onurdongel/iStock via Getty Images

The State of Retail In 2022

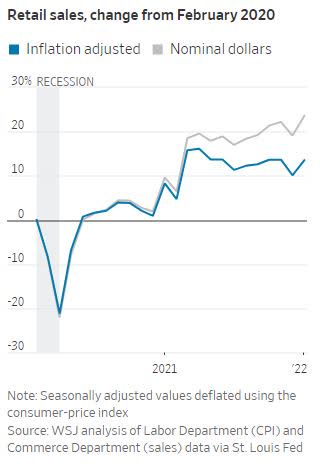

Retail sales advanced to start the new year, with a seasonally adjusted 3.8% rise for January, showcasing that life is getting back to normal. Variants aside, shoppers want to shop, and retailers whose online shopping presence posed benefits during the COVID-19 pandemic reaped the monetary rewards, while those without, suffered. I wrote about 3 Cheap Retail Stocks before Black Friday, and my stock picks continue to offer tremendous growth potential and are highly profitable, two which, Ford (F) and Signet Jewelers (SIG) we’ll discuss in this article.

As supply-chain constraints ease, retail normalizes, and the retail sales continue to show no shortage of slowing, some retailers with stockpiles of inventory are expecting the purchase of goods and services to pick up. With central banks set to potentially embark on the ‘largest quantitative tightening in history,’ suppliers have increased prices, which will trickle down to consumers. I have selected five retail stocks that pose an opportunity to capitalize on stocks where you shop.

Retail Sales Change From February 2020 (WSJ)

5 Top Retail Stocks to Buy Now

The U.S. economy grew faster than we’ve seen since 1984 – at a whopping 5.5%. “Consumers say they are worried about inflation, but they continue to spend…job growth is strong, wages are increasing, and household wealth is way up thanks to rapidly rising home values and, until recently, stock prices,” said Gus Faucher, Chief Economist at PNC Financial. Despite the number of job vacancies, upward pressure on wages is helping curb unemployment and powering consumer demand, which is why I have five top retail stocks that should benefit from increased retail sales.

1. Home Depot (HD)

Ranked #1 in its industry out of #7 by our quant rankings, Home Depot (HD) is the world’s largest home improvement retailer with nearly $150B in revenue. The bustling housing market with perpetual turnover and home improvements have proven why this company has a track record of success. HD thrived during the pandemic as it became a supplier to millions wanting home improvements as spaces adapted to a remote environment. During this lockdown period, the U.S. economy capitalized, as did Home Depot, to the tune of $132 billion in sales for 2020, a 19.9% increase from its prior year. In addition, HD saw excellent 21Q3 earnings, something we’ll dive into as we discuss their growth.

Home Depot Growth

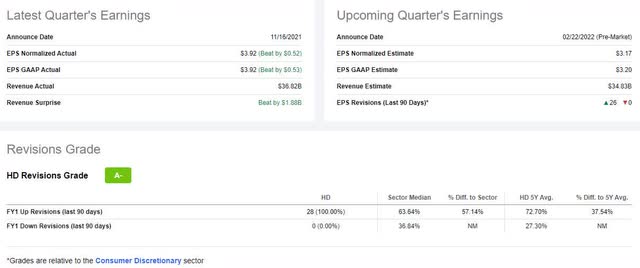

Home Depot has a legacy of appointing great executives to lead the overall quality of the organization. The recent announcement of 20-year Home Depot veteran and COO Ted Decker transitioning into the CEO role should maintain the company’s consistent growth and financial performance. Healthy cash flow continues to elevate the brand and return capital to shareholders. HD’s A Growth Grade is substantiated by its latest quarter’s earnings, with top-and bottom-line beats; EPS of $3.92 beats by $0.52; Revenue of $36.82B beats by $1.88B, a nearly 10% YoY difference. This is why in the last 90 days, 28 Wall Street analysts revised their FY1 earnings estimates up. This closely followed metric earned an A- Revision grade.

