Minerva Studio/iStock via Getty Images

Welcome readers, as we look at A. O. Smith (NYSE:AOS), one of the loved Dividend Aristocrats with a long history of dividend raises. I’ve been on the sidelines for a while regarding this company, but I am always keen to buy quality. Today, I explain why I believe A. O. Smith is a quality company and why the present price is attractive enough for me to start a position. We will look at some challenges they have faced, but why I think the company has turned the corner and why investing in this business now puts the investor in a wonderful position to benefit from the future growth of the company.

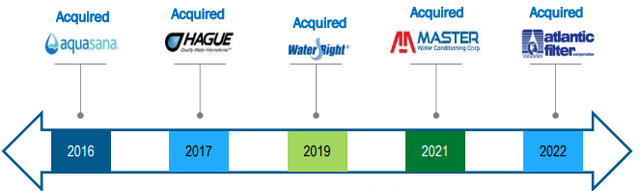

AOS has both elements of organic growth, but its strong balance sheet enables opportunistic acquisitions. They have been able to gain new businesses over the last decade that have helped to grow revenue (Figure 1).

Figure 1. AOS acquisitions (AOS’s Q2 2022 earnings presentation)

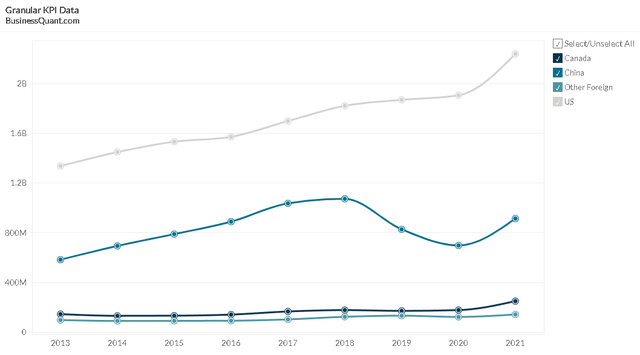

The geographic concentration of sales are predominantly U.S. but it also has strong China sales (Figure 2), which have affected the company. The COVID lockdowns have impacted sales in China, resulting in declining sales and a difficult operating environment. The U.S. sales are strong and consistent, driven by a high 80% to 85% of sales from the replacement of water heaters and boilers. This is business that should continue at a predictable pace.

Figure 2. AOS revenue by geography (BusinessQuant)

The operations and recent successes for A. O. Smith

Ultimately, the Q2 results painted a picture of the A. O. Smith business getting back on track. The adjusted EPS rose 14% YoY to $0.82 with sales up 12% YoY. The sales in North America were up 23%, partially because of the rising prices that A. O. Smith can charge to offset the inflationary costs of materials. The Rest of World sales were down 13% because of the lockdowns in China that have been lessening but not entirely disappearing, with 30 regions still experiencing lockdowns.

There have been worries about China that have dominated the discussion of A. O. Smith’s revenue and demand opportunity. We have largely moved on from these issues. There have been limited opportunities for the team to manage the situation with one element simply to reduce costs and manage margins. This appears to have been successful, as they noted on the Q2 earnings call (emphasis mine):

The steps that our China team have undertaken to right size the business and manage discretionary spend paid dividends this quarter, as China held its operating margins flat to last year despite lower sales in the quarter. The first half of July, we saw consumer demand down approximately 5% to 10% Compared to last year, a sequential improvement from second quarter consumer demand levels.

As such, the impact of these moves paid off and they noted:

rest of the world segment sales of $230 million decreased 13% year-over-year, lower sales volumes primarily driven by consumer demand headwinds in China related to COVID-19 related restrictions. Currency translation of China’s sales unfavorably impacted sales by approximately $5 million. […] In China, the impact of lower volumes was partially offset by lower selling, advertising and engineering expenses. Rest of the World segment margin was 7.9%, down 60 basis points from the same period last year.

China is an important geographic region, but it is not the sole international market. The sales in India grew strongly:

Sales in India grew 79% in the second quarter of 2022 on strong demand compared to last year, which was negatively impacted by the pandemic. We view India as a long-term growth opportunity given its attractive growth characteristics and changes in demographics. Rest of the World segment earnings of $18 million decreased 18% compared to segment earnings in the second quarter of 2021.

The sales in India are something to monitor – if AOS can continue to drive Indian sales higher in the next few years, it will certainly balance the market concentration risks that they presently have.

