FabrikaCr/iStock via Getty Images

Rio Tinto (NYSE:RIO) is a world-class miner that is currently trading at a valuation that we believe is highly opportunistic at the moment.

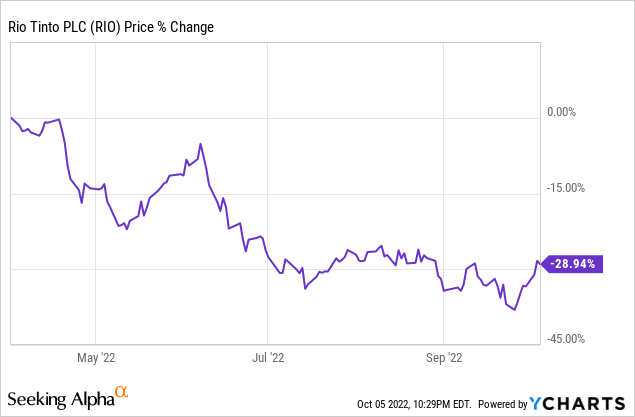

The stock price is down significantly since the beginning of April due to fears about war involving China, slowing demand from the slumping Chinese economy, and global economic recession:

However, we believe each of these concerns is short-term in nature, and ultimately when the dust settles in 3-5 years, the market will have realized that RIO has been worth far more than its current stock price all along. Here are three reasons why.

#1. Stellar Balance Sheet

When RIO reported H1 results in late July, the balance sheet remained in excellent shape, with a $300 million net cash position as of the end of the first half of the year. This gives it significant flexibility in being able to respond opportunistically to any market dislocations should current volatility continue, potentially setting it up to acquire some highly valuable assets at bargain valuations as more highly leveraged/less profitable peers may experience some financial distress.

On top of that, it has a $7.5 billion back-stop revolving credit facility with well over a decade weighted average debt maturity and several years until its next corporate bond matures.

As the CEO stated during the recent investor day presentation:

We’ve chosen not to have a net debt target but a single A credit rating that puts us well within our comfort zone. Should a value-accretive opportunity arise, then we would be prepared to drop below single A but only where there is a clear pathway back.

It also boasts an A credit rating from S&P, giving it access to capital on very attractive terms and signaling to investors that it has little risk of experiencing financial distress. This is especially crucial during a period of elevated macroeconomic and geopolitical risks and a rising rate environment.

#2. Phenomenal Management & Assets

In addition to boasting a pristine balance sheet, RIO has world-class assets and management. This is evidenced by its phenomenal returns on capital employed. For example, during the first half of this year – while production was essentially flat year-over-year and elevated costs and lower pricing from macroeconomic events suppressed free cash flow – RIO’s underlying return on capital employed was still very impressive at 34%, and underlying earnings per share came in at $5.33, easily covering the hefty dividend per share of $2.67. This should come as no surprise, as its returns on capital employed have consistently been north of 20% in recent years.

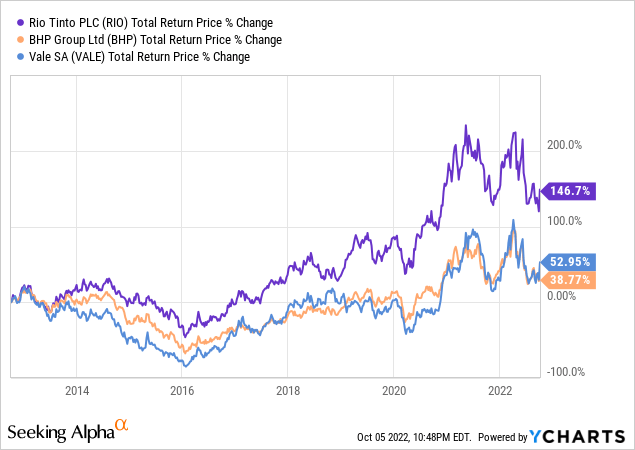

This is a result of its high quality assets that generate high levels of profitability as well as management’s capital discipline, which is enforced by its commitment to paying out a generous percentage of earnings to shareholders via dividends. Since 2016, RIO’s return on capital employed has averaged over 20%, significantly outpacing peers over that span. This superior profitability has translated into significantly superior performance over time relative to peers:

