Andrii Dodonov

Rebalancing of the 60/40 allocation in stocks and bonds is normally performed annually, at the end of the year. However, the portfolio may be occasionally rebalanced during the calendar year if there is a good reason for it. As long as this is a rare event, the nature of the strategic allocation is not affected.

Rebalancing timing, due to luck or analysis, can theoretically boost the performance of the 60/40 portfolio. The question is if luck causes a significant boost in performance, or if the effort for the analysis to determine the timing is justified.

In the article, we will look at the 60/40 allocation in S&P 500 Total Return (SPY) and S&P US Aggregate Bond Total Return (AGG) Indexes from 01/02/3003 to 09/14/2022. Note that exact performance parameters may vary depending on backtest conditions, but the objective here is to look at the relative impact of rebalancing timing luck.

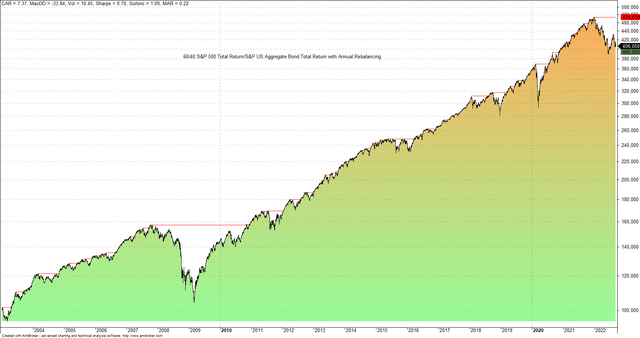

Below is the backtested performance of the 60/40 portfolio with annual rebalancing.

Performance of the 60/40 Portfolio in S&P 500 Total Return/S&P US Aggregate Bond Total Return with Annual Rebalancing (Price Action Lab Blog – Norgate Data)

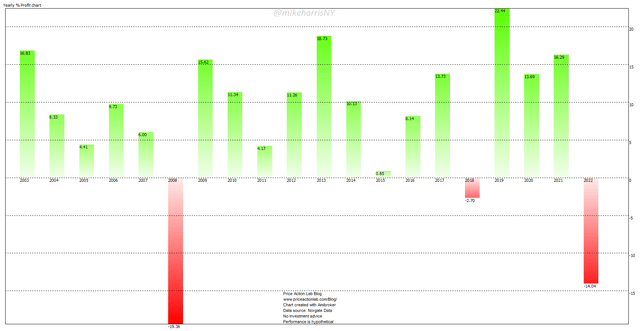

The yearly returns chart provides additional information about the equity curve’s performance.

Yearly Performance of the 60/40 Portfolio in S&P 500 Total Return/S&P US Aggregate Bond Total Return with Annual Rebalancing (Price Action Lab Blog – Norgate Data)

Since 2003, there have been three losing years: 2008 with a loss of about 20%, 2018 with a loss of -2.7%, and a year-to-date loss of -14%.

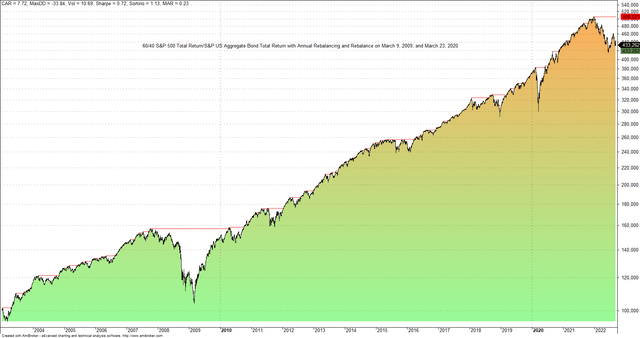

Next suppose that an investor, or portfolio manager, was able to predict the exact bottoms of the GFC bear market and also of the 2020 pandemic crash, on March 9, 2009, and March 23, 2020, respectively, or was lucky to have rebalanced the portfolio at exactly those market bottoms. Note that rebalancing also occurs at the end of the year. Below is the equity curve performance of the 60/40 allocation.

0/40 S&P 500 Total Return/S&P US Aggregate Bond Total Return with Annual Rebalancing and Rebalance on March 9, 2009, and March 23, 2020 (Price Action Lab Blog – Norgate Data)

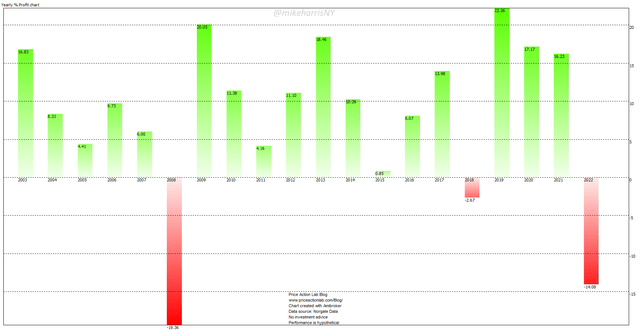

The new yearly returns chart is shown below.

Yearly Performance of the 60/40 Portfolio in S&P 500 Total Return/S&P US Aggregate Bond Total Return with Annual Rebalancing and Rebalance on March 9, 2009, and March 23, 2020 (Price Action Lab Blog – Norgate Data)

There are two main differences between the above chart and the original chart that were expected, as a result of the 2009 and 2020 rebalancing:

- The return for 2009 increased from 15.6% to 20.1%

- The return for 2020 increased from 13.7% to 17.2%

As a result of the improved performance for 2009 and 2020, the annualized return also increased. Below is a table that compares the performance, before and after rebalancing timing luck.

| 60/40 portfolio | 40/40 portfolio with rebalancing luck | |

| Annualized return | 7.4% | 7.7% |

| Maximum Drawdown | -33.8% | -33.8% |

| Volatility | 10.5% | 10.7% |

| Sharpe Ratio | 0.70 | 0.72 |

The difference in annualized return is 30 basis points and in the Sharpe ratio just two basis points. The maximum drawdown is unchanged.

Therefore, striking a deal with some cosmic entity to provide rebalancing timing luck in the sense described in the article, i.e., identifying the exact bottoms of the GFC and 2020 pandemic bear markets, did not have any material impact on the annualized return of the allocation since 2003.

Conclusion

Market timing is way more important than rebalancing timing luck. For strategic allocation, such as the 60/40 portfolio, probably it does not pay to worry about rebalancing timing. More importantly, any gains could be smaller than potential losses if the timing is wrong. It may make more sense to consider alternative 60/40 allocations, as we did in this recent SA article than worrying about improving the performance of the classical 60/40 allocation.

Be the first to comment