sefa ozel

Article Thesis

It looks like the US is in a recession now, although it has not yet been officially declared. Not all recessions are equal, but economic slowdowns generally do not have a similar impact on all companies. Some are more resilient to economic downturns than others, even harsh ones. In this article, we’ll highlight five of those companies.

1: Johnson & Johnson

Johnson & Johnson (JNJ) is one of just two companies in the world with an AAA rating. This is the result of a healthy balance sheet, resilient cash flows, great management that guides the company with a long-term view, and last but not least, JNJ is diversified both geographically as well as when it comes to different industries. Medical tech, non-cyclical consumer goods, and pharmaceuticals are all bought whether the economy is good or bad — after all, people that require treatment do so in recessions and in good times.

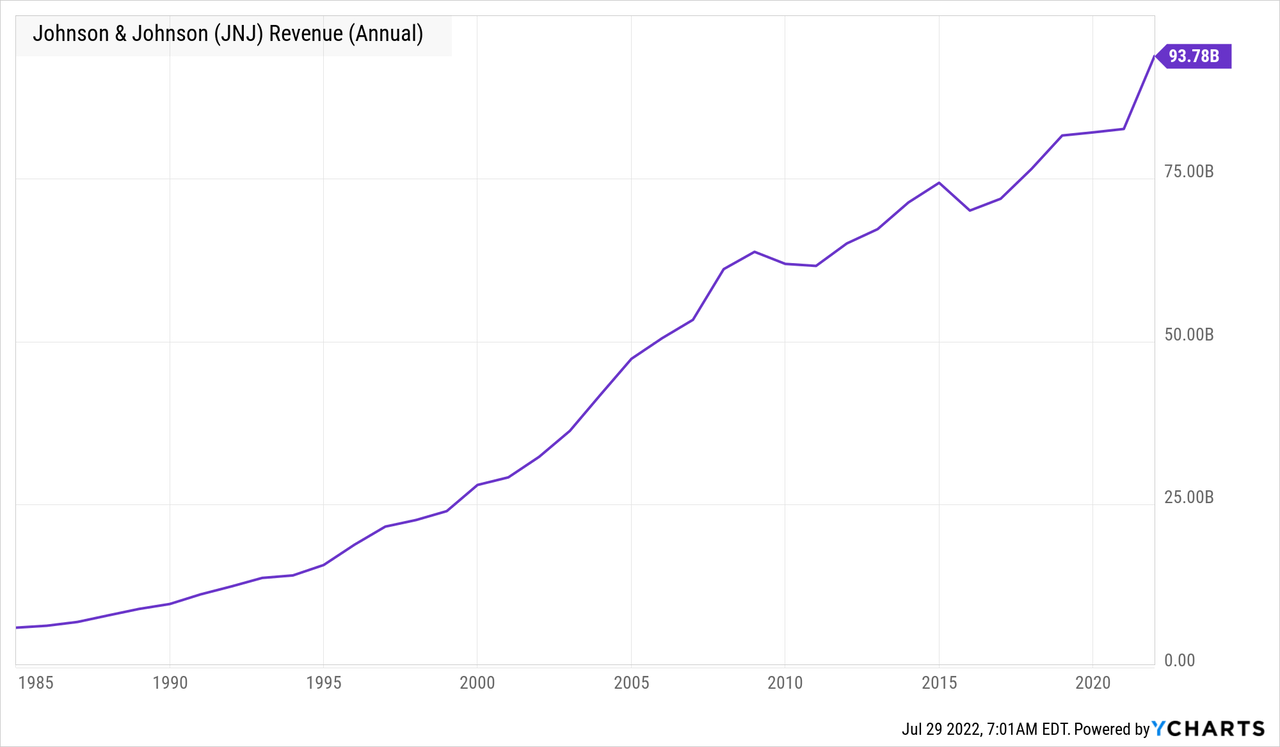

Johnson & Johnson has thus been able to perform pretty reliably, in good times and in bad times:

It’s not easy to spot the Great Recession in the above chart, as revenues only dipped very slightly at that time. Overall, the revenue trend is clearly upwards and to the right, during all kinds of crises. Investors can thus expect that this behemoth will do relatively well in a recession, too.

Investors get a dividend that yields 2.5% at current prices. Johnson & Johnson has been raising its dividend every year for several decades in a row, recession or not. I do believe that there is a high likelihood that this will continue and that investors will get another dividend hike next year.

Due to being so large already, Johnson & Johnson is not a high-growth company any longer. But with a mid-single-digit earnings per share growth rate, Johnson & Johnson could still deliver total returns in the 8% range. For someone that is looking for a lower-risk pick with reliable income growth, that’s far from bad.

2: Altria

Altria (MO) is one of the largest tobacco companies in the world, although its business is focused on the United States. That has the advantage of revenue being independent of forex movements. Especially in the current situation, where a rising US Dollar makes revenues that are generated outside of the US less valuable, this is an advantage. Peers such as Philip Morris (PM), entirely focused on non-US markets, are feeling considerable headwinds from forex rate movements this year.

Studies show that smokers tend to smoke more during recessions, not less. A recession thus is not a major issue for Altria’s business. This is also showcased by the fact that the company has performed well during other crises, including the pandemic. For the current year, Altria is forecasting new record profits, as earnings per share are forecasted to come in at $4.79 to $4.93 in 2022, which implies a growth rate of 4% to 7%. Historically, Altria has grown its earnings per share slightly faster. But even a low-single-digit growth rate or no growth at all wouldn’t be a disaster. Altria is currently offering a dividend that yields 8.2%, thus even without any dividend growth or share price appreciation, the stock would be a solid pick as long as the dividend can be maintained at the current level. Since profits have been growing very reliably in the past and will continue to do so this year, and since MO has weathered past crises well, I do not believe there is a risk of a dividend cut in the foreseeable future.

3: Enbridge

Enbridge (ENB) is a Canadian midstream company. It owns pipelines and terminals for oil, natural gas, and related products. On top of that, Enbridge also has some renewable energy projects, such as wind parks. Demand for natural gas is surprisingly resilient to recessions. The commodity is used for electricity generation, heating, and cooking. Since those are needed in times when the economy is strong and in times when the economy is weak, there’s no meaningful impact from recessions on transport volumes. The current energy crisis, where oil and natural gas are highly expensive due to tight markets, further strengthens the outlook for Enbridge’s business model. With the world needing more of these products, and willing to pay above-average prices, there is little risk that producers won’t want to have their products shipped via Enbridge’s pipelines or LNG terminals.

Pure upstream producers of oil and gas can be cyclical due to their exposure to commodity prices, but Enbridge’s revenues are mostly fee-based. The company earns money, no matter whether energy prices are high or not. That was showcased in past recessions, and also during the pandemic when oil prices dropped below zero for a short period of time. Enbridge still generated record profits during 2020 and 2021, and current guidance sees the company earning even more money this year.

Enbridge has managed to grow its dividend regularly for many years, and I do believe that there is a high likelihood that this track record will continue. On top of that, Enbridge is currently trading at only ~10x this year’s distributable cash flow (where maintenance capital expenditures are already subtracted). The dividend yield investors can get right now is attractive as well, at 6.0%.

4: Microsoft

Microsoft (MSFT) is a tech company. But unlike some other tech companies, it doesn’t produce and sell gimmicky stuff. Instead, it produces and sells software that is essential for consumers, businesses, governments, and so on. Without Microsoft’s operating system, Office suite, and so on, doing business wouldn’t be possible in the way we do it today. On top of that, Microsoft has mostly switched its business to a recurring revenue model, so it isn’t even dependent on sales of new PCs being high, for example.

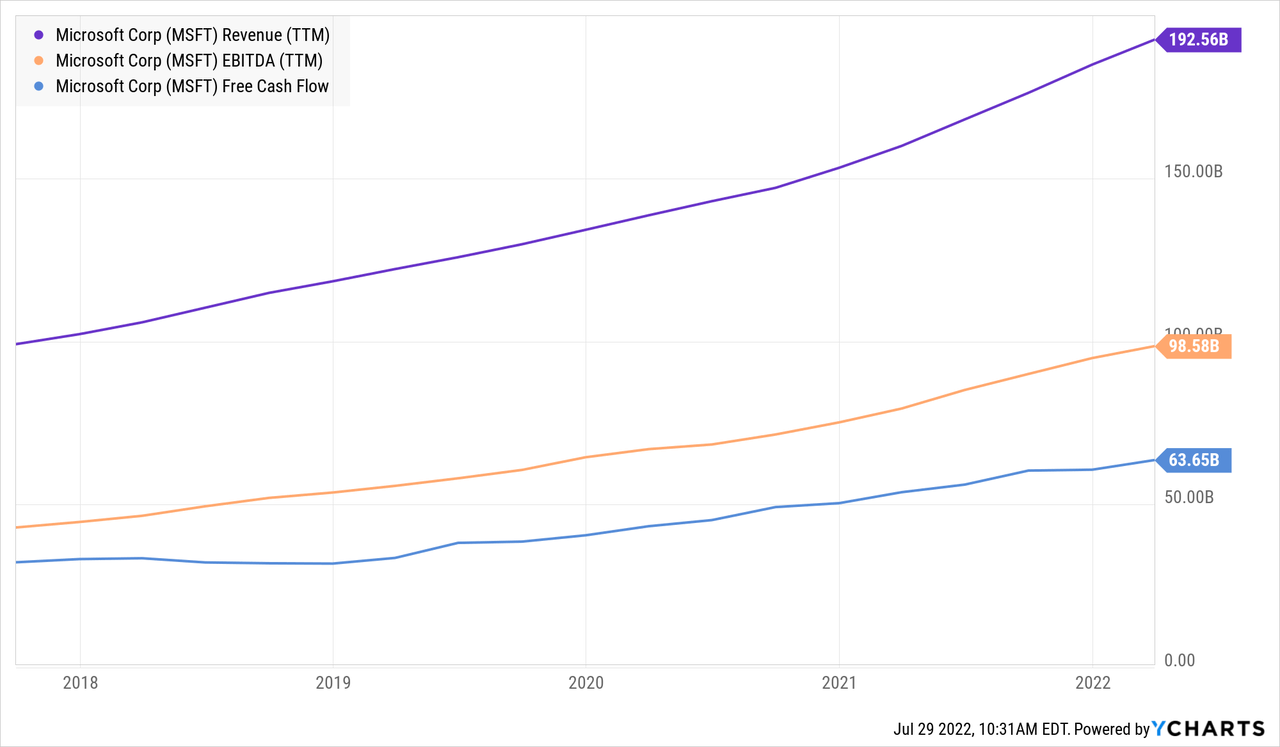

This has resulted in very sticky revenue that has been growing at a highly attractive pace in recent years:

I can’t spot the pandemic and the steep economic downturn it caused initially in the above chart — revenue, EBITDA, and free cash flow are growing very reliably. On top of that, Microsoft is, like JNJ, triple-A-rated. Rating agencies agree that Microsoft’s business is very resilient against all kinds of macro shocks, that competition is not a major factor, and that Microsoft’s fortress balance sheet results in way-below-average risks.

Microsoft doesn’t offer a high dividend yield, at just 0.9%, which means that it may not be suitable for retirees or other income investors. But for someone who seeks a resilient, low-risk pick, Microsoft could be a good choice. The company’s just-announced quarterly results included favorable guidance for the current fiscal year, proving once again that the company is doing well even in times when the economy experiences headwinds.

Microsoft is not a bargain stock, as it trades at 27x net profits right now. But in a recession, a high-quality pick could be preferred from a flight to safety standpoint. When we also account for MSFT’s way-above-average growth rate, the current valuation does not seem overblown.

5: Digital Realty Trust

Digital Realty Trust (DLR) is a real estate investment trust that owns data centers and related infrastructure. Demand for these assets is not very cyclical, as Amazon (AMZN), Microsoft, Alphabet (GOOG)(GOOGL), and so on are processing ever more data, recession or not. This also makes for attractive growth tailwinds for Digital Realty Trust.

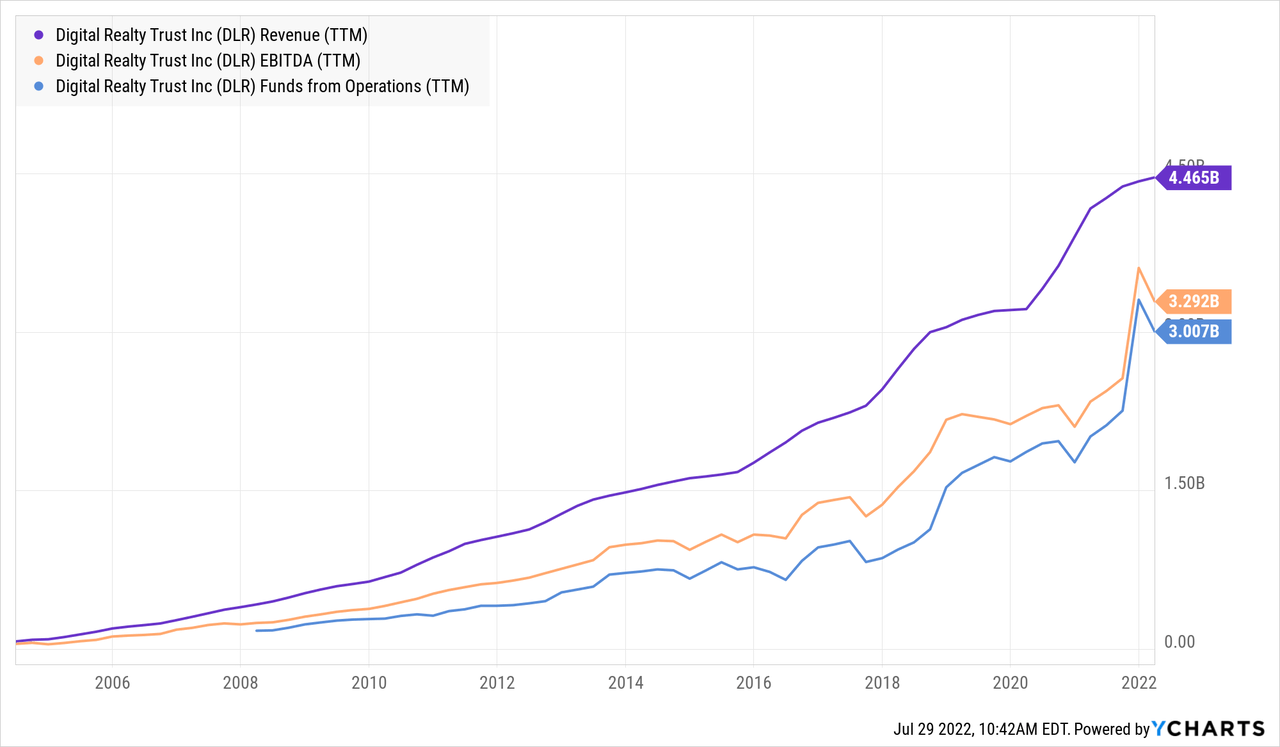

Looking at the company’s long-term revenue, EBITDA, and funds from operations performance, we see the following:

There was no noticeable impact from the Great Recession, and during the pandemic and the economic downturn it caused, DLR also continued to perform very well. On top of that, DLR has a very successful track record overall, growing its business at a compelling pace — revenue, for example, rose by 150% or so over the last six years. DLR is forecasted to grow its EBITDA by around 10% annually over the next couple of years, which seems very achievable based on the company’s track record and the fact that its addressable market continues to expand at a meaningful pace.

DLR offers a dividend yield of 3.6% today, and its dividend has been increased for 17 years in a row — despite several major crises in that time frame. With DLR providing internet backbone infrastructure that is needed in all kinds of scenarios, its business is resilient. Add growth potential and a nice dividend yield with regular dividend increases and Digital Realty Trust looks like a compelling recession-proof income pick.

Takeaway

The US is likely in a recession right now, following two quarters of negative GDP growth. It has not officially been announced, however. It is unclear whether the macro picture will worsen or whether declining inflation might result in a better H2 GDP growth performance. No matter what, some equities promise safety during times of economic trouble. Investors interested in such picks might be interested in taking a closer look at JNJ, MO, ENB, MSFT, and DLR. These belong to the group that could likely weather an ongoing economic downturn well.

Be the first to comment