HD Earnings (Seeking Alpha Premium)

“We had another strong performance on the third quarter. Sales for the third quarter were $36.8 billion up 9.8% from last year. Comp sales were up 6.1% from last year with U.S. comps of positive 5.5%. Diluted earnings per share were $3.92 in the third quarter, up from $3.18 in the third quarter last year. Home improvement demand remains strong,” said Craig Menear during the third quarter 2021 Earnings Call. HD continues to perform and serve communities worldwide and we believe it will continue to see exponential growth and profitability, despite its D valuation.

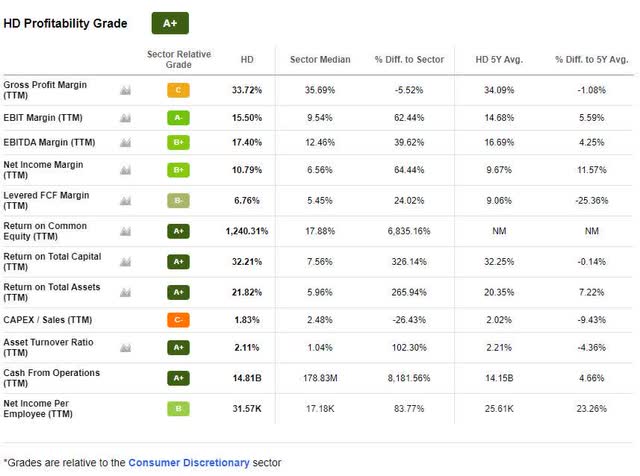

Home Depot Profitability

Home Depot has a strong distribution network and a history of producing profits. Despite CAPEX just under 2%, rising home prices, demand, and improved supply chain should bolster profitability in the new year, especially given the thriving economy, vaccinations leading to people on the move, and recent retail sales numbers proving that shoppers want to shop. With a focus on people, serving veterans, disaster relief, and initiatives to reduce HD’s carbon footprint, HD is in an excellent position to expand its operating margins.

HD Profitability (Seeking Alpha Premium)

Home Depot’s focus on do-it-yourself (DIY), maintenance, and cross-selling of products are helping bolster revenue. Home Depot has an A+ profitability grade and $14.81B Cash from Operations. A strong EBIT Margin of 15.50% indicates that HD is working to continue on the path of operational excellence, even in the face of price volatility and market uncertainty. Although the market has been down, we do not see any slowdown in our retail stock picks. Let us consider my next selection with excellent brand recognition.

2. Harley Davidson (HOG)

Following an impressive Q4 earnings report, custom cruiser and motorcycle manufacturer Harley Davidson (HOG) surged 15.53%. With brand recognition and a lengthy history of manufacturing, HOG has a dominant presence in the American motorcycle market, and its bikes come at a premium price relative to its competitors. During cyclical downturns, competitive pricing proved to be an obstacle that hindered their retail sales and shipments, as seen during COVID-19 in 2020, when HOG temporarily suspended production and shut down factories, causing its market share to fall 42.1% in 2020 from +50% in 2019. HOG has once again regained, possessing a solid valuation.

