The most anticipated moment for bulls arrived on Friday. Ever since June, investors were certain that the Federal Reserve will deliver the goodies in 2023. Every data point was seen with this view. Surely, the central bank that did not see inflation coming in 2020 and saw it as transitory in 2021, would look for excuses to start rate cuts in 2023? Not happening.

Powell’s Speech

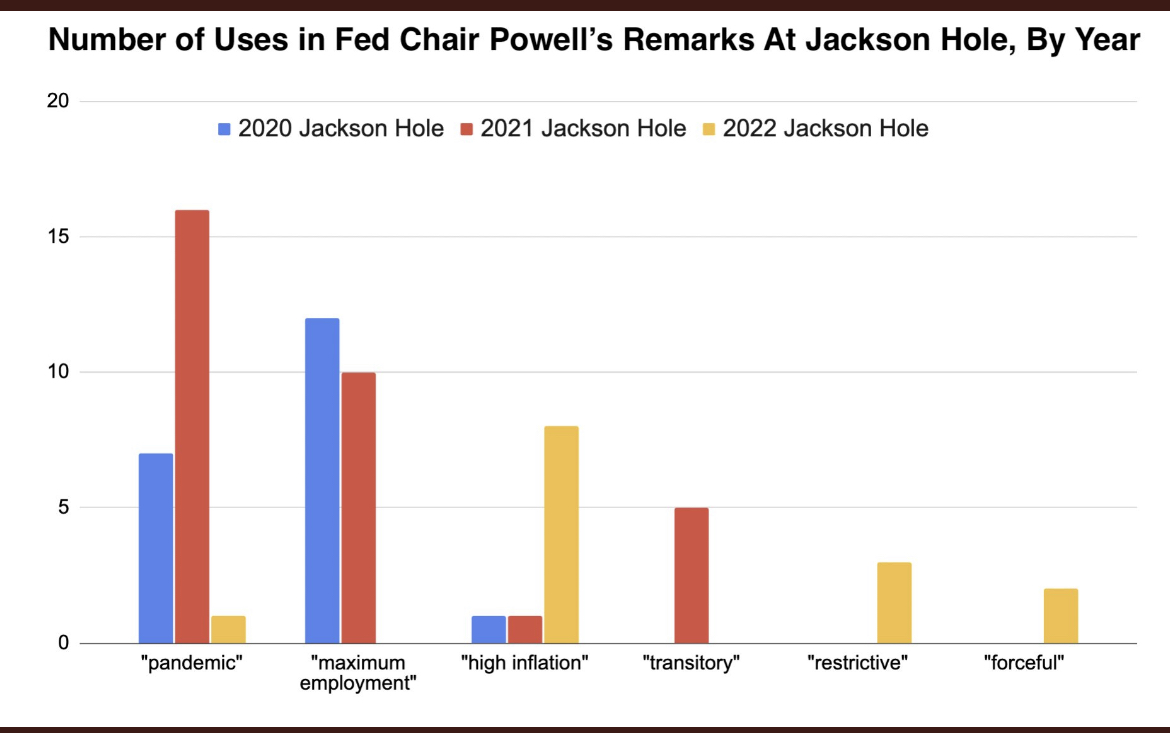

The word plot on the speech pretty much told you what you needed to know. It was about high inflation and it was about reasserting control on the narrative.

