Kanizphoto/iStock via Getty Images

Regulatory Environment

Since 2020, the Chinese government has expedited regulation on internet finance, putting pressure on China online lenders including 360 DigiTech, Inc. (NASDAQ:QFIN). One of the most significant regulation is China won’t allow online lenders backed by financial institutions to charge more than 24% APR and the ceiling of private loan will be capped at four times that of China’s benchmark loan prime rate (LPR) or 14.6% as of Oct 2022. As of Q2 2022, all of the 360 DigiTech loan books have been in compliance with the “24% APR” regulation whereas its top competitor Lexin still has 20-30% above the regulatory threshold.

There are several recent positive developments making investors see light at the end of the tunnel. On April 29, China’s powerful Politburo said it would be more cautious to implement policies which would have a negative impact on companies and the regulatory crackdown is near the ending phase. On June 9, the government gave tentative approval for Ant Group, an affiliate of e-commerce behemoth Alibaba (BABA), to revive its initial public offering in Shanghai and Hong Kong, the biggest sign that Chinese regulator would loosen its tough stance on the internet sector. As the financial business of internet companies is basically all covered in the financial regulatory framework, the regulatory headwind on internet finance is likely approaching the last inning.

Additionally, the CEO of 360 DigiTech also mentioned in the most recent Q2 2022 earnings call that “the recent regulatory meetings have all sent a clear signal that the reform is reaching an ending phase.” IPO of Ant Group could be a potential near-term catalyst for China online lender stocks.

Credit Quality and Funding cost

As a result of COVID lockdown, the company’s provisioning increased 14% yoy and 90+ NPL increased from 2.62% from 2.4% in Q1 2022. For 2Q22, 360 DigiTech posted total revenue of RMB4.2bn (qoq/yoy: -3.2/+4.5%) and attributable net profit of RMB0.98bn (qoq/yoy: -17/-37%). The weak results mainly contributed to stagnant loan growth which was caused by weak macro conditions. Not just in small consumer loans, the weak macro conditions also reflect in the property market as well. Many Chinese state banks have shown more than 20% increase in mortgage prepayment. Starting from June, as lockdown restrictions were eased for some cities, 30-day collection rates improved from levels in early 2Q22. According to the Q2 2022 earnings call, the company’s funding cost has declined to 6.5% from 6.8% in Q2 2022 and 7% in Q1 2022.

