Sezeryadigar/E+ via Getty Images

What many readers and subscribers want is for me to give them my “best picks” for investment. This is a valid request, and one I’m happy to field from time to time. I’m not the type of writer to do this every month, but once in a while, I like making a bit of a list to give everyone what companies I might be investing in at this time.

In my last article, found here, you could read about 6 German companies I’m currently investing in.

In this one, we’ll turn our sights on North America and giving you 5 companies that I’m investing in that currently offer more than 15% annual upside based on a conservative forward valuation, while also yielding a solid dividend and giving you a safety in the form of a conservative, Investment-grade credit rating.

Sounds good, doesn’t it? Relatively safe yields with solid upsides?

Well, here they are – read all of them and see if any of them strikes your fancy.

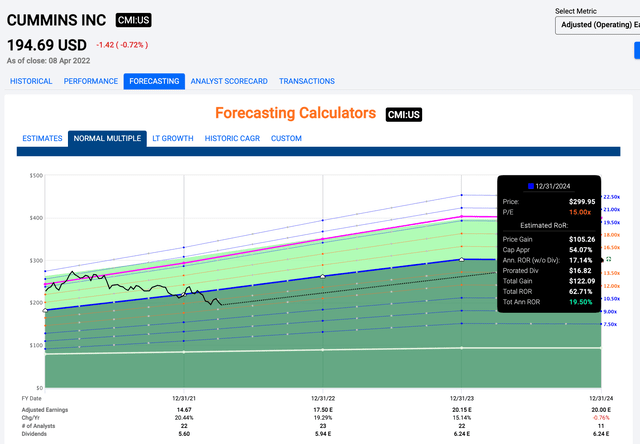

1. Cummins (CMI) – 19.5% annual upside

It’s been some time since Cummins was a “BUY” to me. This recently changed when the company started to deteriorate in valuation, while at the same time seeing upsides from ongoing EV shifts. Cummins today is one of the more solid machinery/engine builders in all of the country.

Not only that, the company is A+ rated with an incredibly solid upside over a forward, 3-5 year period. Even assuming only a 15x P/E, which is fair for this company, you get upsides that are higher than 15% annually.

Cummins Upside (F.A.S.T. graphs)

Whenever a company like Cummins comes out of what is essentially overvaluation, the resulting downcycle is a great opportunity for savvy investors to pick up multi-year total RoRs of 50-100%. All you need do is be sure to pick the company up at a low valuation, the company continue to perform well, and profit from the eventual reversal.

Cummins is one of the safest construction cyclical out there, barring perhaps peers like Caterpillar (CAT) – only CAT isn’t undervalued here. While CMI isn’t risk-free, there’s a fundamental and very real upside to the company at this valuation. Historically, I made over 80% RoR on Cummins once.

I intend to do so again.

Cummins is now 0.4% of my portfolio, and I’m buying more.

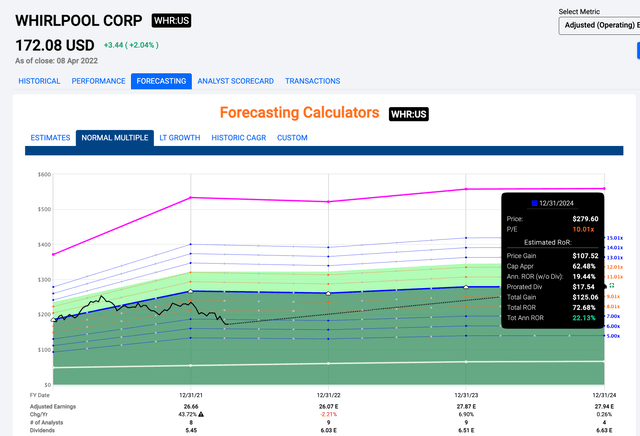

2. Whirlpool (WHR) – 22% annual Upside

Whirlpool is another great pick that I’m going to really highlight here. I even wrote a recent article on the company, and the upside for the company in the long term is massive.

Whirlpool Upside (F.A.S.T. Graphs)

You could make over 70% in only a few years if you invest at this point and the company continues to perform as it has historically. Whirlpool yields over 4% here – which is pretty great in terms of dividends. It’s also one of the world’s premier appliance manufacturers and has global operations.

Whirlpool is also investment-grade rated at BBB – though I would view it as more cyclical with significantly more EM FX exposure than something like Cummins. Still, if you want conservative consumer discretionary – Whirlpool is definitely a way to go for you here.

Even if the company were to trade flat for some time, you’d still make more money than the market is expected to generate on average going into a recession. You’re also buying Whirlpool at less than a 7x earnings multiple, which is insane.

In a risky environment – buy quality cheap. Now is not the time to get fancy or risky with your investment. Go for safety and quality.

Whirlpool is that, certainly.

The company is around 1% of my portfolio here, and I intend to push more to work here.

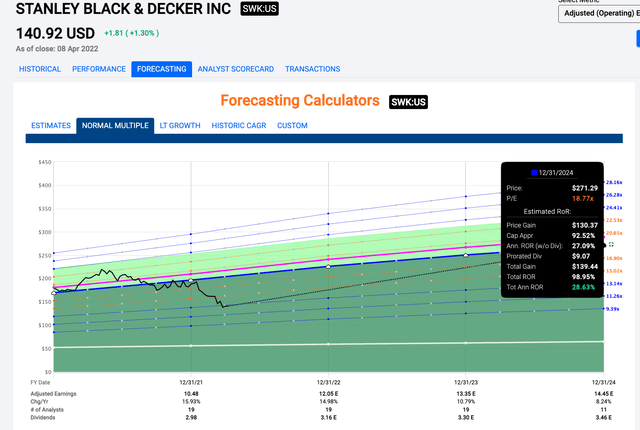

3. Stanley Black & Decker (SWK) – 28% annual upside.

Quality, quality, quality.

I’m going to be shouting this from the rooftops until you get sick of hearing it. SWK is probably the lowest-yielding stock on this entire list – but it also has one of the best upsides of the entire list based purely on valuation. The company is A-rated, and the decline in its valuation has very little correlation to its prospective earnings. The earnings are actually very much fine and expected to grow at double digits until 2024.

Based on this, you could make almost 100% 2024E by investing in one of the best tool companies on earth.

F.A.S.T graphs SWK Upside (F.A.S.T. Graphs)

Quality isn’t enough. That’s something we focus on at iREIT on Alpha. Valuation is the second key to a good investment. SWK has both of these in spades. SWK has experienced a lot of cyclicality over the past few years, going up and down from over 15x P/E to less than 13x P/E. Historically, it’s always been a good idea to buy this company cheaply, allowing for returns in the triple digits over a longer period of time.

I believe this time is absolutely no different – and I’m at a “BUY” on SWK.

0.3% of my portfolio is currently SWK – and I’m expanding that step by step.

I believe you should consider doing the same here.

Risk free – no. The company is cyclical, at least in valuation, and pushing into a recession, we can see that this company can drop pretty deep. But it always goes back up again – at least historically.

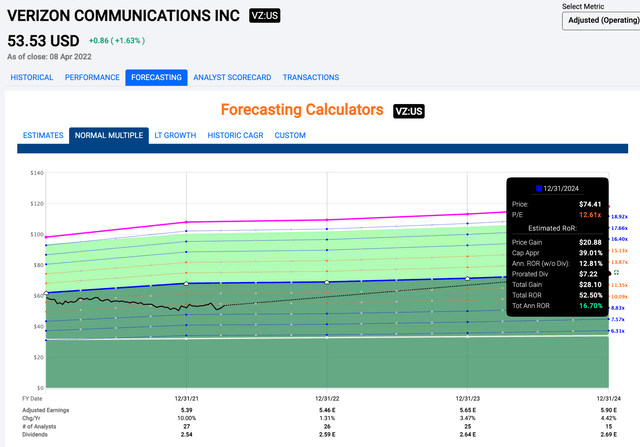

4. Verizon Communications (VZ) – 16.5% Annual Upside

I get that not everyone thinks that AT&T (T) is a good value here, even if I believe that people who did not/don’t invest in the company here. However, the same risk and poor management cannot be claimed for Verizon communications. VZ is well-managed, has a superb yield, a good BBB+ credit rating, and one of the safest upsides in American telecommunications.

Assuming just reversal to a conservative 5-year FV P/E average of 12.61x, investors can have 52% in less than 4 years.

Let me reiterate that. You could make 52% by investing in one of the largest telcos in all of the US. if that’s not close to “risk-free”, I don’t know what is. This company yields over 4.75% in dividend yield, has a decent DGR, but above all, has a backbone of solid infrastructure as its safety.

In my mind, no investor should start looking at other telcos before they start investing or have a full exposure to Verizon. This company is as solid an investment as any long-term investor can hope for.

The one risk to this company is a spectrum, maybe slow growth, and CapEx. Aside from that – and these are in my view manageable, there is very little that could really destroy value for you here in the long run.

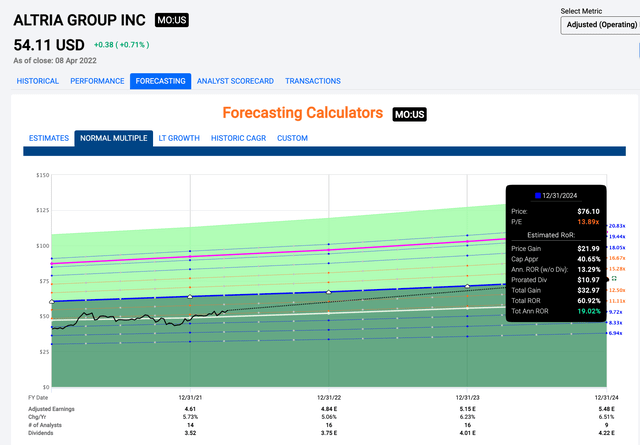

5. Altria (MO) – 19% annual upside

Despite the fact that Altria has been recovered somewhat since I last covered the company, don’t believe that means the company has no more upside left. Even if you just assume a 12-13X P/E upside, the upside for Altria on a 4-year basis is more than 19%, or almost 61% until 2024E.

Altria Upside (F.A.S.T. graphs)

That’s almost 61% by investing in one of the largest tobacco businesses on earth, with a massively high yield of close to 6.7% and a credit rating of BBB. That’s why over 3% of my portfolio is invested in Altria, and why I’m perfectly willing and looking to go all the way to a solid 4-5% in the company.

Altria faces some political risks which are well-described in most of the articles on the company, primarily related to the switch from combusted to heated/other forms of tobacco. But the base case that I view as the most likely is a continued, normalized consumption of tobacco. I don’t believe people will stop using tobacco, just as I don’t believe that people will stop consuming alcohol.

Altria is one of my favorite tobacco sin stocks – and I own significant stakes in all 3 of the major ones.

I believe you should be investing in all of these – and especially in Altria.

This concludes my current overview of North American stocks 1-5.

Wrapping up

You may note that all of these picks are very no-nonsense, large-cap sort of companies. I’m not getting “fancy” in any of these picks. There are no massive growth stocks here, no tech stocks, nothing like that.

That’s because I believe people don’t really need that. As conservative investors, we should be more than happy with returns of 50% in 3-4 years. All of these companies give us this.

You don’t need to take some of the outsized risks that people and other contributors on the site speak about. Why take risks when you can invest in stalwarts like this and still make away with solid returns, provided their business continues to operate as it has for the past 40-80 years?

For 99% of all investors, risks should be calculated and conservative. Too often I see investors taking unnecessary risks without really having any reason to do so. Sometimes they hope for those 500-10000% returns in a short timeframe. Well, remember that those returns also come with a proportional risk. It’s not unlikely that you will not only lose money but perhaps all of your money.

I’m a simple man with simple goals. Simple, market-beating returns. 10-15% minimum on an annual basis – preferably more.

If you look at my article on the German companies I reviewed recently, you’ll notice a clear trend.

Most of these EU businesses, or German businesses, have an upside that’s actually significantly higher than these companies. Some are higher than 30% conservatively.

That’s why currently I’m allocating over 80% of my capital to EU investments. EU is significantly more undervalued than NA, and I’m really only interested in one thing when I invest.

The highest possible, conservatively-adjusted 5-year forward upside with a high dividend yield.

Once that upside is reached and once the company has “no more left to give” at that valuation, I’m perfectly happy to sell off at a nice profit, and repeat the process with another solid company.

This is how I make my money on the market – and I’ve been doing so successfully for many years at this point. So in this piece, I’m sharing with you my latest picks on the NA market.

There are other picks that are solid, of course. But these are the best combinations of safety, risk, and upside that I currently see on the North American market.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Thank you for reading.

Be the first to comment