PeopleImages/iStock via Getty Images

The entire premise of Seeking Alpha is to help investors, like you, to outperform the stock market on a risk-adjusted basis. But just take a moment to reflect: is beating the market really your top financial goal?

It isn’t mine. I couldn’t predict (let alone control) my portfolio performance even if I tried. No, my number-one financial goal is something that is within my control: I don’t want a lot of debt hanging over my head. I can think of three ways to make that happen, and three reasons why I should want to.

(1) Start with your personal debt.

The most obvious ways to go debt-free are to pay off your credit card, to avoid leverage in your brokerage accounts, to avoid personal loans, and to pay off your mortgage. You read sometimes that a fixed-rate mortgage (unlike a credit card balance) can be “good debt” and worth maintaining even after you’ve retired. Maybe so, but let me share a personal anecdote.

My wife and I are both retired and decided to pay for our apartment in Lisbon with cash. I’m glad we did. For one thing, rents in Lisbon are rising stratospherically. In addition, since we don’t have any monthly mortgage payment, our total housing costs come in at just $400 per month in condominium fees, plus another $200 per year in property taxes (one benefit of living in a 300-year-old building is that property tax assessments can be quite out of date). The key thing I want to emphasize is that low living expenses give us flexibility to reinvest more of our portfolio dividends – which is particularly comforting to do when stock prices are crashing. Lower stock prices are nothing to fear when you have the flexibility to invest your savings into bargain-priced shares. Quite the opposite.

The point is that there is a direct link between your personal finances and your investment anxiety. Consider that when you decide whether or not to keep “good debt” on your balance sheet once you retire.

(2) Own companies with either no debt or A-rated credit.

Businesses with low (or no) long-term corporate debt all have two things in common: (1) they face low (or limited) bankruptcy risk; and (2) the corporate earnings are strong enough that the company requires low (or no) outside capital to reinvest back into growing and maintaining the business. These are two plausible reasons why shares or low-debt (or no-debt) companies should theoretically perform less badly than higher-leverage companies whenever the market is going lower.

In fairness, what I’ve found is that low-debt and no-debt companies aren’t necessarily the top performing companies when the stock market is in rally mode. Almost invariably, they are mature businesses that lack the pizazz and instantaneous parabolic returns you might find with the latest crypto-currency or IPO. Fine. I’m content to earn less during a bull market provided that I lose less during a bear market.

How do I build a low volatility portfolio with negligible bankruptcy risk? My solution is that roughly 90% of my portfolio is weighted towards companies with either A-rated or no long-term debt. And in practice, is my portfolio less volatile than the broader market?

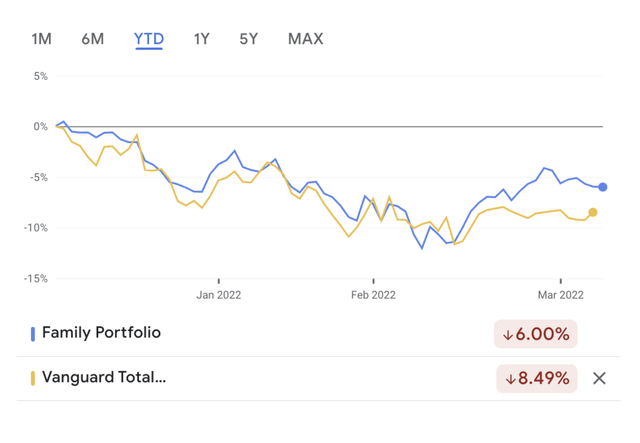

YTD Portfolio Performance (Googlefinance.com)

The answer is that my portfolio has indeed managed to lose less money year-to-date than the Vanguard Total World Stock Index Fund (VT). VT is down about 8.5% this year according to Google Finance, whereas my portfolio is down by around 6% (actually a bit less thanks to dividends).

One-year portfolio performance (Googlefinance.com)

Looking out over the past year, you can see that from November 2021 to today, my portfolio lost a bit less and recovered a bit quicker than VT. Total annual performance is about 8.29% (plus a 2.3% dividend yield) compared to a 1.66% annual return for VT (plus a 1.96% dividend yield according to SeekingAlpha.com).

In sum, it seems that a portfolio of companies with strong corporate balance sheets satisfies my goal of losing less money when stock prices are crashing or grinding lower. That’s as good a reason as I need to prioritize low or no debt on both my personal balance sheet and the balance sheets of companies that I own.

