Douglas Rissing/iStock via Getty Images

The Federal Reserve has made it crystal clear that fighting inflation is currently its primary commitment. The usage of the word “transitory” will be studied in future economics classes along with how we arrived at a 7.5% January Consumer Price Index and a 9.7% Producer Price Index. What we do know is Russia’s war with Ukraine has put significant strain on commodity prices, which have only added to a post-pandemic global economy already struggling to deal with massive consumer demand, historic federal stimulus, and untimely supply constraints.

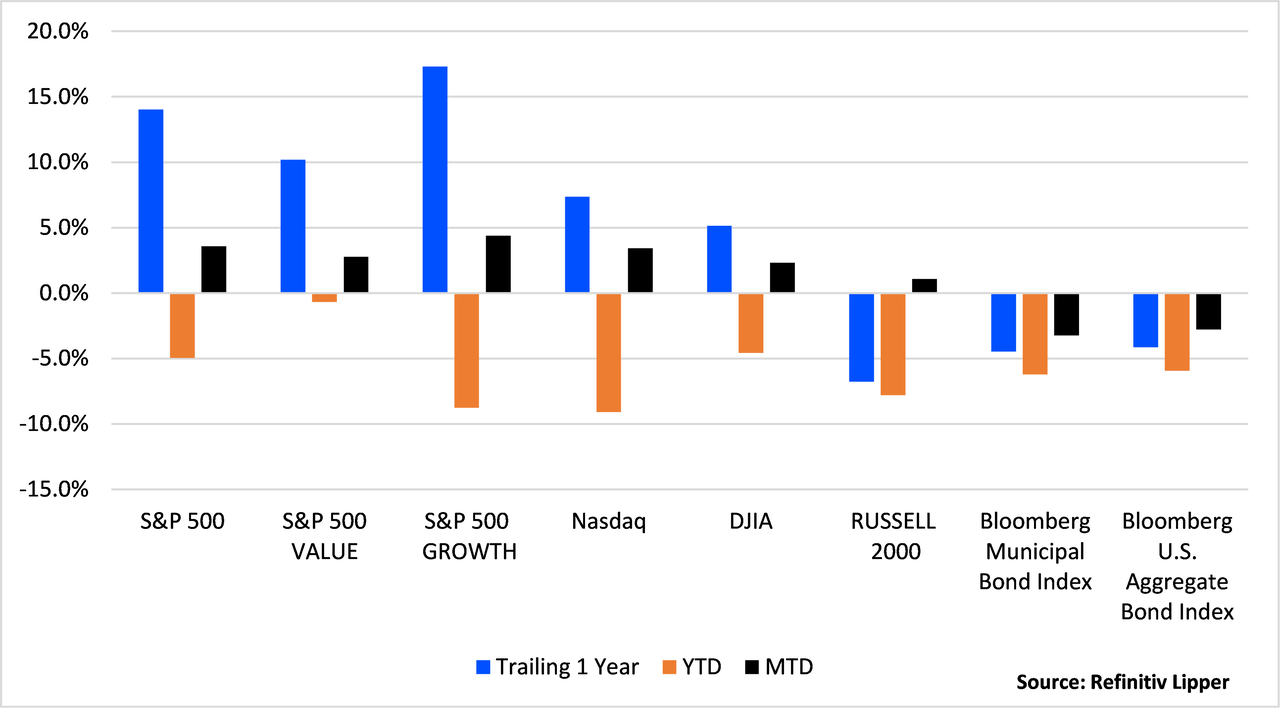

While March flow figures are not finalized until later this month, we can look at preliminary flows to gauge how investors have been reacting to the current macro environment. First performance, Q1 2022 marked the first losing quarter since 2020 for board-based equity indices—Nasdaq (-9.10%), Russell 2000 (-7.80%), S&P 500 (-4.95%), and DJIA (-4.57%). Fixed income markets struggled as well, both the Bloomberg Municipal Bond Index (-6.23%) and Bloomberg U.S. Aggregate Bond Index (-5.93%) finished Q1 in the red.