There have also been challenges with input costs, but they noted that the “steel indices began to stabilize at the end of 2021 and have moderated towards the end of the second quarter.” The stabilization of prices should enable AOS to manage pricing and margins more effectively in the coming quarters. The Q2 results with strong revenue growth are encouraging and show they are past the worst of the pandemic-related issues.

Is A. O. Smith a profitable business?

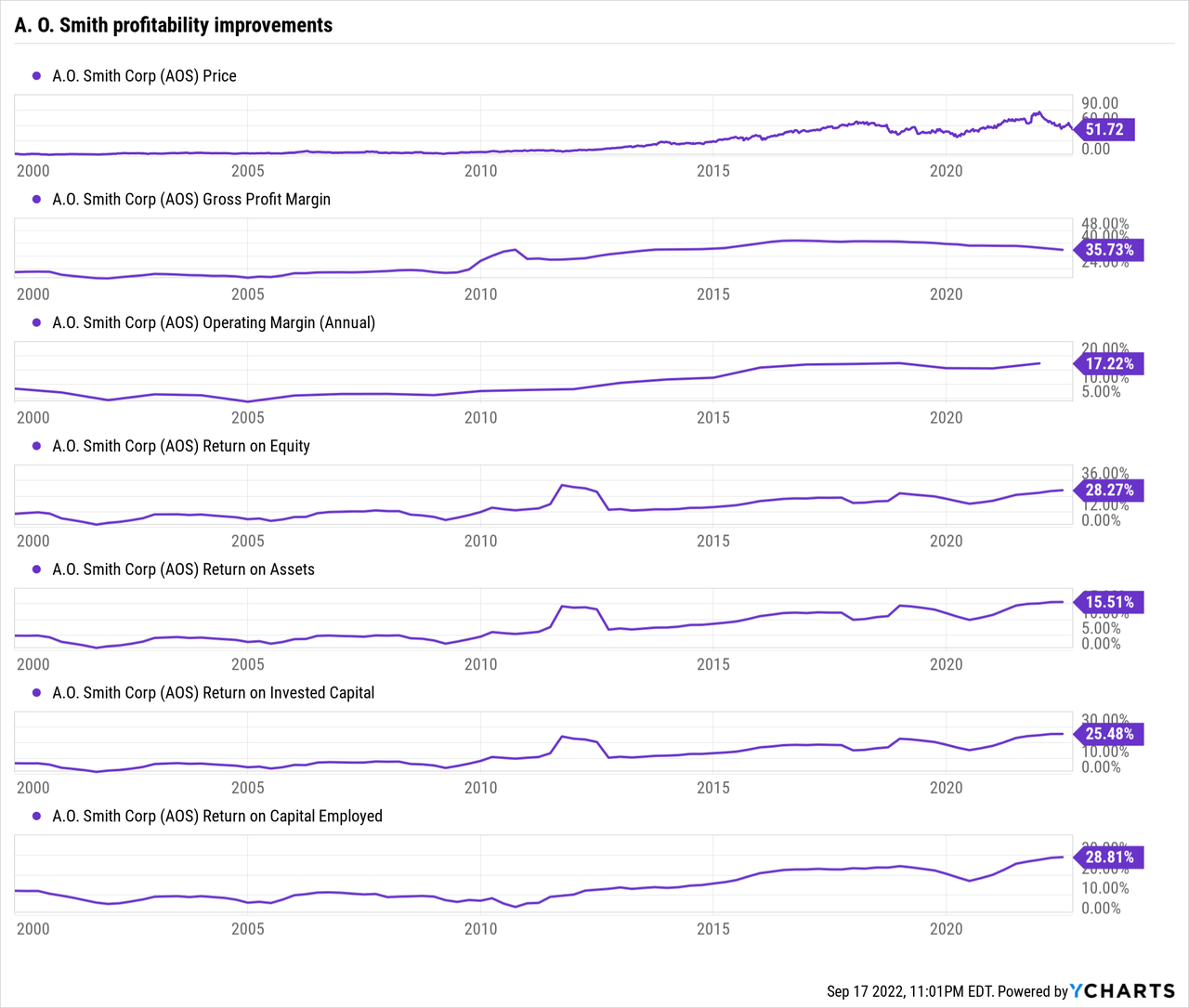

In short – yes. I rate this company highly and the metrics (and their history) paint a similar picture. There are some comparisons with peers below in Table 2, but a quick look at Figure 3 provides a historic overview of some key metrics for A. O. Smith, from 2000 onwards. We can see that margins have been good and steadily improving over the last two decades, despite a slight deterioration in the gross profit margin over the last year or so. The operating margin has improved since 2005, with ROE improving during this period. The ROA, ROIC, and ROCE have all improved and been consistently strong during these periods.

Figure 3. A. O. Smith profitability – improving with age (Source: YCharts)

A. O. Smith is a dividend aristocrat, with a long history of payments. Seeking Alpha shows it has a 2.17% forward dividend yield and a 15.17% five-year DGR. AOS scores an “A” for growth and consistency, and a “B” for safety.

Peers – valuation

To get a feel for how A. O. Smith is being valued and how they are performing, I turned to the following peer group:

- Crane Holdings (CR)

- Donaldson Company (DCI)

- Graco Inc (GGG)

- ITT Inc (ITT)

- Nordson Corporation (NDSN)

- Pentair PLC (PNR)

These are all comparable firms. They have similar market sizes and reasonable levels of financial strength (as assessed quickly with the Piotroski Score). We can see from Table 1 that CR tends to be the most under-valued of the group. However, within the group, A. O. Smith is below the average EV/EBITDA and Price/Sales, while slightly above the average Price/Book. This suggests that it is available at a reasonable valuation relative to its peers.

Table 1. AOS compared to peers in terms of valuations (the lowest valuation metric in each column has been put in bold)

| Company | EV / EBITDA | Price / Book | Price / LTM Sales |

| (AOS) | 10.7 | 4.5 | 2.1 |

| (CR) | 9.4 | 2.7 | 1.6 |

| (DCI) | 12.6 | 5.6 | 1.9 |

| (GGG) | 17.1 | 6.0 | 5.1 |

| (ITT) | 11.3 | 2.9 | 2.1 |

| (NDSN) | 18.1 | 5.7 | 5.0 |

| (PNR) | 10.6 | 2.7 | 1.8 |

| Average: | 12.8 | 4.3 | 2.8 |

Source: Author, with data from Finbox.io

There are many opportunities to invest in dividend-paying businesses in the industrials sector. While many industrials may not pay a dividend or opt for lower dividends, this peer group has some reasonable dividend yields and is about on par with the S&P 500 as a group. As we can see in Table 2, AOS has the highest dividend yield of its peer group and also has the greatest dividend CAGR. Despite this, they have a below-average free cash flow payout ratio, suggesting a safe dividend. Their ROIC and Shareholder yield figures are above average for the group and are the second highest among their peers.

Table 2. AOS compared to peers in terms of dividends, ROIC, and yield

| Full Ticker | Dividend CAGR (5y) | Dividend Yield | Free Cash Flow Payout Ratio | Return on Invested Capital | Shareholder Yield |

| AOS | 18.47% | 2.17% | 41.0% | 23.7% | 4.2% |

| CR | 5.44% | 2.07% | 37.5% | 13.6% | 5.7% |

| DCI | 5.02% | 1.78% | 65.7% | 19.2% | 2.9% |

| GGG | 11.84% | 1.36% | 66.1% | 24.7% | 2.5% |

| ITT | 12.15% | 1.50% | 46.2% | 12.6% | 0.8% |

| NDSN | 13.56% | 1.19% | 25.7% | 16.3% | 3.1% |

| PNR | -10.33% | 1.96% | 38.6% | 16.5% | 1.1% |

| Average: | 8.02% | 1.72% | 45.8% | 18.1% | 2.9% |

Source: Author, with data from Finbox.io

Risks and considerations when evaluating A. O. Smith

There are risks with any investment. As noted, AOS has a strong concentration in the U.S. and China markets; we have seen the impact of this with the trouble with sales in China amidst lockdowns over 2021 and early 2022. While AOS looks to be building sales in India, the geographic concentration continues to offer risks.

Like many industrials, AOS is reliant on input pricing that can squeeze margins. In contrast to some firms, AOS has proven resilient with strong margins and the ability to pass on costs through increases in pricing, particularly from steel. Prolonged periods of high prices in a core commodity, such as steel, may cause difficulties in passing on the costs.

