da-kuk/E+ via Getty Images

This article was first released to Systematic Income subscribers and free trials on Mar. 24

Given the recent increase in geopolitical tensions, increased risk of persistent inflation and the flattening in the yield curve, the consumer-linked sector offers attractive risk/reward for income portfolios. In this article, we briefly review the health of the consumer and highlight a number of securities that are more directly linked to the sector.

Go Long Consumers

We see two main reasons to add consumer-linked assets to income portfolios. First, many traditional income portfolios tend to be heavily oriented to corporate risk whether through equity and credit funds, often leaving a smaller allocation to other economic actors such as sovereign, state/local and consumer-linked assets. Adding consumer-linked assets to portfolios often provides additional diversification.

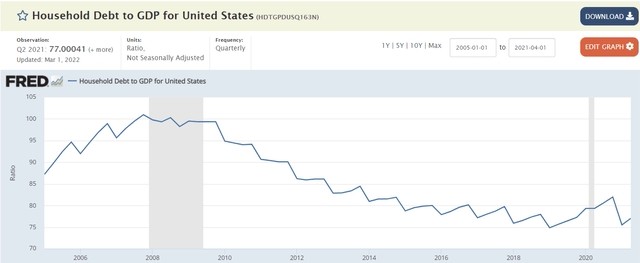

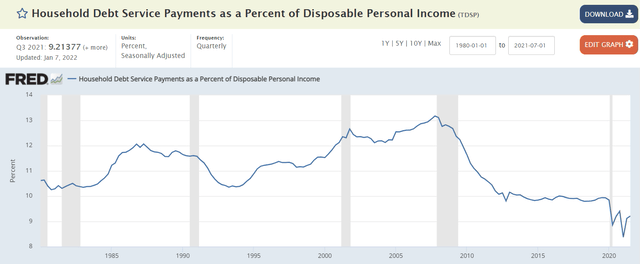

And secondly, the consumer is in a relatively good place. Households have deleveraged sharply since the GFC.

Household debt payments are also quite low relative to disposable income.

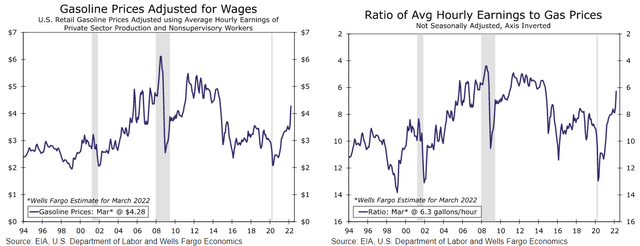

The current inflation backdrop is a challenging one for consumers. That said, it’s important to keep things in perspective. For instance, while the cost of gas is the highest in decades, it is not only a significantly lower part of overall consumption of the last two decades but it is also well off the peak when adjusted for wages.

It’s also important to point out that, according to Wells Fargo, lower-income households (who have less room to accommodate price increases) are not necessarily the hardest hit from gas price spikes as they tend to rely more on public transportation or, if they do have access to a car, it is often a shared car. This suggests that while rising prices are chipping away at consumer budgets, overall consumer health is not in as much danger as some of the headline data may suggest.

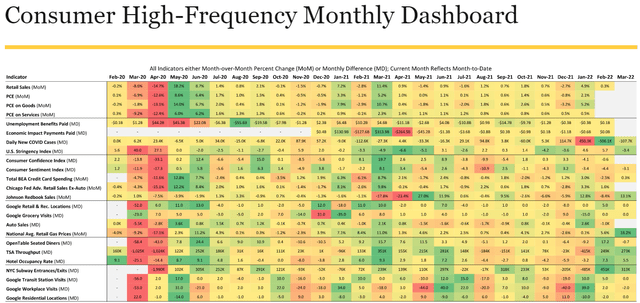

The helpful Wells Fargo color-coded consumer dashboard highlights that consumer indicators have recovered from the previous short-lived recession and are doing quite well.

Some Ideas

In our view, there are, at least, two parts of the income consumer market that are worth attention.

The first is the mortgage REIT preferreds market, both agency and hybrid versions. Many investors might be tempted to go for mREIT common stock over the preferred due to their typically higher yields. However, in our view, this is a mistake for two reasons. First, mREIT common stock is highly dependent on mortgage and loan valuations due to a high level of leverage – the recent drops in agency mREITs has highlighted this fact. And secondly, it is a rare mREIT common stock that has historically outperformed its preferred counterparts in total return terms.

Within the sector, hybrid mREIT preferreds offer a more direct play on consumer health.

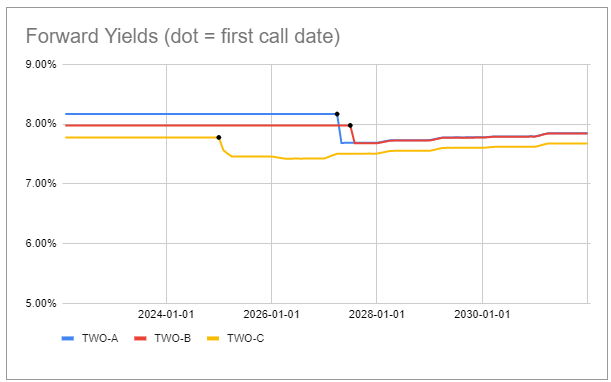

The Two Harbors Investment Corp 8.125% Series A Fix/Float (TWO.PA) has an 80%/20% agency/MSR allocation. Mortgage servicing rights are attractive in the current environment of rising rates as their value increases due to the drop in likelihood of prepayment which, in turn, increases the length of the servicing annuity stream. The stock is trading at an 8.17% YTW up to the first call date and a 7.69% reset yield (based on Libor forwards as of the Apr-2027 first call date). TWO.PA looks most attractive within the 3 preferred suites.

