to time my tax loss sales so as not to be doing it at the same time everybody else is.

The beauty of this strategy is that it makes your losses work for you. If you have a stock, you are hesitant to trim because of embedded capital gains, a tax loss can be used to offset the gains. If you have no gains to offset you can use up to $3000 to offset ordinary income. You can also keep a tax-loss bank indefinitely. In most recent years I haven’t had much to sell for a tax loss because most portfolio positions have very long term capital gains. This year, however, I did a quick sale of two small positions which I had been too early to buy. I’ll back them back in good time.

Bear markets frequently provide opportunities for tax loss selling. People don’t like to sell losers and are often too quick to take profits. This turns the best strategy upside down. Another market adage: “Sell your losers and let your winners ride.” Many of my winners have been riding for more than a decade. Along with keeping your expenses down, taking tax losses is one of the few freebies in investing.

Conclusion

Defensive stocks like consumer staples, health care, utilities, and REITs often outperform during the early stage of a recession, but the solution isn’t that simple. You should probably own some of these defensive sectors, but once a recession is on the way it’s usually too late to buy. You should also consider where an overweight in these sectors leaves you during the stages of recovery and expansion. And do you really want to load up on stocks whose main virtue is that they will go down less than the market? Don’t chase sectors that are popular at the moment. Cash will serve better and provide flexibility.

What you do need to do is recognize that there will eventually be a recession and build a balanced portfolio which will do well over the long term through all stages of a Market Cycle. The great second best, as usual, is an index ETF. When a recession is at hand, the important thing is not to panic. Maintain a stoic attitude, remain detached, take walks in the woods, and take only well-thought-out actions. The fewer actions you take the better.

In some ways recessions and the bear markets that accompany them provide opportunities. As Warren Buffett has often recommended, you should look to buy good companies whose stock prices have made them bargains. Don’t worry about what sector you find them in.

There are two actions you can actually take during the recession. It’s not hard to improve fixed income returns by adjusting maturities. While rates continue to rise you can use a mix of cash and a Treasury ladder to ride short rates up. When rates are definitively falling it makes sense to lock in longer maturities. The middle ground on this, which I still see as the current case, is half bonds and half cash until the rate direction is clear.

The second action to consider during a recession is selling some positions which are in the red to bank a capital loss. You can use this in the future to offset capital gains or offset up to $3000 of ordinary income on your tax return. You can buy the stock back after 31 days without compromising the tax advantage and you will also have the satisfaction of finding a positive side to a temporary loss. The above six suggestions add up to a strategy. Think about them and do what makes sense to you. Good investing.

Be the first to comment