hirun/iStock via Getty Images

Co-produced by Austin Rogers

Right now is one of the best times in years to be invested in midstream oil & gas companies, such as the ALPS Alerian MLP ETF (AMLP).

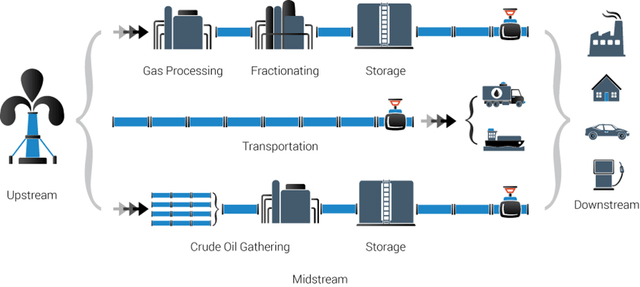

When it comes to the energy space, there is a wide variety of business models. It is helpful to separate the oil & gas sector into three segments:

- Upstream: Exploration, production, and servicing.

- Midstream: Transportation, processing, and storage.

- Downstream: Refining and retail sales.

Upstream, midstream, downstream (ALPS Funds)

When most people think about energy stocks, they typically think about upstream companies or integrated supermajors like Exxon Mobil (XOM) and Chevron (CVX).

But in this article, we explain why our favorite sector in the energy space is midstream. We can break down the investment thesis into seven points.

1. Midstream Is The Most Stable Energy Sub-Sector

While upstream companies are largely price takers that must accept the commodity prices present in the market at the time and downstream companies are subject to the highs and lows of consumer demand, midstream companies typically offer the greatest revenue and cash flow stability.

That is because most of midstream companies’ revenue derives from long-term, fixed-fee, take-or-pay contracts in which counterparties agree to pay certain amounts regardless of commodity prices or the volume passed through the infrastructure.

This makes midstream’s pipeline infrastructure similar to a real estate lease. Regardless how much the tenant sells at its rented real estate and for what price, the tenant is obligated the same monthly rate.

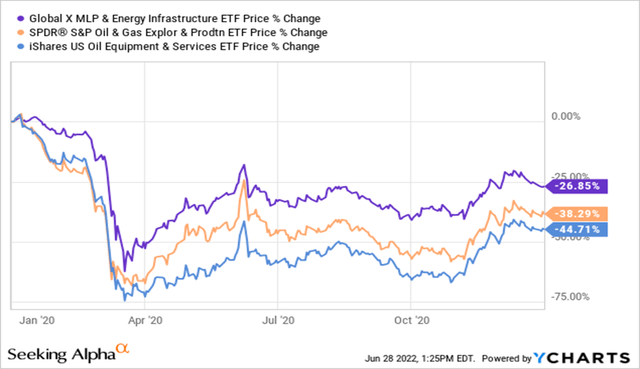

Hence why midstream companies (as measured below by the Global X MLP & Energy Infrastructure ETF (MLPX)) have demonstrated more stock price stability than their exploration & production (XOP) and oil equipment & services (IEZ) peers.

Midstream companies are more resilient (YCHARTS)

Unlike E&P companies, midstream companies are not directly exposed to commodity prices. Likewise, oilfield equipment & services companies may not be directly exposed to commodity prices, but their performance is just as volatile as if they were.

Midstream’s stability should be further enhanced by dramatically reduced development of new pipelines and storage units, as it increases the value and necessity of the existing infrastructure.

2. Midstream Offers The Highest Dividend Income In Energy

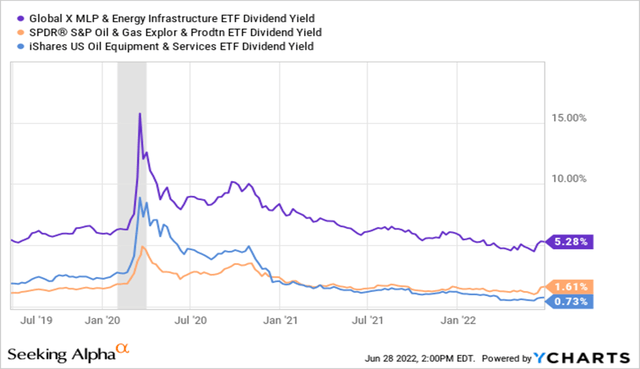

Meanwhile, as a result of greater stability of cash flows, midstream companies have long paid generous and generally growing dividends while offering higher dividend yields.

Midstream companies pay high dividends

Master limited partnerships (“MLPs”), which are taxed differently than C-corps and generate K-1 forms, offer even higher yields of around 8% on average.

In a still mostly low-interest rate environment, midstream companies’ dividend yields are very attractive on top of their growth prospects.

3. Oil & Gas Production Is Set To Gradually Rise

Rather than commodity prices, midstream performance is more directly tied to commodity volumes that pass through its infrastructure. For multiple reasons, midstream companies stand to make more money from higher volume rather than higher commodity prices.