Better risk assessment than peers

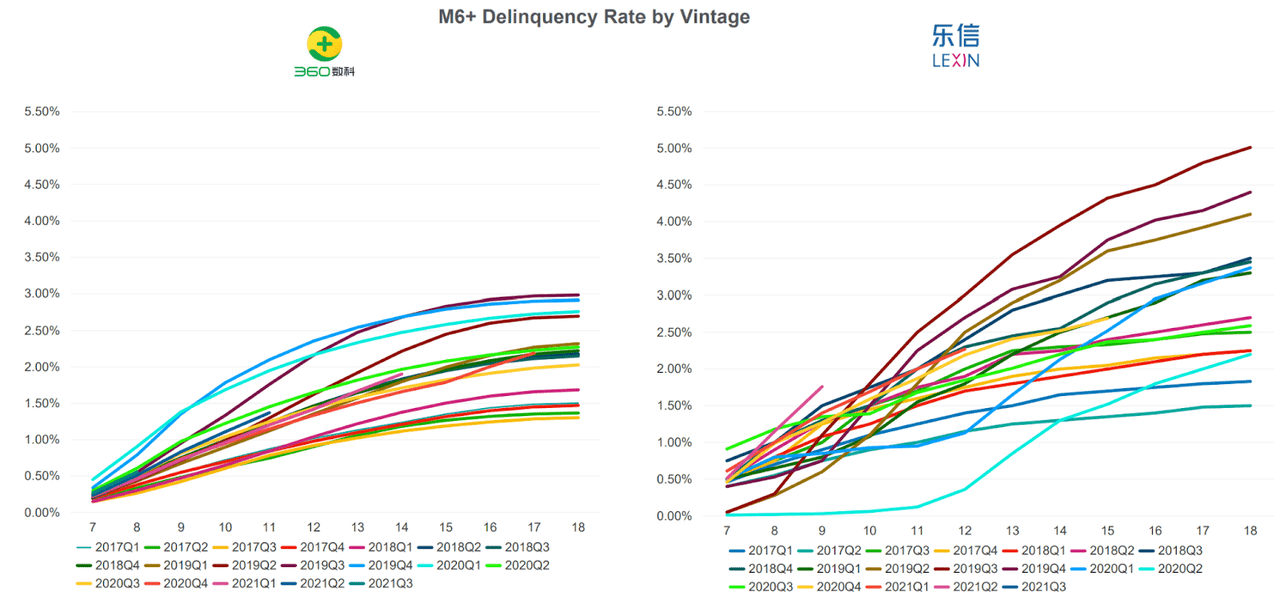

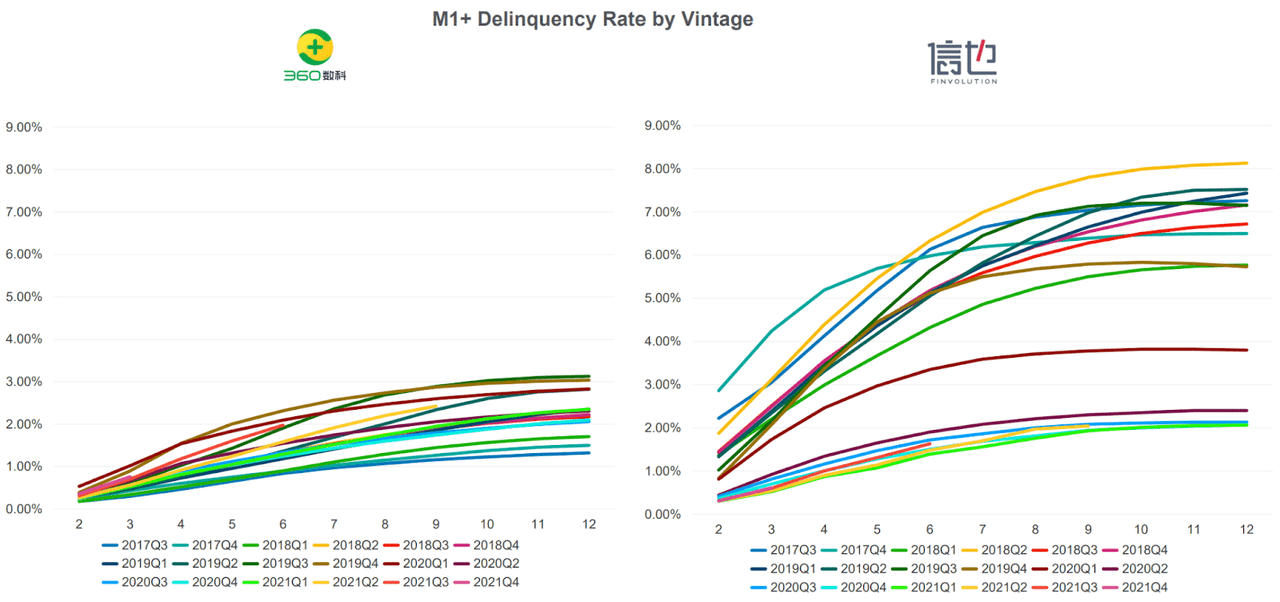

360 DigiTech has demonstrated better credit underwriting and risk assessment than its major competitors. As illustrated in the charts below, 360 DigiTech is more consistent in its underwriting and has achieved lower M1 and M6 delinquency rate.

