NicoElNino/iStock via Getty Images

Dear readers,

I invest through thick and thin. I make no secret of this fact. If the market is up, I invest in undervalued companies. If the market is down, I invest in undervalued companies. I’m aware and I consider macro when I invest, and there are times, such as the COVID-19 crash, when I do invest more than usual.

However, in the end, I’m a firm believer in the approach of putting money to work – consistently and regardless of what’s happening.

There are always quality companies around, and there are always quality companies available at an undervaluation.

As an analyst, it’s my job to cover the companies I invest in and consider interesting, and identify such opportunities for my readers, my followers, my/subscribers, and my clients.

That is what I do.

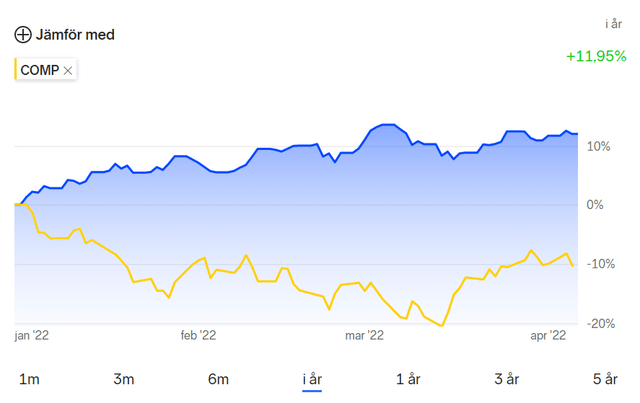

It’s been an interesting first 3-4 months of 2022. It’s been interesting to be able to generate an outperforming profit during these months, but it’s been entirely possible to do so – such as with my non-SEK portfolio, focused on USD/CAD/EUR investments.

Portfolio performance (Nordnet YTD performance)

This YTD performance is only possible due to very strategic picking of undervalued investments. Of never being willing to compromise on quality or valuation, and to make sure that my diversification targets are being met.

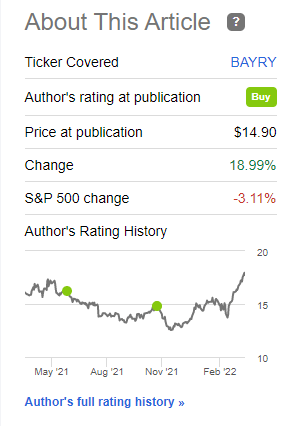

Such performance has been possible thanks in no small measure to investments such as Bayer, which I wrote about a few months ago…

Bayer Article (Seeking Alpha)

…and similar-performing undervalued stocks which have given annual RoR of 15-35% in less than 3-5 months. In addition, and of course, the above figure also includes paid dividends, which are another major component of my investment success. I tend to not invest in companies that don’t pay a dividend.

In this article, I want to pick 6 companies that I plan to invest more money into. All of these companies are:

- A-graded or better by S&P Global (!)

- Paying a well-covered dividend

- Owned in my core portfolio at more than 0.5% of my TPV

- Currently at an upside of more than 20% on a historically conservative forecasted P/E multiple and earnings estimates.

Consider that for a moment – all of these companies are A-grade or above. None of these companies are flights of fancy. They won’t be small businesses or new growth stocks. All of these businesses we look at will be absolutely stellar in terms of quality. Even if one of these companies were to crash and burn for years, the substance in the company is still going to be solid in the long term.

In other words, it’s exactly what I’m buying myself. I believe it’s one of the best ways to guard yourself against poor performance in the long term.

Are these companies/picks completely non-volatile? No. Volatility is part of investing, as I see it. However, if you’re confident that the underlying substance is qualitative, short-term price movements shouldn’t really be a worrying factor, but rather an exciting opportunity.

Without further talking, let’s get to that list – though remember, every pick in this list isn’t for everyone.