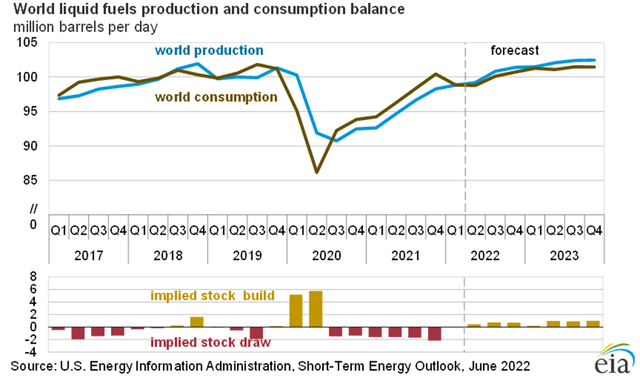

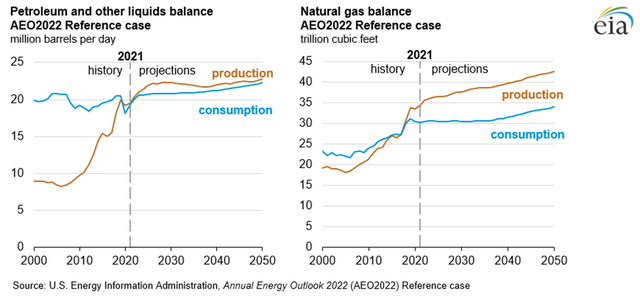

But, of course, higher oil & gas prices incentivize more production. That makes the US Energy Information Administration’s short-term forecast for continued production growth a positive for midstream.

Short term energy outlook

As long as the price of oil remains above around $70 per barrel, production growth should continue unabated. It would likely take a fairly deep recession to lower demand enough to bring the price of oil to $70.

Energy production is too low

Even if US consumers cut back on their traveling in an effort to stem their spending on gasoline, consumers around the world should pick up the slack.

This is especially true for natural gas, as seen in the charts above.

4. US Natural Gas Exports Should Soar

In the wake of the Western world’s sanction war with Russia, countries that formerly imported much of their oil & gas from Russia are quickly searching for other sources of fuels. The US is one of the primary sources picking up the slack.

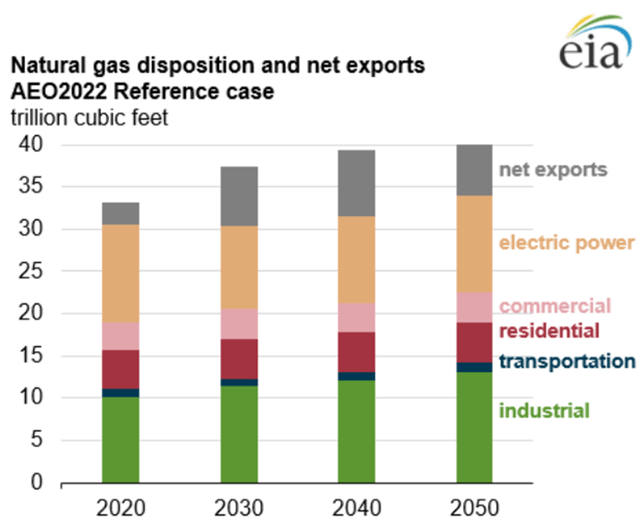

As such, US net exports of gas should soar in the coming years and decades.

US exports of natural gas should soar

The EIA expects natural gas production to rise ~3% year-over-year in the second half of 2022, but consumption is expected to rise around the same amount.

So far this year, liquefied natural gas exports have surged 45% YoY. For the full year of 2022, LNG exports were expected to jump 22% as a result of additional export capacity as well as high demand for LNG from Europe. However, the recent fire at the Freeport export facility will almost certainly put a damper on this forecast.

In the wake of the war in Ukraine and sanctions on Russian fuels, Europe has become the number one destination for US natural gas exports, accounting for about 3/4ths of all natural gas exports in the first four months of 2022. The EIA forecasts that LNG exports should rise another ~6% in 2023 after a very strong year in 2022.

As the Russian military incrementally gains ground in its so-called “special military operation” in Ukraine and the Ukrainians refuse to give up territory in exchange for peace, the war appears likely to drag on indefinitely. As a corollary, sanctions on Russian oil and gas are likely to continue indefinitely as well, which should further decouple European demand from Russian supply.

This development greatly benefits the US energy sector. For example, the US and European Union recently announced a task force to reduce the EU’s reliance on Russian gas by 2/3rds this year and end oil imports completely by 2027.

5. Low Gas Inventories Are Supportive of Higher Prices

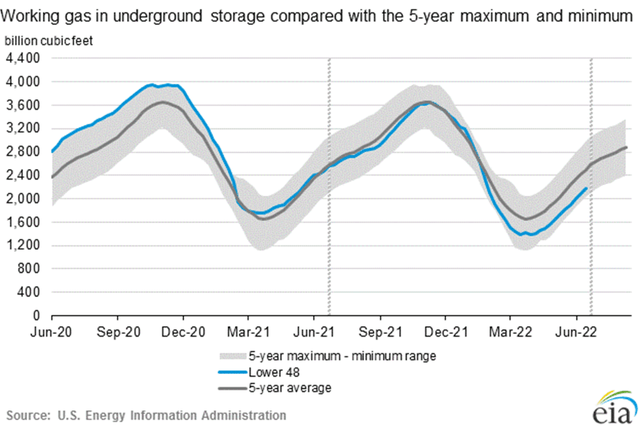

In the more immediate term, gas inventories in storage are significantly lower than their 5-year average level.