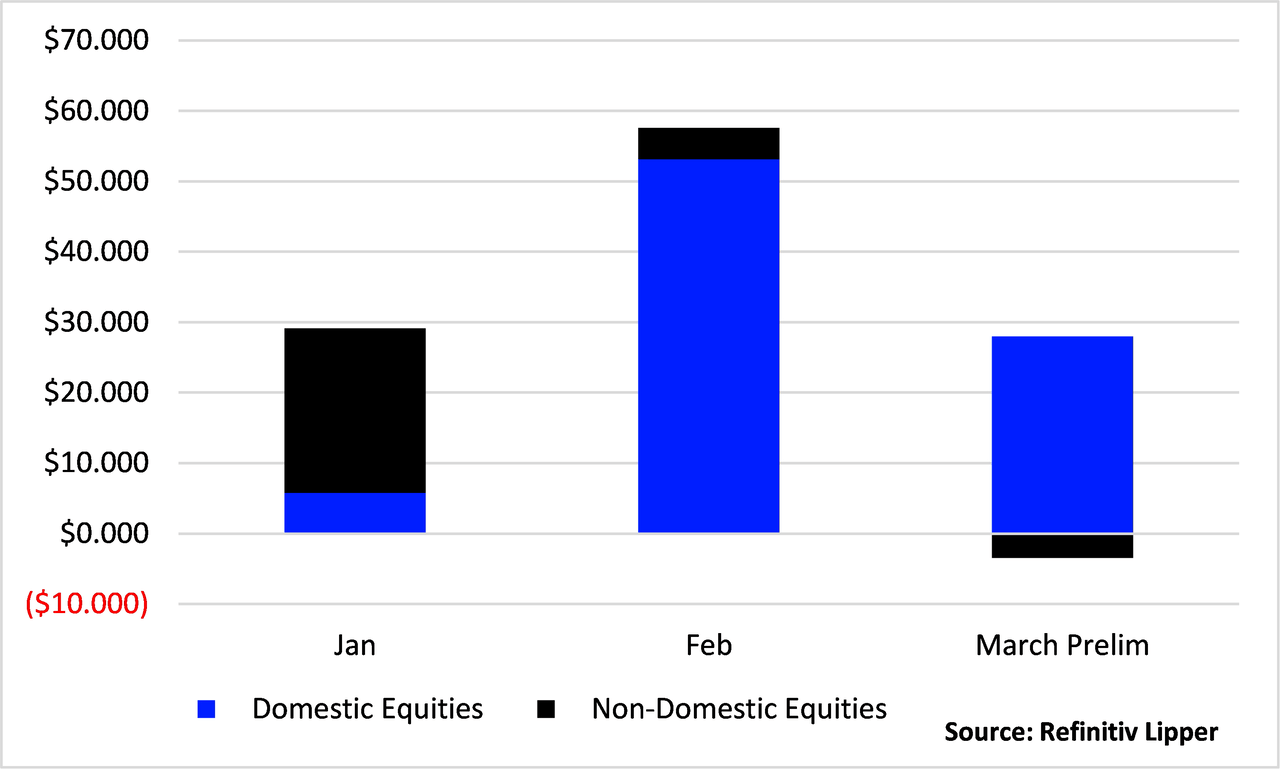

Despite the rough quarterly performance, trailing one-year returns and March month-to-date returns were strong for equity markets. Investors continued to pile into equity funds, adding another $24.5 billion (preliminary) during the month. January reported huge inflows into non-domestic equity funds (+$23.4 billion), but investor preference has shifted abruptly toward domestic funds. In March, U.S. domestic equity funds attracted $28.0 billion whereas non-domestic funds reported an outflow of $3.5 billion.

Market participants have also shunned fixed-income funds in March, preliminary totals show outflows of $7.5 billion from taxable bond funds and $6.3 billion from tax-exempt bond funds. The significant rise in interest rates has forced investors to allocate toward shorter-duration funds as well as international income. Shorter duration gives investors the chance to reinvest at the higher rates quicker, while international debt provides diversification from U.S. policy rates.