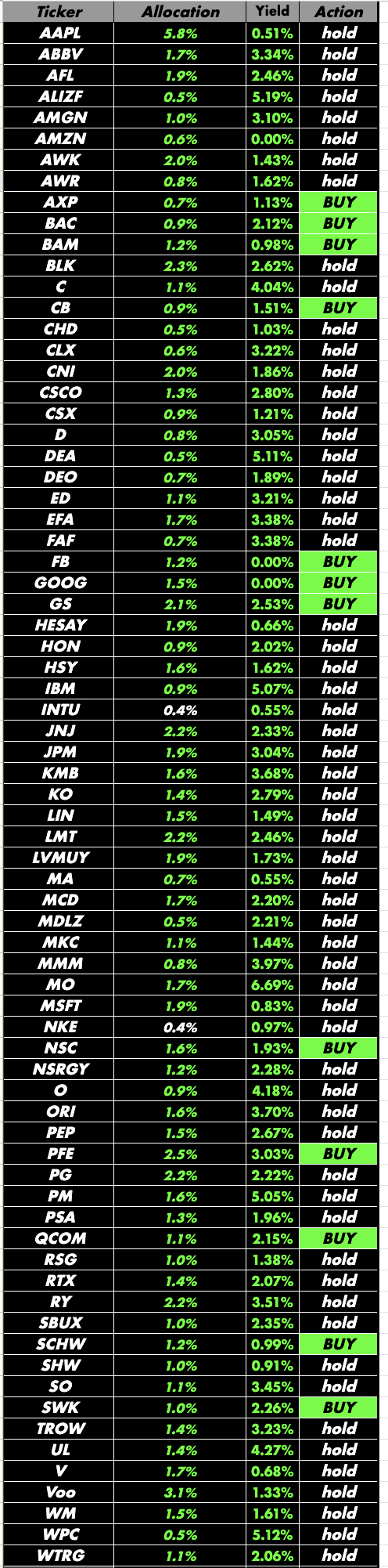

What’s in my mostly A-rated stock portfolio? All of my portfolio positions and allocations for every single public security I own are shown below. You’ll see that I’ve included the current dividend yields (which I pulled from Seeking Alpha). As an aside, please note that the yield calculations don’t include the rather enormous special dividends paid by T. Rowe Price (TROW) and Old Republic International (ORI) last year. I’ve also included my investment plans (or at least ideas) for each security in my portfolio (I think doing so would highlight any biases that I might harbor).

Author’s portfolio (Author’s personal spreadsheet, data from SeekingAlpha.com and GoogleFinance.com)

(3) Treat your future tax liabilities as personal debts.

I’ve talked with a lot of people who’ve spent years building their retirement savings accounts. After they stop drawing a salary, they may find that their income tax bill drops precipitously… that is, until required minimum distributions (“RMDs”) kick in. Once those start, income taxes start proliferating like mushrooms.

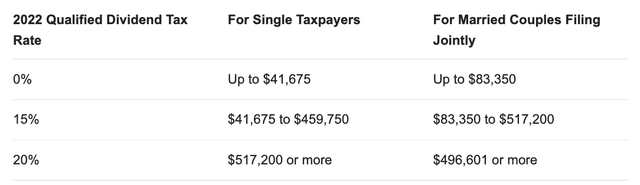

But here’s something interesting that will happen when you stop working and your only source of income consists of capital gains and dividends. If you’re married and file jointly, you pay zero Federal income tax on the first $83,350 of qualified dividends and long-term capital gains. Then, you can claim a standard deduction of $25,900, which means $109,250 of completely tax-free income.

Tax rates on investment income (Fool.com)

Once you start earning ordinary income in retirement (which is what will happen when you take RMDs), it eats away at your ability to earn $109,250 of tax-exempt qualified dividends and long-term gains. For example, suppose you have to take a $40,000 RMD from your IRA this year. The first $25,900 is tax-free but consumes your standard deduction. The remaining $14,100 of that RMD is subject to ordinary income taxes, and how many qualified dividends and long-term gains can you earn tax-free? That number drops from $83,350 down to $69,250. In other words, those RMDs can be a double whammy. And what’s worse is that the amount of qualified dividends and long-term gains that you can earn tax-free drops proportionately as your RMDs increase in future years. But eliminate the need to ever take RMDs in the future and you could have a shot at preserving your ability to keep earning the maximum amount of tax-exempt qualified dividends and long-term capital gains.

That’s what my wife and I decided to do after we retired. Since we have no other income besides dividends and capital gains, we enjoyed super-low Federal income tax rates and decided to “spend” some of that tax benefit by steadily converting our IRA accounts to ROTH IRA accounts. More often than not, if a stock in our IRA was trading sharply lower, we’d just transfer it to our ROTH IRAs at a lower tax cost than we’d otherwise have faced if that stock had been trading higher. Any subsequent recovery in the stock price is tax-exempt since it takes place in a ROTH IRA.

At this point, all of our retirement assets are in ROTH IRAs and that means we won’t ever face RMDs in the future. Barring an adverse change in law, that means a future of tax-exempt (or partially tax-exempt) qualified dividends and capital gains PLUS tax-exempt distributions from our ROTH IRAs.

That’s a third reason to make a debt-free portfolio and lifestyle worthwhile financial priorities.

Be the first to comment