Deagreez

This article was co-produced with Cappuccino Finance.

Wall Street and the rest of the world breathed a huge sigh of relief on Thursday.

Inflation data looked better than expected and is showing some signs of slowing down. It’s still much higher than we would like, but at least it is heading in the right direction.

Even though I believe the Federal Reserve waited too long to act, their monetary tightening is showing its effectiveness, which is great to see.

But I think it’s still too early to say we are out of the woods.

First, we need to see inflation keep heading downward.

Second, I don’t expect a true bull market to return until the Federal Reserve officially signals a plan to end the interest rate hikes.

Lastly, we may still be headed towards an economic slowdown. Many of the major tech companies have announced layoffs or hiring freezes.

With all this uncertainty, investing your money in strong dividend yield and rock-solid real estate investment trusts (“REITs”) is always a great idea. Collecting nice dividends from companies with strong fundamentals never goes out of style. Here are five to put on your shopping list…

CareTrust REIT, Inc. (CTRE)

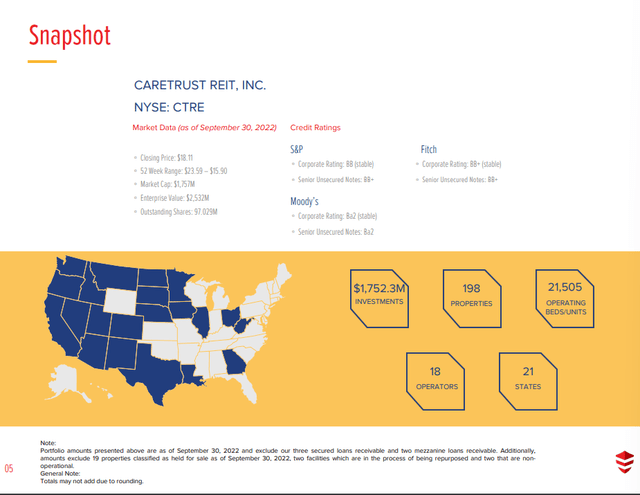

CareTrust REIT engages in the ownership, acquisition, development, and leasing of skilled nursing, senior housing, and other health-care related properties. Currently, they have nearly 200 properties across 21 different states, and they have over 20,000 operating beds/units. Also, their properties are geographically diversified, which greatly reduces the risk.

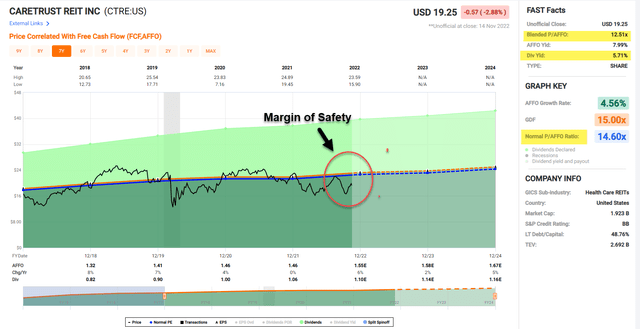

Since 2015, CareTrust has consistently invested over $100 M per year to expand their portfolio and revenue. Accordingly, their adjusted funds from operations (“AFFO”) grew 6.3% per year in the past 5 years, and I expect the growth trend to continue.

Their dividend also grew 8.5% per year in the past 5 years as well and is now yielding 5.6%.

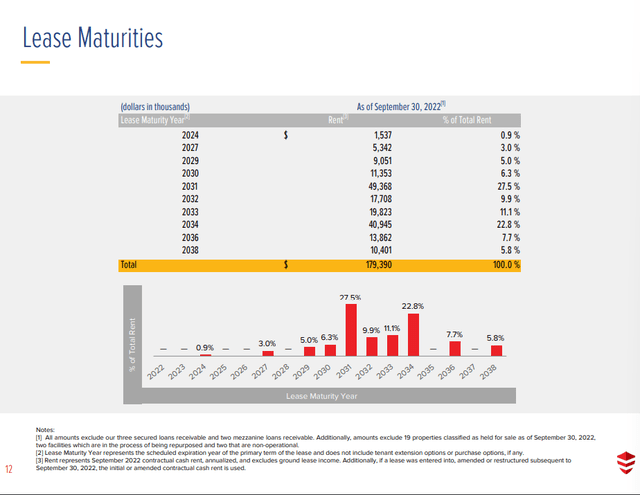

Looking at their lease maturity schedule, they are very well spread out over the next several years. The debt maturity is also very well spread out. All three credit agencies (S&P, Fitch, and Moody’s) are rating CareTrust as investment great (BB from S&P, BB+ from Fitch, and Ba2 from Moody’s).

I don’t think CareTrust will be in financial hardship anytime soon.

CareTrust shares are currently trading about 10% lower than their historical norm. P/AFFO of 12.54x and P/FFO of 13.04x are below their 5-year average. Therefore, I believe CareTrust is undervalued at this point. It is a great time for an investor to pick up some of their shares (sweet 5.7% dividend yield to boot).

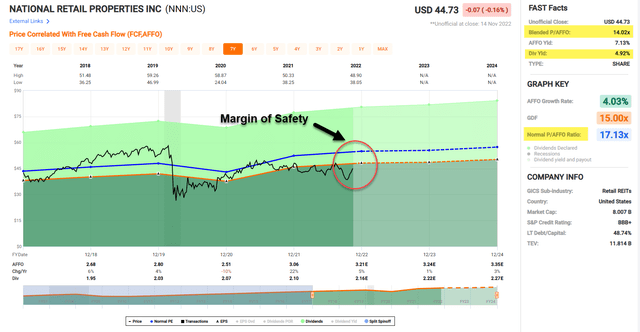

National Retail Properties, Inc. (NNN)

National Retail Properties acquires, owns, invests, and develops properties that are leased to retail tenants under a long-term net lease. Their business model is geared toward delivering mid-single-digit growth per share on a steady, multi-year basis. Top tenants include Taco Bell, Wendy’s, and Mister Car Wash.

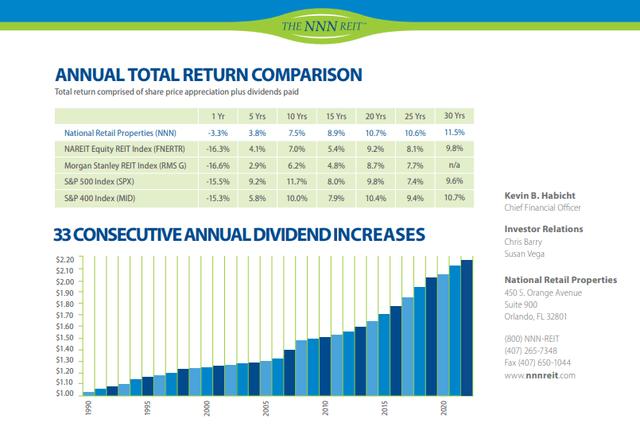

The 33 consecutive annual dividend increases are a great testament to their success. The dividend payment from National Retail Properties is safe at this point, with a cash dividend payout ratio of 64.75% and AFFO payout ratio of 67.92%. Dividend yield is 4.9% right now.

National Retail Properties’ assets are in high demand. The occupancy level of National Retail Properties has never fallen below 96.4% since 2003, which is 3-4% higher than the REIT industry average.

Also, the lease expiration schedule is very well spread, and the weighted average remaining lease term was 10.4 years in the last quarter.

National Retail Properties has been actively growing their portfolio and improving asset quality. They consistently invest between $500 M and $900 M in acquisitions (except for 2020). Given their strong balance sheet and ample liquidity, I expect them to continue investing and developing their properties.

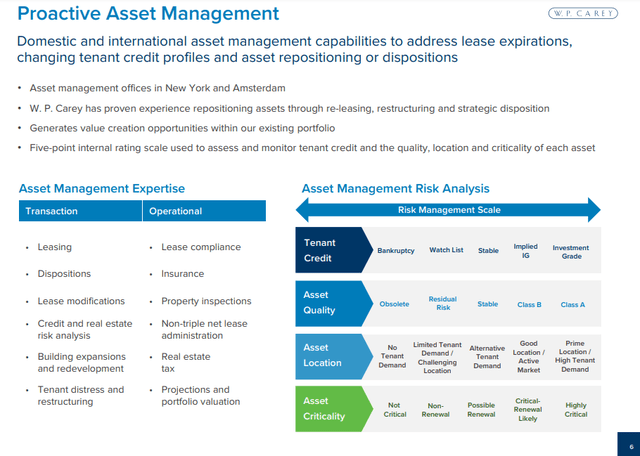

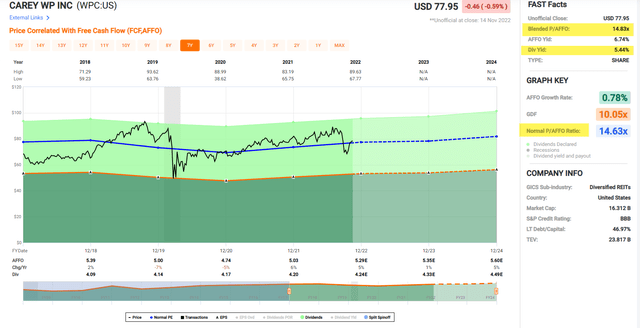

W. P. Carey Inc. (WPC)

W.P. Carey is a diversified REIT and a leading owner of commercial real estate, net leased to companies in the U.S. and Europe. They invest in a diversified portfolio of high quality, mission-critical assets on a long-term net lease basis.

They have over 1,400 properties and over 390 different tenants. Their top tenants include U-Haul, Marriott, and Advance Auto Parts.

W.P. Carey has been doing a great job at managing their lease expiration schedule. The lease expiration schedule is well spread over the next ten years and longer.

The historical occupancy rate of W.P. Carey’s properties is great. It has stayed above 96.6% since 2009.

W.P. Carey has a great balance sheet. Pro Rata Net Debt/Adjusted EBITDA stands at 5.6x, and Total Consolidated Debt/Enterprise Value is at 34.8%. The weighted average interest rate is low at 3.0%. Total Leverage (Total Debt/Total Assets) is at 38.7%, which is comfortably below their covenant target (< 60%).

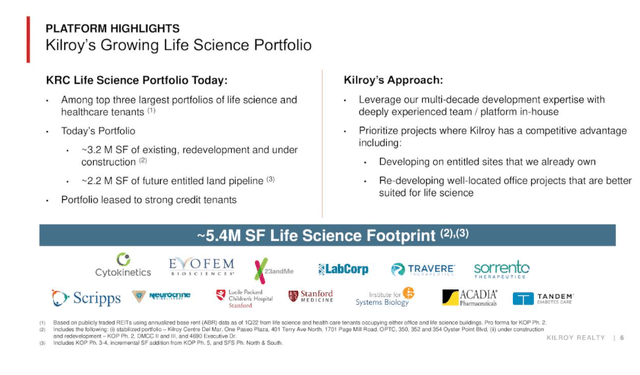

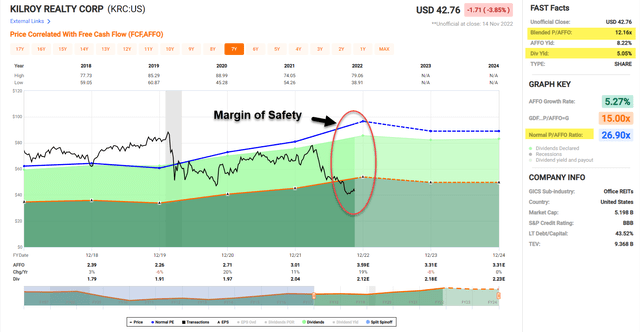

Kilroy Realty Corporation (KRC)

Kilroy Realty Corporation is a REIT that owns, develops, and manages premier office, life science, and mixed-use properties. Their properties are primarily located in Los Angeles, San Diego, San Francisco, Seattle, and Austin. They have over 120 office properties and over 1,000 residential units.

Kilroy has been focusing on expanding their Life Science portfolio. Leveraging their multi-decade experience and expertise, they are rapidly expanding their Life Science footprint. I believe this is a great move as demand for Life Science will continue to rise in the future.

Currently, they have about 3.2M square feet of existing or redeveloping properties, and they have 2.2 M square feet of future development pipeline.

Kilroy’s 4.9% dividend payment is very safe at this point. The cash dividend payout ratio is at 41.31%, and FAD payout ratio is at 51.34%.

Given their strong balance sheet and expanding portfolio, I don’t expect Kilroy to run into financial troubles anytime soon. The solid dividend yield of 5.0% is a big plus as well.

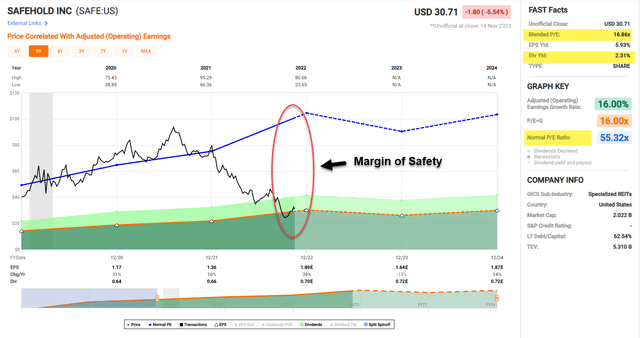

Safehold Inc. (SAFE)

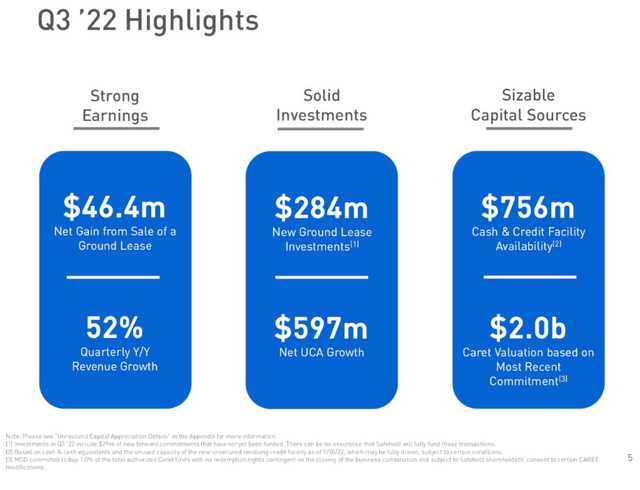

Safehold acquires, manages, and capitalizes ground leases that represent the ownership of land underlying commercial real estate projects. They lease the land on a long-term basis.

Their portfolio has grown substantially since the IPO, with 18x growth since 2017. The portfolio value grew from $0.3 B in 2017 to $6.1 B in 2022. Given they just had an outstanding quarter (revenue growth of 52% YoY) and invested $284 M on new ground lease, I expect their strong growth trajectory to continue in the future.

Safehold’s portfolio is very well geographically diversified. Their portfolio is spread across the U.S., and, therefore, insulated from the performance of local economies or real estate markets.

Also, Safehold has a favorable capital structure. Total debt/equity market cap is at 2.1x, and interest rate spread (difference between annualized yield and effective interest rate) is at 138 basis points. It’s not surprising to see their solid credit ratings from credit agencies. Moody’s rated Safehold at Baa1, and Fitch rated them at BBB+.

Safehold’s dividend payment appears safe at this point, with a cash dividend payout ratio of 61.70%, and an FFO payout ratio of 28.99%. Along with their safe business model, I don’t expect their dividend payment to be in danger anytime soon.

Investors can sleep well, knowing their money is with Safehold.

Risk

Even though the CPI index showed that the inflation might be easing, it’s too early to say that we are out of the woods. Also, 7.7% is still way above rates that any of us want to see.

Now, everyone is expecting that the Federal Reserve will slow down their interest rate hike early next year. However, if they don’t slow down (because of persisting inflation data or for some other reason), the market will respond poorly.

The mortgage rate is still at a high level, and major metropolitan real estate prices are softening. Also, the valuation of properties is diverging between buyers and sellers. Due to this uncertainty, the REITs may have to adjust their plans for acquiring and disposing of their target properties.

Conclusion

The five REITs in this article have strong balance sheets, favorable capital structures, and robust portfolios. Also, they have been growing nicely in the past several years, and I expect that to continue.

Even though inflation might be easing, there is still plenty of uncertainty in the air. The unemployment rate may pick up after large layoffs from big tech companies, and economic growth may slow.

During times of uncertainty, putting your hard-earned money in these strong REITs is a great strategy. In good times or bad, they will keep on paying dividends and help you achieve your financial goals.

Be the first to comment