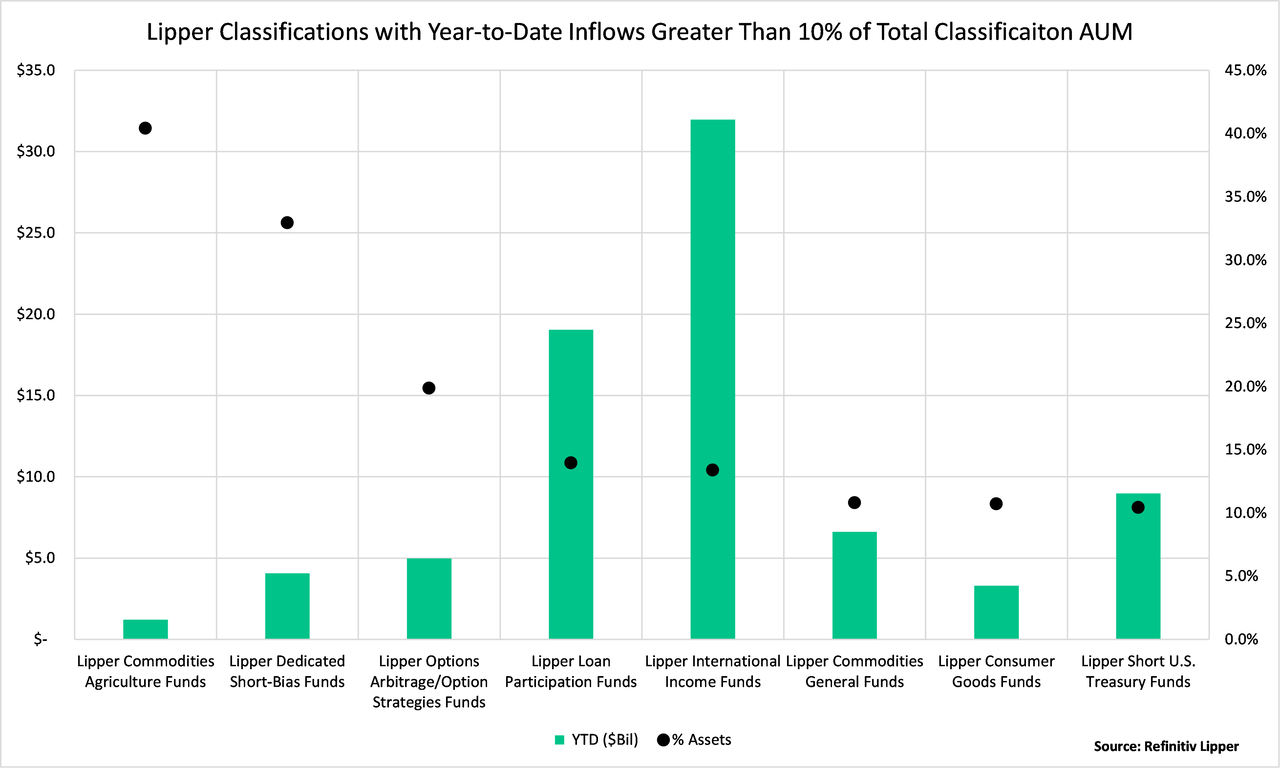

The below chart highlights the Lipper classifications which have seen significant year-to-date inflows. Each of the eight classifications has realized inflows greater than 10% of the total AUM held within the classification. Lipper Commodities Funds drew in the largest percentage of flows to classification AUM (40.4%).

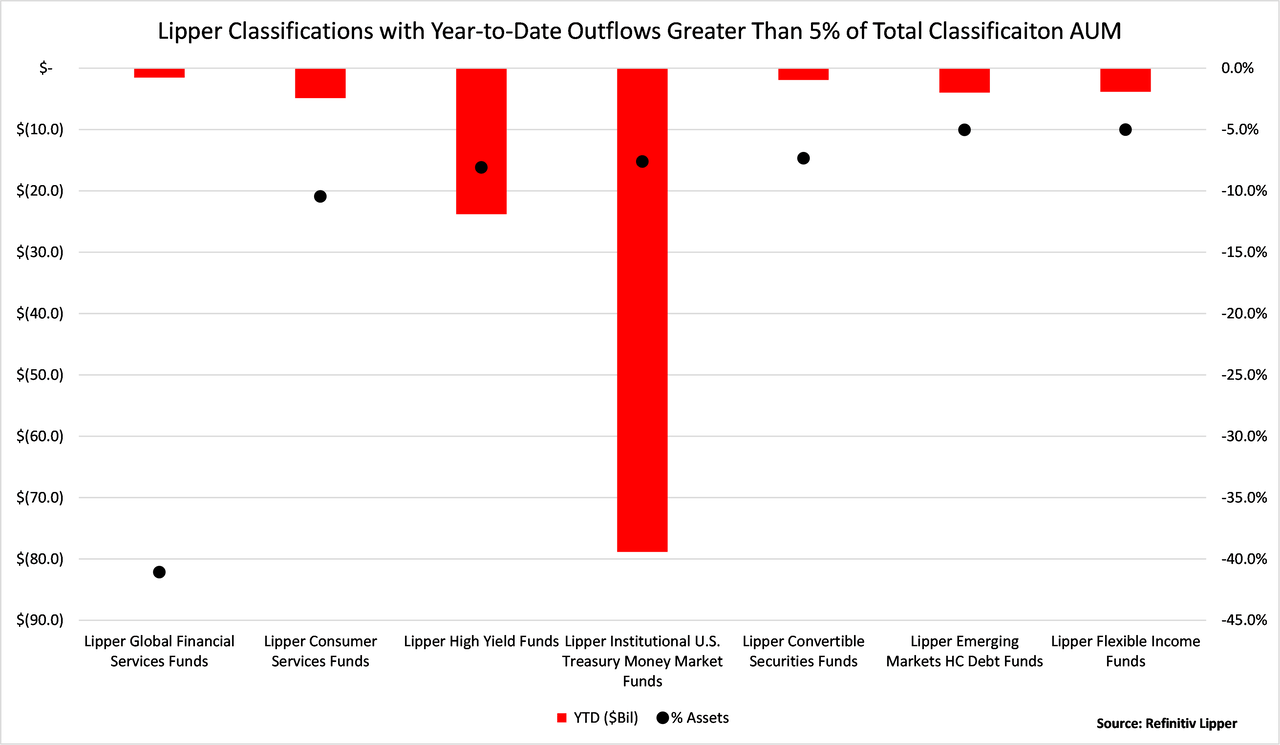

On the flip side, the below seven Lipper classifications have suffered year-to-date outflows greater than 5% of their classification AUM. Lipper Global Financial Services Funds witnessed 41.1% of their AUM withdrawal from the classification since the start of the year.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment