EXTREME-PHOTOGRAPHER

We recently covered a market outlook for the second half of the year in stocks with a bullish thesis that economic conditions will prove to be resilient despite the higher interest rates. A potential confirmation that inflation has peaked into the July data, consistent with the recent decline in commodity prices, can open the door for “peak hawkishness” as it relates to Fed policy. As long as the labor market remains stable, all indications are that the U.S. can emerge out of the current soft patch.

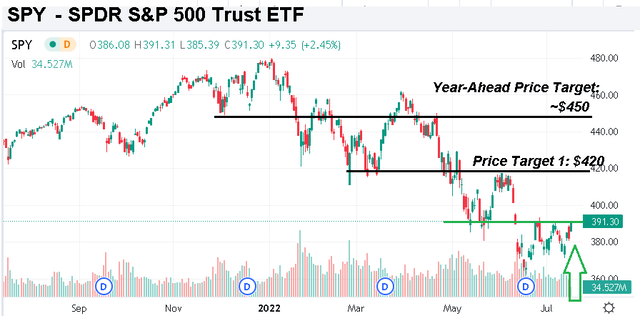

Equity valuations are attractive with the potential for better than expected macro data going forward shifting market risk sentiment positively. The naysayers and bears will be scrambling to come up with excuses chasing stocks all the way up. We see the S&P 500 ETF (SPY) trending higher over the next few months targeting $420 (approximately 4,200 in the Index). Improving market conditions into Q4 can drive a rally towards $450 as a year-ahead price target. The call is to get bullish, and we highlight five trade ideas for the current Q2 earnings season.

Five Q2 Earnings Trade Ideas

The setup and theme here is a group of tech and consumer-facing names that have been beaten down all year and head into the upcoming reports with otherwise low expectations. We see room for these companies to outperform, kick-starting a reversal higher and a sustained rally in shares. With all the talk of a recession and record inflationary headwinds, this is a case where it may have been “sell the rumor, and buy the news”.

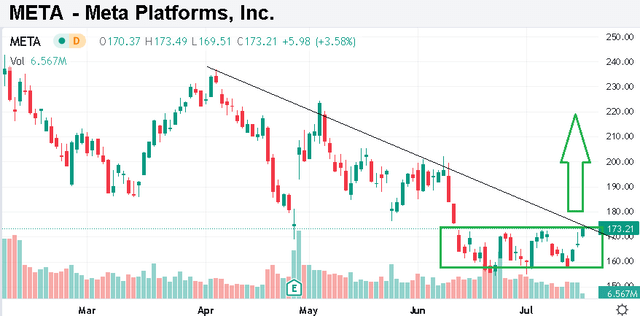

Buy – Meta Platforms, Inc. (META)

- Reporting earnings on Wednesday, July 27th after the market close

- Consensus EPS $2.60, down 28% y/y

- Consensus revenue $29 billion, flat y/y

The challenges for Meta Platforms have been well publicized. The company is looking for its next phase of growth and has pivoted its strategy towards the “metaverse” which remains several years away from materially contributing to growth. Significant spending on research and development, along with a broader slowdown in its core social media platforms has resulted in a softer earnings environment.

That being said, it’s important to remember that META remains profitable with significant cash flow generation. The bullish case heading into the Q2 report is that CEO Mark Zuckerberg may have been able to pull some levers during the quarter to control costs and find operational efficiencies in support of margins. We see room for a top and bottom line beat which should be able to pop shares higher with a retest of $220 in the cards this year. This is a great opportunity to buy a high-quality market leader trading at just 15x forward earnings with significant upside over the next several years.

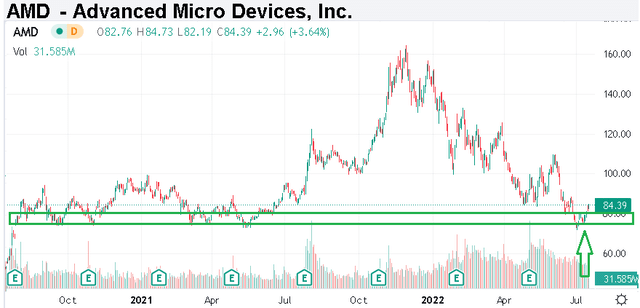

Buy – Advanced Micro Devices, Inc. (AMD)

- Reporting its Q2 earnings on August 2nd after the market close

- Consensus EPS $1.04, up 64% y/y

- Consensus revenue $6.5 billion, up 70% y/y

It wasn’t that long ago when AMD could have been called the “Pepsi” to its competitors’ “Classic Coke” considering Nvidia (NVDA) in graphics and Intel (INTC) with computing. In other words, AMD arguably offered a 2nd tier product with a leg behind in terms of its chip technology. Fast-forward, the tables have turned with AMD breaking out through major innovations and its value proposition driving significant gains in market share over the last several years in several categories. We expect these trends to continue supporting a positive long-term outlook for the company.

Beyond the recent weakness in the chip sector against what was a record 2021. The attraction of AMD is its exposure to several themes across cloud networking, artificial intelligence, 5G communications, gaming, and smart devices which are still high-growth opportunities.

For the upcoming report, the company is expected to generate revenue growth near 70% based on the impact of its 2021 “Xilinx” acquisition and push into the server business. This layer of diversification further strengthens the business which helps it to limit more volatile PC sales related to gaming.

Management comments on improving semiconductor supply chain conditions along with some positive guidance could be a catalyst for shares to rally on the report. We like the setup in the stock which has reversed back down to 2020 levels with an opportunity here to buy AMD trading at a historically low forward P/E multiple under 20x.

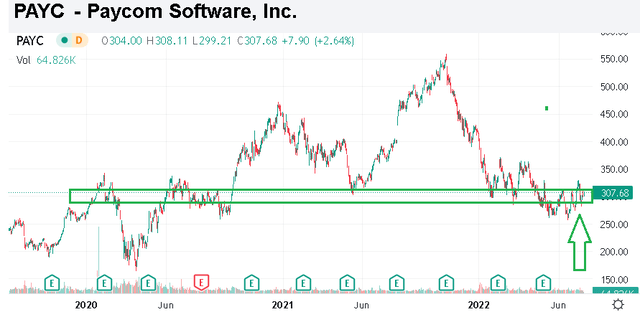

Buy – Paycom Software, Inc. (PAYC)

- Q2 earnings are expected on August 2nd after the market close

- Consensus EPS $1.12, up 15% y/y

- Consensus revenue $308 million, up 27% y/y

The bullish case with PAYC is simple. The company as one of the largest providers of cloud-based human capital management “HR” software continues to benefit from what has been a solid pace of hiring and tight labor market conditions. In June, the U.S. economy added +372k jobs, well above the consensus of +268k. More people getting hired represents a positive operating environment for the company which generates revenue on a per user basis from corporate customers signed onto the platform.

The trend this year has been solid profitability even as shares have sold off sharply from highs in 2021 based on a deeper pessimism over the growth outlook. We like the stock here at around $300 per share heading into the upcoming Q2 earnings report and believe it can outperform estimates Notably, Paycom announced a large share repurchasing program in June highlighting its overall solid fundamentals supporting a positive long-term outlook as a segment leader.

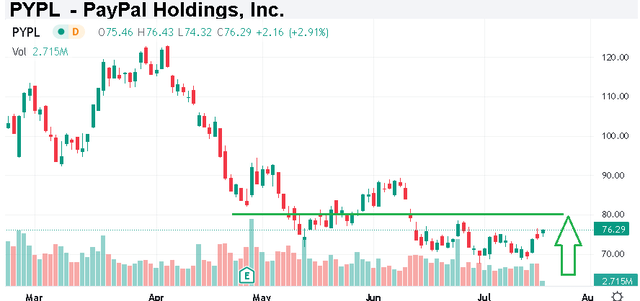

Buy – PayPal Holdings, Inc. (PYPL)

- Expected to report Q2 earnings on August 2nd (not yet confirmed)

- Consensus EPS $0.87, down 24% y/y

- Consensus revenue $6.8 billion, up 9% y/y

PayPal is the perennial fintech that has been crushed over the past year amid the broader market selloff. The silver lining from the 75% move lower from its all-time high is that the stock has transformed into more of a value-play trading at a forward P/E ratio of 19x. Indeed, fundamentals are solid including positive free cash flow, recurring profitability, and climbing total payments volume as a key growth measure.

For the upcoming earnings report, we’ll be looking for a top-line beat that can also help EPS outperform expectations. This is a stock that should be able to lead the market higher to the upside and will benefit from improving macro conditions, including lower signs of inflation and more positive consumer sentiment. Our price target on PYPL is $110 representing a 27.5x multiple on its 2022 consensus EPS.

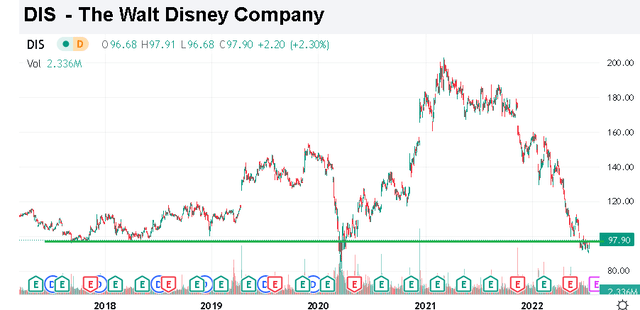

Buy – The Walt Disney Company (DIS)

- Expected to announce earnings on August 10th after the market close

- Consensus EPS $0.99, up 24% y/y

- Consensus revenue $21 billion, up 23% y/y

The doom and gloomers calling for a catastrophic recession with a collapse in consumer spending must have forgotten to tell visitors to Disney theme parks. Indications are that the resorts are packed with the daily reservations system at the Florida complex selling out on most days. A big takeaway from the last quarterly report was the parks and experiences segment generated a record operating margin despite some lingering Covid disruptions. We expect an even bigger result in the Q2 earnings report helping to brush aside any concerns that visitors are staying away.

Separately, reports suggest Disney’s investments into digital with Disney+ and ESPN+, along with its interest in HULU are performing well. Some of the most watched streaming series on any platform this year include Disney originals like “The Book of Boba Fett” and “Obi-Wan Kenobi” which may have helped subscriber numbers outperform.

This will be the company’s fiscal Q3 report, and we believe shares of DIS look increasingly cheap trading at a forward P/E of 17x getting into fiscal 2023 consensus EPS and ongoing growth momentum. Notably, shares are trading under $100 which goes back to near pandemic crash lows of 2020 while we make the case that the company’s outlook is now stronger than ever. Look for shares to pop with a beat across the board. We believe the $125 stock price range is in play over the next few months.

Final Thoughts

It’s been a historically challenging year for investing, but the takeaway is that it’s important to look forward. Headlines of record inflation and the Fed being forced to scramble are essentially old news at this point. The upside here is that many of these headwinds are priced in setting up an environment where more favorable conditions into 2023 can be very positive for risk assets.

Even with an optimistic view, we don’t expect the market to be a straight line higher and volatility should be a recurring theme. Nevertheless, getting invested and increasing exposure to equities can make sense in the context of a diversified portfolio. The SPY ETF is a great option as a long-term core portfolio holding.

Be the first to comment