Systematic Income Preferreds Tool

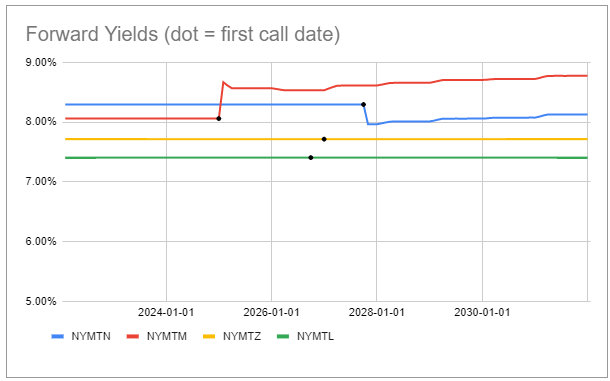

The NYMT 7.875% Series F Fix/Float (NYMTM) is from a mortgage loan focused issuer with very low leverage of 0.4x and decent equity/preferred coverage of 4.2x. The stock is trading at an 8.06% YTW up to the first call date and an 8.67% reset yield (based on Libor forwards as of the Jan-2025 first call date). As the chart below shows, although NYMTN does have a higher YTW for about 3 years, NYMTM should have a higher yield if it remains outstanding past its first call date and will definitely have a higher yield if both stocks remain outstanding past their first call date.

Systematic Income Preferreds Tool

On the fund side, there are not many options with pure consumer exposure. However, there are a number of CEFs with some consumer-facing risks such as non-agency mortgages (both legacy and CRT securities) as well as asset-backed securities such as credit card receivables.

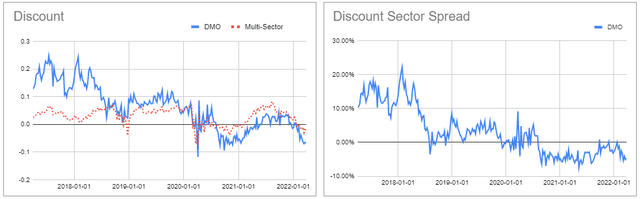

The Western Asset Mortgage Opportunity Fund (DMO) is primarily allocated to mortgage credit securities such as non-agency legacy and CRT. It is trading at a 6.7% discount and a 9.4% current yield. And although its duration is on the high side at 6.3, its return year-to-date is better than all PIMCO taxable funds which boast a duration of less than half. The fund had a distribution right-sizing recently which shouldn’t require another one for some time. Its valuation is also attractive relative to the sector.

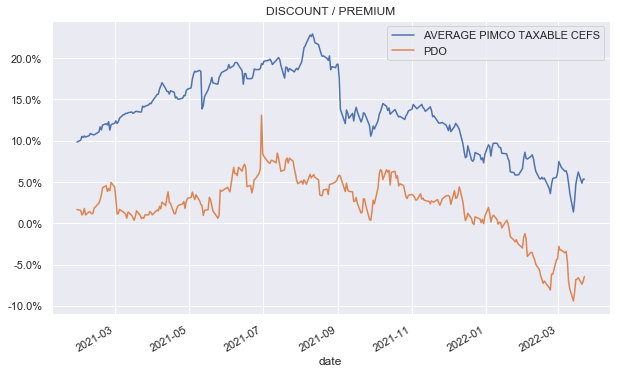

The PIMCO Dynamic Income Opportunities Fund (PDO) has a 15% allocation to non-agency mortgages and trades at a 6.5% discount and 8.5% current yield. The fund continues to trade at a significantly wider discount relative to the rest of the PIMCO taxable suite despite having a similar allocation profile, the same managers and a similar performance in total NAV terms. The fund’s management fee is on the higher side within the suite, however, its discount differential is wider than implied by the fair-value impact of the higher fee. The fund’s duration is relatively modest at 3.4.

Systematic Income CEF Tool

The Western Asset Diversified Income Fund (WDI) is a relatively recently launched fund with about a fifth of the portfolio in residential mortgage securities. It is trading at a 12.3% discount and an 8.75% current yield.

The Nuveen Mortgage and Income Fund (JLS) has a bit more than a third of its portfolio allocated to non-agency mortgages along with a small amount of auto loan asset-backed securities. A third of the portfolio is in investment-grade securities, and the fund’s duration is 3. JLS is trading at an 11.6% discount and a 5.5% current yield.

Takeaways

The recent geopolitical and monetary policy surprises alongside market volatility and creeping recession estimates have highlighted the value of diversification in income portfolios. And while many investors diversify carefully among different holdings, industries and asset classes, they may not diversify as carefully among economic actors such as corporates, sovereign/locality and household/consumer risk. In our view, investors should have some consumer-focused allocations not just for diversification reasons but also because consumers are in pretty good shape.

Be the first to comment