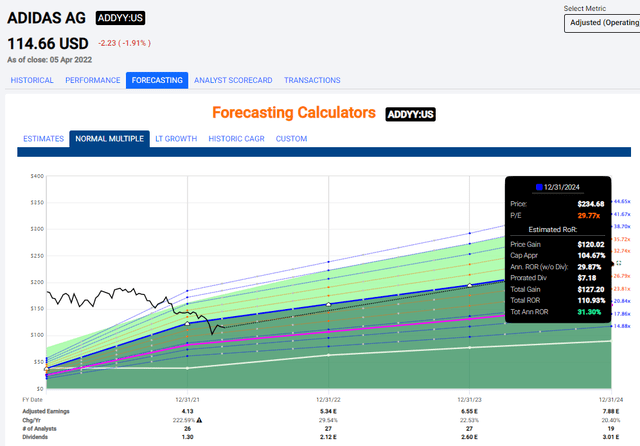

1. adidas (OTCQX:ADDYY) – 31% annual upside

I’ve been beating the drum for adidas since before they dropped below €220/share. I now own tens of thousands of euros in the company, and I consider the company a massively-appealing long-term holding with a significantly better upside than the closest peers, such as NIKE (NKE).

adidas is an A+ rated consumer product company, specializing in shoes and garments. This is a high-growth, high-valuation sort of company, but the company has dropped well below its typical premium and is now at a level where I would consider them cheap even for this company.

The upside for adidas at this point is not less than 30% in the long term.

adidas Upside (F.A.S.T. Graphs)

adidas has gained significant market share in both apparel and footwear, and is a market leader not only in Europe but in China as well, and growing further with a 20%+ market share. Its ongoing downstream optimizations, including moving to D2C and online sales could accelerate the company’s margins between 150-250bps, according to my calculations and forecasts.

This isn’t the least-valued company on the list – it’s actually one of the companies with the higher average P/E multiples you might be looking at. But the fundamental upsides for this business are massive – and that’s why I invest here.

Risks do exist. The company has some issues with Chinese cotton boycott – but in my current forecast, I assume a normalization of western brand appeal, which would normalize sales within 1-2 years. SCM also wreaks havoc on the company’s current results. Sourcing its products strictly from Asia is a bit of a problem – but adidas is far from unique in this, in that all peers do this. I would argue that a 4-7 year forward perspective is required to invest in adidas, with my base case being a 100% 4-7 year RoR.

The company is over 3% of my TPV here.

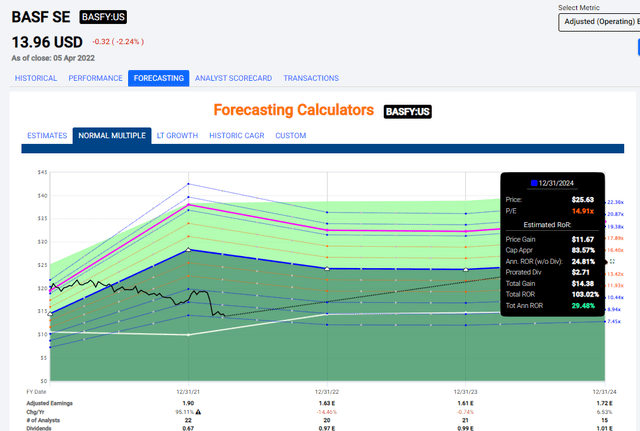

2. BASF (OTCQX:BASFY) – 29.5% annual upside

BASF certainly isn’t the most stable of companies. This is especially true given the recent uncertainty in Ukraine and the whole geopolitical conflict and the impact on BASF. More on these specific impacts can be found in the company-specific articles I write on BASF, as this is one of the primary chemical businesses I follow.

However, as dirt-cheap as the company now is, even on a 13-13.5X forward P/E, the upside is no less than 29%.

BASF Upside (F.A.S.T. Graphs)

This is, like adidas, an A-rated company with significant safeties. Any arguments against its safety and stability first needs to counter the argument where its customers, it being the largest chemical company on earth, would source its products if not through BASF.

BASF is not appealing at any valuation – but it’s appealing at this valuation. The upsides of its strong Co2 ambitions and movements into hydrogen as well as it’s ongoing (if currently postponed) portfolio changes make this appealing and will add to the company’s already-substantial cash. More importantly, the core and its Verbund concept remains a fully-contributing factor to company profitability here.

At a near-30% upside, BASF is a “BUY” to me and I’m adding to my position here.

The company is over 4% of my TPV here.

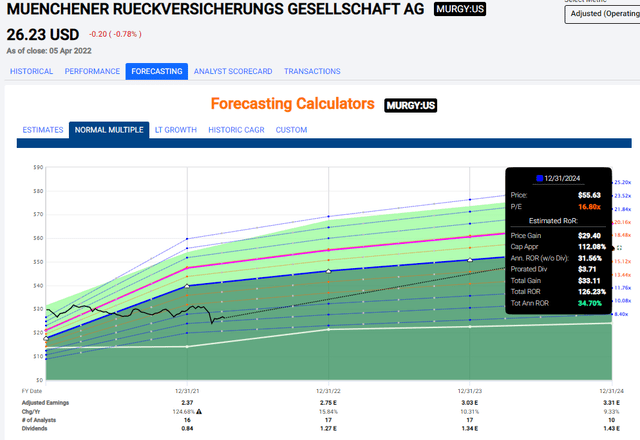

3. Munich Re (OTCPK:MURGY) – 34% annual upside

Like Allianz is the biggest insurance company in the world, Munich Re is the biggest Reinsurance company on earth. It’s also one of the most conservative, in terms of underwriting/safety insurance businesses available. Munich Re is a superb place to put your cash safely, and at a yield of no less than 4% at today’s share price.

The upside in this reinsurance business is no less than 34% at a relatively conservative 5-year average.

Munich Re Upside (F.A.S.T. Graphs)

Munich Re is only one of the many quality businesses that you can invest in with a triple-digit 2-3 year upside – and one that’s not even all that crazy, all things considered. The turnaround that investors have been awaiting for years seems to be coming, with renewals and volume growth pushing things up. What’s more, this is a superb safe pick with a massive upside.

Risks do exist, in that Munich Re is the only major reinsurance business I cover that also runs a primary insurance business – and the company’s profit margins in its ERGO business are limited, with no “Wow” factor compared to its primary insurance peers. Munich Re is also perhaps a bit too conservative, to the degree, it might hamper earnings a bit, and there are continued COVID-19 impacts to the tune of around €300M expected in 2022.

However, Munich Re is another “BUY” in my book, and I’m adding more.

The company is over 2% of my TPV here.

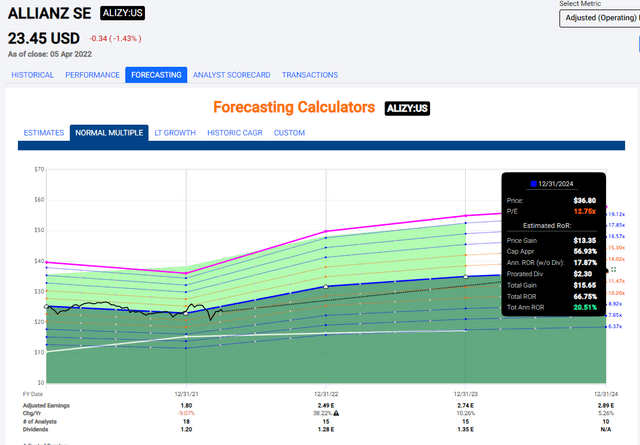

4. Allianz (OTCPK:ALIZY) – 20% Annual Upside

Do you mind that the largest insurance company on earth “only” has an upside of 20% while yielding more than 4.5%?

I didn’t think so.

Allianz is a German stalwart. A market leader in not only insurance but wealth management and assets through its PIMCO arm, making it one of the biggest asset managers around with an AUM of nearly 2 trillion USD. This is an absolutely unique quality of the company, which to my mind, makes it a superb sort of investment for the conservative investor.

The upside is excellent, even when considering only a 12.75X P/E.

Allianz Upside (F.A.S.T. Graphs)

I don’t really care if Allianz goes back down to valuations well below its current share price. I’ll only buy more. Allianz is one of the safest companies around, with an AA credit rating, a staggering market cap of almost €90B, and a history going back to the late 1800s.

Allianz does have some risks as well – in that the company is far more dependent on macro than some of its competitors. The company is also under a still-ongoing lawsuit due to the Structured Alpha Funds of AGI which suffered $6B in losses, with an already-provisioned pre-tax amount of €3.7B set aside for about 1 year for risk coverage. Its size also makes it far less flexible than some of its lower peers.

However, the company is one of the safest finance investment’s possible to make in today’s market (as I see it) – and that’s why I’m pushing more money to work here at this time.

The company is over 3% of my TPV here.

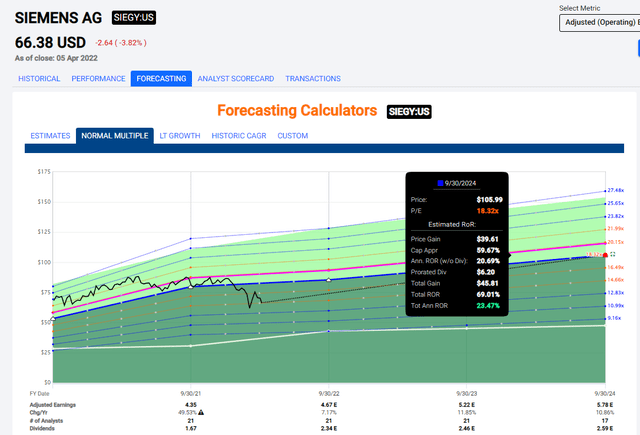

5. Siemens (OTCPK:SIEGY) – 23.5% annual upside

Look, I’ll put it simply. If you don’t yet have Siemens exposure, you should seriously consider getting one.

This A+ rated industrial stalwart is on the tail-end of a decade-spanning portfolio reorganization that has left it in a superb position for safety and growth. Not only this but because of the war and the uncertainty, Siemens is now almost cheap.

Siemens has successfully transitioned to a very lean structure, having spun off every volatile segment out there. It has an unmatched engineering talent in its remaining portfolio with an appeal to a global market, and the company even still has portfolio assets that, if it wanted to, it could very well divest.

Siemens does come with some risks, including stagnant revenue growth for the past few years, which might be hard to pick up in a post-pandemic business environment despite some of the positive forecasts. In addition, the post-divestment portfolio company distributions are inherently volatile (that’s why they were divested), and energy’s contribution moves like a Jojo in tandem with sector volatility. The company also has yet to move its ROCE above its overall WACC, and it seems unlikely to do so in the near future.

Still, Siemens has an over 3% yield at this point and an upside well over 20% annually to a 5-year average P/E of 18X.

Siemens upside (Siemens IR)

To me, there’s very little downside to investing in Siemens at this cheap valuation. You’re investing in safety, at A-grade credit. What more, in truth, do you want out of an investment at this time?

The company is over 4% of my TPV here.

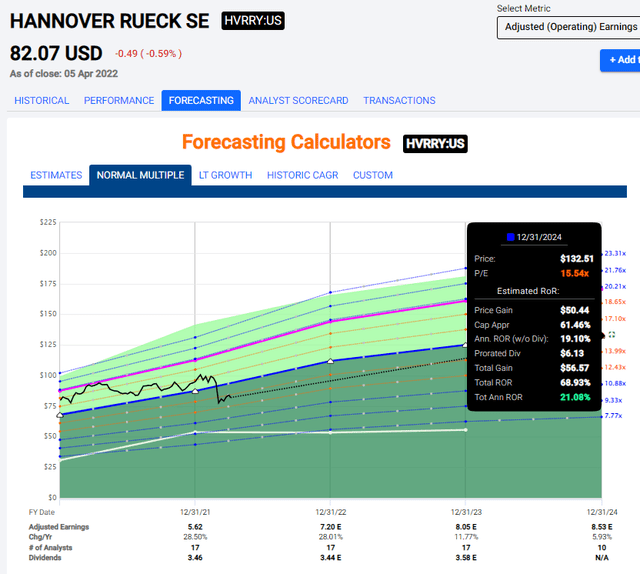

6. Hannover Rueck (OTCPK:HVRRY) – 21% annual upside

Hannover Rueck is a reinsurance company, almost on par with Munich Re. The yield is slightly lower. But Hannover Rueck is the third-largest reinsurance company in the world. It’s also one of the most profitable reinsurance companies around.