Twitter

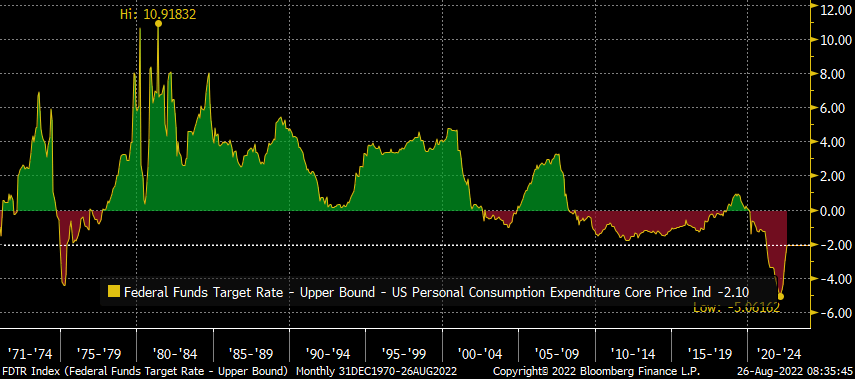

Investors have to realize that there are no goodies coming their way. Powell and Co. may slow down the pace of rate hikes, even pause to reassess, but they are not cutting, not with their preferred measure of inflation being 5% higher than Fed Funds rate.

Richard Bernstein-Twitter

You might notice that it is still the most negative number in the last 50 years. What does this aggression mean for your investments? We cover that under 4 areas.

US Economy

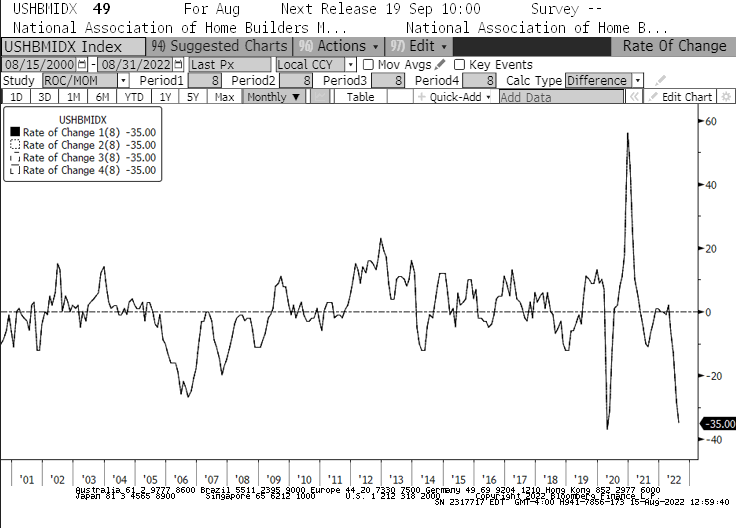

The major massive headwind facing US specifically is that housing is absolutely tanking.

Steph Pomboy-Twitter

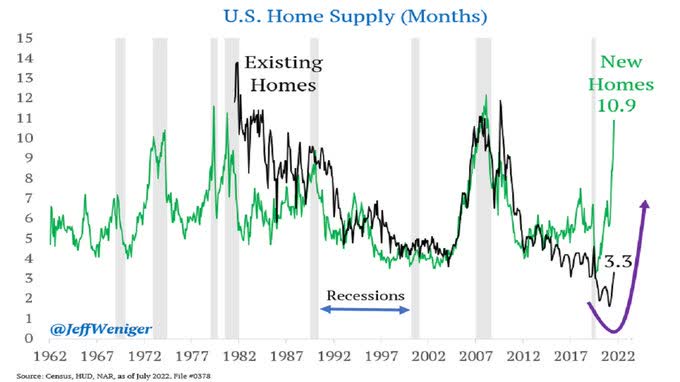

Supply of new homes is now at 11 months of sales.

Jeff Weniger-Twitter

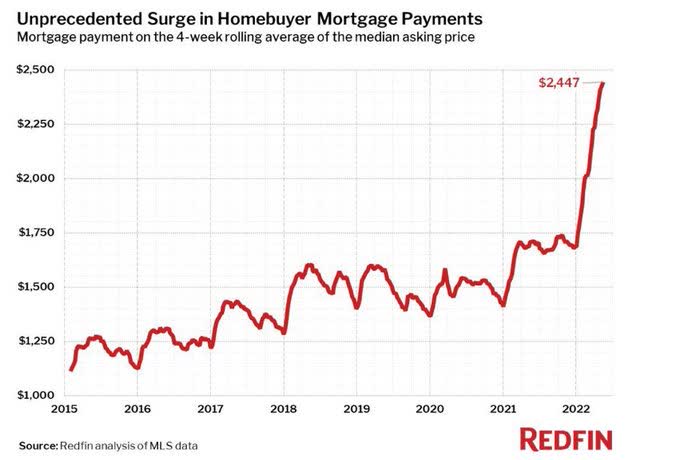

No one should be surprised by that considering where payments have gone.