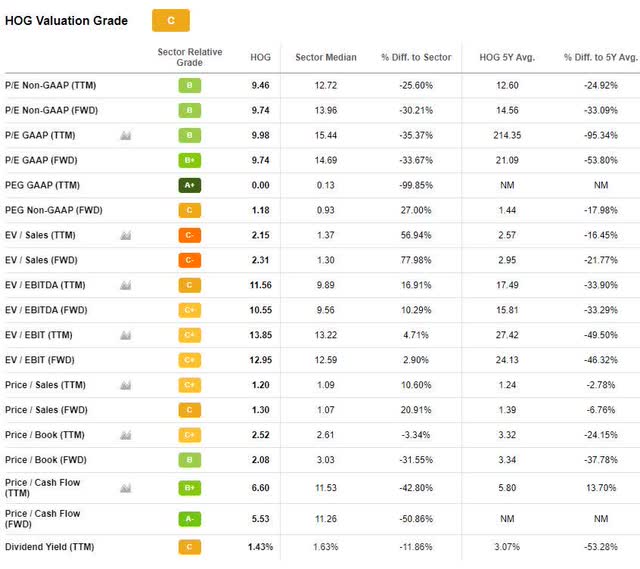

Harley Davidson Valuation

Harley Davidson comes at a reasonable price, trading under $45/share. With an overall C valuation grade, the company is attractively priced; however, at a -25.60% difference to the sector, its P/E ratio of 9.46x with a Seeking Alpha B Grade is very attractive.

Harley Davidson Valuation (Seeking Alpha Premium)

Year-to-date, the company’s share price is +11% and up nearly 20% over one year. HOG’s fair value and brand loyalty will help lead its core customers back to an uptick in demand, as evidenced in its upward trajectory. “The Hardwire [5-year strategic plan] continues to strengthen and build the brand, deepening loyalty, creating value, and driving engagement across both existing and new consumers,” said Jochen Zeitz, HOG President & CEO. Although 2020 was a challenging year for Harley Davidson and supply chain disruptions have posed problems, the company has historically generated strong free cash flow, which it expects again as the pandemic subsides. Additionally, HOG has maintained stable growth and profitability, which we will dive into in the next section.

HOG Growth & Profitability

In 2021, Harley Davidson launched its five-year strategic Hardwire plan, focusing on the following six elements:

-

Increasing Profits

-

Expansion and redefining product offerings and demographic

-

Lead in Electric Vehicle (EV)

-

Growth beyond bikes to include parts, accessories, merchandise, and financial services

-

The Customer Experience

-

Inclusive Stakeholder Management

Hardwire aims to increase profitability and realize low double-digit EPS growth through 2025 through strengthening core segments by expanding into high-growth potential divisions like Adventure Touring. Harley Davidson’s plan is clearly working, as evidenced by its surprise 21Q4 Earnings Results. EPS of $0.15 beat by $0.48 and Revenue of $816.02M (53.69% YoY) beat by $147.17M. Revisions grades are B+, with 10 FY1 Upward Revisions in the last 90 days.

Harley Davidson Profitability (Seeking Alpha Premium)

Consolidated revenue was up 40%, despite -2% gross margin for 21Q4 compared to the previous year due to cost headwinds, additional EU tariffs, and supply chain constraints. “Looking ahead, we are fully committed to achieving our long-term Hardwire Strategy, as the most desirable motorcycle brand and company in the world,” said Zeitz.

As evidenced by the A Profitability grade, current 18.56% EBITDA Margin, A+ Free Cash Flow, HOG’s financial health and growth prospects indicate its potential to outperform the market, substantiated by continued upward growth price trajectory and earnings estimate revisions. Harley Davidson is a good stock for investors.

3. Ford (F)

On the heels of Ford’s Friday announcement that the automaker is considering a standalone electric vehicle (EV) business, the stock jumped +4% in a down market. Ford CEO Jim Farley wants his EV to branch away from its internal combustion engine (ICE) business in hopes of optimizing the transition from internal-combustion to battery-electric vehicles and earning a similar valuation framework that other pure EV manufacturers receive. I believe the move is positive. If they spin off the division, Ford is the largest holder of an asset that potentially has a very strong valuation framework and will also be a benefactor of a fast growing EV business that will not be tied to legacy pension plans.

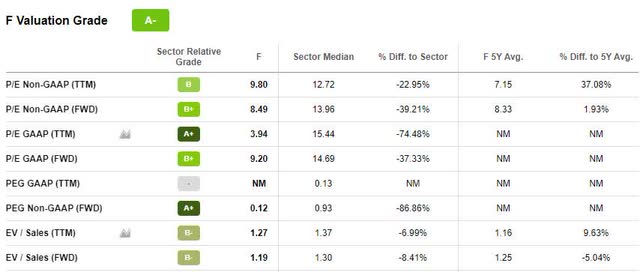

Ford Valuation Grade (Seeking Alpha Premium)

Ford comes at a great value, even with its stock price up +50% in the last year. With an A- valuation grade, forward P/E trading 8.49x, and the sector at 13.96x, this stock is a strong buy. The forward PEG ratio has an A+ grade, trading more than 86% below the sector. As semiconductors which impact the automotive sector, especially EV, took a beating during the pandemic, stocks like Ford are reaping the benefits of these chips and a thriving automotive industry. Given the current political environment, rising gas prices, and expansion of charging stations, Ford is one of my Top EV Stock Picks as well as one of my Top Stocks for 2022 given its favorable momentum, growth, and profitability grades.

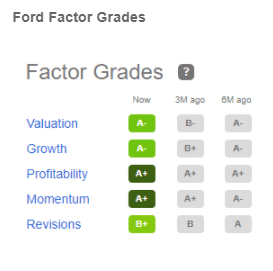

Ford Factor Grades (Seeking Alpha Premium)

Ford Growth & Profitability

Ford continues to have solid growth and profitability grades. With an A- and A+ respectively, the automaker seeks to cut costs and continue diversifying in the auto industry, which should serve as a benefit in scaling business, especially as it plans to expand EV production, targeting 600,000 vehicles by 2030. Ford had excellent Q3 results with top-and- bottom-line beat; Non-GAAP EPS of $0.51 beat by $0.24 which resulted in analyst revisions of 19 FY1 Up in the last 90 days, zero down. Although Q4 Earnings were not as positive with an EPS of $0.26 miss by $0.15 and Revenue of $35.26B miss by 6.14% YoY, Revisions are still at a B+, profitability is solid, and momentum as evidenced by the figures below is stellar.

Ford Momentum (Seeking Alpha Premium)

John Lawler, Ford CFO stated during the Q4 Earnings Call, “For the year, we posted $10 billion in adjusted EBIT, with a margin of 7.3%. That’s our strongest performance since 2016… And despite a 6% decline in wholesale, our automotive business posted its strongest EBIT margin since 2016. North America delivered an 8.4% EBIT margin, and is firmly on the glide path to a 10% EBIT margin. In addition, our operations outside the US collectively posted their best results since 2017.” As I’ve previously written, Ford is built tough, and with its fair valuation, solid fundamentals, and projected growth and momentum, I believe this stock is an opportune buy.

4. Signet Jewelers Limited (SIG)

Jewelry retailer Signet Jewelers (SIG) operates online and through shopping malls and jewelry stores globally. As the largest mid market jewelry chain in the U.S., U.K., and Canadian markets, SIG benefits from purchasing diamonds through direct diamond contracts with mining companies and bypassing the wholesaler. This is very advantageous compared to some of the mom-and-pop shops having to exit the market since the pandemic.

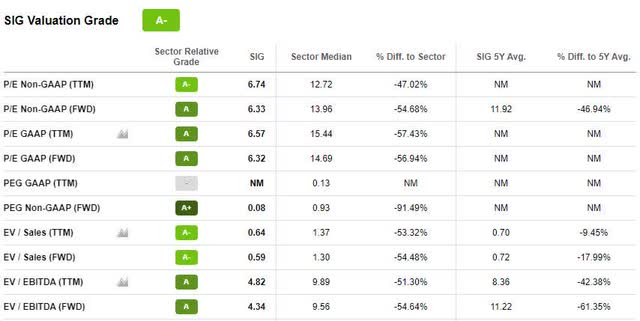

SIG Valuation (Seeking Alpha Premium)

SIG comes at a great valuation. With an overall A- Valuation grade and A’s across the majority of its underlying valuation metrics, this stock comes at quite the discount. Forward P/E ratio of 6.33x is trading nearly 55% below the sector, and forward PEG ratio is more than 90% below the sector average. SIG continues to see a rise in share price, with an overall one-year increase +80%. Its performance was so stellar to end the year that Chief Financial & Strategy Officer Joan Hilson reported, “We are raising guidance to reflect our strong holiday performance. We delivered operating margin expansion as our strategy drove higher traffic and strong conversion with effective promotion and cost management.” With 30% growth in holiday season revenue, Signet’s growth and profitability are exciting metrics for review.

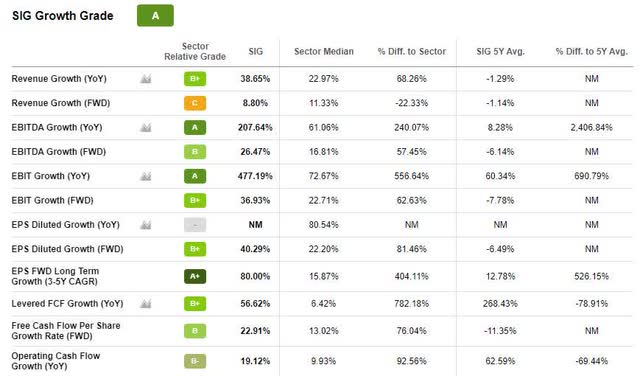

Signet Growth & Profitability

Signet Jewelers has experienced tremendous growth and profitability. With an in-house credit division in markets where consumer lending is low and credit standards are higher, Signet has benefited.

SIG Growth Grade (Seeking Alpha Premium)

SIG possesses excellent growth metrics. Third Quarter Earnings Results were strong with EPS of $1.43 beat by $0.71. Revenue of $1.54B beat by $110.62M, an 18.27% YoY increase. “We delivered approximately $576 million this quarter in gross margin or 37.4% of sales. This is a 380 basis point improvement to last year, and a 630 basis point improvement to two years ago. Leveraging of fixed costs contributed roughly 2/3 of the improvement in both years, driven by fleet optimization efforts,” said Hilson. Cyclically, as the job market and finances improve, customers will continue to spend, resulting in potential increased margins for SIG and better credit repayments. In the words of fellow Seeking Alpha author Anthony H. Steinmetz, “Signet has an excellent leadership team and made several improvements to the business that should pay dividends as the company moves forward. Additionally, there is a real possibility to see future returns of capital above and beyond today’s level. Therefore, Signet receives a Strong Buy rating.”

5. Ralph Lauren Corporation (RL)

Ralph Lauren (RL) is a global lifestyle products and apparel company with wholesale distribution channels as well as retail stores and e-commerce. As malls and retail stores rebound, increased traffic has prompted Ralph Lauren to rally. RL’s valuation is improving after historically trading “at ~18x earnings, with an average earnings multiple closer to 17 over the past decade. If we assume a more conservative earnings multiple of 16 due to what’s been a slower-than-planned turnaround due to COVID-19, this translates to a fair value of $129.90, based on FY2023 earnings estimates of $8.12,” writes Seeking Alpha author Taylor Dart.

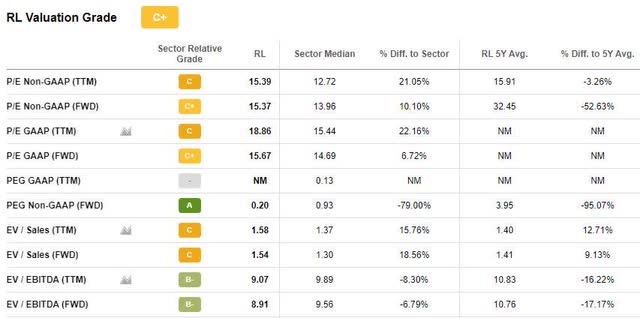

RL Valuation (Seeking Alpha Premium)

At a current C+ valuation and P/E ratio of 15.39x, RL is trading at a fair value. Its share price continues to trend up +6.0% YTD, one-year +13%, and five-year +61%. Gaining more than any other consumer stock in the S&P 500 as of Feb 3, 2022 following its strong Q3 earnings report, in our view RL is on the path to see solid growth and profitability.

RL Growth and Profitability

The challenge of COVID-19 coupled with poor inventory control, heavy discounts in past years and closing more than 75 stores has prompted the retailer to make improvements which have improved its gross margins. “Our company is fundamentally healthier than it was 2 years ago. We’re bringing in a younger, higher-value, less price-sensitive consumer,” said RL CEO, Patrice Louvet. The company has restructured for sustained growth and margin levels for fiscal 2022, adding new merchandise and increasing online shopping. RL saw a double-digit revenue growth across all the segments: North America +30%; Europe +47%; Asia +16%.

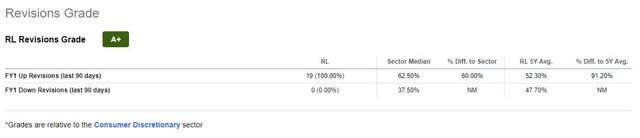

Ralph Lauren’s latest earnings report was great. Both top- and bottom-line beat, with EPS of $2.94 beat by $0.75. Revenue of $1.82B beat by $169.83M, resulting in 19 FY1 Up revisions in the last 90 days and an A+ revisions grade.

RL Revisions Grade (Seeking Alpha Premium)

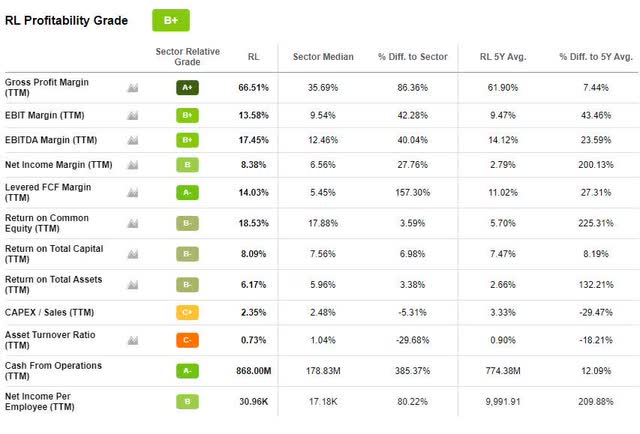

Considered a premium brand in Europe and Asia relative to North America, RL is expecting most of its growth will come from international markets. RL has solid profitability metrics and an overall B+ profitability grade, with $868M in Cash from Operations.

RL Profitability (Seeking Alpha Premium)

In addition to positioning itself for more growth and profitability, RL has decided to diversify by adding its fashion brand in the form of digital clothing in the metaverse. Through collaboration with gaming platform Roblox (RBLX), RL is offering its designer accessories and clothing for digital avatars, which they have partially attributed to the success of 21Q3. As the metaverse and virtual world expands, so too will fashion brands like RL. As Ralph Lauren is ahead of the curve in offering designs through technology, I believe them taking this jump into the metaverse will result in a price jump for their stock and sales.

Conclusion

Certain segments of retail are back, and for investors that want to consider the best stocks to buy for future gains, consider our top five retail stocks. Fear and market volatility are creating buy opportunities and although prices are on the rise, retail is rebounding and there are companies that will stand to gain from improving retail sales. Our Factor Grades and Quant Ratings can help you make tactical investment decisions.

We have dozens of stocks to choose from, including Top Consumer Discretionary Stocks and Top Consumer Staple Stocks. Our investment research tools help to ensure you’re furnished with the best resources to make informed investment decisions. Also consider using Seeking Alpha’s ‘Ratings Screener’ tool to help you achieve diversification into desired sectors using our Quant Rating as an objective, quantitative view of each stock.

Be the first to comment