michaelquirk

Dividend Safety and What Dividend Cuts Mean

Dividend growth investors seek investments that generate a rising income stream over the long term. As market volatility increases along with inflation and recession fear, investors tend to flock to investments that can serve as inflation hedges or offer income to offset losses. One of the best hedges against inflation is dividend-paying stocks, which tend to be less volatile in an environment that may experience a downturn, offering the opportunity to get paid while waiting out the storm so-to-speak. But not all dividend-paying stocks are created equal, and more often than not, higher-yielding dividend stocks or those with declining prices experience a greater risk of cuts to their dividend. Pay attention to warning signs that a rocky road lies ahead.

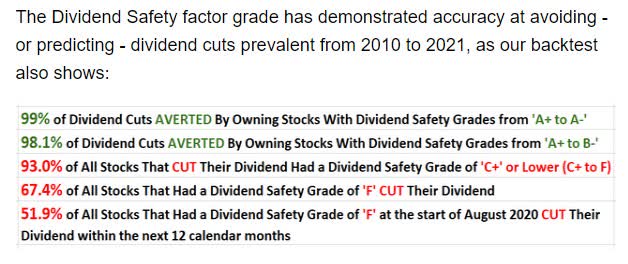

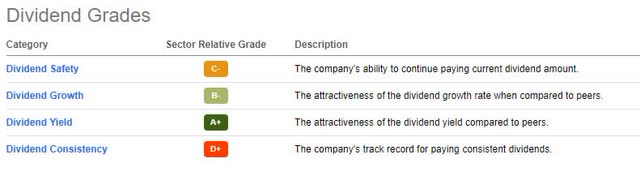

Indicators like payout ratios, dividend coverage ratios, interest coverage ratios, debt ratios, profitability metrics, and weak cash per share figures can flag when a dividend is at risk. For this reason, I developed Seeking Alpha’s Quant Dividend Grades to provide an instant characterization of each stock’s dividend strength or weakness compared to its sector. The model works well, and the measured dividend metrics are very transparent and have demonstrated their accuracy by averting 99% of dividend cuts since 2010.

Dividend Safety and Averted Cuts (Seeking Alpha Premium)

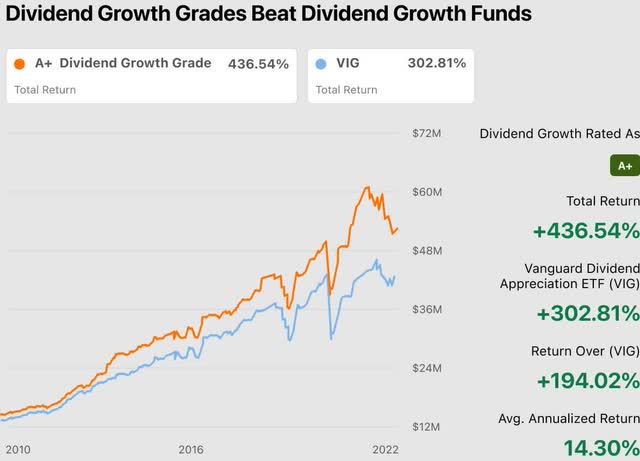

Additionally, stocks with an A+ for Dividend Growth have returned 436.54% in the past 12 years, vs. 302.81% for the comparable index.

SA Dividend Growth Grades Beat Dividend Growth Funds Chart (Seeking Alpha Premium)

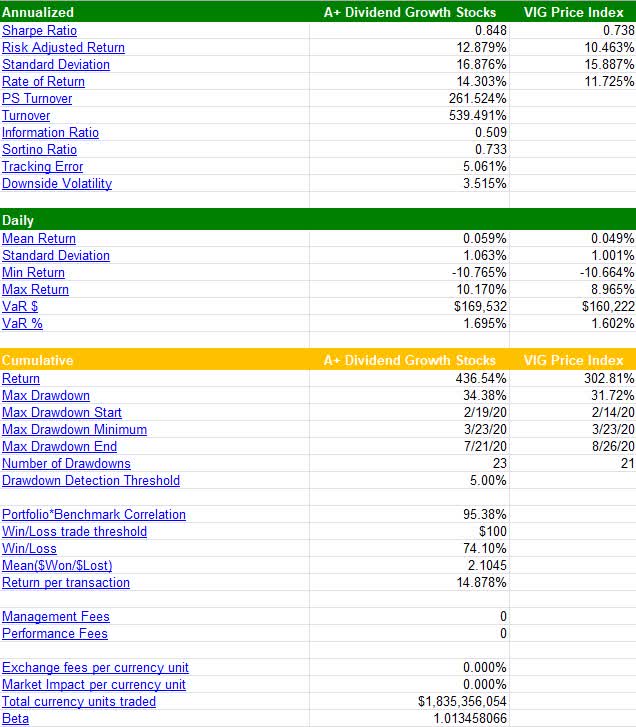

The performance of the graph above and the below Portfolio and Performance Attribution Statistics reflect the period 01/04/2010 to 07/26/2022.

Portfolio and Performance Attribution Statistics (01/04/2010 to 07/26/2022) (Seeking Alpha Excel file)

Investors should be knowledgeable about stocks with poor dividend grades that carry negative analyst ratings and poor fundamentals, which is why dividend safety is a vital measurement of a company’s ability to reward shareholders from profits. In an economic downturn like we’re currently experiencing, you’ll typically see more minor cuts or a suspension of dividends. But when cuts are business specific – they’re often overleveraged with too much debt, experiencing a business downturn as we saw with the pandemic where earnings and revenue fall, or some other circumstance – that’s where the situation could be troublesome or a worst-case scenario. Additionally, as a pre-emptive strike, fearful corporate executives may cut dividends in preparation for an oncoming recession or economic slowdown.

The three dividend stocks I am highlighting today have cut their dividends. In each case, poor dividend safety grades were a major red flag. A simple click on the Dividend Safety grade would have unveiled the poor underlying metrics and data points that can undermine a dividend’s safety.

3 Stocks That Cut Their Dividends

Dividends distribute a portion of a company’s profits to shareholders. Because top dividend stocks with excellent safety ratings and metrics can help preserve capital and make investors money on a quarterly or annual basis, they help combat inflation. Those that fail to pay consistent, consecutive dividends over the years prove their vulnerability when their dividends are slashed. Heed the warning signs showcased in our Dividend Grades as we look at three dividend stocks with Hold ratings.

1. Rio Tinto Group (NYSE:RIO)

-

Market Capitalization: $100.21B

-

Quant Sector Ranking (as of 7/29): 73 out of 279

-

Dividend Yield (FWD): 8.75%

-

Quant Rating: Hold

-

Dividend Safety Grade When Cut: D

Diversified metals and mining company Rio Tinto Group (RIO) is a mining and exploration company known for processing mineral resources and operating underground mines globally. The company is headquartered in London and offers aluminum, copper, diamonds, gold, lithium, and several other materials. Although its valuation is extremely attractive that includes a forward P/E ratio of 6.23x, a 48.34% discount to the sector, and a forward EV/EBIT of 4.42x with a more than 50% discount below the sector, it has not been enough of a catalyst to move the stock in the right direction. The stock’s momentum compared to the sector could use a boost along with its dismal growth figures. Take a look at RIO’s momentum grade below.

RIO Stock Momentum

With an overall momentum grade of C, RIO’s quarterly price performance is strongly bullish. Many analysts indicate the stock is overbought, driving the share price higher, despite its YTD price performance -of 7.81%.

RIO Stock Momentum Grade (Seeking Alpha Premium)

Over the three-, six-, and one-year price performance, RIO’s sector peers have outshined this leading mining company. But like many commodities this year that have faced price surges and declines, the company’s performance has been tied to volatility, hindering its growth and profits.

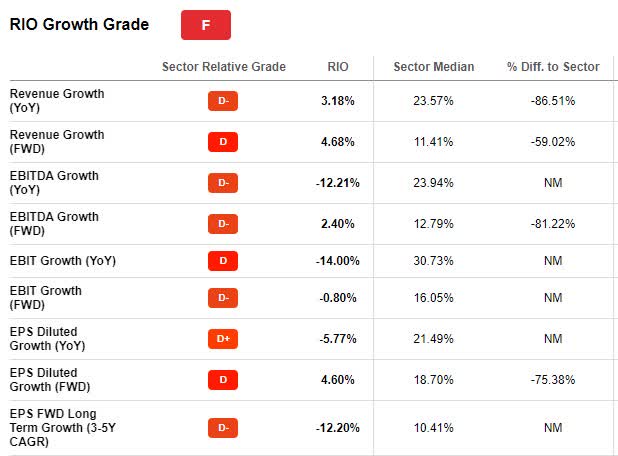

RIO Growth & Profitability

Historically, RIO has benefited from its core product, iron ore. With this in mind, the most recent year-over-year growth figures and the forward estimated growth figures look pretty lackluster. Price fluctuations from 2013 to 2016 experienced a 70% decline, only to recover and increase by 400% from 2016 to early 2021.

RIO Stock Growth Grade (Seeking Alpha Premium)

Following a drop in H1 revenue of 10% and an EBITDA decline of 26% year-over-year, RIO slashed its dividend by 53%, from $5.61/share to $2.67/share despite its yield being as high as 13.42%, citing weaker iron ore prices, higher costs amid inflationary pressures, and labor shortages. The company’s cash flow from operations was down from $13.7B in H1 2021 to $10.51B, and with the stock down nearly 30% over the last year, the company may need to reassess its strategy.

“Market conditions were good, albeit below last year’s record levels. We delivered largely flat production and solid financial results, with an underlying EBITDA of $15.6 billion, free cash flow of $7.1 billion, and underlying earnings of $8.6 billion, after taxes and government royalties of $4.8 billion. As a result, we are paying our second highest ever interim dividend of $4.3 billion, a 50% payout, in line with our policy. The market environment has become more challenging at the end of the period” – Jakob Stausholm, RIO Chief Executive.

Despite RIO’s history of rapid earnings and dividend growth from 2012 to 2021; following negative earnings in 2012 and 2015 amid expenses and the acquisition of aluminum assets north of $20B; the company recovered given the jump in iron ore prices over the years. Most recently, several factors have contributed to RIO’s dividend reduction, including soaring inflation, a substantial decrease in earnings amid the surge in energy costs, labor constraints, and a slowdown in demand from China. The dividend grades below showcase the unlikely chance of a strong and safe dividend.

RIO Stock Dividend Safety Grades (Seeking Alpha Premium)

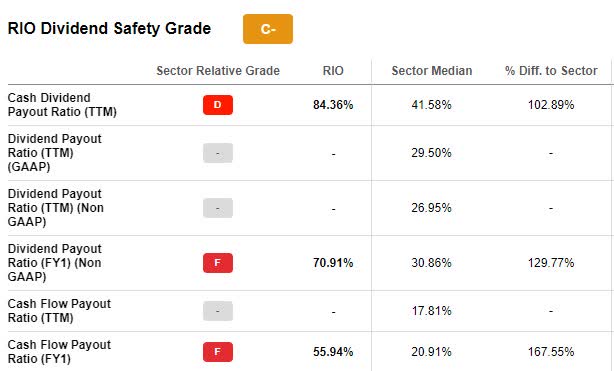

It’s important to note that RIO slashed its dividend on July 27th of this year when the dividend safety possessed a D grade. RIO’s dividend safety rating has since been updated to C-. It’s important to note that even with the improvement in overall dividend safety rating, some of the current underlying metrics are very poor, including a D for trailing Cash Dividend Payout Ratio of 84.36% and F’s for FYI Dividend Payout Ratio and Cash Flow Payout Ratio.

RIO Dividend Safety Underlying Metrics (Seeking Alpha Premium)

Overall, RIO’s business is stable, but commodities can be volatile, subject to volatile price fluctuations, as we’ve seen this year, contributing to the company’s dividend cut. In addition, RIO has spent a substantial amount of money on acquisitions, which eats into profits. As fellow SA Author John Kingham writes, “Be wary of companies that spend more on acquisitions than they make in profit.” In addition, China’s lockdowns have harmed RIO’s growth, given the halting of investment into construction and infrastructure that kept iron ore prices above $150 per ton.

While China’s economy rebounds, hopefully, this will improve the picture for RIO’s dividend going forward. Its overall scorecard paints a doubtful picture for the dividend going forward, especially following three downward earnings revisions in the last 90 days and speculative forward guidance. RIO’s overall Dividend Safety is a D. Many of its underlying dividend safety metrics are very poor, so it is important to consider our scorecard as a tool to avoid companies whose dividends may be at risk of being cut.

2. Shaw Communications Inc. (NYSE:SJR)

-

Market Capitalization: $13.51B

-

Quant Sector Ranking (as of 7/29): 79 out of 250

-

Dividend Yield (FWD): 3.41%

-

Quant Rating: Hold

-

Dividend Safety Grade When Cut: C-

2022 may have felt like the Shawshank Redemption for this stock. YTD, the stock is down 11.3%, and the monthly dividend was thinly cut in February, March, and May. Cable and satellite telecommunications provider Shaw Communications is a Canadian-based company that operates connectivity of WiFi, internet, and data services throughout North America. SJR has an average valuation and improving momentum. However, the company’s growth is lacking, and its share price has experienced a decline over the last year, indicating why it slashed its dividend on May 9th of this year.

Shaw Communications Stock Valuation & Momentum

Despite a C- valuation grade, Shaw Communications’ underlying valuation metrics indicate the stock is trading at a premium. With a forward P/E ratio of 21.72x, a more than 16% difference to the sector, and EV/Sales and EV/EBIT well above 100% difference to its sector peers, the stock is considered overpriced by many investors.

SJR Stock Valuation (Seeking Alpha Premium)

In addition to its valuation, the stock’s YTD performance is -11.32%. Over the last year, while momentum is improving quarterly, its performance is down 7.24%, on the heels of increasing recession concerns.

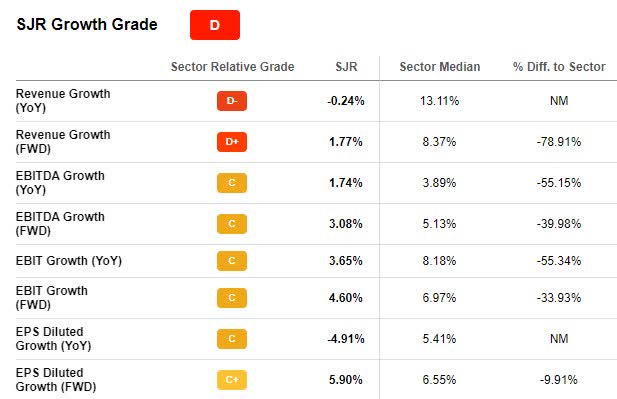

SJR Stock Growth

The communications sector has faced tremendous post-pandemic headwinds, including high inflation, macro pressures involving the fall of advertising dollars, the shift from cable to streaming services, and increased recession fears. Communications Services companies are getting pummeled, many of which have given up half their value in 2022. Take, for example Snap Inc. (SNAP) -78.79% YTD, Netflix (NFLX) -62.35% YTD, and Roku Inc. (ROKU) -71.90% YTD.

SJR Stock Growth Grade (Seeking Alpha Premium)

In the current environment, companies like Shaw are struggling to grow, hence, its D growth grade. And despite Q3 EPS of $0.32 beating by $0.02, revenue of $1.05B missed by $10.66M. Our quant ratings maintain SJR as a Hold amid the company’s lower than anticipated valuation and halted merger with Rogers Communications (RCI). In March of 2021, RCI announced that it would purchase SJC but has experienced roadblocks from Canadian regulators investigating antitrust concerns, posing a headwind to its growth and dividend.

“Shaw remains deeply committed to the combination with Rogers, and our announced agreement for the sale of Freedom Mobile to Quebecor marks a critical point in our bold and transformative journey to join together with Rogers. We feel strongly that the sale of Freedom to Quebecor will be seen as a positive outcome by the regulators as Quebecor expands their successful wireless operations through this acquisition. We continue to support the ongoing process and remain optimistic that there is a clear path to obtaining the remaining regulatory approvals in an expeditious manner” –Brad Shaw, CEO.

Despite a forward dividend yield of 3.41% and 35 consecutive years of dividend payments, the Consecutive Years of Dividend Growth Grade is F because of the Dividend Cut. The company’s overall growth characteristics and middle-of-the-road valuation factor grades indicate uncertain future stock performance. With this in mind, the dividend reduction has enabled analysts to take up their actual earnings estimates. In the last 90 days, five analysts have revised their earnings estimates up and only one has reduced their estimates.

SJR Dividend Consistency Grade (Seeking Alpha Premium)

Recession fears are mounting. A decline in ad dollars and a merger deal that may blow up may be a recipe for disaster and a big risk for investors considering this stock which already saw a dividend cut by 87.6% earlier this year.

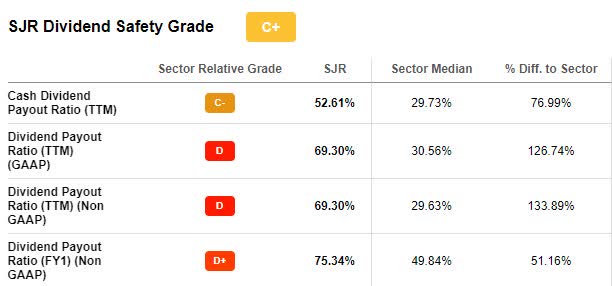

Dividend Safety Grade

Moreover, as we look at the dividend scorecard, SJR’s dividend safety has been declining. As evidenced by the underlying dividend safety metrics, SJR’s are nearly 2x that of sector median peers. High payout ratios (those generally between 55% to 75%) indicate that a company distributes more than half of its earnings to shareholders, and therefore less earnings are retained for growth, limiting CAPEX plans for the future.

SJR Dividend Safety Grade (Seeking Alpha Premium)

SJR has a Dividend Coverage ratio (TTM) grade of D with coverage at 1.42% compared to the sector at 1.97%. With the current macro outlook, investors looking for that steady income stream may want to consider another stock with better dividend metrics to try and avoid the risk of another dividend cut.

3. Micro Focus International plc (NYSE:MFGP)

-

Market Capitalization: $1.17B

-

Quant Sector Ranking (as of 7/29): 117 out of 633

-

Dividend Yield (FWD): 4.66%

-

Quant Rating: Hold

-

Dividend Safety Grade When Cut: F

It doesn’t get much clearer than the warning banner. Micro Focus International plc (MFGP) is at high risk of cutting its dividend.

MFGP Stock Price Performance Chart (Seeking Alpha Premium)

The prominent software company MFGP headquartered in the United Kingdom, has been on a longer-term bearish trend, lacking growth, and has cut its dividend. MFGP has an F grade for dividend safety. Except for its 4.66% dividend yield, its overall dividend metrics are abysmal. Over 11 years, 64.4% of stocks with an F dividend safety grade cut their dividend.

MFGP Dividend Grades (Seeking Alpha Premium)

With a beaten-down share price, high debt levels, and bearish momentum, Seeking Alpha author Evin Rohrbaugh writes:

While currently unprofitable by accounting standards, they have remained FCF positive in spite of recent turmoil. This is one of the few positives I see in this story, but it is quickly hampered by misallocating capital to dividends while highly levered. When you are still struggling to make your operations profitable again, you shouldn’t be paying out 60% of FCF, especially when long-term debt far exceeds annual revenue.”

Not only did it suspend its dividend in 2019 and 2020, following a brief reinstatement, as of July 22, 2022, but the company has again cut its dividend, an indication of its slowing growth amid rate hikes and recession fears.

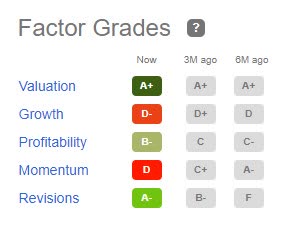

MFGP Factor Grades (Seeking Alpha Premium)

As we look at the company’s overall factor grades, you can see that growth and momentum are unattractive, and these metrics impact a company’s ability to pay a dividend. Since 2019, MFGP’s net and operating income have declined significantly, and operating income is a crucial metric for analyzing a stock’s value.

MFGP Stock Growth & Profitability

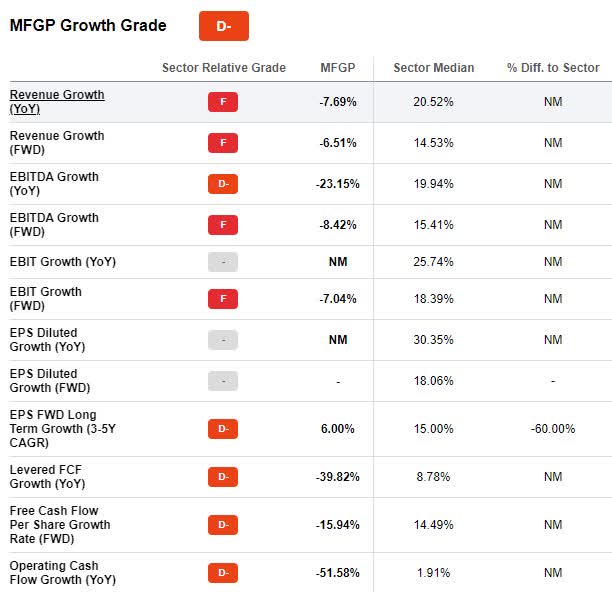

Despite improving its free cash flow by 36% and a reduction in leverage, the company’s 2022 Q2 revenue of $1.3B declined year-over-year by 6.8%, adjusted EBITDA was $449M, and following the announcement of the miss, sent the stock’s premarket shares -15%.

MFGP Growth Grades (Seeking Alpha Premium)

While the company’s overall business is diversified by sector and geography, as you can see by its underlying growth metrics, this company has a rough road ahead, despite a stellar valuation.

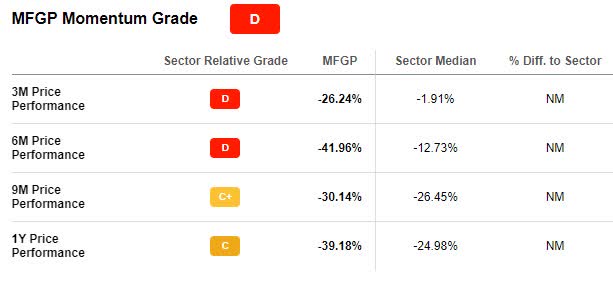

MFGH Valuation & Momentum

Although the stock’s valuation is A+, I would look long and hard at the collective metrics before attempting to buy this stock at a discount. MFGP – while severely discounted – possesses a forward P/E ratio of 2.54x, a difference to the sector of +86.40% and a forward PEG of 0.42x, a -71.05% difference to the sector, its bearish momentum and sector peers outperforming its price quarterly indicate this stock may have a long road ahead. Down nearly 40% YTD and over the last year, while you may be able to catch this stock at a discounted $3.43/per share, it may not be done falling.

MFGP Momentum Grade (Seeking Alpha Premium)

Collectively, when you look at Micro Focus’s overall performance, its industry, the current environment, and the company’s financial and outlook consider the bigger picture. If you’re looking for income-producing stocks, it’s crucial to consider dividend stocks that can stand the test of time and have solid dividend safety grades. The stocks we’ve outlined in this article should serve as tools on where to look and how to avoid stocks that may cut their dividend. MFGP comes with a warning for a reason, and this article is an attempt to warn about two other stocks at high risk of performing badly. All three possess characteristics historically associated with poor future stock performance, and Seeking Alpha’s dividend grades are a great tool to help avoid stocks with potential dividend cuts.

Evaluate Your Dividend Stocks

In an inflationary environment, many investors look for dividend stocks to help offset portfolio losses while offering a steady income stream. The current economic outlook is uncertain as recession fears mount and economists weigh in on whether the U.S. is or isn’t in a recession. When investors fear downturns, assessing a company’s ability to maintain a dividend is key when purchasing stocks.

RIO, SJR, and MFGR share a decline in momentum, Factor Grades, and fledgling Dividend Safety. With rising inflation, a hawkish Federal Reserve, and a slowing economy, the three securities are at risk of not performing well. Among many poor dividend metrics relative to their sectors, the stocks stand out with weaker payout ratios, dividend coverage ratios, interest coverage ratios, and weak cash per share figures. How do you avoid dividend cuts? By paying attention to the red flags and triggers affecting dividend metrics.

Dividend stocks can benefit in both a rally and bear market, but it’s crucial to evaluate stock picks in making tactical investment decisions. While many dividend-paying stocks stand to benefit in the current environment, they should possess strong dividend safety grades and robust quant grades or strong fundamentals. Check out the Dividend Grades on your stocks to determine if the dividend income is strong, safe, and can stand to increase over time. Finding knowledgeable investment resources is also a great way to be a successful investor in volatile or rallying markets.

Be the first to comment