Baris-Ozer/iStock via Getty Images

I’d like to talk a little bit about the 3 Rs today. As is well known, the 3 Rs are 3 basic skills taught in schools, Reading, Writing, and Arithmetic. I would like to propose that whoever coined the phrase, was likely a bit of a cacographer, and possibly not the most accomplished linguist. Perhaps “RAW” would have been a more appropriate abbreviation. But I digress. The 3 Rs I would like to speak about are the Rising Risk of Recession.

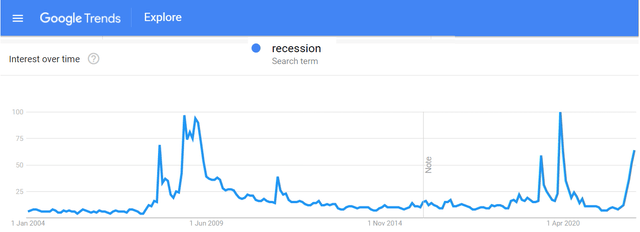

Certainly, current interest in the word “Recession” around the world indicates that it is becoming an increasingly popular topic as can be seen below:

Google Trends graphic for the search term “Recession” (Google Trends)

So, what exactly is a recession? The precise definition of a recession is typically rather vague and wishy washy, but a recession is a significant decline in economic activity as expressed by a fall in the level of a nation’s GDP (Gross Domestic Product). This is typically accompanied by a sustained period of contracting income and manufacturing, falling sales, and rising unemployment. Recessions are considered an unavoidable part of the business cycle. The most popular definition of a recession is 2 consecutive quarters of declining GDP. Given that typically, over time, a healthy economy expands, 2 quarters of declining GDP indicates that “something is not quite right”.

Over time, as an economy expands, lenders tend to make it easier and less expensive to borrow money, encouraging people and businesses to take on more debt. People get increasingly confident, have high expectations of future sales and growth, invest in projects that are based on overly optimistic projections, pay too high a price for assets, and hire additional workers for higher wages on the expectation that the growth will continue. At some point, the asset values get bid up too high and the debt becomes too much of a burden until, ultimately, growth contracts and the economy enters a recession.

In the paragraph above, I described a typical business cycle. This cycle can also be interrupted by external factors/shocks which may cause recessions to take different forms and occur more. Examples include:

- A global pandemic that leads to an immediate cessation of activity through lockdowns

- Excessive debt which becomes too costly to finance

- A sudden unexpected shock like OPEC suddenly cutting off the oil supply in the 1970s

- Inflation getting out of hand leading to Central Banks aggressively raising rates to combat inflation, crushing the economy in the meanwhile (sound familiar?)

Recessions are difficult to predict ahead of time and typically last a few months – the most recent Covid-induced recession in 2020 lasted just a few weeks. The Financial Crisis recession of 2008/9 lasted for a full 18 months. The norm tends to be somewhere in between. Interestingly, recessions are becoming more infrequent and are typically shorter in duration than they used to be.

On a personal level, one can lose their job, find it harder to find a replacement, or experience a wage cut as the economy goes through this transition. Business owners face declining demand, and most experience a reduction in sales, causing a greater number to go out of business. Lenders typically tighten their standards as an increasing number of people fail to keep up with their financing commitments. It is a genuinely difficult time for many, and my heart truly goes out to those who suffer.

Although inevitably a great deal of pain is felt by almost everyone, the good news is that:

1) Recessions don’t last forever.

2) They are backwards-facing and, almost by definition, are already in motion for several months by the time they are declared.

3) Recessions come about for a variety of reasons and no 2 recessions will be characterized by similar market effects. Not every recession is characterized by a market that sees extreme market volatility and downside, many are milder.

As opposed to economic data which is backwards-facing, the stock market is forward-facing and will likely have discounted much of the contraction in activity well in advance. The expectations of a recession are priced into the market before the economy even experiences it. Therefore, it is somewhat counter-intuitive, but as economic data (backwards-facing) paints a picture of a worsening outlook, the market rallies in anticipation of an upcoming recovery. Typically, as frightening as it may be, buying when things look bleak is actually the most opportunistic time to buy, and can lead to wonderful returns, as opposed to investing when things look wonderful, which can lead to woeful returns. It must be said that stock markets are a rather poor indicator of a future recession. Due to their forward-facing nature and the fact that they project negative sentiment and fear into the prices more than they reflect what is truly going on, the joke goes that markets have famously been credited with predicting 12 of the previous 10 recessions.

So, now that we have discussed the main R, recession, without being too data-specific, I’d like to have a quick look at the 2 other Rs and see whether the current macro environment really does indicate a rising risk of recession…

*The current state of the economy shows that growth is clearly weakening (GDP coming down), and estimates are coming down further due to a combination of ongoing pandemic-related lockdowns in China and a war in Ukraine that is having a massive impact on the price of energy as well as other commodities and raw materials. This is having a large negative effect on supply chains which were already in disarray as manufacturers struggled to keep up following the initial Covid lockdowns.

*Inflation is already at its 40-year high and proving to be just a bit less transitory than was originally anticipated.

*Interest rates have effectively doubled in 6 months and the Fed is in the very early stages of reducing the balance sheet in an attempt to unwind the excess liquidity that was injected over the last few years to shore up the economy.

*Consumer confidence (as captured by the University of Michigan consumer sentiment index) has plunged below previous crisis levels and is now at the lowest since the late 1970s.

*The labor market remains scorching hot with unemployment back to pre-pandemic lows of 3.6%.

Although it has become consensus that we are indeed heading for a recession (if we are not already in one), there are tentative positive signs too:

- The USD is strong (the GBP is at its weakest level against the USD since 1985). If the USD was weaker, it is likely that inflation would come in even higher than it already is. It is reining in on expectations going forward.

- Mortgage rates (in the US) are above 6%, which has unsurprisingly had a massive effect on new mortgage loan origination and has cooled what was undoubtedly a “hot” housing market.

- Inflation is coming in at very high levels and is likely to be somewhat higher than we have been accustomed to for a while. Nonetheless, expectations are that peak inflation levels are pretty much here (or thereabouts) and are likely to come down in the future.

It doesn’t take a rocket scientist to know that the combination of weakening growth and rising rates is not a good combination first and foremost for the economy, and secondly for corporations. For all of these reasons and plenty more, corporate earnings will undoubtedly be affected. Wages are higher, as are other input costs. Margins will come under pressure. The Fed (and other central banks around the world) are determined not to let inflation run further out of reach and will want to see solid signs that it is under control before they take a step back.

Market participants reacted to these fears and have run ahead of the worsening economic outlook with both the stock market and the bond market coming off significantly over the last few months. Valuations, although still high in the greater scheme of things, have become far cheaper than at any point over the last 5 years (with the exception of 5 minutes during the initial March 2020 Covid panic). Interestingly, Government bonds, which traditionally were thought of as a good portfolio diversifier (safe and boring), have sold off even more than the stock market. The following chart shows the ACWI, the ETF for Global Equities, versus the TLT ETF (the ETF that tracks US Government bonds of long durations of 20 years or more):

Global markets are down 21% YTD whilst Long US Treasuries are down 24%. There truly has been nowhere to hide!

This post has mainly focused on the macro side and has painted a rather gloomy picture. As mentioned, recessions are part and parcel of a regular functioning economy. Although they are painful, they are an efficient way of purging the market of excess. Recessions and market drawdowns create opportunities in their aftermath. I would like to explore the positive implications for investors in my next post.

For the record, I am also closely following Google trends for the term “Cacographer”, which I would like to see shoot up following this post!

Be the first to comment