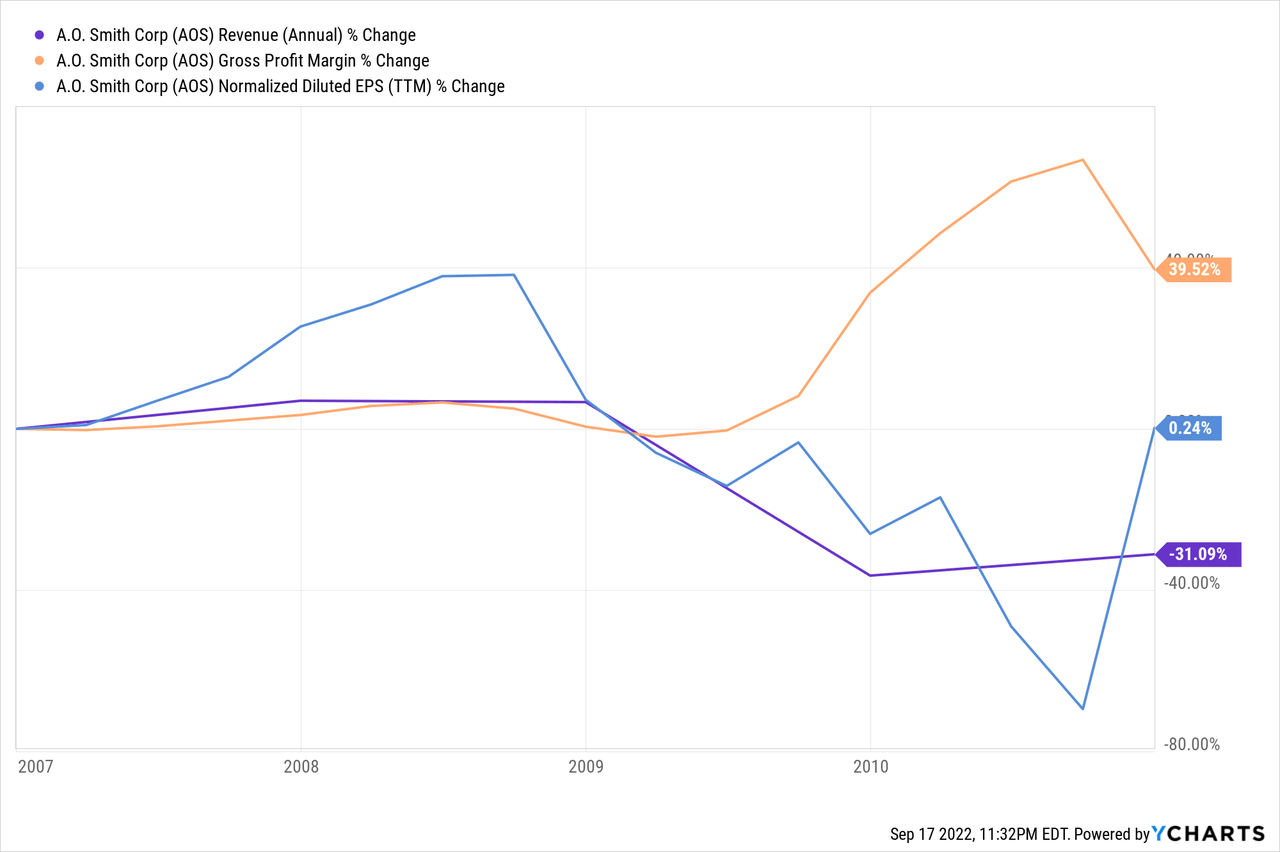

A serious economic situation or slowdown might affect sales in the U.S. While there is some security from the large proportion of U.S. sales being in replacement equipment, sometimes these purchases might be deferred by customers and sales might decrease. For example, during the global financial crisis, we saw the P/E decrease to about 7.6 in early 2009. Meanwhile, in Figure 4, we see the changes in revenue, gross profits, and normalized diluted EPS; the revenue drop of 31% is notable and worth considering as evidence that AOS sales are not guaranteed.

Figure 4. AOS metrics during the global financial crisis (Source: YCharts)

Valuation and thoughts about an investment in A. O. Smith

I have established that A. O. Smith is a good business and the next issue is whether I can buy at a good price where I have a reasonable yield and upside potential. I like to use analysts’ estimates of future earnings and historic P/E multiples to assess the likely future price in several years. The calculations rely on analysts’ estimates being accurate and P/E ratios reverting to historical levels; both elements are uncertain and so, like any estimation, there is an element of uncertainty in this approach.

