Sezeryadigar/E+ via Getty Images

We’re all feeling the pain these days.

Rising gas prices. Increasing food costs. Building prices.

I’m sure you can relate to one if not all of these inflationary-driven costs that are hitting most pocketbooks.

We’re all living in unchartered territory right now.

Of course, I was not alive during The Great Depression of the 1930s that occurred due to a range of factors, such as untamed speculation that led to a bubble bursting in 1929.

I was around in the 1970s, however, I was too young to remember the inflation that slowed growth.

Some fear that we could be entering a “stagflation” phase in which high inflation, a stagnant economy, and high unemployment could lead to another ’70s-style phenomenon.

That sounds scary…

But it’s worth noting that real estate is a terrific hedge against inflation, because it tends to grow in value alongside inflation.

And even if stagflation itself doesn’t happen, inflation happens and is happening right now, and holding real estate can bolster your long-term wealth even as inflation hurts your bank account.

Think about it like this…

Real estate is essential to almost any business model:

- Manufacturing

- Warehousing

- Office

- Retail

- Healthcare

- Housing

- Farming

- Technology (Data Centers and Cell Towers)

- Casinos

- Fast Food Restaurants

- Casual Dining

These businesses all rely on real estate to be productive, and that list includes all of the properties we live, work, and shop. Property values tend to rise because of rising costs of labor, land, and materials.

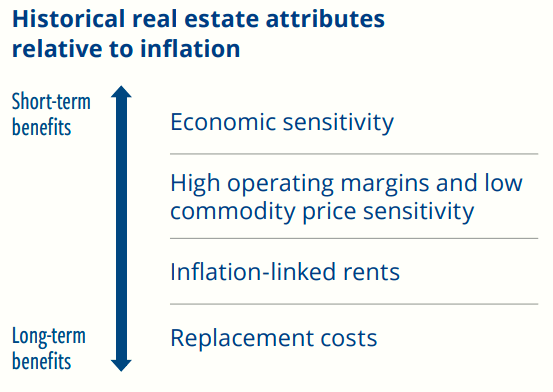

Also, real estate companies – or REITs – have high operating margins and low labor costs, and of course, as rental proceeds increase, so do property values. As Cohen & Steers explains in a research paper,

“This environment provides a potentially sturdy backdrop for REIT investors: Traditional asset allocations may provide less safety to defend against a prolonged environment of higher inflation than real estate assets, which have historically performed well in elevated inflationary periods.

In inflationary environments where the economy is expanding, REITs have historically benefited from higher demand and less competition as new supply is curtailed due to higher construction costs and construction delays.”

Cohen & Steers

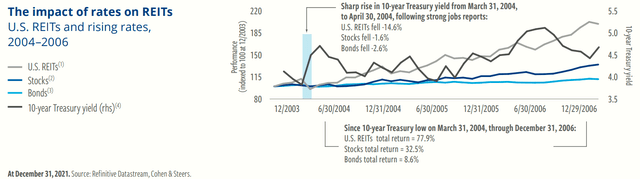

What about the other monster in the room, rising rates?

Not so fast…

Between 2004 and mid-2006 the Federal Reserve hiked interest rates 17 times (from 1.0% to 5.25%) amid an improving economy, and yet REITs outperformed stocks and bonds during this period.

While long-term interest rates can affect capital costs, an expanding economy typically drives stronger demand, often leading to higher occupancy levels, which can give landlords the ability to offset rate increases by raising rents.

Of course, as any intelligent REIT investor can attest, the primary appeal to REITs these days is valuation. In addition to the potential benefits of growth, inflation sensitivity, and income, REITs are attractively valued.

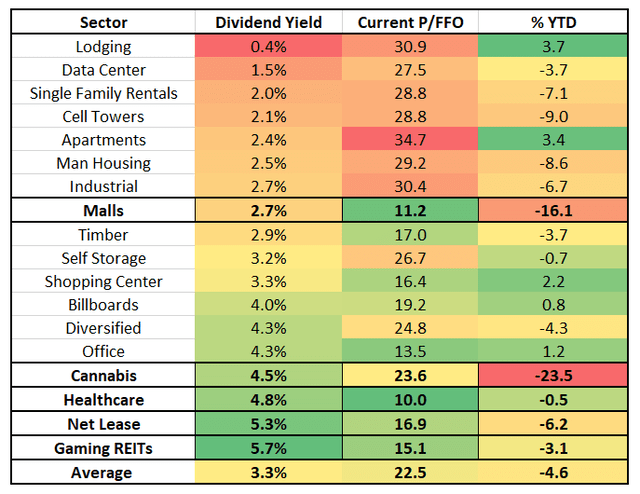

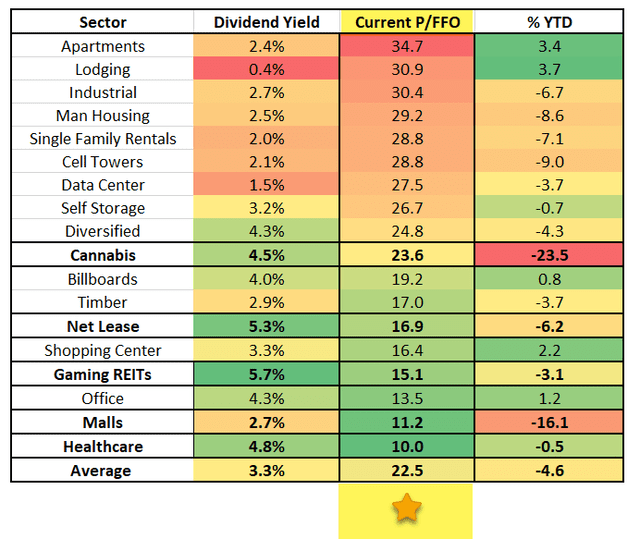

As seen below, REITs are trading at 22.5x P/FFO while the broad equity market’s price-to-earnings ratio is 25.9x, or a 3.4x discount (that compares favorably with REITs’ 1.3x average premium since 2005).

Also as seen below, the higher-yielding sectors (and mall sector) appear to provide the best risk-adjusted opportunity.

As seen below, these same favored high-yielding sectors – gaming, net lease, healthcare, cannabis, and malls – also trade at lower multiples. These five sectors are trading at an average P/FFO multiple of 15.4x.

So, given their overall “cheapness”, I decided to provide readers with a listicle-style article in which I will highlight one REIT in each of these (5) property sectors.

Cannabis Pick: NewLake Capital (OTCQX:NLCP)

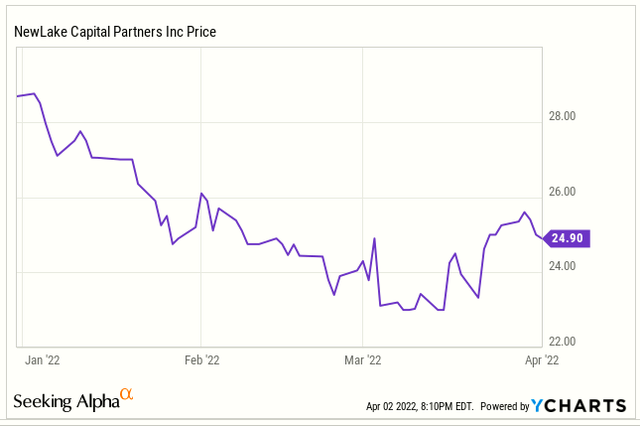

NewLake Capital Partners is a cannabis REIT that owns 29 properties in 11 states. The company is traded over the counter but is hoping it can get listed on either the NYSE or NASDAQ. As viewed below, NLCP shares have dropped 13% year-to-date:

In Q4-21, NLCP’s rental income increased by approximately $4.3 million to approximately $8.4 million compared to approximately $4.1 million for Q4-20. Rental income for the 12 months (ended 2021) increased by approximately $15.9 million to approximately $27.6 million, compared to $11.7 million for the full-year 2020.

NLCP’s AFFO in Q4-21 was approximately $7 million and for the full year, it was $21 million. On March 15th, the company declared a $0.33/share quarterly dividend, a 6.5% increase from the prior dividend of $0.31.

Recently I spoke with NLCP’s CEO, Gordon DuGan, and he pointed out to me that NLCP is part of the “equity riddle”. In fact, we find shares ridiculously cheap, now trading at $24.90 with a P/AFFO of 18.4x and dividend yield of 5.3%. To put that into context, Innovative Industrial (IIPR) is trading at 27.9x (and a dividend yield of 3.5%).

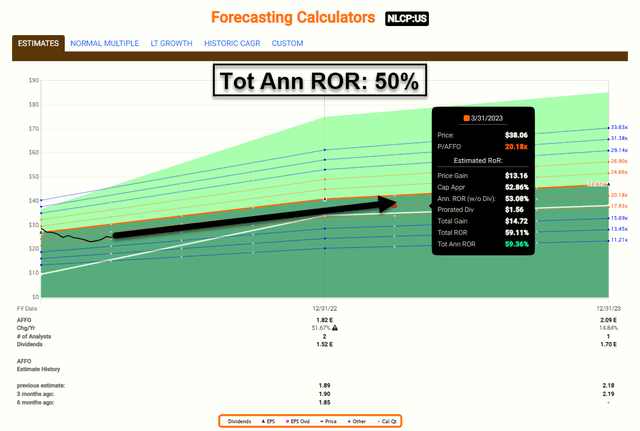

So, just assuming that NLCP solves the “equity riddle” and begins to trade in line with IIPR, you get a 12-month total return of over 100%. I’ll be happy with half of that number!

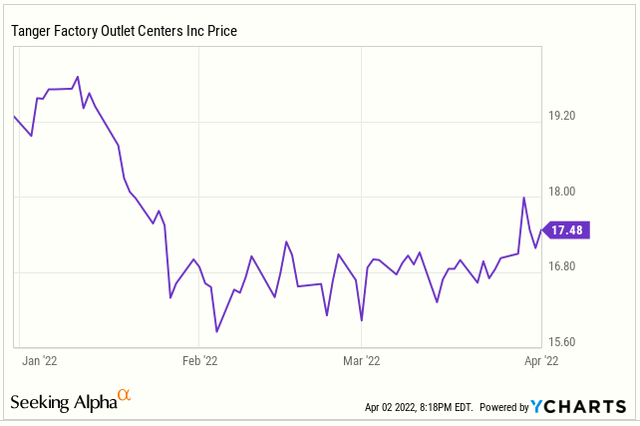

Mall Pick: Tanger Factory Outlet (SKT)

Tanger Factory Outlet is a mall REIT that owns 36 properties in the US and Canada. As viewed below, shares have fallen by around 10% year-to-date:

In Q4-21, SKT generated solid results including domestic traffic that exceeded 2019 levels, up 12% from Q4-20. Also, occupancy recovered to 95.3%, representing a sequential increase of 90 basis points and a 310-basis-point year-over-year increase.

Tenant sales reached an all-time high for the portfolio at $468 per square foot, a 17.6% increase over 2019, and generated significant percentage rental growth.

Taken together, all of these metrics helped generate year-over-year same-center NOI growth of 5.6% for the fourth quarter and 16% for the full year.

SKT’s balance sheet is holding up just fine, with no significant debt maturities until April 2024 and solid debt metrics: net debt to adjusted EBITDAre improved to 5.5x for the trailing 12 months compared to 7.2x for the comparable 12-month period.

For the full year, the dividend was well-covered, with an FAD payout ratio of 53%, and as seen below, the AFFO payout ratio was 49.7% in Q4-21. This screens well for a sizeable dividend boost! SKT introduced guidance for 2022 and expects core FFO to be in the range of $1.68 to $1.76 per share and same-center NOI growth at a range of 1.5% to 3.5%.

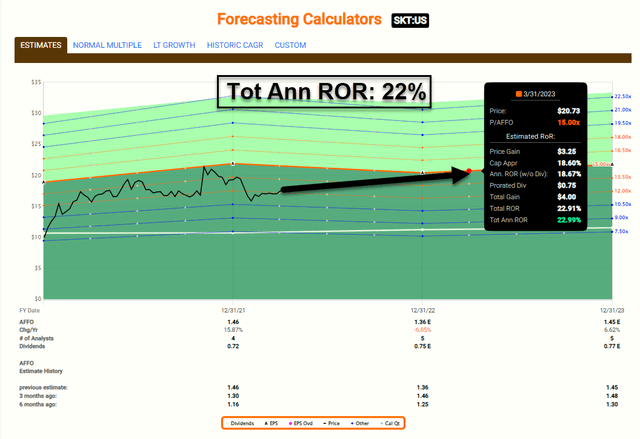

SKT shares now trade at $17.48 with a dividend yield of 4.2%. The P/AFFO is 12.2x compared with a normal multiple of 15.0x. Analysts forecast 32% FFO growth in 2022 (after a 20% decline in 2021).

Once more, the low dividend payout ratio suggests to us that SKT will boost its dividend meaningfully, and, of course, this should spark shares to move in line with the 15x multiple. We forecast annual returns of 22% or higher over the next 12 months.

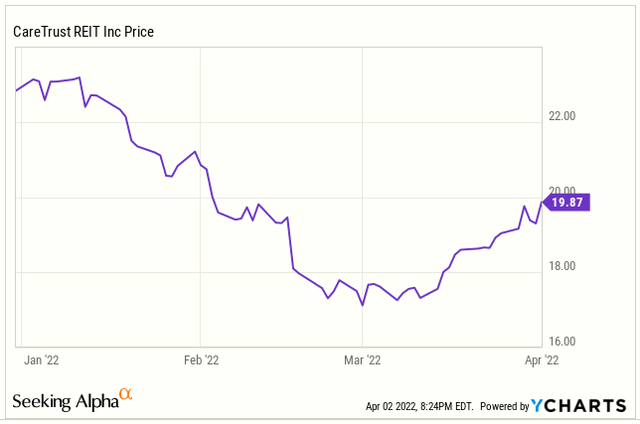

Healthcare Pick: CareTrust (CTRE)

CareTrust is a healthcare REIT that focuses on skilled nursing (71%), multi-service campus (16%), and senior housing (13%). The company owns 224 properties (23,421 beds) in 27 states (as of Q4-21). As viewed below, CTRE shares have declined by around 13$ year-to-date:

One thing I like about CTRE is that the company has maintained low leverage 3.7x (flat Q/Q) vs. a 4.0-5.0x target and net debt to enterprise value was 23% (as of Q4-21).

In Q4-21, CTRE FFO grew FFO by 9% over the prior-year quarter to $37.3 million and normalized FAD grew by 11.5% to $39.8 million.

According to CMS national data, sequential occupancy grew +80bp M/M through 3/13/22 (+45bp prior month) as Omicron faded. The pace of the occupancy recovery and waning government support will be key in maintaining rents.

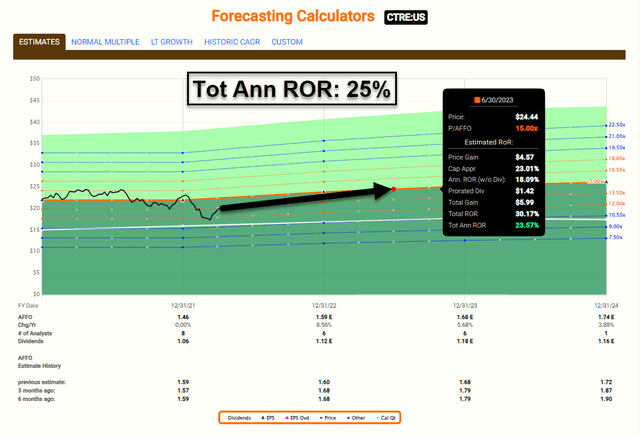

There are 8 analysts that cover CTRE and 6 have BUY ratings and the average growth estimate for 2022 is 9%. CTRE shares are now trading at $19.87 with a P/AFFO multiple of 13.3x (normal is 15.0x) and dividend yield of 5.5%. We forecast shares to return ~25% over the next 12 months.

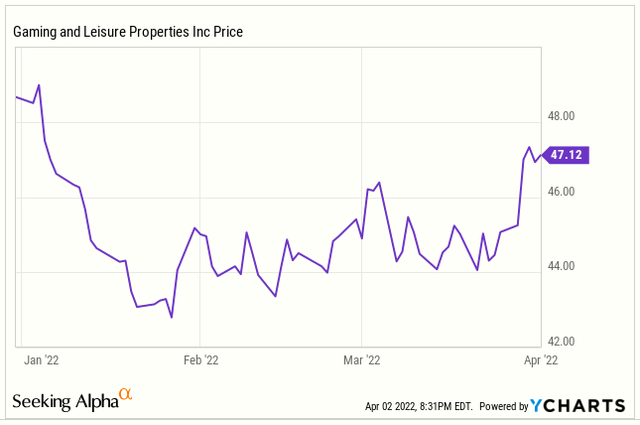

Gaming Pick: Gaming and Leisure (GLPI)

Many of you know I like VICI Properties (VICI), but I’m also a big fan of Gaming and Leisure, a regional gaming landlord that owns 52 properties in 17 states, with a total of 25.6 million square feet and 15,206 hotel rooms. The company was created from a tax-free spin-off of the real estate of Penn National Gaming (PENN) in February 2013. As seen below, GLPI shares have fallen ~3% year-to-date:

GLPI is the oldest gaming REIT (8 years in existence) with the greatest perceived stability through economic cycles considering its 100% regional portfolio (zero on the Las Vegas strip).

GLPI’s major tenants are creditworthy public companies with strong balance sheets, institutional platforms, extensive experience, and established brands.

Almost all of GLPI’s revenue comes from premier publicly-traded gaming companies PENN, BYD, and CZR with no single property generating > 6.0% of 2020 pro forma gross gaming revenues.

I also want to point out the fact here that Realty Income (O) recently announced its first gaming acquisition, a sale/leaseback for Encore Boston Harbor for $1.7 billion, representing a 5.9% cap rate.

That’s a great deal for O, but also it validates the attraction to the gaming sector, and also opens up the doors for other net lease REITs to “get in the game”.

GLPI trades at an attractive multiple of 13.5 P/AFFO, and high equity yield, 7.4%. To put that in perspective, GLPI’s closest peer, VICI Properties, trades at 15.7x (P/AFFO) and an equity yield of 6.4%. With O now “in the game” for casinos, I suspect to see more deal flow in the sector, and perhaps GLPI become a takeover target (as I referenced in a recent article).

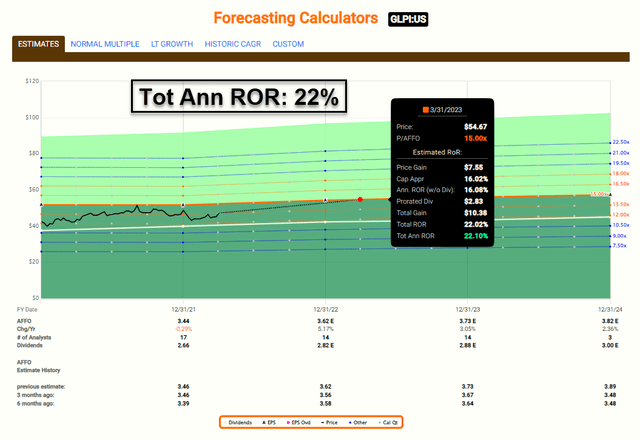

In terms of yield, GLPI’s dividend is 5.9%, compared with 4.9% for VICI and 4.2% for O. Factoring in cheapness, growth (+5% in 2022) and multiple expansion, we consider GLPI a Strong Buy that could return 22% annually.

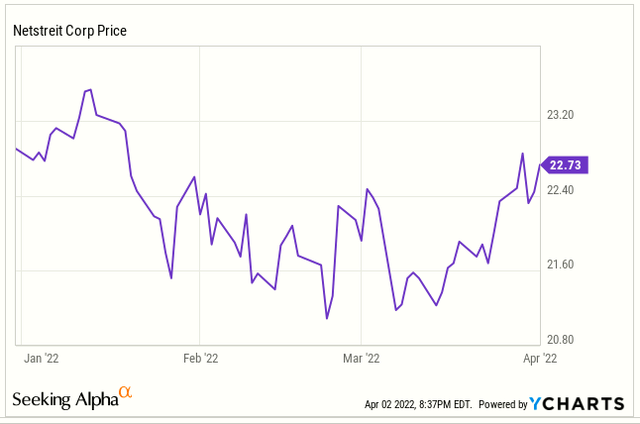

Net Lease Pick: NETSTREIT (NTST)

NETSTREIT is a net lease REIT that IPO’d in 2020, and currently has a portfolio of around 300 properties in which over 85% of the portfolio consists of investment grade tenants, or tenants with an investment grade profile (the highest % in the net lease sector). As seen below, NTST shares are basically flat year-to-date (-.70).

In just around two years, NTST has grown its portfolio by an average of $101 million per quarter and now has a market cap of around $1 billion. To fund that steady growth, NTST has maintained strict financial discipline, at year-end, the balance sheet had total debt of $239 million outstanding, of which $175 million was from its fully hedge term loan with a remaining balance from the revolving line of credit.

NTST has no debt maturities until the maturity of the revolver in December 2023, which is subject to a one-year extension option. The net debt to annualized adjusted EBITDA ratio was 4.2x at year-end (below the targeted leverage range of 4.5x to 5.5x).

For Q4-21, NTST reported net income of $0.05, core FFO of $0.25, and AFFO of $0.27 per diluted share, and for the full-year 2021, the company reported net income of $0.08, core FFO of $0.87, and AFFO of $0.94 per diluted share. In NTST’s January business update, it established a 2022 AFFO per share guidance in the range of $1.13 to $1.17 per share.

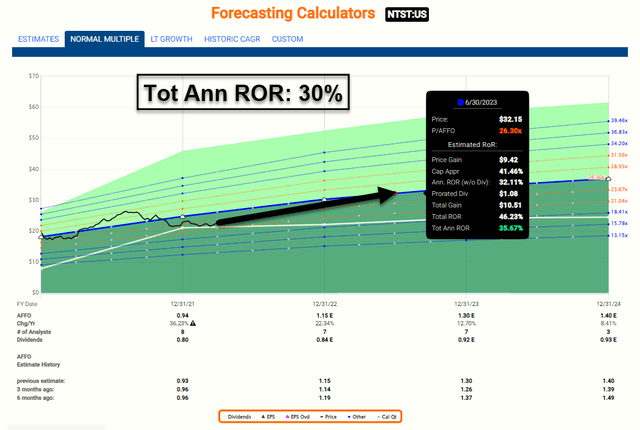

NTST grew AFFO by around 36% in 2021 and analysts are forecasting more impressive growth of 21% in 2022 (highest in the peer group and one of the highest in the REIT sector).

Shares are now trading at $22.73 per share with a dividend yield of 3.5%. NTST’s equity yield is now around 4.4% and the payout ratio is around 80%, which means the company should boost its dividend substantially this year.

Given its small size, NTST should be able to move the needle, especially if the company continues to acquire around $100 million every quarter. As you can see below, we updated our forecast for 2022, which reflects a total return target of 30%.

In Closing: REITs to the Rescue

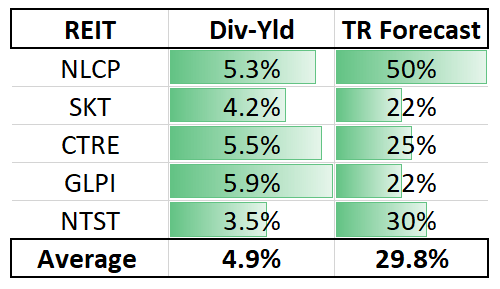

These 5 REIT picks have an average dividend yield of 4.9% and our average 12-month total return forecast is 29.8%.

iREIT on Alpha

As I said earlier, I’ve never lived through a Great Depression, however, I have lived through a Great Recession, which is partly the reason I’m now writing articles on this Seeking Alpha platform.

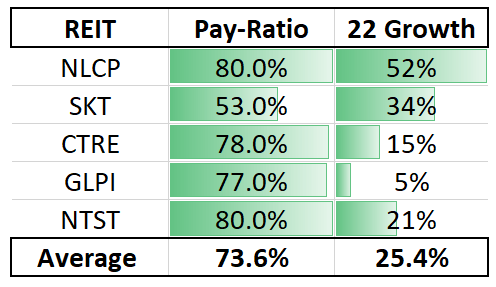

The reason I handpicked these 5 REITs is because the companies have low payout ratios, high dividends, and very solid growth prospects.

iREIT on Alpha

But most importantly, I selected these 5 REITs because I’m a value investor, which simply means I know a bargain when I see one. As the legendary investor, Benjamin Graham, wrote (in The Intelligent Investor).

“The stock investor is neither right or wrong because others agreed or disagreed with him; he is right because his facts and analysis are right.”

Be the first to comment