Company presentation Company presentation

Valuation

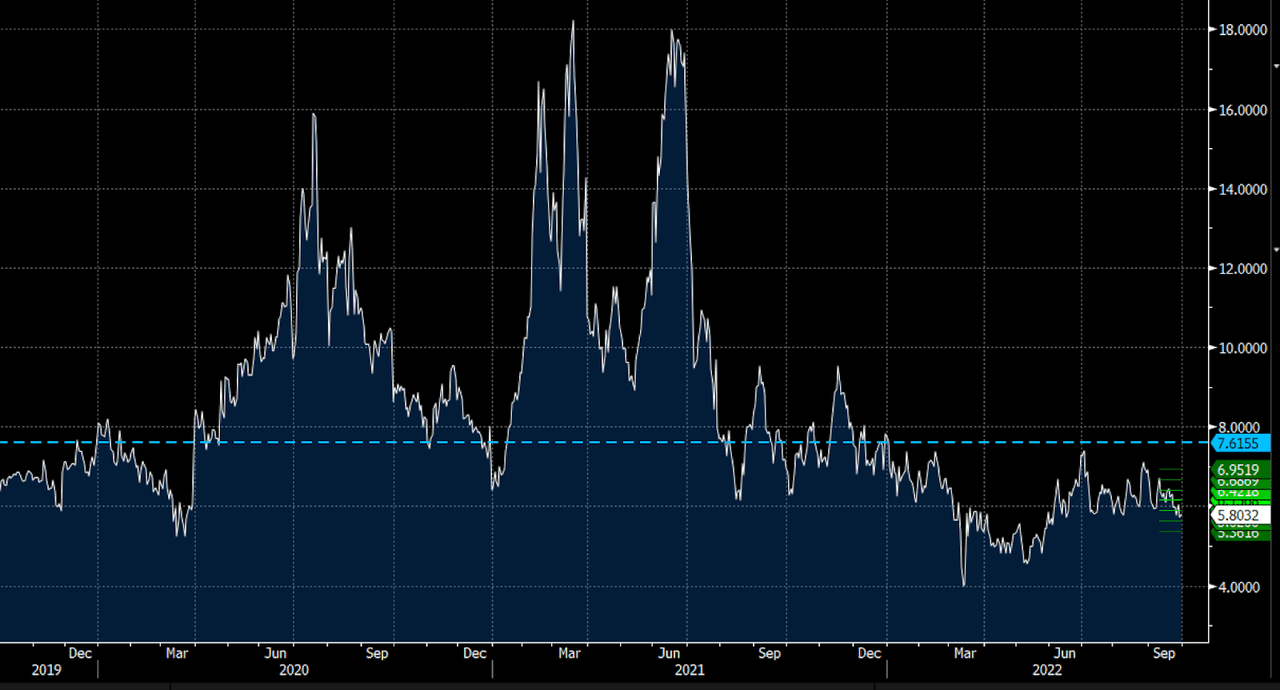

The company’s 5 Year Median P/E multiple is 7.6 and the Bloomberg estimated 2024E EPS $5.9. Assuming a $5 EPS in 2024 and 6x P/E multiple, the stock is worth $30. The expected return over a two-year period is 2.3x and 52% IRR.

5-Year P/E Band (Bloomberg)

Risks

While there have been some positive developments between the US and Chinese regulators on audit paper inspection, it remains as a huge risk to all the Chinese companies listed in the US if two parties could not reach an agreement. The China Securities Regulatory Commission and U.S. Public Company Accounting Oversight Board signed an agreement for cooperation on inspecting the audit work papers of U.S.-listed Chinese companies in late August. China has voluntarily de-listed several SOEs from NYSE, a sign that China is willing to hand over full audit paper of other private companies listed in US for inspection. Several U.S. Public Company Accounting Oversight Board authorities are currently in HK to conduct onsite inspection. If a deal could not be reached, a HK relisting is not a good option as companies listed in HK are trading at their historical low valuation of 8x P/E.

Conclusion

360 DigiTech is a market leader and has done better in underwriting than its competitors. While it is hard to predict China’s COVID policy and regulatory headwind, recent signs have all indicated the darkest period may have passed. Even under conservative assumption, the current valuation offers attractive risk reward.

Be the first to comment