Gas reserves are historically low

The EIA projects that gas inventories will end the pre-winter buildup season about 10% below the 5-year average level.

It is difficult to discern how much the Freeport export facility fire alleviates this problem in the short-term, but once the facility is repaired, surely much of the gas produced in the US will be exported to Europe, thus returning to the current low-inventory levels.

Low inventories are supportive of elevated prices, which should spur producers to gradually increase output further. More output equals more volume, which generally equals growth opportunities for midstream.

6. Capital Allocation Is Shareholder-Friendly

Capital allocation decisions in the midstream sector are now overwhelmingly geared toward the goal of creating shareholder value rather than expansion of asset footprints at the expense of balance sheets and dividend safety. Capital discipline is prioritized today more than ever before.

This is a big change from the first half of the 2010s, in which midstream companies stretched their balance sheets and operated with unsustainably high payout ratios in service to rapid portfolio expansion.

There is no longer the fear of missing out on rising oil & gas output from the most productive basins. Instead, there is the fear of over-expansion into a future that increasingly prioritizes clean energy. There is also the fear of greenlighting a huge project like Equitrans Midstream’s (ETRN) Mountain Valley Pipeline that suffers delays, cost overruns, court battles, and regulatory hurdles.

Instead of portfolio expansion, midstream management teams are allocating free cash flows to growing dividends, pursuing share buybacks, and selectively investing in growth opportunities, especially in natural gas and LNG.

Here are some examples:

- Kinder Morgan (KMI) is planning a 0.65 Bcf/day expansion of its Permian Highway Pipeline as well as a 0.57 Bcf/day expansion of its Gulf Coast Express Pipeline.

- Enbridge (ENB) is expanding multiple projects to supply 1.5 Bcf/day to a third-party LNG facility on the Gulf Coast.

- Energy Transfer (ET) has initiated the regulatory process for a new natural gas pipeline from the Permian that will feed into ET’s existing pipeline network in central Texas.

- Williams Companies (WMB) announced the acquisition of the Haynesville gathering & processing infrastructure assets of Trace Midstream (subsidiary of Quantum Energy Partners) for $950 million, which should give it expansion opportunities in the area.

- Enterprise Products Partners (EPD) completed its $3.25 billion acquisition of Navitas Midstream, which “gives Enterprise a foothold for natural gas gathering, treating and processing in the core of the Midland Basin of the Permian” via the addition of 1,750 miles of pipelines and 1 Bcf/day of capacity.

These are just a handful of the numerous examples of selective, careful growth opportunities being pursued in the midstream space.

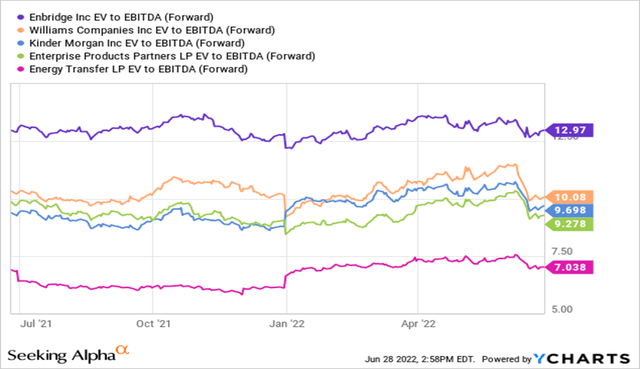

7. Valuations Remain Attractive

Last but not least, it is important to note that, even after the strong rally in midstream stocks over the last year, midstream stocks still sport attractively low valuations. Look, for example, at enterprise value to EBITDA for five of the biggest midstream companies:

Midstreams trade at compelling valuations

Compare this to the S&P 500, which ended 2021 at an EV to EBITDA multiple of 17.1x, according to Siblis Research.

While we do not advocate buying midstream companies for a quick pop of valuation upside, we do believe that the lower valuations in the space provide an additional margin of safety.

Bottom Line

Energy has long been one of the more cyclical and volatile sectors of the economy and stock market. Returns are great in the boom times, but losses are devastating in the busts.

At High Yield Landlord, we believe that midstream energy stocks are the best way to tap into the tremendous cash generated by the oil & gas industry while avoiding the worst value destruction of the busts. In fact, we believe there remains ample upside for US midstream companies regardless how upstream stocks perform.

One of our top picks in the sector right now is Energy Transfer (ET), largely because of the huge margin of safety resulting from its low valuation metrics: around 7x EV to EBITDA and under 5x price to distributable cash flow. Bolstered by strong dividend coverage of nearly 2x DCF, inflation-based fee escalations, and multiple growth opportunities, ET is extraordinarily attractive and should produce 15%+ total returns going forward.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment