AlpamayoPhoto/E+ via Getty Images

After the surge in the major market indices last week, I’ll take yesterday’s modest decline as a win. There was not a lot of news available to move markets, but what we did learn was clearly positive. Pending home sales broke a six-month losing streak to rise 0.7% in May, which was well above expectations for a 4.2% decline. Four of the largest U.S. banks increased their dividends after the Fed gave them a clean bill of balance-sheet health from their annual stress tests, indicating they can easily weather a significant economic downturn. Nike reported results after the close that beat top and bottom lines, and while guidance was cautious due to supply-chain issues and weaker sales in China, both are headwinds that should abate during the second half of 2022.

Finviz

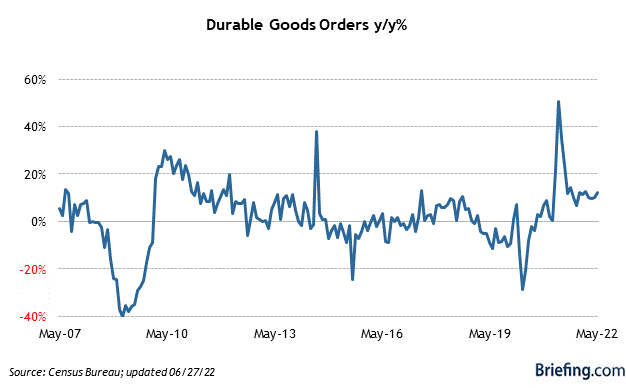

The most encouraging news was that durable goods orders for the month of May rose 0.7%, showing strength across all categories, which was well above the consensus expectation for an increase of 0.1%. Unfilled orders also continued to rise (+0.3%), which means that this strength should have carried into June. Business spending, which is reflected by the shipment of non-defense capital goods exclusive of aircraft, rose 0.8% and is on pace to rise at an annualized rate of 7.5% above first-quarter levels. Wait! I thought we were on the cusp of a recession with bloated inventories and declining sales. To the contrary, the real-time data paints a different picture.

Briefing.com

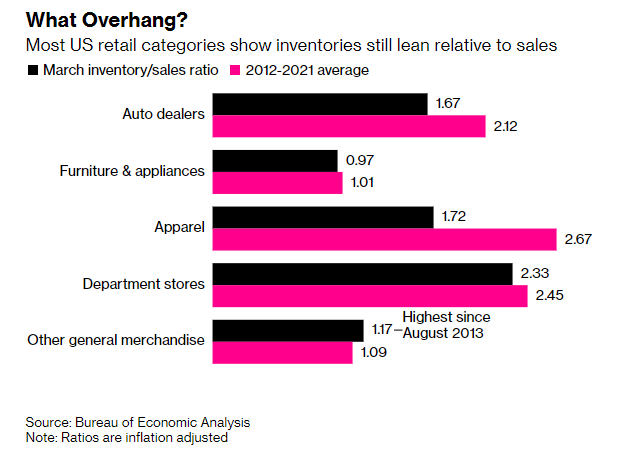

When Walmart and Target reported an unexpected surge in inventories earlier this month, it sparked recessionary fears, as that is what we typically see at the onset of a recession when demand declines significantly. Yet I asserted at that time that these were anomalies, despite coming from two of the largest and most efficient general merchandise stores. Other retailers did a better job of anticipating the shift in consumer spending from goods to services. Still, the missteps by these two companies resulted in the highest inventory-to-sales ratios for general merchandise stores since August 2013. Other retail categories showed no reason for alarm, which is why we continue to see strength in durable goods orders.

Bloomberg

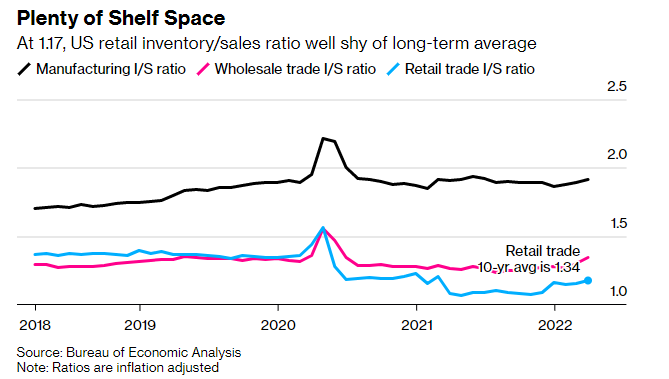

To the contrary, the overall retail inventory-to-sales ratio at 1.17 is well below the 10-year average at 1.34, and while inventories for manufacturers has risen, the value of unsold finished durable goods is at the lowest level since 2013.

Bloomberg

The mid-cycle slowdown camp is a very lonely place to be right now. It would be much easier to join the recession crowd, but it simply isn’t in the numbers. Manufacturing production is up at a 6.6% annualized rate through the first five months of this year, while inflation-adjusted consumer spending and income were at record highs in April. The unemployment rate has fallen from 3.9% to 3.6% this year, and the economy has been adding more than 450,000 jobs per month. The rate of economic growth is slowing for obvious reasons, but the growth continues. That suggests that the worst is behind us in terms of the valuation adjustments we have seen this year for risk assets

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment