BrianAJackson

During the FAANG (Facebook (META), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google (GOOG) (GOOGL)) heyday, it seemed like investing in boring dividend stocks was a bad idea.

Putting money into the stocks that only yield a 3% dividend sounded like a silly idea when hot tech stocks were rising 20% per year.

Well, this was true up until the Federal Reserve started tightening monetary policy. The persistent high inflation and tighter monetary policy have soured the economic sentiment, and growth stocks got hammered.

During this time of uncertainty and volatility, Dividend Aristocrats that reliably increase their dividend are shining once again.

They may not bring the 20% per year stock appreciation of tech stocks, but they are the ones that can help you achieve your retirement goals with high probability and give you a true sense of security.

The following five are great Dividend Aristocrats to help you sleep well at night!

AbbVie (ABBV)

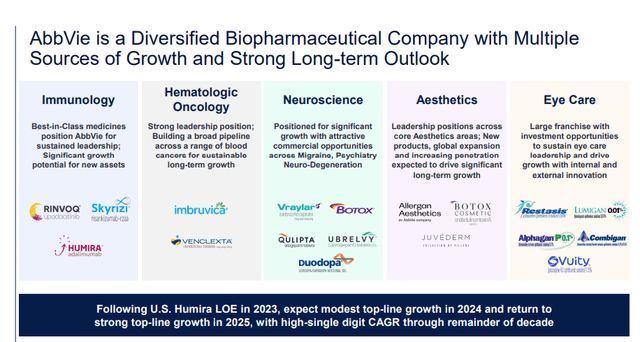

AbbVie is a global biopharmaceutical company that develops, manufactures, and sells medical products in immunology, hematologic oncology, neuroscience, aesthetics, and eye care. Their revenue has been growing substantially in the past several years (17.66% per year, 5-year average), and they have many promising drugs in their pipeline.

AbbVie used to get labeled as a “one trick pony,” since they relied heavily on a single mega blockbuster drug Humira. However, management has been making a strong effort to diversify their portfolio through acquisitions (e.g., Allergan) and new drugs (e.g., Skyrizi and Rinvoq).

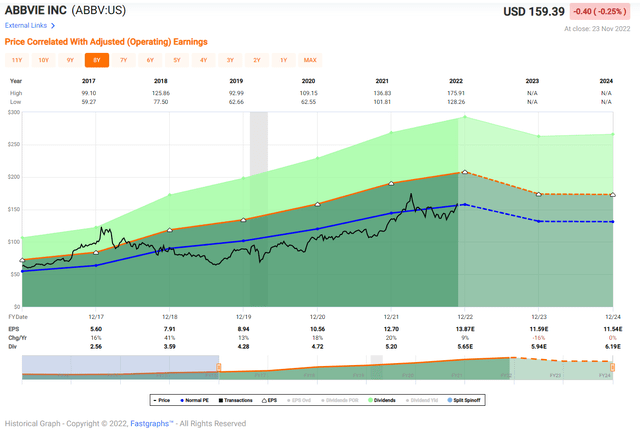

AbbVie’s dividend (current yield is at 3.82%) is safe at this point. The cash dividend payout ratio is 44.94%. AbbVie generated $22.5 B of operating cash flow, and this strong cash generating ability isn’t going to dry up anytime soon.

Profitability metrics show the strength of AbbVie’s economic moat. Gross profit margin (69.83%), EBIT margin (36.51%), and EBITDA margin (50.85%) are far superior to peers.

With their great competitive advantages, strong pipeline, and excellent research team, I expect AbbVie to stay a great company in the future.

(Dividend Kings rates ABBV a HOLD)

Chevron (CVX)

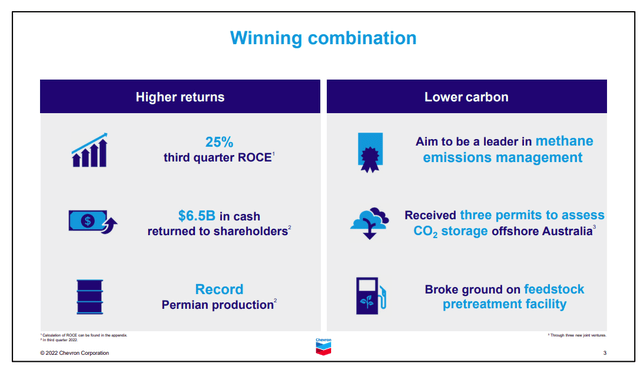

Chevron is an integrated energy company, and they own most of the oil and gas industries’ value chain. Their upstream unit pumps oil out of the ground, the midstream unit transports crude oil and other petrochemical products to refineries, and the downstream unit produces gasoline, diesel, and other petrochemical products.

Due to global underinvestment during the pandemic, crude oil and fuels have been in short supply, and the price of gasoline and diesel have stayed high. Geopolitical volatility also contributed to these high prices as well.

Thanks to their integrated business structure, Chevron is in the best spot to take advantage of this environment, and their profit has soared in the past year or so.

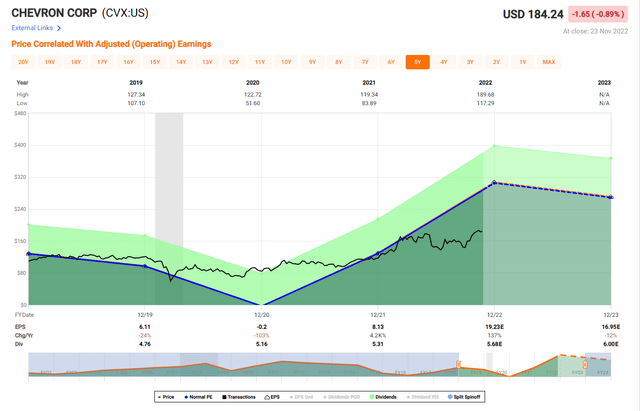

During the pandemic, Chevron made strategic decisions to reduce costs and selectively invested to increase their productivity. These efforts are starting to show results. Their ROCE is at 25%, and they generated $15.3 B operating cash flow during 3Q2022.

Chevron’s dividend is safe at this point with a cash dividend payout ratio of 30.21%. Also, their balance sheet is stronger than peers (e.g., Exxon Mobil (XOM) or Shell (SHEL)). Their total debt to equity ratio (14.81%) is lower than peers, and the liquidity measures (current ratio and quick ratio) is at the higher end of the industry.

(Dividend Kings rates CVX a HOLD)

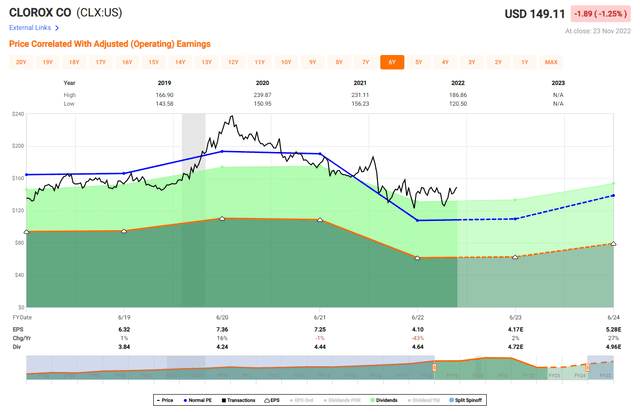

Clorox (CLX)

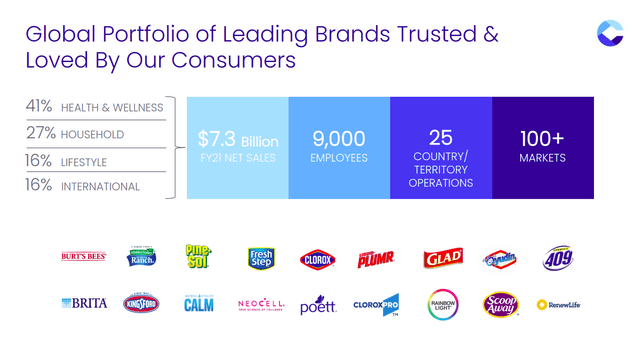

Clorox develops, manufactures, and markets consumer and professional products worldwide. Clorox is one of those companies that we use their products every day without really thinking about it too much. Their product lines include cleaning products, water purifiers, plastic wrap, and charcoal.

Regardless of economic conditions, people need to use their products, and that makes Clorox a great long-term investment.

Looking at the numbers, it’s really mind boggling how strong their portfolio is. More than 80% of their products are #1 or #2 in the market. Nine out of ten households use some types of their products, and 75% of their portfolio has superior consumer value than competitors.

Based on their strong brand, Clorox has steadily grown over the past, and they have been a great investment choice for investors. Clorox’s total shareholder return over the past 20 years was far higher than S&P 500.

The dividend growth rate of 7.75% per year (5-year average) is also far superior compared to their peers.

Given their strong operating cash flow ($923 M in the past twelve months) and their continued growth, I expect them to continue to be a strong investment option for investors.

(Dividend Kings rates CLX a HOLD)

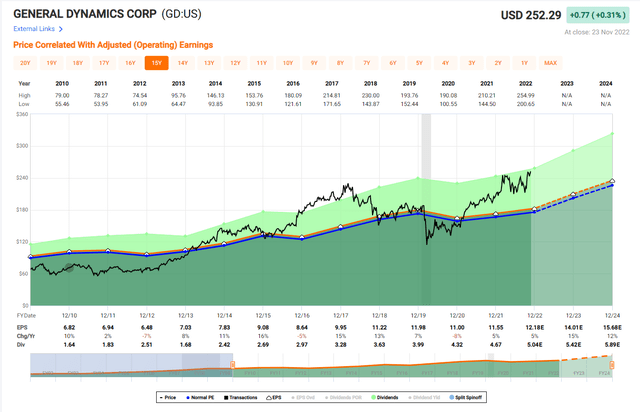

General Dynamics (GD)

General Dynamics is a global aerospace and defense company that specializes in high-end design, engineering, and manufacturing of high-performance systems. General Dynamics is a leader in the sector, and I expect that to continue. The business is organized into four operating segments: Aerospace, Marine Systems, Combat Systems, and Technologies.

One of the benefits of investing in leading defense contractors like General Dynamics is their solid backlog. As of October 2022, General Dynamics has a total backlog of $88.8 B. This backlog ensures that General Dynamics will maintain strong revenue for several years and gives investors greater peace of mind.

No matter what kind of economic cycle we are in, General Dynamics will have money to sustain their business and support their growth.

General Dynamics has strong fundamentals. Their total debt to equity (74.34%) is at the lower end compared to their peers, and their liquidity measures (current ratio and quick ratio) are at the higher end. Also, they generated $5.61 B of net operating cash flow, while generating $3.65 B of levered free cash flow.

General Dynamics has raised its dividend by 9.00% per year on average during the past 5 years, and their dividend remains very safe at this point. Their cash dividend payout ratio is at 29.45%.

(Dividend Kings rates GD a HOLD)

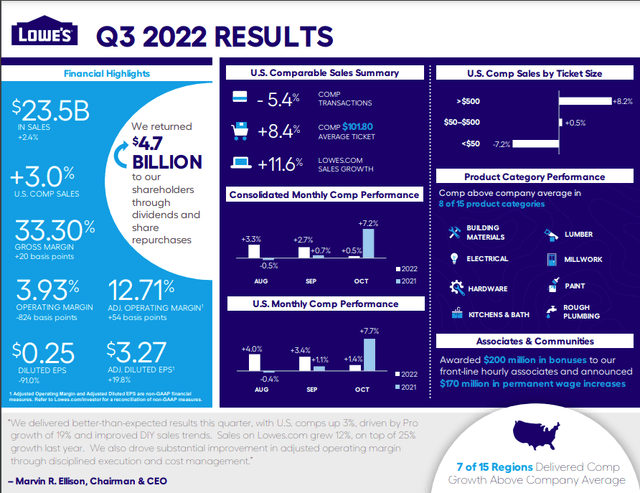

Lowe’s (LOW)

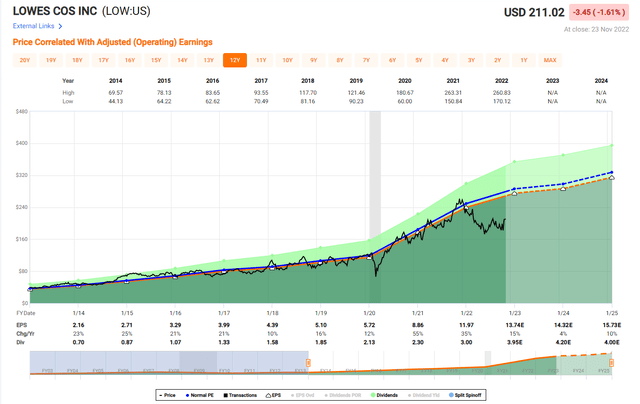

Lowe’s is a U.S. home improvement retailer that offers a portfolio of products for construction, maintenance, repair, remodeling, and decorating. Riding the housing market boom in the past decade, Lowe’s has been growing substantially. Their revenue has grown 8.19% per year during the past 5 years.

With rising mortgage rates and the slowdown in the real estate market, experts predicted that Lowe’s would struggle in the short term. However, Lowe’s easily beat estimates.

There are a couple of reasons to believe that Lowe’s will continue to grow in the future. The first one is the housing shortage in the U.S. Many different entities agree that Americans are running short of new construction by several millions houses. Therefore, demand for building won’t stop anytime soon.

Secondly, homeowners are still investing in remodeling and home improvement. Investing in the home has been one of the best ways for an American to grow their assets for a while, and homeowners certainly know the value of it. Thus, demand for Lowe’s home remodeling product will remain strong.

Lowe’s current valuation metric (P/E of 15.89x) shows that they are undervalued at this point. Their current P/E ratio is lower than the 5-year average value. Also, their dividend is safe at this point, shown by the cash dividend payout ratio of 30.85%.

(Dividend Kings rates LOW a BUY)

Risk

Even though inflation is showing signs of easing, it’s still much higher than the Federal Reserve (and us) would like. Until inflation shows a clear downtrend and approaches the desired 2% range, the Federal Reserve will maintain their hawkish stance.

Therefore, a true bull market won’t return to the Wall Street until then and the stock market will stay volatile. Additionally, a possible recession caused by high inflation and high interest rates may impact stock prices substantially.

Russia-Ukraine war has cost a lot of human and economic capital around the world, and it added substantial volatility to the stock market. Especially, oil prices have been impacted significantly based on the war headlines.

Chevron’s short-term revenue/profit outlook will be impacted significantly by the war news. Also, defense contractors’ stock prices fluctuate based on the news headlines. Therefore, General Dynamics’ stock price might be volatile for a while.

Conclusion

Dividend growth stocks are one of my favorite types of investment vehicles. During volatile times like this, investors can collect a solid dividend.

During the bull market, the stock prices of the blue-chip companies listed in this article appreciate substantially as well. So, it’s the best of both worlds.

The companies in this article have strong track records of success, solid fundamentals, and great competitive advantages. Therefore, they are great options to put some money on for the long ride…

Most importantly, we recommend buying these companies when there is a definitive margin of safety. LOW is the best buy on this list of five.

Happy SWAN Investing!

Be the first to comment