Redfin-Twitter

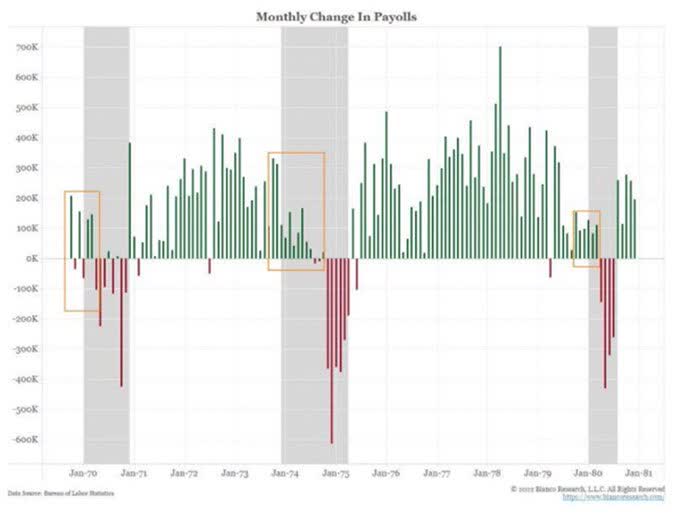

Labor Markets look strong, but that is expected in stagflationary recessions.

Twitter

Global Economy

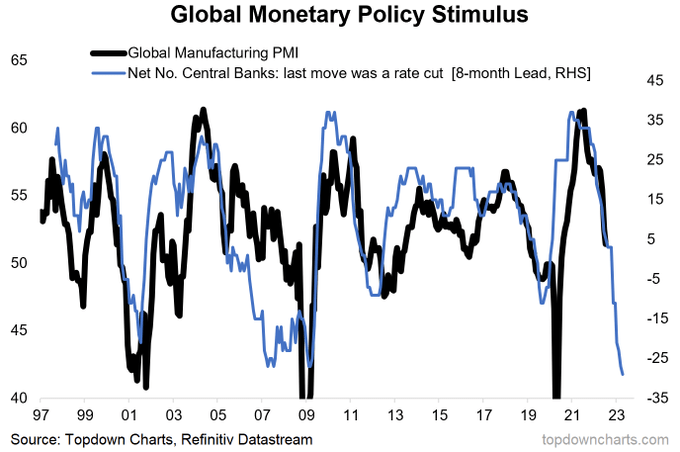

It is not just the US Federal Reserve that is tightening. Most others are and the results won’t look pretty. Global PMI is likely to crash right down to the 40s.

TopDown Charts-Twitter

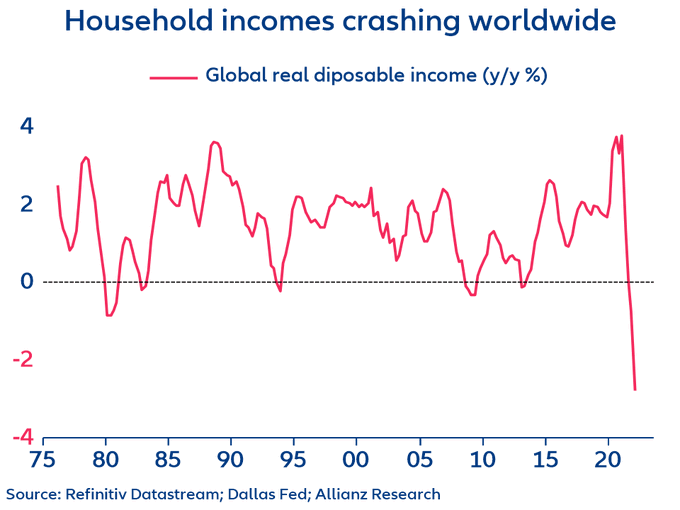

That fits in line with how quickly real (adjusted for inflation) disposable incomes are crashing.