Its risk management is top-tier. It’s smaller than Munich and Swiss Re, but it’s more profitable than either of these. Combine this with the superb risk control, and you’re probably willing to forgive the company’s slightly smaller 3.5% yield when you consider that you get a 20%+ upside from the most profitable reinsurance company in Europe.

Hannover Re Upside (F.A.S.T. Graphs )

Downsides for the company? None, as far as I would say – not serious ones at least. Oh, there are some concerns about the shareholder structure given the company’s ties to Talanx. The life business has improvement potential, and once you start digging into filings, materials, and call information, you’ll find some industry-specific concerns regarding Hannover Re treatise of renewal policies and the business volume it’s been writing compared to Munich and Swiss – but none of this is thesis- or company-breaking, as I see it.

Hannover Re is a superb company with a 20%+ annual upside. I’m buying more.

The company is over 0.6% of my TPV here.

1 Bonus pick – a growth stock!

Some readers believe that I’m inherently anti-growth stock investing. This isn’t true – I just apply the same treatment to growth stocks that I do to other stocks. I want them cheap, and I want what I view as quality. These two qualities rarely, in my view, align.

I do want to point out that growth investing is vastly riskier than investing in any of the 6 stocks I’ve mentioned. That being said, I have allocated a small portion to this stock that I’m going to mention.

Wise plc (OTCPK:WPLCF)

To those of you subscribing to iREIT on Alpha, you can read my full article on Wise on our marketplace platform. To those not on iREIT, I will provide a very quick synopsis here.

Wise is a recently-IPOed payment gateway that focuses on, not being a bank but providing cost-effective Remittance services. The company is what I would view as a market leader. It has a supremely agile business model based on effective money transferring. It has absolutely superb RoE, ROCE, and generation of cash.

The company benefits from the much-coveted first-mover advantage and has declined over 48% since the IPO. This puts it in an undervaluation, as I see it, for a growth stock.

Based on NAV, DCF, and Peer assumptions (including PayPal (PYPL), Adyen (OTCPK:ADYEY), and Block (SQ), Wise is undervalued here. In weighting Wise to a native share price of 740 pence, or £7.4/share. That gives the company a massive upside of over 40% to this share price.

S&P Global has 7 analysts following the company, giving the business a current average target range of 660-1150p, with an average of 835p. While this may sound great, only 2 out of the 7, despite no analyst actually believing 499p being overvalued, have “BUY” ratings for the business. 1 analyst is a “SELL” and 4 are at “HOLD” here. How this squares with their price targets, or the fact that these targets have been cut by around 20% on average in less than 6 months, I will leave it up to them.

Wise is not without risk – no growth stock is. But I believe the company to have a good chance to dominate the attractive remittance sector, and initiated official coverage about 2 weeks back, with my initial PT. I’m LONG Wise PLC at this time.

Wrapping up

In a book series I like, the main character uses the line:

“When the sky falls, I take cover under lies/bull.”

That’s not me. When the sky is falling – when risks of recession seem to increase, and instability seems to be the name of the game, I take cover under an incredibly solid and well-constructed portfolio with iron-clad names.

That’s what this article is about. Picking 6 iron-clad, A-graded, dividend-yielding names that even in the case of a share price drop, can be counted on to deliver safety and security to where you really don’t need to worry about the company to any major degree.

All of the names I gave you here (with the exception of the growth stocks) are massively safe names. They’re all superb. They can drive entire portfolios by themselves. and do so with relative success.

It’s by picking names like the ones in this article, and picking them when they’re undervalued that I’ve managed to really outperform both in the long and short term. It’s how I’ve managed a portfolio-wide, 5-year well-above 100%+ RoR, and it’s how I’ve built what I would consider the be the “foundation” of my wealth.

In this article, I share with you 6 high-conviction, superb names, that I myself invest significant amounts of capital into. I’m essentially giving you “my recipe” for success – or part of it, as It stands now, and as it stands for EU names.

If you have questions about any of these names, let me know – but none of these investments are small, and together they represent well above $100,000 of invested capital in my core portfolio.

Thank you for reading.

Be the first to comment