#3. Undervalued Stock Price

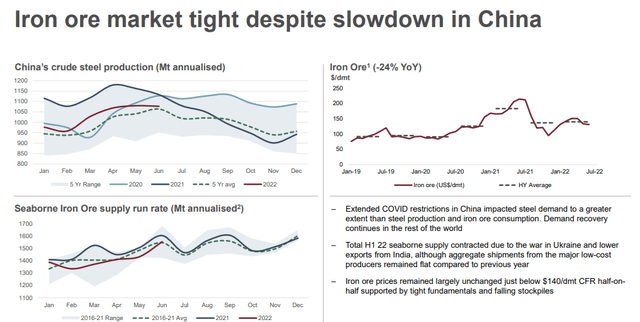

In addition to boasting one of the strongest balance sheets, business models, and management teams in the mining industry, RIO also trades at an attractive valuation despite demand for its products remaining robust:

Iron Ore Market (RIO H1 Slideshow)

As the table below illustrates, despite arguably having the strongest balance sheet of its two main peers (especially relative to VALE which also brings more geopolitical risk given that it is based in Latin America and has more leverage on its balance sheet), RIO is the cheapest on an EV/EBITDA basis. Furthermore, it also pays out the highest expected forward dividend yield. Most tellingly, it is considerably more attractively priced on all major valuation metrics relative to its nearest peer, BHP Group (BHP), in terms of quality and balance sheet.

| EV/EBITDA (forward) | P/E (forward) | Dividend Yield (forward) | |

| RIO | 3.83x | 6.95x | 9.1% |

| BHP | 4.42x | 8.66x | 8.1% |

| VALE | 3.86x | 4.71x | 8.7% |

source: TIKR.com

Furthermore, looking out over the next several years, RIO is only expected to see its normalized earnings per share decline at a 6% CAGR whereas BHP is expected to see its normalized earnings per share decline at a whopping 17.4% CAGR and VALE’s normalized earnings per share are expected to decline at a 6.8% CAGR. In our view, the risk-reward here is clearly in RIO’s favor relative to its peers.

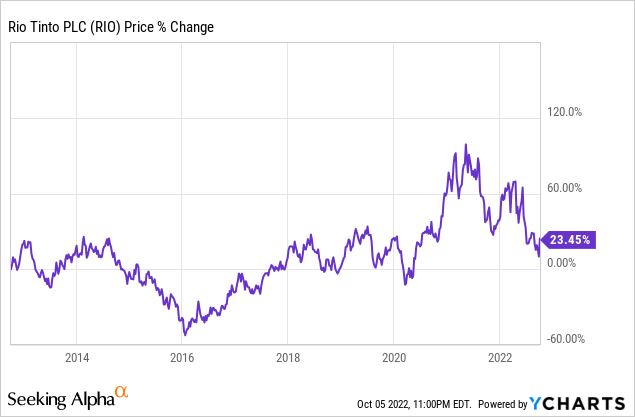

On top of that, RIO is also quite cheap relative to its historical averages. Its 3.83x EV/EBITDA is well below its all-time average of 5.83x and its 6.95x price to earnings ratio is also well below its all-time average of 10.38x. Furthermore, despite the global economy growing considerably over the past decade and RIO continuing to invest aggressively in growth projects over that span, its stock price has only appreciated by 23.45% over that span, providing another piece of evidence that the stock is quite possibly undervalued right now:

Investor Takeaway

With some analysts – such as those at Goldman Sachs – projecting that we are at the beginning of a commodity super cycle, buying shares in world-class miners like RIO after the recent sharp pullback is a great opportunity for patient long-term minded investors.

While the stock price continues to languish due to fears over a slowing global economy and Chinese geopolitical and economic risks, RIO continues to generate strong cash flow, distribute it generously to shareholders, and maintain a stellar balance sheet. Meanwhile, RIO continues to also pursue adding meaningful lithium and copper production to its portfolio, which could further diversify the company’s revenue stream and also prove quite accretive over the long-term to its revenues and earnings.

Given its discounted valuation relative to its own history and peers despite its clear strengths, we rate RIO stock a Strong Buy and hold it in our growing basket of high conviction high yielding commodity stocks at High Yield Investor.

Be the first to comment