franckreporter/E+ via Getty Images

Real Estate has often been one of the strongest sectors for building long-term wealth. When it comes to investing, private real-estate may seem out of touch for investors, but it does not have to be that way. One can utilize REITs to gain exposure to Real Estate.

For me personally, I aim to have 20% to 30% exposure to the REIT sector within my dividend portfolio.

2020 brought tremendous pain across many sectors within the stock market, but also opened doors to many companies as well. REITs were hit extremely hard with falling occupancy rates and missed rent payments, which eventually led to dividend being cut by some REITs.

During 2020, the S&P 500 fell hard in the first quarter, but ended the year up nearly 20%, meanwhile the REIT sector (VNQ) fell 5% on the year.

The roles were flipped in 2021 when REITs came roaring back. On the year, the Vanguard REIT ETF climbed 40.5%, outpacing the S&P 500 which had a banner year itself being up 28.7%.

We have been through a lot the past few years as investors and now face new uncertainties. These include high inflation, geopolitical turmoil, and rising interest rates to name a few.

The latter is what investors interested in REITs are focused on the most.

The strongest and most well-run REITs took advantage of the downturn by expanding their portfolio and footprint. We saw strong consolidation within the sector and do not believe that will slow anytime soon.

Rising rates and all, it is still a great time to invest in REITs and in today’s piece I will be discussing 5 of my favorite REITs for 2022 and beyond.

Let’s jump in!

#1 Realty Income (O)

We begin with one of the most well-known REITs on the planet, Realty Income also known as The Monthly Dividend Company.

As I mentioned above, the sector has gone through a lot of consolidation and that includes Realty Income. The company closed their acquisition of VEREIT and then recently announced the acquisition of $1.7 billion in casino assets from Wynn Resorts (WYNN). This places Realty Income into the gaming sector now, which bodes well for another selection I have down below.

I recently had the opportunity to chat with CEO Sumit Roy, who discussed the strength of the company:

We continue to see core retail opportunities leased to high-quality clients who are leaders in their respective industries generate favorable risk-adjusted returns in the long-run. Our strategy was proven during the pandemic, as we were only of only four retail REITs with positive earnings growth in 2020

Realty Income is very intriguing, not only because they provide stability with their pristine Balance Sheet, but also they have the opportunity for some solid growth in the year ahead, even despite the rising interest rates.

The company is looking to expand its footprint internationally as well as domestically, as we have already seen. What separates Realty Income from the rest is its low cost of capital, allowing them to generate sizable investment spreads.

Shares currently trade at an attractive 17.1x forward P/FFO. Over the past five years, shares have traded closer to 19x P/FFO. The company pays a very safe dividend that currently yields 4.4% and they have now paid 620 consecutive monthly dividend payments.

#2 Simon Property Group (SPG)

The next REIT on our list has actually been the BEST performing REIT in my portfolio, which is Simon Property Group. SPG has the largest and best portfolio of mall properties in the world, loaded with class A malls.

Simon is yet another REIT that expanded their portfolio through acquisition when it acquired TCO at the close of 2020. In 2021, shares of SPG surged 95%, hence why I mentioned it was the best performing REIT in my portfolio last year.

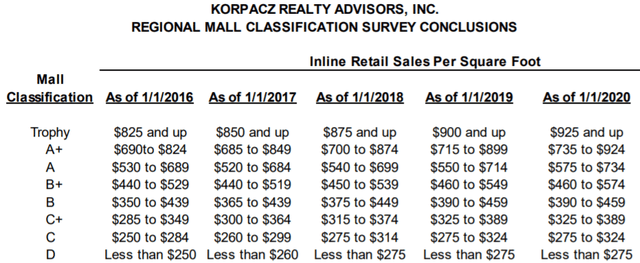

Malls are classified based on their retail sales per square foot. Looking at the analysis, which is conducted each year by Korpacz Realty Advisors, you can see that malls have a classification of A+ to D.

Prior to the pandemic, SPG was operating with Retail Sales per square foot of $693 across their entire portfolio, which classifies them as an A-rated portfolio. Fast forward to Q4 2021, sales per square foot reached a record $713 per square foot at SPG’s mall and outlet centers, surpassing the pre-pandemic highs.

When looking at the mall portfolios that have struggled or closed, the large majority of them have been malls with class C+ or lower classifications. These are the types of malls that are closing. Very few class A malls are shutting their doors for good.

Simon Property Group is also ran by a very strong leadership team, led by CEO David Simon. CEO David Simon has been a great leader for SPG over the years and has been at the helm since 1995, guiding the company through many different economic cycles.

As I mentioned above, 2021 was a banner year for shares of SPG, but 2022 has been the complete opposite. Shares of SPG are down nearly 20% YTD, which I believe to be a great opportunity to pick up a position in this industry leader.

Today, shares of SPG currently trade at $130 with a forward P/FFO of only 11x. The company has a lot to be excited about, especially in the near-term with many of their retail leases being tied to CPI, which has been raging. I currently rate shares of SPG a BUY.

#3 VICI Properties (VICI)

We already saw above that the likes of a Realty Income are entering the gaming sector of real estate, which could bode well for a leader in the space, which is VICI Properties. The gaming sector is very specialized with a high moat combined with a higher floor than regular net-lease REITs.

Two of the most well-known gaming REITs are VICI and MGM Growth Properties (MGP). MGP owns popular properties such as the MGM and Mandalay Bay in Las Vegas.

In August 2021, VICI Properties announced that they would be acquiring MGP for $17.2 Billion, making them the largest landlord on the Las Vegas strip.

The pent up demand to visit properties owned by the likes of VICI is huge and will be a big catalyst for the company moving forward. People visiting their properties will not directly impact VICI immediately, but it will impact them indirectly. As operators thrive, so will the landlords. Proven real estate drives future results.

VICI currently trades at an FFO multiple of 13.9x. When looking at other top net-lease REITs we see that they trade in a range closer to 18x FFO, yet the growth that will be taking place within VICI is much higher, making shares of VICI look very intriguing. I currently rate shares of VICI a BUY.

#4 Medical Properties Trust (MPW)

Medical Properties Trust was one of the best performing REITs during the pandemic. Obviously being that they own hospitals, these were necessary and jam packed facilities during the depths of the pandemic.

One area that did struggle was the properties that conducted elective surgeries. Similar to VICI, this impacts the operators/tenants more than the landlord in the present time.

MPW is the premier player within the hospital real estate space being that they own the LARGEST portfolio of non-governmental owned hospital properties in the WORLD.

The company’s model to acquire these healthcare facilities allows hospital operators to be more flexible and keep facilities in the best possible shape given they do not have significant dollars locked up in the actual real estate.

The company has a solid balance sheet, but I would like to see them continue to improve lessening their debt levels, which they have been doing well at. Another area of risk that investors bring up when it comes to MPW, is tenant risk, meaning they have some high(er) exposure to a few tenants. Still, there top 2 tenants account for ~4.5% of annual base rent for the REIT as a whole.

Inflation as we know has been running extremely hot, which actually bodes well for a landlord like MPW. The company includes built in escalators into their lease agreements and 75% of those escalators are tied to CPI, with inflation ceilings averaging roughly 4.5%.

Shares are down ~15% year to date and present a solid long-term opportunity in my opinion. Shares of MPW currently trade at a forward P/FFO of 10.9x and they have traded closer to 11.4x over the past five years.

#5 Public Storage (PSA)

The final REIT we will discuss today hails from the self-storage sector, which has been on absolute fire over the past 12 months. Out of all five REITs I discuss today, I would be willing to say Public Storage has the least amount of upside solely based on how much they have appreciated.

Over the past 12 months, shares of PSA have risen a staggering 55%. That is incredible appreciation for a growth stock, but we are talking about a REIT. Year-to-date the stock is up 2%, while the S&P 500 is down 6%.

Public Storage is the largest self-storage REIT in the US with a market cap of $65 billion. PSA operates roughly 2,800 properties in 39 states with 1.8 million customers renting space from them.

In terms of the balance sheet, public storage has been led by a strong management team that runs the company very effectively and efficiently. This has led to the company maintaining an A2 and A credit rating from Moody’s and Standard & Poor’s, respectively.

Again, the stock is not cheap, and I do not expect the type of outperformance we have been seeing, but when it comes to investing, you also want your money invested in high-quality companies. High-quality is exactly what Public Storage is.

Currently, shares of PSA trade at a forward P/FFO 24x compared to their 5-year avg P/FFO of 21.2x. So if anything, take small bites or keep the company on your watchlist in the event the stock pulls back.

Investor Takeaway

REITs are great for investors looking to increase their passive income. Given that REITs need to distribute at least 90% of their taxable income every year equates to some solid yields across the sector.

The five REITs discussed today all have one thing in common: high-quality. All but Public Storage, which is coming off a monster 2021, is trading at a valuation below their five year average when looking at funds from operations.

Be the first to comment