marchmeena29/iStock via Getty Images

Introduction

The market this year is wild. Volatility is back, high-growth stocks are in a bad place and economic growth expectations and consumer sentiment are plummeting. It’s a truly tough environment for traders. For long-term investors who stick to their game plan not so much. Although sitting on unrealized capital losses or lower unrealized capital gains is never fun, I enjoy it when high-quality stocks offer us more attractive buying opportunities, even if it drags down my portfolio. The A. O. Smith Corporation (NYSE:AOS) is a fantastic example of a dividend aristocrat that has delivered value for decades through all kinds of cycles. In this article, I will explain why I like the sell-off and why this industrial company might be a good fit for your dividend (growth) portfolio. So, bear with me!

Quality With A Capital Q

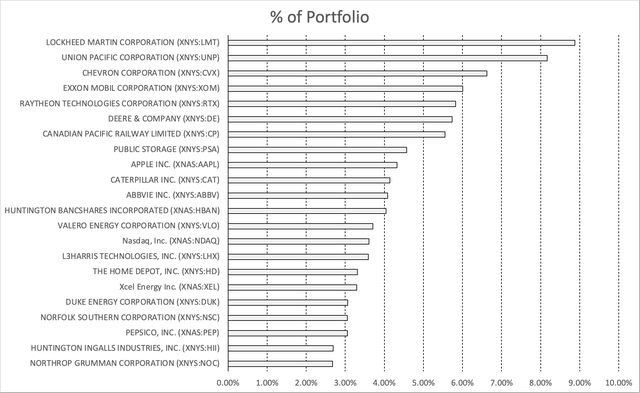

My investment philosophy isn’t extremely complicated. I try to buy “quality” at a good price. I look for high(er) yield as well as dividend growth opportunities in the United States. I have invested 95% of my entire net worth in the 22 stocks listed below. Roughly half of them are industrials. Whenever I buy a stock, I try to make the timeframe “forever”. That’s a long time and the main goal behind that thinking process is to pick something that I won’t sell when the market tanks. This is only possible because I understand the companies that I own. I know that some will fall hard in a recession, but I know that they will more than likely bounce back just as fast. The same applies to AOS right now.

While I do not own A. O. Smith, it’s one of the stocks investors will enjoy owning.

The company has one operating segment: water heaters, boilers, tanks, and water treatment.

According to the company, “We believe we are the largest manufacturer and marketer of water heaters in North America with a leading share in both the residential and commercial portions of the market. In the commercial portions of the market for both water heating and space heating, we believe our comprehensive product lines and our high-efficiency products give us a competitive advantage. Our wholesale distribution channel, where we sell our products primarily under the A. O. Smith and State brands, includes more than 1,100 independent wholesale plumbing distributors serving residential and commercial end markets.”

With a market cap of $10.4 billion, this Milwaukee, Wisconsin, based industrial company is one of the leading companies in its industry. It sells roughly 70% of its products in North America, with the remaining piece of the pie coming from all parts of the world. One of these countries is China where the company has operated for more than 25 years. AOS has more than 13,000 points of sale in China with 5,800 retail outlets in tier one and tier two cities. Since 2008, the company is also operating in India.

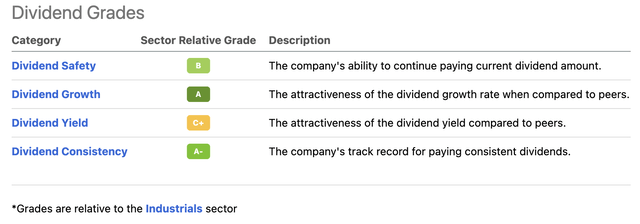

Furthermore, and with regard to quality, the company scores extremely high on Seeking Alpha’s dividend scorecard, which can be accessed here. I will give you the details in this article, but looking at the overview, we quickly see an A- for consistency, an A for dividend growth, a B for safety, and a C+ for yield.

The C+ is justified as the dividend yield is currently 1.7%. That’s not a lot. However, before high-yield investors stop reading, allow me to show you dividend growth and safety first, as there’s a lot more to it!

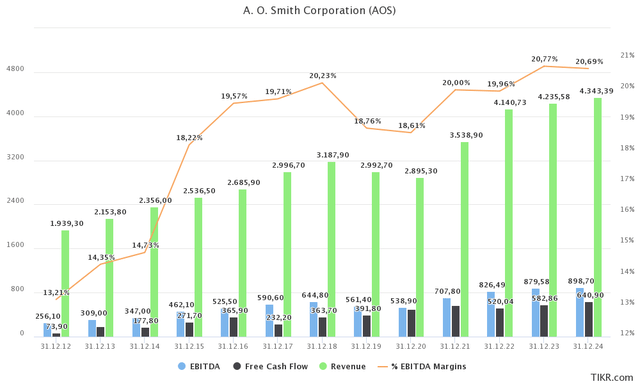

To me, a great company is a company that can consistently grow sales, EBITDA, and margins while also generating high free cash flow. Free cash flow is basically net income adjusted for non-cash items and capital expenditures. It’s cash a company can spend on dividends, buybacks, and debt reduction.

In the case of A. O. Smith, we’re dealing with a beautiful long-term uptrend in all of these financial indicators. In 2012, the company did $1.9 billion in sales, $256 million in EBITDA (13.2% margin), and $74 million in free cash flow. Including 2022-2024 expectations, we’re dealing with the following long-term implied growth rates in 2012-2024E:

- Revenue: 6.5%

- EBITDA: 10.2%

- Free cash flow: 18.1%

These growth rates are no guarantee for future performances, but they are stunning, nonetheless. The company is a great example of a major player that uses its dominant position to improve margins, its market share, and its ability to turn income into free cash flow.

To give you an idea of how much $580 million in expected 2023 free cash flow is, it’s roughly 5.6% of the company’s $10.4 billion market cap. The company’s current dividend yield is 1.7%. If AOS were to spend all of its FCF on dividends, investors would be sitting on a 5.6% yield. In this case, the company achieved a 116% free cash flow conversion. This means FCF was 116% of net income, which is an indication of “quality” earnings.

The company isn’t paying out all of its free cash flow, but it gives you an idea of why dividend growth has been so impressive – which I will show you now.

Dividend Growth

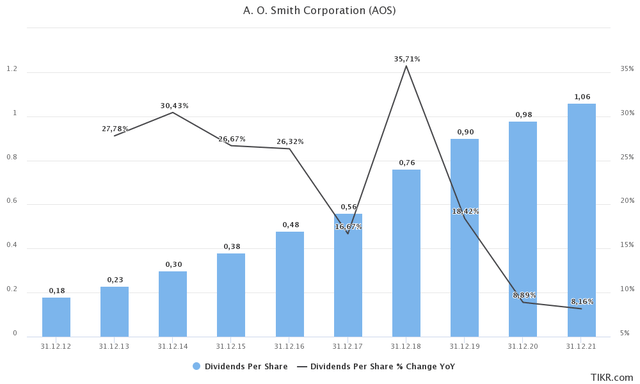

The Seeking Alpha scorecard I just showed you gave AOS an “A” for dividend growth, which makes sense.

The 10-year compounded annual growth rate of AOS’ dividends is 21.4%. This drops to 16.7% and 10.5% on a 5Y and 3Y basis, respectively. That’s still not bad as 10.5% annual compounded dividend growth turns a 1.7% yield into a 4.6% yield on cost ten years from now.

Dividend growth is impressive because of the company’s capital allocation priorities. The company’s dividend is a top priority after capital has been set aside for organic and acquired growth. These investments are already accounted for in my free cash flow numbers as it excludes capital expenditures.