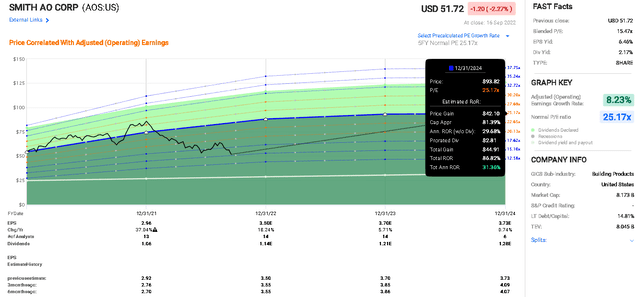

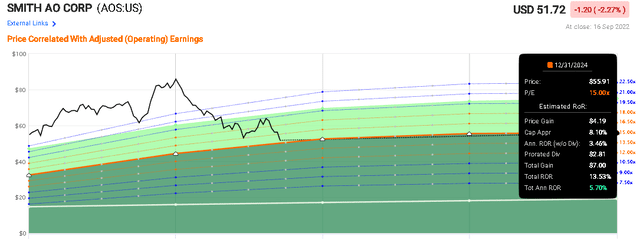

The FAST Graphs Analyst Scorecard for AOS suggests the analysts do a good job of getting the forecasts right. They have a 23% beat, 62% hit, and only 15% miss on the two-year forwards (with a 20% margin of error). Thus, I have confidence in relying on the estimates of earnings. Further, if we look at the lower panel of Figure 5, we can see that the revisions in the last six months have been moderate, suggesting a level of stability.

If we assume that A. O. Smith can reach the end of 2024 and regain the same P/E ratio they have had for about five years (25.17x), this would cause a total rate of return of 87% or an annualized ROR of 31%. I note that the last five years have shown a premium P/E multiple for AOS; while I’ve argued the business is high quality, I am uncertain it warrants a multiple this high.

Figure 5. AOS calculations based on a normalized P/E in 2024 (FAST Graphs)

I also consider more conservative outcomes. For instance, Figure 6 shows the outcomes if, at the end of 2024, a very reasonable P/E of 15x is obtained. This outcome would provide a total rate of return of 13.5% or an annualized RoR of 5.7%. Over time, I think the P/E multiple will settle above the 15x level and I think a P/E of 18x to 20x would be warranted for a quality company like A. O. Smith. Even if AOS achieves a multiple of 17.62x at the end of 2024, this suggests a total RoR of 32% and an annualized RoR of 13% (Source: FAST Graphs calculator).

Keep in mind that the P/E could go lower, as I noted earlier. It could, feasibly, fall into the single digits (such as it did during the global financial crisis). If the earnings were maintained or went flat, this would suggest that prices could still fall quite a way, showing the potential for capital losses.

Figure 6. AOS calculations based on a 15x P/E in 2024 (FAST Graphs)

Note downward price pressure since the start of the year (Figure 5). We are buying a quality business as it becomes cheaper, as it enters a more attractive valuation. In this respect, buying now may feel strange, but it is simply waiting for an attractive business when it is on sale at a reasonable price. At this price, I see that there is the potential for further decreases in price but it is a reasonable value and I have an expectation of both improvements in income (through the dividend CAGR) and capital appreciation as prices return to a more normal P/E ratio and the earnings improve. Analysts counts seem positive and also see upside with five Buys, eight Holds, 1 Underperform (Source: Finbox.io).

Buying a dip like we see now enables us to enter a position in a quality business and benefit from the earnings growth the company experiences. Thus, we can take advantage of a decline in market prices to buy a quality business.

A quick overview of my thoughts on A. O. Smith

Below, I summarize my thoughts.

- Business – a strong, profitable business with opportunities for international growth. Challenges related to the pandemic seem to ease.

- Valuation – reasonably priced but not high value. Good opportunity to benefit from increasing P/E multiples and increased earnings.

- Financial safety – strong balance sheet and metrics.

- Dividend – reasonable yield for the sector with strong CAGR measures and safety.

- Catalysts – No major catalysts.

- Recent management moves – growth in India was good and presents a pathway to future growth. Good product development and acquisitions.

A. O. Smith – investment thesis

A. O. Smith remains committed to dividend payments and has a long history of operational success. Despite the recent challenges presented by the COVID pandemic, the firm has maintained successful operations. Their balance sheet remains strong, sales are picking up, and margins are good. A. O. Smith remains ahead of its peers and is a business I am happy to own at the right price.

My analysis of the opportunity suggests that this is a good time to start a position. While there remains downside opportunity, the dividend status, and long-term viability of the company remain strong. AOS is at a reasonable value here relative to the company quality, but certainly not deep value.

As a result, I rate A. O. Smith as a Buy and I will buy the dip and start building a position this week.

Thank you for taking the time to read this analysis. Let me know if you have questions or if there are any other companies you think I should examine

Be the first to comment