Thomas Barwick/DigitalVision via Getty Images

As many of you know, I have been writing on the Seeking Alpha platform for over a decade, and during that time I have amassed more than 100,000 followers (among the top authors in terms of followers on Seeking Alpha, thank you!).

Based on this statistic alone it should be clear that many people invest in REITs. In fact, according to Nareit, an estimated 145 million Americans own REITs through their retirement savings and other investment funds.

Owning REITs is a great way to generate ongoing income while also enjoying a world of potential upside. And so it pays for retirement savers to load up on REITs and hold them for the long haul.

A recent study by Chatham Partners found that 83% of financial advisors recommended REITs to their clients. A majority of advisors agree on the underlying long-term fundamentals that support inclusion of REITs within a diversified portfolio.

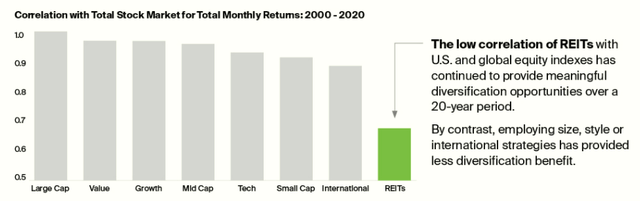

Over the past few decades, assets have become increasingly correlated. This has challenged advisors to identify investments to better diversify their clients’ portfolios.

Fortunately, REITs provide investors access to meaningful diversification opportunities.

In fact, according to Chatham Partners’ research, the vast majority of advisors now invest their clients in REITs and the most frequently cited attribute as to why is “portfolio diversification.”

The following are illustrations of the low correlation REITs have with the broad stock market and how they can improve a portfolio’s risk-and-return profile.

Nareit

One question that I get often from readers is whether homeownership is a substitute for REITs.

My answer is simple: A home is a consumption good, not an investment, particularly when financed with a sizable mortgage.

A residence does not produce current income, but rather requires regular mortgage interest, real estate taxes, insurance payments and maintenance costs.

In contrast, REITs represent investment in commercial real estate (and single-family rentals), which generates continuing income flow from rents.

Also, a REIT is a liquid investment that’s diversified across a range of real estate properties in a variety of geographic locations. By comparison, a house is a comparatively illiquid asset whose investment risk is not diversified, but rather highly concentrated.

Another frequent question that I get is how many REITs should I own?

My answer again is simple: It depends on the investor’s risk tolerance level (and age is a factor). At a minimum I would recommend 10% exposure (not counting your home) and for certain investors 25% could be warranted.

Whatever the exposure, I would not recommend just one REIT. I always suggest balancing your portfolio with various property sectors and try to maintain no more than 10% exposure in each REIT. In other words, make a goal of allocating 10% of your REIT exposure with 10 different REITs.

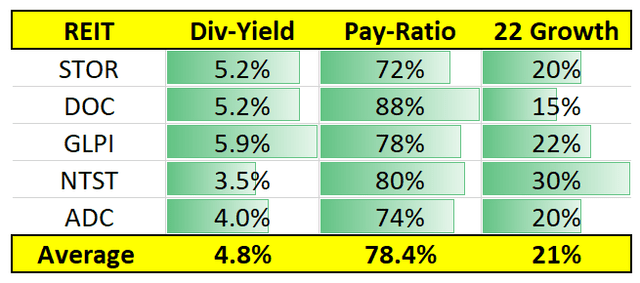

Now I don’t have enough time to recommend 10 today, but I will provide you with five worth buying.

Retirement Pick #1: STORE Capital Corporation (STOR)

Our first retirement REIT pick is STORE Capital, a net lease REIT specializing in the acquisition and ownership of single tenant net lease properties across the U.S. STOR was established in 2011 and has a total market capitalization of $8.1 billion, making it the third largest Net Lease REIT.

STOR has a unique asset allocation strategy that focuses on middle market companies in which STOR utilizes unit-level sales reporting (98% locations subject to unit-level financial reporting).

Looking at its top tenant base, you’ll see that STOR seeks out diverse categories such as full-service restaurants (7%), early childhood education (6%), health clubs (5.1%), etc.

STOR’s Q4-21 beat expectations in a meaningful way. Funds From Operations grew by 7.3% in 2021 to $1.92. In the fourth quarter alone, STOR acquired 100 properties for $486 million at a blended cap rate of 7.2%. Management also expects STOR to acquire $1.1 – $1.3 billion in 2022.

STOR ended 2021 with $64 million of cash and an additional $470 million available on the credit facility. Earlier this year, S&P raised its rating outlook to positive from stable and affirmed the BBB.

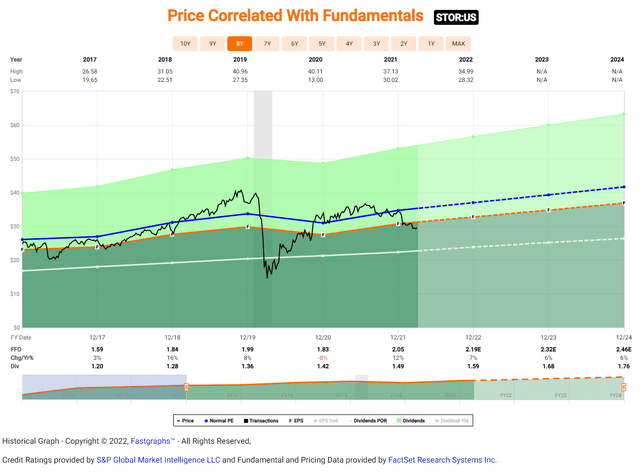

FAST Graphs

Shares of STOR are currently trading at $29.57 and 14.2x P/AFFO (a discount to the historical P/AFFO average of 16.5x). Shares are yielding 5.2% with an AFFO payout ratio of 72.8% and analysts estimate AFFO per share to grow by 7% and 6% in the next two years. We’re maintaining a Buy rating with a buy below target of $34.00. Our 12-month total return target is 20%.

iREIT on Alpha

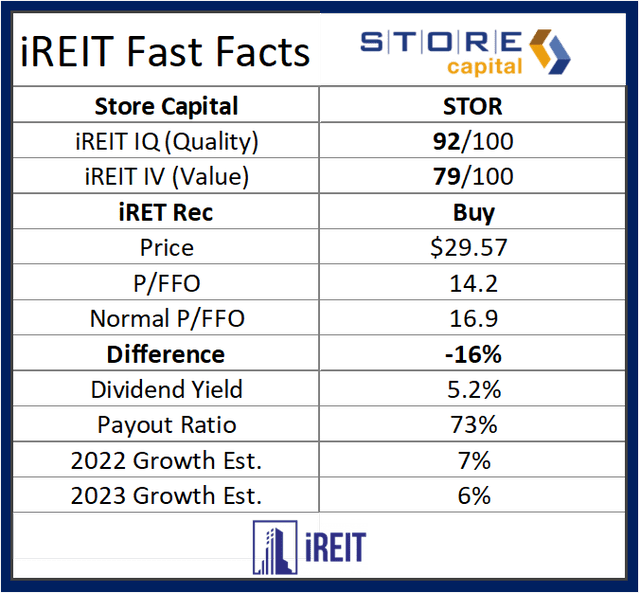

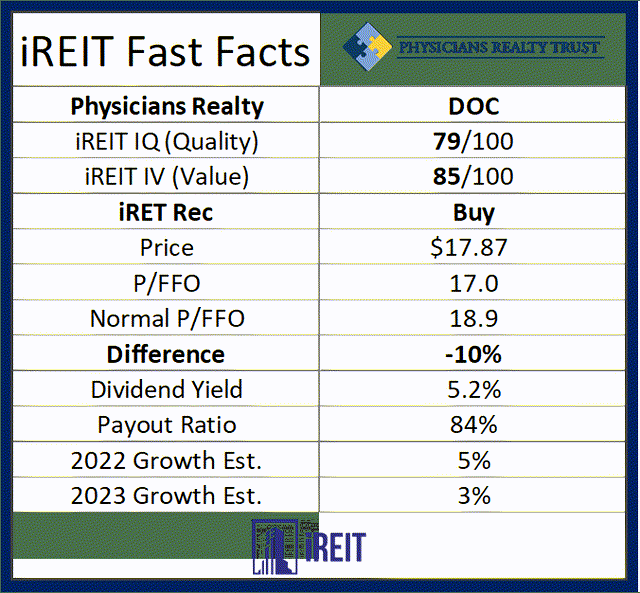

Retirement Pick #2: Physicians Realty Trust (DOC)

Physicians Realty Trust was founded nine years ago and focuses on the acquisition and ownership of medical office properties across the U.S. DOC’s portfolio includes 291 properties in 33 states with 16.2 million square feet of GLA.

Almost 90% of the portfolio consists of properties affiliated with local and regional health systems such as CommonSpirit, and Baylor Health. DOC is a member of the S&P MidCap 400 index with a total market capitalization of $6.4 billion.

DOC doesn’t generate the same reliable dividend growth prospects as the other retirement picks, but we expect to see the company begin to grow its dividend soon (I discussed that topic with the CEO on a recent interview).

However, we believe that DOC’s dividend is relatively safe, with its payout ratio expected to decrease over the coming years due to steady growth (+5% estimated for 2020).

FAST Graphs

Shares are currently trading at a FFO multiple of 16.7x (vs. the historical average of 18.9x) and shares are now trading at $17.87 which represents a 15% discount to our $20.50 buy under target. Our 12-month total return target is 15%.

iREIT on Alpha

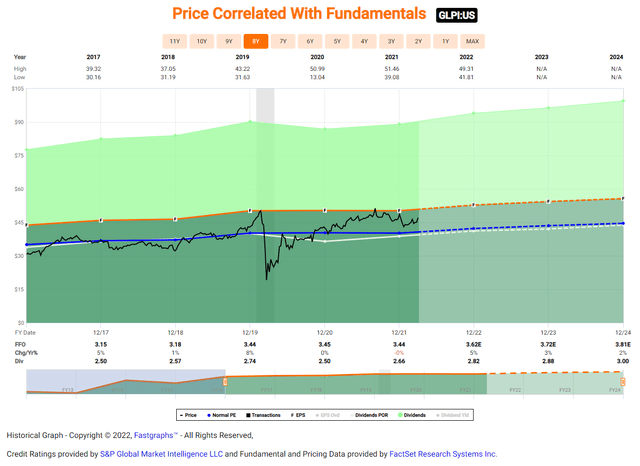

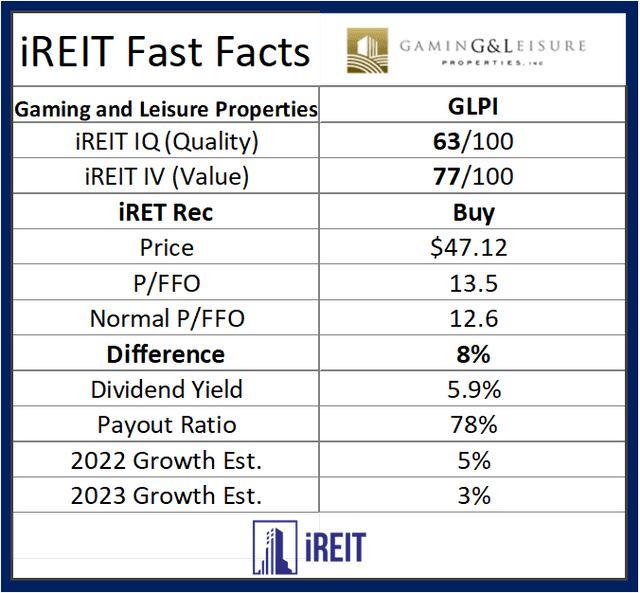

Retirement Pick #3: Gaming and Leisure Properties, Inc. (GLPI)

Our next retirement pick is Gaming & Leisure, a regional gaming landlord that owns 51 properties in 17 states, with a total of 25.6 million square feet and 15,300 hotel rooms. The company’s largest tenant is Penn National Gaming and affiliates (PENN, 74% of revenues), which formed GLPI in a spin-off transaction in 2013.

GLPI’s major tenants are credit worthy public companies with strong balance sheets, institutional platforms, extensive experience, and established brands.

In the latest earnings report GPI announced full-year 2021 AFFO of $3.44/share which was in line with the previous year. The company also announced the acquisition of three gaming properties in Maryland, Philadelphia, and Pittsburgh from affiliates of Cordish for $1.8 billion.

On April 1, GLPI announced that, it completed the previously announced acquisition of the land and real estate assets of Bally’s three Black Hawk Casinos in Black Hawk, CO, and Bally’s Quad Cities Casino & Hotel in Rock Island, IL, for $150M. The transaction was announced last year and shows GLPI’s ability to execute on acquisitions in the gaming space.

FAST Graphs

GLPI trades at an attractive multiple of 13.5x P/AFFO, and to put that it perspective, GLPI’s closest peer, VICI Properties (VICI) trades at 15.7x (p/AFFO). With Realty Income now “in the game” for casinos, I suspect to see more deal flow in the sector, and perhaps GLPI become a takeover target. GLPI also declared a first quarter dividend of $0.69/share, up 3%.

Gaming and Leisure closed at $46.85/share and is currently trading as a buy. Our 12-month total return target is 22%.

iREIT on Alpha

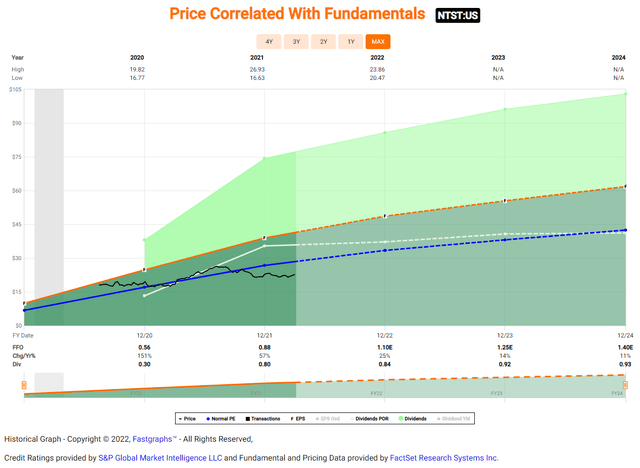

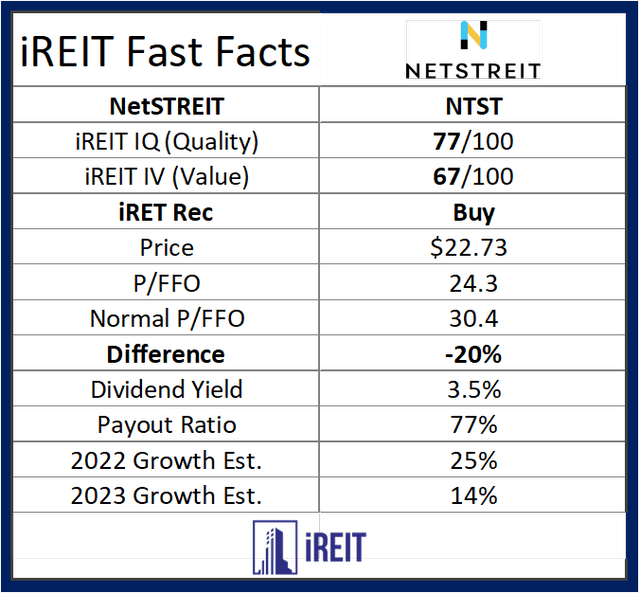

Retirement Pick #4: NETSTREIT Corp. (NTST)

NETSTREIT is a small-cap net lease REIT that IPOd in 2020. The portfolio currently includes 327 properties in 41 states with an average remaining lease term of 9.9 years. 65% of the portfolio is leased to investment grade tenants including Walgreens, 7 Eleven, Hobby Lobby, Advance Auto Parts, and Dollar General.

In around two years NTST has grown its portfolio by an average of $101 million per quarter and now has a market cap of just over $1 billion.

To fund that steady growth NTST has maintained strict financial discipline, at year end the balance sheet had total debt of $239 million outstanding of which $175 million was from its fully hedge term loan with a remaining balance from the revolving line of credit.

FAST Graphs

NTST already reported guidance for 2022 AFFO of $1.15/share, up 22% from 2021 and management also declared a regular Q2 dividend of $0.20/share. The payment ratio is a healthy 80%, thus we expect to see more solid dividend growth from this little gem.

Given its small size, NTST has been able to move the needle, this should continue if the company maintains acquisitions of around $100 mm every quarter. Our 12-month total return target is 30%.

iREIT on Alpha

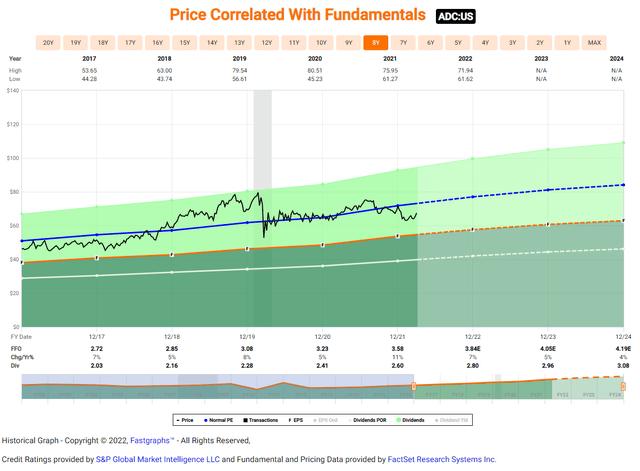

Retirement Pick #5: Agree Realty Corporation (ADC)

My final retirement pick is Agree Realty, a small-cap net lease REIT and member of the S&P SmallCap 600 with a total market capitalization of $7 billion.

In 2009 ADC owned just 56 free-standing properties that included 18 Borders (18) and 12 shopping centers. After Borders filed bankruptcy, ADC went to work to build a much more defensive portfolio with a majority of investment grade tenants (67% today).

Today ADC’s portfolio includes 1,404 properties in 47 states and was 99.5% leased (as of Q4-1). Top tenants include Walmart (6.6% of base rent), Tractor Supply (3.9%), and Dollar General (3.9%).

Diversification is much stronger these days, as ADC has added ground leases (182 properties) to the mix, that represents 14.3% of ABR (with a weighted average lease term of 12 years).

On April 1, Morgan Stanley initiating coverage with an overweight rating and $75 price target. The analyst highlighter high quality tenants, with a focus on internet-resistant businesses, and a vertically integrated platform, as differentiating the company vs. peers.

FAST Graphs

Agree is currently trading at $66.46/share which is 8% below our buy below target. Shares are currently yielding over 4% with a payout ratio (AFFO) of 74%. The P/AFFO multiple is 18.9x and analysts are forecasting growth of around 7% in 2022. Our 12-month total return target is 20%.

Diversification is Critical

The older I get, the more I understand the concept of diversification.

In a few days I plan to write an article on diversification, but I must emphasize in this article (focused on retirement) that diversification is a tenet to any intelligent investment strategy.

In fact, I decided to include other income-oriented stocks – such as BDCs and MLPs – to iREIT on Alpha, because I wanted to provide our membership base with a one-stop shop for income.

Personally, I’m extremely overweight REITs, but I have become increasingly fixated on diversifying my holdings, in order to protect my nest eggs at all costs. As Sit John Templeton explained,

“Diversification is a safety factor that is essential because we should be humble enough to admit we can be wrong.”

iREIT on Alpha

Be the first to comment