The company has increased its dividend for 30 consecutive years, which makes the company a dividend aristocrat. In this case, it’s somewhat rare to deal with an aristocrat that has a 10-year dividend growth CAGR of more than 20%.

Note that the company also engages in buybacks. In 2021, $367 million was spent on share buybacks. That’s roughly 3.5% of the current market cap. Between 2017 and 2021, the number of shares has been reduced by 7.4% or 1.5% per year. That’s not very much, but it’s a nice addition on top of high dividend growth.

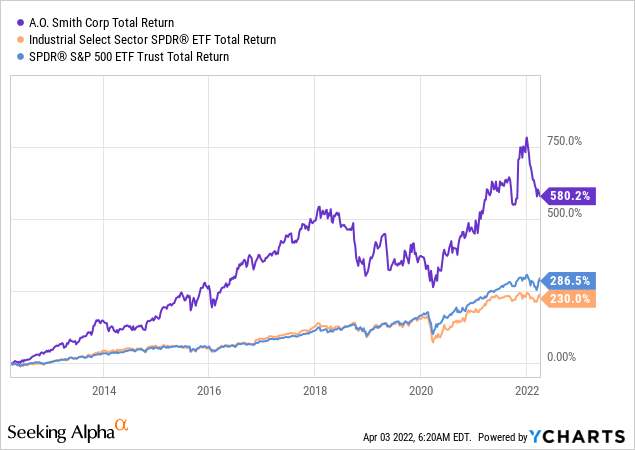

As a result, the company has performed both its sector peers and the S&P 500 on a 10-year basis. It returned almost 300 points more than the S&P 500, which is truly remarkable for a company founded in 1874.

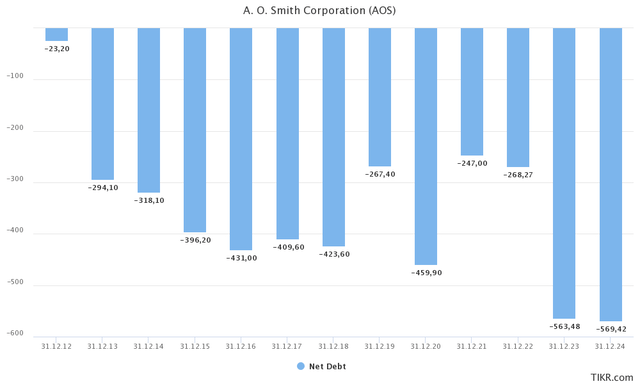

With that said, high dividend growth is only possible because the company maintains a very healthy balance sheet. After all, companies with a high debt load need to prioritize debt reduction in order to reduce interest payments and maintain financial stability.

In the case of AOS, we’re dealing with one of the healthiest balance sheets I’ve discussed on Seeking Alpha – ever. The company has just $190 million in long-term debt. $146 million of this consists of term notes with insurance companies expiring between 2029 and 2034 with average interest rates of 3.1%.

When we include cash, we get a negative net debt result (net debt = gross debt minus cash). In this case, the company has very high negative net debt, which is means net cash. The company has so much net cash that there is no need to ramp up lending or to use free cash flow to increase the cash position on the balance sheet even more.

This is as healthy as it gets.

So, what about the valuation? After all, good things don’t come cheap.

Valuation

A. O. Smith is down 23% year-to-date. That’s a big decline, especially because the market is down only 4.6%.

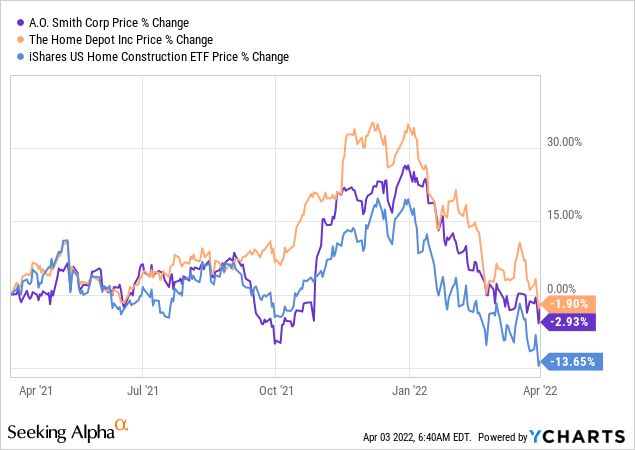

Do you know what this reminds me of? My own investment in Home Depot (HD). I think it’s fair to say that Home Depot is one of the best dividend growth stocks in the world, yet it’s down 27% year-to-date.