Dallas Fed-Twitter

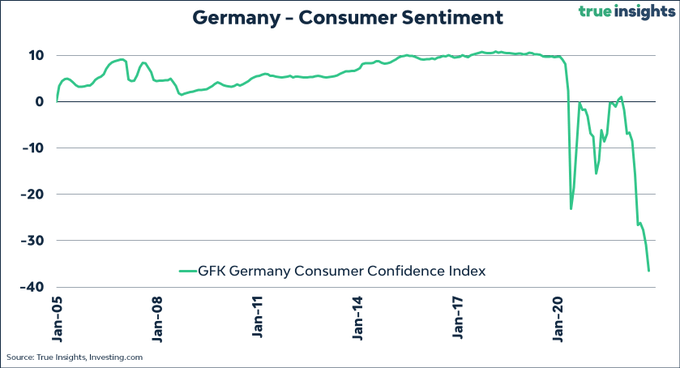

We outlined the issues in China recently and Europe’s powerhouse Germany looks about as bad.

True Insights

The chart above had to be rebased to accommodate that sentiment.

Earnings

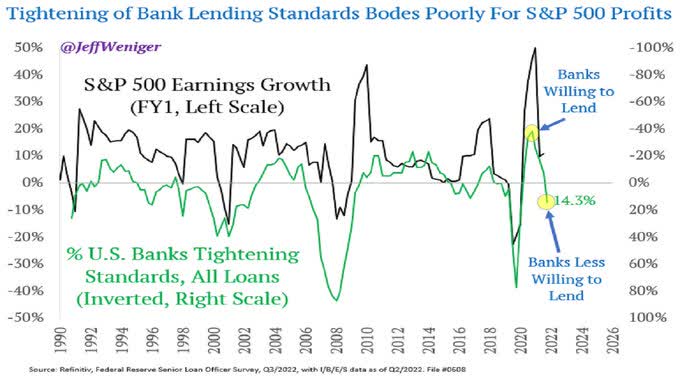

Earnings always do far worse than what investors expect in a recession. As banks tighten lending, profits follow lower.

Jeff Weinger-Twitter

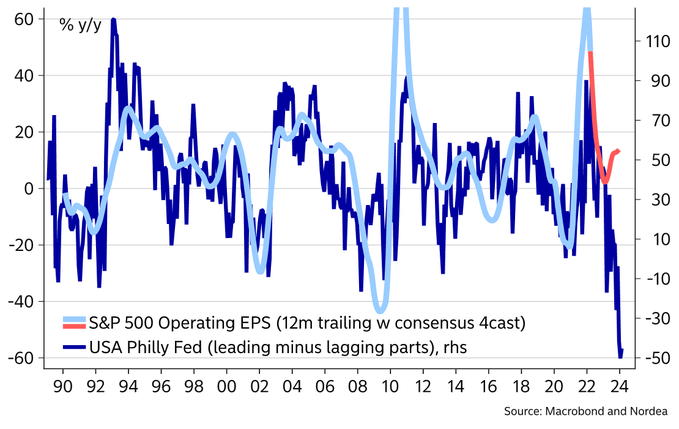

The Philly Fed Model for earnings delta is the lowest it has been.

Nordea

Consensus is looking for $230 in earnings for the S&P 500 (SPY) next year. We are looking for $180 in our best-case scenario.

Outlook For The Markets

Powell will pivot after the markets move far lower and inflation subsides. If there is a premature turn, it will be because the economy performs extremely badly relative to even their pessimistic expectations. Remember in that case, stocks will ignore the central bank stimulus until valuations normalize. We witnessed this in both the 2009 and 2001 recessions. We would expect a sub 3,000 SPX in that scenario.

If our best case comes to pass and we do deliver $180 in earnings on SPX, the markets could do better. If the Federal Reserve aggressively eases into that because inflation falls, we could support an 18-20X multiple on that level of earnings. That would get us to SPX 3,240 – 3,600. Stay defensive.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment