da-kuk/E+ via Getty Images

Dear readers,

Despite the market dropping, cash keeps coming in. If you have a job, savings, dividends, or some form of consistent income, then chances are you have excess capital to invest at some point during this year.

When I get a larger amount and I get notice – I take some time, usually a few hours, to go through exactly how I’ll invest it, much like a capital package. I set up some requirements for that money, I set up targets, and I allocate the amount based on these targets.

Because in the end – the markets can drop, they can decline over time, but investing in undervalued, good-yielding businesses means that your long-term upside is, at least potentially and theoretically, solid. That’s what I’m counting on when I do investments like this.

Market timing is a great strategy – in theory. But given the absence of any and all crystal balls, it really doesn’t work in the actual market or the real world. The real math of investing is clear on this – long-term returns for broad investing make a case for being invested even in downturns – at least if your time horizon is long-term. Missing out on those recovery days is what can essentially kill your returns compared to someone that “stays in”.

My strategy, therefore, is very simple.

I keep investing.

I continue to put money to work in the safest, most undervalued companies with the highest possible yield and safety that I can find. Not just in the USA or Canada. But in Germany, France, UK, Sweden, Norway, Finland, Denmark, Austria, Switzerland, Spain – and many other countries. International investing in undervaluation is my “spiel”.

And it’s working very well, despite the volatility of the market.

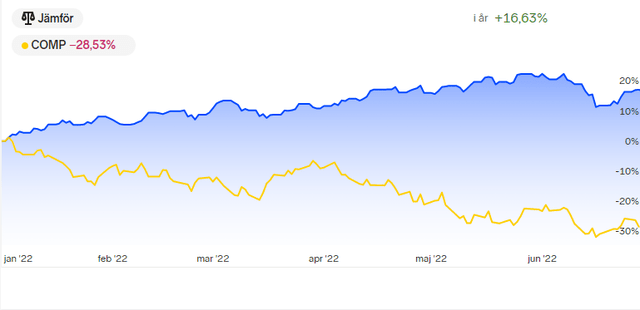

Author’s Non-SEK portfolio YTD RoR (inclusive of dividends) , compared to NAS (Author’s data)

While other investors may say that we should go “90% cash” or “stay out”, this is not my approach. As I see it, it will never be my approach.

It’s with that in mind, that I’ve made the following allocation plan for $60,000.

- $5,000 into Orange (ORAN) at a yield of 6.2%, or $310 per year.

- $5,000 into Simon Property Group (SPG) at a yield of 6.8%, or $340 per year.

- $5,000 into Manulife (MFC) at a yield of 5.06%, or $253 per year.

- $5,000 into Allianz (ALIZY) at a yield of 5.9%, or $295 per year.

- $5,000 into Munich RE (MURGY) at a yield of 4.95%, or $247 per year.

- $5,000 into Castellum (CWQXF) at a yield of 5%, or $250 per year.

- $5,000 into Stanley Black & Decker (SWK) at a yield of 2.9%, or $145 per year.

- $5,000 into Altria (MO) at a yield of 8.3%, or $415 per year.

This is a combined dividend of $2,255, or a yield of 5.63% on my invested money.

Why these companies, you may ask – well, I’ll show you why – in an abbreviated, quick-pick sort of way. For the more extensive case studies and stances, I refer you to my individual pieces on the various companies – which are usually available under the above-mentioned tickers.

1. Orange

Orange is a French telecommunications giant. I’ve been a long-term investor for some time, and since my original piece, the company is up significantly, delivering alpha and superb yield. Many investors mistake the company’s price performance with the assumption that there’s no upside left in the company.

There is plenty of upside left in Orange. Based on a conservative valuation for ORAN of a non-impaired P/E of less than 12.5X, the upside to a 14-15X P/E at this time is more than 30% annually, or 104% until 2024E.

Orange is the principal telecommunications company in France and many other nations. It’s an FTTH leader, and in the past year, we’ve seen an inflection point where EBITDA growth led by fiber and TV content will deliver long-awaited returns and growth as well as dividend stability.

Orange is a “BUY” with an upside of no less than 40%. I own 3% in my portfolio in ORAN and will buy more.

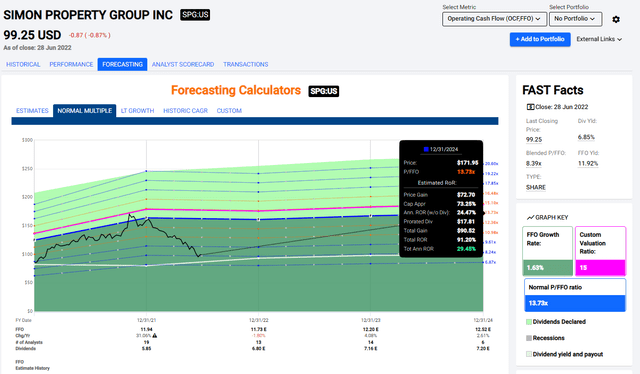

2. Simon Property Group

One of the world’s most principal Mall REITs needs no introduction. Again, investors mistake recent price weakness and drawdown in valuation with actual fundamental deterioration – but this is not the case.

The numbers coming from Mr. Simon and out of Indianapolis confirm continued growth in cash flows and operations. Forecasts currently call for a flat/1% decline in FFO, but this wouldn’t affect the REITs ability to pay its dividend or deliver alpha in any material way.

Based on a current valuation of 8.4X to P/FFO, with a typical multiple closer to 12-13X, I see an upside of 30% annually to a 13.7X P/FFO, or 91% until 2024E. This also includes a 6.8%+ yield that’s recently been raised, a superb investment-grade credit rating above most peers in the sector, and one of the best management teams in the entire sector.

Here is the upside and my target.

Disagree? Feel free to – but I’m putting my money where my mouth is. SPG has a conservative long-term PT of at least $170/share, and at this dirt-cheap valuation, my position is low enough that I can buy more. I own 4.5% of my portfolio in SPG.

3. Manulife

Not a popular insurance play, by most metrics – and I disagree with this notion. MFC is an A-quality insurance business. It’s the largest insurance business in all of Canada, not to mention also being the 28th-largest fund manager in the entire world by AUM. From a valuation perspective and appeal, the company hasn’t been this cheap in at least a year.

At an average weighted multiple of below 7X, this A-rated, 5%-yielding insurance company has one of the better upsides in the entire financial sector. At a forecasted multiple of no higher than 9X P/E, based on growth rates of around 7% for the next 3 fiscals, this investment could yield RoR of 26% per year, or 78.8% total RoR until 2024E.

There are very few real, unique risks to this company that could, or would make this a risky or somehow non-appealing investment. I consider this one of the better investments available in the sector, next to the next company I intend to present.

I’m long 1.6% of my portfolio in MFC, and I’m going to buy more. The company is a “Buy” with a PT of $26.5 for the ticker MFC on the US stock market.

4. Allianz

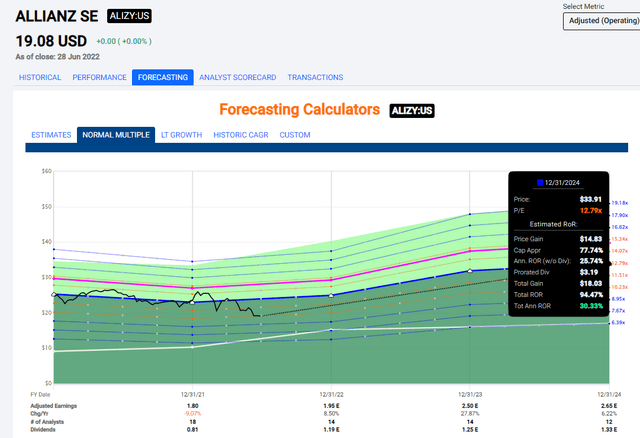

Only Allianz can be considered a “better” insurance play next to MFC from a valuation and quality perspective. Allianz is the largest insurance company on earth – it has a better credit rating (AA-rated instead of A), better yield (5.9% instead of 5%), and an upside of around 30% annually, or 95% until 2024E.

Allianz is currently valued at around 10X earnings, which is below the typical 12-13X P/E ratio that we typically see for the business. Couple this with a significant EPS growth of 14-15% annually until 2024E, and that upside and how we calculate it is, to me, obvious.

Allianz Upside (F.A.S.T Graphs)

The company is a market leader in the entire sector in Germany, but Germany, due to the company’s international profile is only 30% of the company’s total premium income – meaning the company is much better balanced than some of its peers. The company is also a leading asset manager with an AUM of close to €2T as of late 2021.

Very few things can dislodge this company fundamentally – and I see no reason in the near term why this should happen here. I own 3.5% in Allianz in my portfolio, I give the company a PT of no less than €230/share – which implies an upside of over 25% here, and a long-term upside as I’ve specified above.

5. Munich Re

From insurance to reinsurance. Munich Re is the largest business in this particular segment, again, in the entire world. Investing in both of these companies means you’re investing in market leaders. Munich RE is also AA-rated, and currently carries a yield of almost 5%. The upside is even greater than in Allianz. This potential upside is based not only on reversal, which can happen but growth. EPS is expected to grow 11% over the next 3 years – annually.

This is possible because Munich RE is one of the most conservative reinsurance businesses on the planet – massively conservative underwriting standards, targeting an RoE of around 12-14% by 2025. By tradition, it’s more conservative than its peers with regards to the sort of business the company takes on. This gives us an upside.

The long-term upside, combined growth, and reversal until 2024E for MURGY is 36% annually, or 117% total RoR to a 15X P/E – and the company usually goes up to 16X, indicating an even higher upside.

I own 4% of Munich Re in my portfolio, and I’m going to buy more. The price target is €270 for the native at this time, implying an upside of around 20%.

6. Castellum

What is Castellum, you might ask?

Castellum is a leading, Swedish real estate company (not REIT) that focuses in part on the lettable areas to public institutions and governmental organizations (around 33%). The rest is a mix of office and residential space. Thanks to no small part of price action, the company now yields 5% and trades at close to a discount, something I never thought would happen again. Less than a year ago, this company represented almost 9% of my total portfolio, and I sold off 5% at a triple-digit profit when the stock hit 230 SEK+ for the native.

Now I’m buying it back. For a complete overview of Castellum, I suggest you look at one of my previous articles that goes into the specifics. For now, I have Castellum at a PT of 210 SEK following quarterly records. The stock price is down 34% in one year, with analysts expecting earnings and cash flows to remain stable, and dividends to slowly grow between 6-10% per year.

Last quarter saw prop management income grow by nearly 50%, positive leasing, an LTV of 37.3%, and strong growth. Castellum is the leading property company in the Nordics with a lettable area of 6.3M square meters, and despite headwinds here, I expect the positives to continue.

I now own 4.9% in Castellum again, and I’m willing to push this up to 6%. I’m considering the company a “Buy” with a 210 SEK PT.

7. Stanley Black & Decker

You know this one more, I’ll wager. SWK is a leading, A-rated industrial machinery/tool company, and it’s currently dirt-cheap at below 10X P/E. What do value investors do when we see this?

We look to make sure we know all the facts – and then we “Buy”.

Even on a conservative 15X P/E forecast – the company typically trades closer to 18X P/E, SWK has the very real potential to return over 28% per year, or 86% in less than 3 years here. The yield at 2.9% isn’t the greatest, of course. It is in fact the lowest yield in this list of companies – but it is nonetheless a solid potential return.

SWK’s share price may show volatility. But you know what doesn’t show even close to that volatility, despite how the company bounces up and down like a JoJo?

The Earnings.

SWK’s earnings, for the past 15 years, have stayed at a near-consistent 11% per year. That’s double-digit EPS growth that has generated 8% annualized RoR or 155% in 11 years, which is market-beating. Had you applied some undervaluation logic and only bought at below 15X P/E, that goes up to almost 9%.

The company currently trades at 10.5X. That’s the lowest it’s been since COVID-19, and before that, the lowest since the recession in -11.

I own 0.6% SWK – and I’m buying more. This company is a “Buy” with a PT of $180/share.

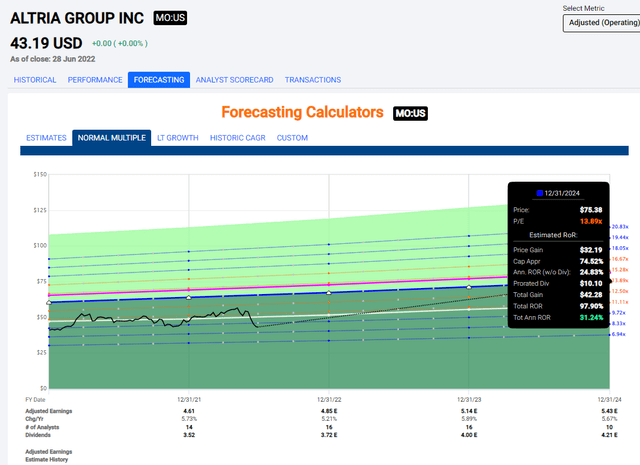

8. Altria

Really, Tobacco?

Yes, tobacco. Even if Juul is removed, there is no fathomable case to be made as to why exactly this company would see any sort of significant earnings impact that detracts from its long-term 4-6% annual growth rate and its excellent coverage of its dividend.

People have been betting against tobacco and other sin stocks for as long as there has been a stock market. However, Tobacco always rises again – and I have no reason to believe that Tobacco will not rise again from this latest slump, as it’s not earnings-related.

Altria’s earnings are absolutely fine. The company is expecting continued EPS growth and currently trades at a P/E lower than 9.5X, which for an investment-grade world-leading consumer products company, is way too low even in this environment.

That’s why I’m almost 5% in Altria in my portfolio – and why I intend to buy more here.

Here’s the upside I consider valid for the long term.

Altria Upside (F.A.S.T graphs)

Disagree? That’s fine – but in that case, I’d really love to hear what the counter-argument against USA’s 30.8 million smoking adults is. That they stop overnight? Over the next years? While quitting movements and products are, of course, prominent, the fact is that the number of smokers has stayed above 30M for some time – and I don’t see that this changes anytime soon. Even if they change, chances are that they move to a smoking substitute – which Altria is among those offering.

No, dear readers – Altria is a “Buy” and a long-term “Hold” for me here.

Wrapping Up

Whenever I have a somewhat “larger” amount of capital to invest, I like to go outside of my typical weekly/bi-weekly buy processes and make a more detailed plan.

The reason for doing this is to ensure that I make the relevant comparisons on a high level and that I place my capital in the best circumstances for growth and yield possible. If I didn’t do this, but instead invested a bit more impulsively, chances are I might pick riskier, but lower-yielding or higher beta investments.

This is not my style.

- Every single one of these companies is investment-grade rated, with most at BBB+ or above. Two of them are AA.

- Every single company on the list has a well-covered yield

- 7 out of 8 companies have a yield of above 4.95%

- Every single one of these investments has a conservative, longer-term (3-5 year) annual upside of more than 25%. This is based on reversal, yield, and capital appreciation.

As long as I am not fully invested in companies that offer such fundamentals, or better/similar ones, why on earth would I invest money in anything else? As long as I invest this way, I’ve seen my portfolio and my investments withstand the current onslaught of negative news fairly well.

The proof, as they usually say, is in the pudding. Despite the market crashing, my portfolio dividends are at all-time highs – as are those of others who follow my approach. Because dividends haven’t changed. No major company I invest in has cut its dividend.

I’m in this for the long game – and these are my current quick picks for that $40k.

What about you?

Thank you for reading.

Be the first to comment