SolidMaks/iStock via Getty Images

Nothing ever becomes real ’til it is experienced.“― John Keats

Today, we look at a small manufacturer of non-lethal security solutions. After a steep pullback over the past year, the shares look more than reasonably valued and the stock has seen some recent insider buying as well. An analysis follows below.

Company Overview:

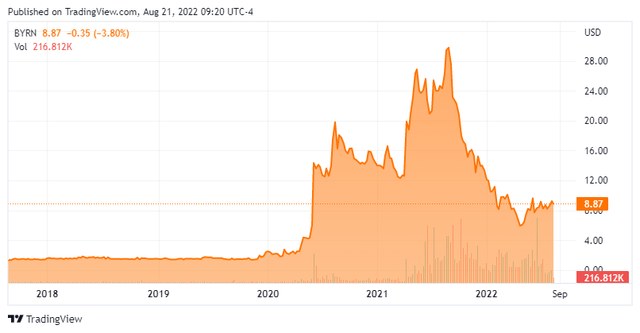

Byrna Technologies Inc. (NASDAQ:BYRN) is an Andover, Maryland based manufacturer and retailer of security solutions that do not require the use of lethal force. The company’s product portfolio includes handheld personal security devices and shoulder-fired launchers, an attendant line of projectiles, as well as other safety products and accessories. Byrna was formed in 2005 as Security Devices International, initially listing on the OTC Bulletin Board in 2006 after pricing an IPO at $2 a share when giving effect to a 1-for-10 reverse stock split in 2021. It converted to its current moniker in March 2020 and listed on the NASDAQ in May 2021. Shares of BYRN trade just under $9.00 a share, translating to a market cap of approximately $200 million.

The company operates on a fiscal year (FY) ending November 30th.

Product Portfolio Overview

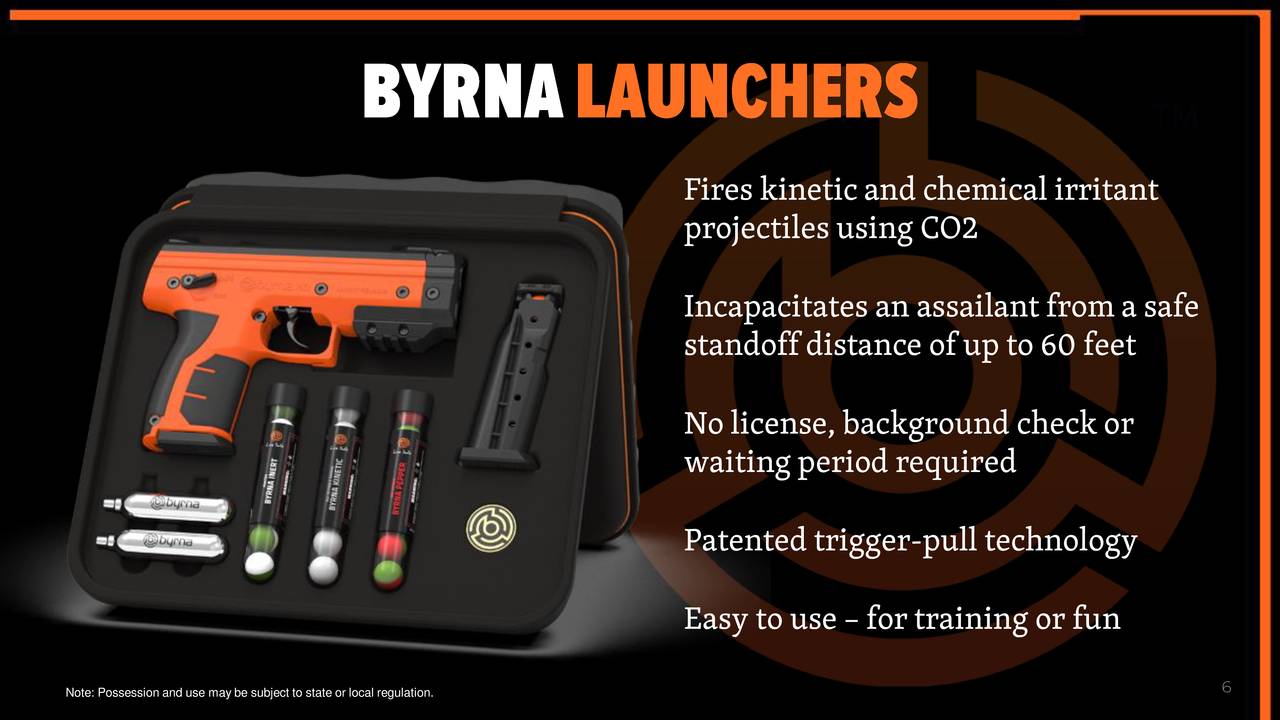

Byrna’s flagship product is Byrna SD, a handheld device resembling a handgun with a magazine that holds and fires up to five .68 caliber projectiles accurately at ranges much greater than that of tasers or pepper spray. Aided by CO2 cartridges, it shoots pepper, eco, and kinetic projectiles that look like paintballs, which cause painful yet non-fatal harm upon impact. Byrna SD is designed to stop a would-be assailant, and online demonstrations appear to bear out its efficacy. Although it looks like a firearm, it is not one as per federal law, making its purchase relatively simple.

October 2021 Company Presentation

In May 2021, the company acquired Mission Less Lethal, a manufacturer of .68 caliber, non-lethal, shoulder-fired launchers for law enforcement and correctional personnel. Byrna plans to leverage this technology to develop a compact rifle that can fire 19 rounds in rapid succession at more than 325 feet per second. The company also released Byrna M-4, a full sized rifle with either 120-round capacity for law enforcement applications or two 20-round magazines for civilian use.

The product portfolio is a razor-razorblade model featuring several different projectiles. The pepper projectile contains a blend of pepper and tear gas that is designed to burn an attacker’s eyes and skin while temporarily making it very difficult to breathe. Byrna offers cheaper plastic projectiles for practice and fully biodegradable projectiles that can be employed for both safety and recreational purposes. The company recently started developing 12-gauge ammunition, which is accurate at distances greater than 25 meters and with a simple conversion can be used in standard 12-gauge shotguns. Introduction is likely in late FY22 or FY23. In addition to less-lethal handguns, rifles, and projectiles, Byrna sells accessory products such as laser sights, flashlights attachments, barrel extensions, and apparel. It also recently added self-defense spray maker Fox Labs for $2.2 million in May 2022.

October 2021 Company Presentation

Market Expansion Strategy

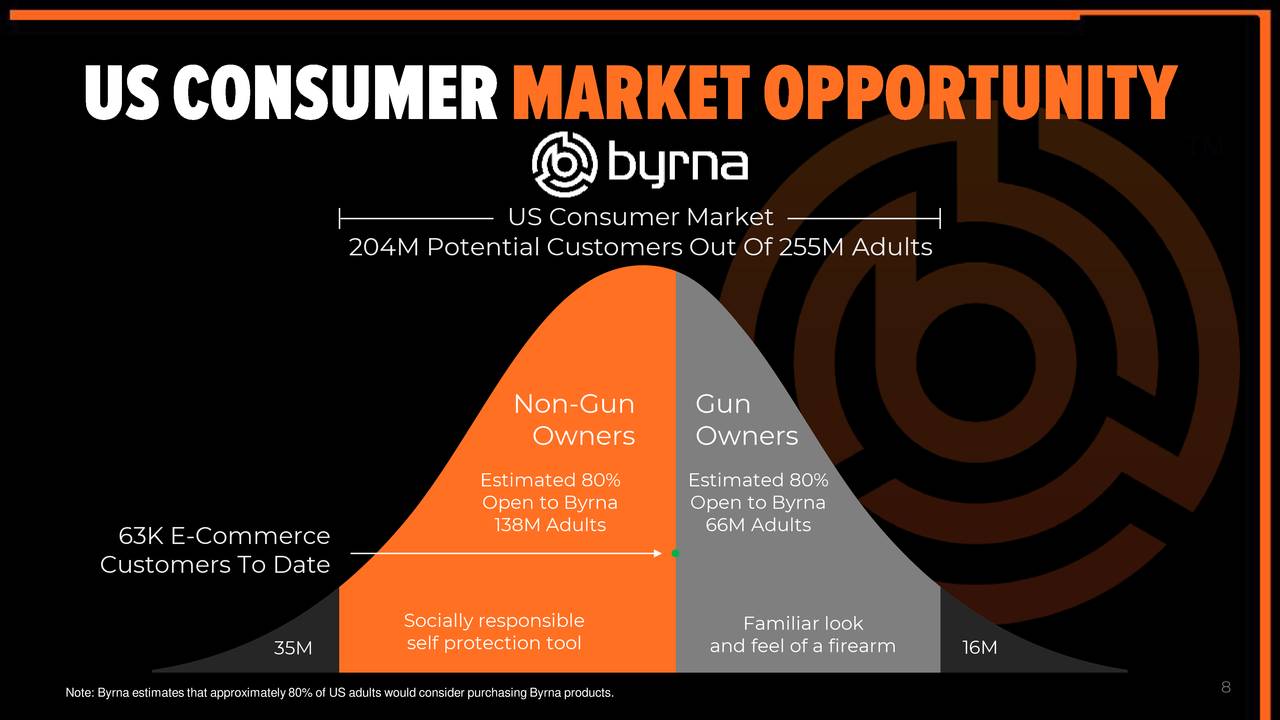

The global ‘less-lethal’ security market, which is dominated by offerings – primarily tasers – from Axon Enterprise (AXON), is projected to reach $12 billion by 2023. Byrna’s approach to attaining a large share of this opportunity is through the marketing of its products specifically to both civilians and law enforcement. It sells to consumers through its website and Amazon.com (AMZN), as well as 1,300+ outdoor and sporting goods stores. The company announced in May 2022 that Bass Pro Shops and would carry the Byrna SD at 46 of their locations. By contrast, it targets the professional security market through training programs designed to educate police and correction officers on the proper use of its products and de-escalation tactics. One of the offerings it was marketing to this demographic was a 40mm blunt impact projectile [BIP] with a collapsible gel head, but third-party manufacturing issues suspended its production in FY21. Byrna recently resolved this issue by out-licensing its IP and tooling for its BIP to Facta Global of Canada. In addition to an undisclosed sum of cash and future royalties, Byrna maintains the exclusive commercial license for the U.S. and South African markets. As can be gleaned from the prior sentence, Byrna also sells its products internationally, supplied primarily by its manufacturing facility in Pretoria, South Africa. International sales accounted for 8% of FY21 total (ending November 30, 2021).

The company’s generated FY21 sales of $42.2 million. These results were boosted when its products received significant exposure on Fox News’ Hannity Show of April 3, 2021. To further raise awareness regarding its non-lethal offerings in 2HFY22, management is developing a school safety program that features the father of a Parkland School shooting victim. It is designed to drive sales of its Byrna Shield, a ballistic-rated backpack engineered to protect the wearer from both the front and back.

October 2021 Company Presentation

2QFY22 Earnings & Outlook

With all these product introductions and reintroductions looming, Byrna reported its 2QFY22 quarter on July 7, 2022, posting a net loss of $0.13 a share (-$3.0 million) and Adj. EBITDA of negative $0.9 million on revenue of $11.6 million, versus a gain of $0.06 a share ($2.0 million) and Adj. EBITDA of positive $2.8 million on revenue of $13.4 million in 2QFY21. Gross margin was 52.7%, down from 56.4% in the prior year period. Although these metrics indicate a regression year-over-year, the prior year’s performance was impacted by the Hannity Show mention, which was worth an incremental $7.5 million of sales in 2QFY22. Removing the Hannity effect, ecommerce orders were up 114% year-over-year. Sequentially, revenue was up $3.6 million over 1QFY22. The gross margin decline was a function of freight – which was impacted by supply chain dislocations and higher energy costs – as well as a higher proportion of lower-margin international sales, which temporarily spiked to 23% of total in the quarter. Management plans to eventually switch to ocean freight once it has built inventories to a level where that transportation mode is more logistically feasible, which should drive gross margins towards 65%.

The strength of the company’s top-line momentum can be viewed through its monthly average daily Amazon.com sales, which were as follows: January 2022 $7,500; February $8,600; March $10,000; April $12,600; May $16,800; and June $20,800.

Management reiterated FY22 revenue guidance of $57.5 million (based on a range midpoint), representing a 36% increase over the Hannity-bolstered FY21.

Balance Sheet & Analyst Commentary:

As of May 31, 2022, Byrna held cash and equivalents of $25.8 million, down from $56.3 million on November 30, 2021. The drop in cash is partly a function of a share repurchase program under which it has spent $15 million buying back ~1.8 million shares to date. The average buyback price of ~$8.40 per share is well below a secondary offering the company executed in July 2021, when it raised net proceeds of $56.0 million at $21 per share. Byrna has no debt and has enough cash to fund its operations for the foreseeable future.

The company enjoys small but enthusiastic sponsorship from the Street with four buy ratings and price targets ranging from $12 to $25. On average, they expect Byrna to generate a FY22 loss of $0.03 a share (non-GAAP) on sales of $54.6 million followed by a gain of $0.40 a share (non-GAAP) on sales of $76.1 million, representing 39% growth at the top line.

In agreement with the Street’s assessment are CEO Bryan Ganz and Chief Strategy Officer Michael Wager, who purchased 13,000 and 10,000 shares (respectively) below $8 on July 12, 2022.

Verdict:

Byrne’s stock is down over 70% from its September 2021 high of $30.55 a share, which isn’t surprising given that at that time its market cap represented a 12.5 multiple to FY22E sales (company guidance). Its current market cap represents an approximate 2.5 multiple to FY23E sales (Street consensus). Between the introduction of its repellent sprays, 12-gauge non-lethal rounds, and Byrna Shield (amongst other products), the company should gather momentum in 2H22. And concurrent with expectations for its top line to grow by nearly 40% in FY23, Byrna should push decidedly into the black while its market opportunity continues to expand as the need for self-protection and non-lethal force by law enforcement authorities increases. Significantly cheapened on a forward price-to-sales basis by the selloff, below $9 represents a good entry point for a longer term investment.

Good judgment comes from experience, and experience comes from bad judgment.”― Rita Mae Brown

Be the first to comment