What we’re looking at is housing/construction weakness. It doesn’t matter how good one’s product is, when investors bet on a slower housing market, they start de-risking their portfolios. Hence, The Home Depot, A.O Smith, and the iShares US Home Construction ETF (ITB) are falling in lockstep.

As weird as it may sound, I’m actually enjoying this downtrend despite having a (relatively) big position in Home Depot. Dividend growth stocks are getting a better valuation, which means we get to buy a higher yield. It’s a good thing to have every once in a while, except for retired investors who want to cash out.

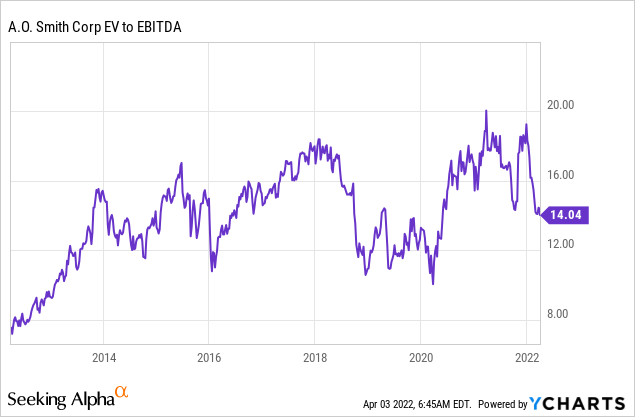

In this case, we’re dealing with a $9.8 billion enterprise value for AOS. That’s based on its $10.4 billion market cap and $560 million in expected net cash in 2023. That way, I get to price in some of its free cash flow growth. Pension liabilities are neglectable.

$9.8 billion is 11.9x and 11.2x 2022 and 2023 EBITDA expectations, respectively. That’s a good valuation as investors have consistently valued the company at roughly 15x EBITDA.

This leads me to the following conclusion:

Takeaway

I have never researched AOS, and that’s an issue. AOS deserves to be on everyone’s radar as it’s truly one of the best dividend growth stocks on the market. The company has a straightforward business model tied to construction demand and a rock-solid balance sheet. The company has hiked dividends for more than 30 consecutive years and still has double-digit annual dividend growth.

Its 1.7% yield isn’t very high, but I think it’s a good deal for long-term dividend growth investors. The company has so much net cash that there really isn’t a good use for its high annual free cash flow except for high dividend growth and buybacks.

The current stock price decline is caused by lower construction sentiment caused by rapidly rising (mortgage) rates, slower economic growth, imploding consumer sentiment, and fears that the Federal Reserve might break something by hiking aggressively.

As a result, AOS’ valuation has reached a very attractive point.

The problem is that I’m not sure if this is the bottom. We could see 10-20% more downside depending on the severity of the housing downturn – if it continues.

Hence, I advise investors who are interested to initiate a starters position. Expand the position by buying regularly i.e., on a quarterly basis. That way, entry “risk” is spread out a bit. It would be a mistake if AOS were to take off right away, but I don’t think that’s happening.

For that reason, I will maintain a neutral rating despite the fact that I’m extremely bullish on a long-term basis.

On a side note, the only reason I won’t be buying is that I have 50% industrials exposure. Most of them (except for aerospace) are in some way tied to construction. Adding even more exposure in that area only makes sense if I diversify first.

(Dis)agree? Let me know in the comments!

Be the first to comment